|

Oh oh... Things are getting very serious. Every department in Malaysia is started to be very strict especially when come to summons. MPPJ have make their move, is it the offenders turn to make their move to pay up? Anyway, they are giving discounts now. Perhaps the right time to pay up, or else you wont able to renew your road tax. Good news for the country but then lets hope it use in the right way and right channel.

PJ CITY TO BAR TRAFFIC OFFENDERS FROM RENEWING ROAD TAX From The Star PETALING Jaya City Council traffic offenders who failed to settle their summonses will not be able to renew their road tax starting March next year. Details of the defaulters would be submitted to the Road Transport Department, which would bar the car owners from renewing their road tax. Petaling Jaya mayor Mohd Azizi Mohd Zain said the council received the approval to enable them to take the drastic action from the department last month. The City Council has 4.1 million unpaid traffic summonses amounting to RM100 million. He said in a move to encourage traffic offenders to settle their summonses before the deadline, the City Council is offering an 80% discount until Feb 29.

0 Comments

Its great that Bank Negara to have this apps to increase financial awareness to consumers. Those who lack the knowledge feel free to have a look.

Bank Negara Malaysia Launches New Mobile Apps Article refer from iMoney.my Written by Iris Lee In its bid to boost financial awareness and literacy among financial consumers to make informed financial decisions, Bank Negara Malaysia (BNM) launched three mobile applications last week. These apps are MyTabung, MyBNM and BNM MyLINK. By marrying technology and finance, these apps aim to equip Malaysians with the necessary knowledge, skills and tools to make smart and prudent financial decisions. MyTabungFor those who are struggling with money management, BNM has launch a budgeting app, MyTabung, which caters specifically for those who live in Malaysia. This tool helps individuals to create a personal or household budget, where one can capture incomes, savings and recurring expenses with an on-the-spot display of the user’s financial standing and spending patterns. Individuals can also obtain financial advice and budgeting tips to guide them in managing their finances sensibly. MyBNMThis official BNM app keeps consumers informed of the latest financial news including notices and announcements, speeches and interviews, press releases, financial fraud alerts and foreign exchange rates at their fingertips. The information available here includes latest developments and news, and updates on the monetary and financial policies and regulations by the central bank. BNM MyLINKThis app connects consumers and financial service providers in Malaysia with an extensive directory of conventional and Islamic banking, insurance and takaful companies, as well as SME institutions. Consumers can make enquiries, obtain advice and lodge their complaints directly with the financial service providers. The apps come in both Bahasa Malaysia and English, and are available for free from Apple App Store and Google Play Store. “The use of these mobile applications will not only provide consumers with the latest development and updates on financial matters, but also provide financial consumers with tools to plan and manage their finances and exercise their rights as financial consumers,” BNM said in its statement. Malaysian youngster nowadays is getting more exposure to property investment or owning their first home information through internet. This have not only enhance their knowledge but also it have create and urgency for the youngster as they realize that if they don't buy now, they can't buy later at equivalent price. Either they have to settle with smaller unit or pay higher price later on to own a same size unit. I have deal with youngster who graduates for one year only as the couple looking for their own home. I asked them they bought at very young age. They told me they have no choice or else later cant afford to own it and have to settle a smaller unit or further away location. "ITS EITHER SUFFER NOW OR SUFFER MORE LATER". Some parents (actually a lot) already help their children in buying a property now to prevent them of not able to own a home later on. Some kids even have the privilege of choosing the property they like. Whatever method used, the root of cause is everyone is worry on affordability. Here's a great article from Hannah Rafee from The Edge Property. Young Malaysian graduates rushing to buy homes out of fear, says Khazanah Research Institute director

By Hannah Rafee / theedgeproperty.com | November 16, 2015 6:19 PM MYT Petaling Jaya (Nov 16): Fresh graduates feel compelled to buy property quickly because they fear prices will soon outpace the growth of their income, said Khazanah Research Institute director of research Dr Suraya Ismail today. “Young people used to rent for 10 years before deciding to buy a home. However, graduates today rush to buy their first homes, for fear of rapid price escalation. They think that if they do not buy today, they will never be able to afford a house.” She explained that this places fresh graduates under stress because “they do not have the confidence they can earn an income and fall in the middle income bracket,” she said at the National Real Estate Convention (NREC) 2015 on Thursday. Suraya was part of the panel discussion, ‘Homeless Graduates: Reality or Myth?’ on challenges faced by young, aspiring homeowners in purchasing their first homes. Her fellow panelists include Rahim & Co International Property Consultant Bhd founder and executive chairman Tan Sri Abdul Rahim Abdul Rahman, PR1MA assistant vice president for research and development, Ezlina Adnan, and Bank Simpanan Nasional (BSN) senior vice president and head of distribution, Akhzan Zaini. Rahim said fresh graduates were facing a hard time buying their first homes due to the huge disparity between current average household income and property prices. Suraya said the disparity between income and house prices is a complex matter. “It is not as simple as increasing income to enable graduates to purchase homes. It is very difficult to increase income, especially if we’re not increasing productivity. “The job market feeds into the housing market; for example, a labourer may be incur both consumption and production of a house,” she added. According to Suraya, one way of slowing the growth in housing prices is to increase the productivity of all sectors, especially the construction sector. “Something has got to give, and house prices should go down. We believe that the level of profit before taxation could go down, although we won’t be able to achieve supernormal profit,” she said. Meanwhile, BSN’s Akhzan advised graduates to be realistic in applying for housing loans. “You may not be able to purchase a home in the RM300,000 category if you are earning RM3,000 a month. For BSN, we do offer 100% loans for homes that are below approximately RM130,000. “Graduates should look for homes within their means. If you go beyond your means, bankers will look at your repayment capability, therefore you may have a smaller chance in getting your loans, approved,” he said. Akhzan said that BSN has approved 335 of 800 applications under the Youth Housing Scheme so far. For affordable housing, PR1MA is doing the best it can to provide homes for the masses and young graduates, said Ezlina. “Our goal is to build 500,000 homes by 2018. There are currently 60,000 units on the ground. Based on Budget 2016, our goal is to set house prices below market price. “What we do is to always evaluate [our projects] on a case-by-case basis. Our projects are based by state, and the products we have,” said Ezlina. She added that PR1MA is expediting completions by using industrialised building technology. This will lower the cost of construction, which should allow for lower home prices. The panelists concurred that the government’s affordable housing initiatives should be streamlined under one ministry that handles financing, planning, land acquisition and construction of the homes. Malaysian youngster nowadays is more alert and more young to own their first home. Either its because of exposure and awareness due to internet circulation or parents advice or others reason. No matter which, the main reason is still worry of not able to own a house later on if they drag on. I do see younger couples who bought their first condominium just one year after graduation. Some is parent who bought for them, which is a bless. There are even cases where the kids have their choice to choose which property to own even thought parents is the one who pay for it. The fear of not able to own a home is getting more urgency than ever. Here's an article from The Edge Property site.

This article is refer from imoney.my, written by Fiona Ho Its a very useful guideline for those who want to climb above and don't want to be left behind in the social chart. I personally don't agree on the categorization of middle class as I think its somewhere around RM3,000-RM10,000 due to inflation and also more high income earner arising. In city or township the range could be even higher as the daily expenses is much higher. Anyhow, the first thing is how to increase your income and at least not left behind? Here's some guideline. Enjoy your learning... Budget 2016: What Can The Middle Class REALLY Do About It? Written by Fiona Ho Last week, Prime Minister Datuk Seri Najib Tun Razak announced Malaysia’s annual budget with the theme, “Prospering the Rakyat.” This year’s affair highlighted the government’s plans to narrow its budget deficit, as well as measures to address issues such as the rising cost of living and housing unaffordability. These measures include increasing its cash handouts under the 1Malaysia People’s Aid (BR1M) assistance programme and raising the minimum wage for workers. They also introduced new income tax provisions, such as the introduction of tax relief for children who provide for their parents and an increase in tax relief from RM1,000 to RM2,000 for each child from year of assessment 2016. But let’s face it – amid inflation woes triggered by the sharp drop in the Ringgit, the introduction of the Goods and Services Tax (GST), and the recent increase in toll rates across the Klang Valley – these measures really don’t do much for those already grappling with the rising cost of living. Middle-income earners who are not eligible for cash aids, and yet do not earn enough to weather the rising living costs, continue to bear the biggest brunt of the current economic situation. Many middle-income earners in Malaysia are already resorting to drastically cutting back on their expenses, including fewer trips to restaurants to tackle rising living costs.

A better solution for this would be to boost their disposable income. The million dollar question is, how? 1. Generate your passive incomeOne of the easiest ways to do this is by increasing your passive income. Unlike active income (which you usually earn through having a job or running a (profitable) business), passive income generation typically requires less time and effort. Passive income can include investments, especially with low-to-mid risk instruments that let you leverage on capital with minimal active input. This could be in the form of unit trusts, REITs, shares, investment-linked policies or even in your good ol’ fixed deposit account. They let you accumulate returns while you grow your savings pool. The more you save, the more returns you will get. Lower-risk financial instruments like fixed deposit will give you lower returns, but they are generally considered safe and are an effective tool to help preserve the value of your contingency funds. 2. Make your money work harder for youStretch your Ringgit further by adopting strategies that allow you to save while you spend. For example, buying essential items such as rice and toiletries in bulk can save you a small fortune. You can also save a few bucks with hypermarket loyalty cards. Benefits often include reward points, special member price for selected items or additional discounts from selected merchants. They may also offer shopping-related benefits. For example, the AEON member card offers free parking for the first two hours. You can also save money on purchases when you shop at online stores, or by using a shopping credit card that offers rebates or privileges when you shop online. For instance, the CIMB Cash Rebate Platinum card gives you 5% cash rebate and up to 25% discounts when you shop online. Bogged down by fluctuating petrol prices? You can fuel up your purchasing power as you fill up your tank when you use a petrol credit card that gives you cashbacks or reward points. 3. Avoid investment mistakesThere’s a difference between investing and investing properly. Anyone can put their money into investment products, but without a sound financial plan, you may not know which investment strategy or products will work best for you, and how to build a balance portfolio. The key to building your financial strategy starts with understanding your goals and risk appetite. Younger investors typically have a higher tolerance for risk and can afford to make riskier investments due to their longer investment horizon. They also have longer time to work on achieving their financial goals. Next, you will need to identify your short and long-term goals, and how much you can afford to set aside, in order to determine the type of financial products that will work best for you. Without taking these factors into consideration, you may end up investing too much in the “wrong products”, or end up putting all your eggs in the same basket, financial advisor and coach Yap Ming Hui explains on his website. For example, investing in property is not a bad thing. But if you’re putting your entire fortune into a single asset class, you risk “over investing” and exposing yourself to “too much risk”. “If the property sector takes a dip, it will badly affect your investment. In addition, it may also affect your cash flow if you take too much loan to finance your property investment,” Yap says. Having a diversified investment portfolio that comprises various asset classes can help protect your capital from adverse market conditions. 4. Get a financial plannerIf you have the capital and a goal but are a little sceptical on how to reach it, a financial planner can give you a nudge in the right direction and help devise a financial strategy to help you get there. This strategy will work as a road map towards your money goals – whether it is buying a house, saving for your kid’s education, or achieving early retirement. A financial planner can also help you buy or sell, and manage your investment portfolio on your behalf, depending on the nature of the agreement. Some planners do not charge a fee but are paid commissions on the financial products you purchase. Meanwhile, others may charge an hourly rate or a retainer fee. With their expertise, a financial planner can point you to the right financial tools to help you make informed money decisions. The current economic situation is unlikely to improve in the months and years ahead. For the time being, Malaysians will just have to suck it up and learn to adjust to higher prices. While you can’t control the economy, do keep your chin up and focus on what you can control – they lie in the choices that you make every day that can determine your financial future. Here's some good news for Damansara Damai residence & investors. There shall be alternative access routes which the construction cost is bear by developers. Of course, during construction period, there shall be frustration but long term wise, its great. Previously one of the reason I personally not looking good at Damansara Damai is the road access, now there shall be some game changer factor. Developer to build alternative access routes to PJU10 Refer from http://www.starproperty.my/index.php/articles/property-news/developer-to-build-alternative-access-routes-to-pju10/ BY SHEILA SRI PRIYA and ERIK NG THE Petaling Jaya City Council has given project approvals to three developers in Damansara Damai, PJU10, with the condition they complete the promised access routes before their project are completed.

The developers will bear the costs for the RM16mil access routes. Based on a traffic impact study conducted in January 2013, Damansara Damai suffers from traffic congestion during peak hours in the morning. In just an hour some 4,000 vehicles pass the traffic light junction at Jalan 10/1 in the morning rush hour. However, the bustling area will have several landed and highrise developments by three developers – Tetuan Jaya Megah Building and Engineering Sdn Bhd, Tetuan Medan Prestasi Sdn Bhd and Tetuan Prousaha Sdn Bhd. Petaling Jaya mayor Mohd Azizi Mohd Zain said the council had come up with a few solutions based on the traffic impact study.Among the conditions set by the council was to build a dedicated U-turn under Jalan Sungai Buloh and Kuala Lumpur interchange opposite Jalan PJU 10/1. Another was to build a connecting road from Damansara Damai PJU 10/5A and Sri Damansara Jalan SD 13/3. There will also be a new connecting road from Damansara Damai at PJU10/5 to Prima Damansara at Jalan Tanjung SD13/3. As well as a new road from Damansara Damai Jalan PJU10/1b to PJU10/9 or PJU10/1a. “On Aug 14, Tetuan Jaya Megah Building and Engineering Sdn Bhd was given development approval but with strict conditions. “The developer has to complete building the dedicated U-turn under the Jalan Sungai Buloh and Kuala Lumpur interchange opposite Jalan PJU 10/1 concurrently with the first phase of the project . “There must be no heavy vehicles transferring soil during peak hours,” he said, adding that the developers had also signed a detailed agreement with the requirement set by the council. The council had sent two letters to the Malaysian Highway Authority requesting for their approval to build a road to exit from Damansara Damai (PJU10) to the New Klang Valley Expressway (NKVE). The purpose of the road is to ease congestion for those using Jalan PJU 10/1, PJU 10/10G, PJU10/1F and PJU10/1E. The mayor said the council was waiting for the approval from the highway concessionaire. “We held a meeting on Aug 4 with the Public Works Department and they agreed to the traffic management plan. We are waiting for approval from the highway authority to go ahead with building of the road. “We invited the resident representatives to attend but no one was present during the meeting,” said the mayor. What is PRISM ?

PRISM is Malaysia’s largest property investment summit and expo, brought to you by Property Insight. This annual event has been the most exciting and anticipated event for the property industry since 2013. It’s a dynamic platform connecting property experts, developers, investors and homebuyers to network, learn and keep abreast of the latest property trends and deals. Always in November, its highly received by property enthusiasts and stakeholders to network and align strategies to the newly announced Budget in October annually. Date: 14 - 15 November 2015 | Sat - Sun Time: 9am - 6pm Venue: Sunway Pyramid Convention Center To know more about PRISM, you can surf the link blow: http://prism.my/v2/ Here's where you can get your tickets: https://www.eventbrite.com/e/prism-2015-property-investment-summit-expo-tickets-17144761443 How many of us know the story of Deepawali? Here's some of the well known stories about Deepavali

Refer from http://festivals.iloveindia.com/diwali/story-of-diwali.html Story of Diwali India, the land of rich cultural heritage, has one or the other festival for every month. It is the spiritual and religious richness in India that each festival is related to some or other deity. One of such festival is the 'festival of lights' - Deepawali. It is the glorious occasion that is not restricted to one day, but extended to a five-day celebration. All through these five days, people are in a festive mood. Adding to the festivity is the colorful display of lights. Like every other Hindu festival, stories from Mythology are associated with Diwali too. Given below is information on the celebrations of Diwali. Stories & Legends of Deepavali Return of Shri Ram To Ayodhyaa The most famous legend behind the celebrations of Diwali is about the prince of Ayodhya Nagri - Lord Shri Ram. The king of Lanka, Ravana, kidnapped Ram's wife - Sita from the jungle, where they were staying as per the instructions of King Dashratha, father of Lord Ram. In order to freed Sita from Ravana's custody, Ram attacked him. This was followed by a war, in which, Ram defeated Ravan and released Sita from his custody. On the arrival of Lord Ram along with his wife Sita, people of Ayodhya decorated their homes as well as the city of Ayodhyaa by lighting tiny diyas all over, in order to welcome their beloved prince Shri Ram and Devi Sita. Incarnation of Goddess Lakshmi On the auspicious new moon day, which is 'Amavasyaa' of the Hindi month of Kartik, the Goddess of wealth and prosperity - Lakshmi was incarnated. She appeared during the churning of the ocean, which is known as 'Samudra Manthan', by the demons on one side and 'Devataas' (Gods) on the other side. Therefore, the worship of Goddess Lakshmi, the Lakshmi Pujan, on the day of Diwali, became a tradition. Lord Krishna Destroyed Demon Narakasur One famous story behind the celebrations of Diwali is about the demon king Narakasur, who was ruler of Pragjyotishpur, a province to the South of Nepal. After acquiring victory over Lord Indra during a war, Narakasur snatched away the magnificent earrings of Mother Goddess Aditi, who was not only the ruler of Suraloka, but also a relative of Lord Krishna's wife - Satyabhama. Narakasur also imprisoned sixteen thousand daughters of Gods and saints in his harem. With the support of Lord Krishna, Satyabhama defeated Narakasur, released all the women from his harem and restored the magnificent earrings of Mother Goddess Aditi. The Return of The Pandavas The great Hindu epic 'Mahabharata' has another interesting story related to the 'Kartik Amavasyaa'. According to the story, 'the Pandavas', the five brothers Yudhishthhira, Bhima, Arjuna, Nakula and Sahdeva, were sentenced to thirteen years exile as a result of their defeat against 'the Kauravas' - Duryodhana and his ninety nine brothers, at the game of dice. Therefore, the Pandavas spent thirteen years in the jungles and returned to their kingdom on the day of 'Kartik Amavasyaa'. On their return, the people of their kingdom welcomed the Pandavas by celebrating the event by lighting the earthen lamps all over in their city. Coronation of King Vikramaditya Another legend or story about Diwali celebrations relates to one of the greatest Hindu King - Vikramaditya. It was the day when he was coroneted and the people celebrated this event by lighting tiny earthen 'diyas'. - See more at: http://festivals.iloveindia.com/diwali/story-of-diwali.html#sthash.JLnPoqI0.dpufHow many of us know th Malaysians are now the third-largest Asian investors in UK and AU Refer from http://www.property-report.com/malaysia-zooms-up-to-be-the-third-largest-asian-investor-in-uk-and-au/ But still a long way off the top spotA recent report from Knight Frank has found that Malaysia has been the third largest Asian investor into the Australian and United Kingdom’s property markets in the last two years. The country follows Singapore in first place, and China in the runner-up position. Malaysia’s investments accounted for USD5.61 billion, while China’s were worth a total of USD22.09 billion and Singapore USD25.10 billion. In total, Asian property investment in the United States, UK, Europe and Australia since Q3 2013 have totalled USD78.4 billion. The UK, in particular, has been responding proactively to the interest from Asia with one investment company even taking their plans on a two-week road show around Singapore, Hong Kong and Malaysia, reports the South China Morning Post. London Central Portfolio (LCP) have announced plans to raise USD150 million from Asian and Chinese investors to buy up 100 prime central London residential units in iconic buildings around the British capital, targeting property offering 12 percent annual returns. “Affordability is not an issue and will not be for some time to come. With over 13 million high net worths around the world and just 5,000 sales a year in London, it is the scarcity of stock and the constant global demand that underpins future price growth potential,” explained LCP chief executive Naomi Heaton in Hong Kong, on the decision to target Asian investors. Malaysians have invested USD2.23 billion into UK property in the last two years.James Buckley, executive director of Knight Frank, commented that Malaysia’s overseas property investment has been “incredibly active” but is now at risk of slowing down thanks to the weakened ringgit.

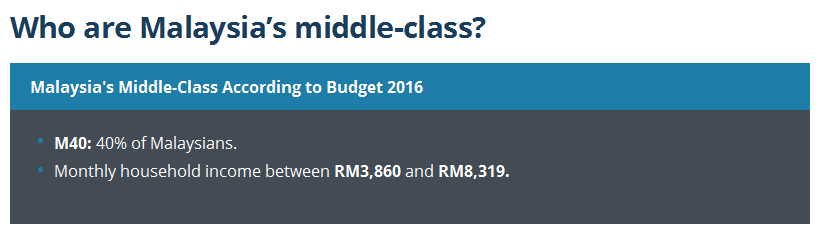

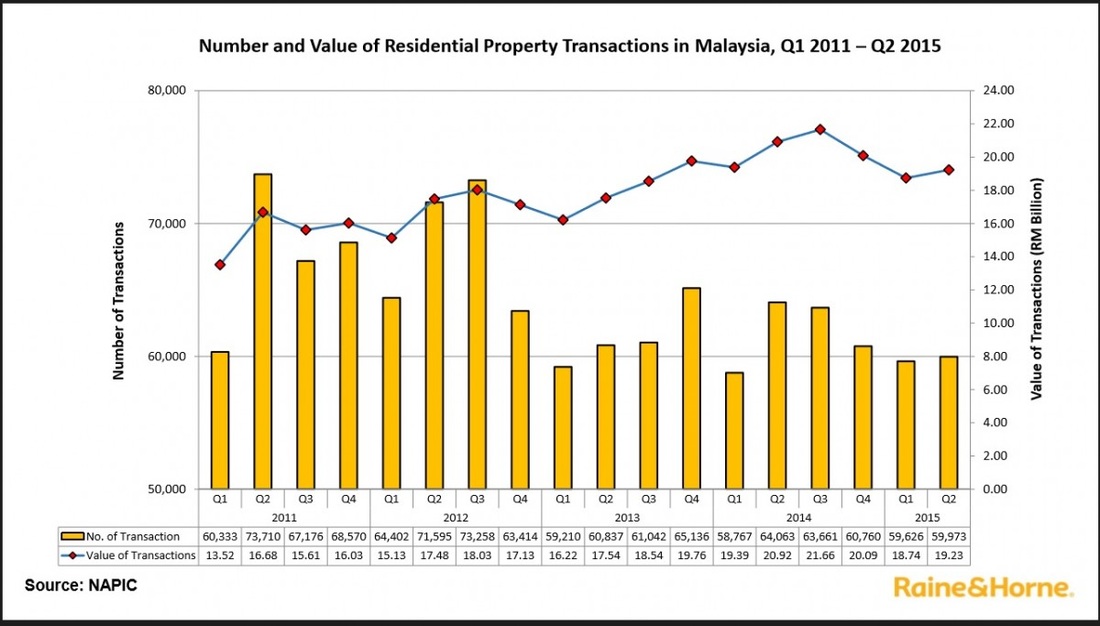

“There is a strong desire from Malaysian investors to diversity their wealth into overseas markets. There has been a slight shift in outbound capital, with Malaysian investors focusing more on the Australian market compared with the UK. “This has largely been driven by the value of the Malaysian ringgit relative to the Australian dollar, which has weakened 6.6 percent versus 24 percent relative to the pound sterling,” he added. Image is by barony and is used under a Creative Commons licence We are approaching the end of the year of 2015, a lot of people is saying the market is falling. Are we? Here's a great analysis from Raine & Horne International Zaki & Partners Sdn Bhd. Rising, falling, rising? Market observations for the first half of 2015 By Raine & Horne International Zaki + Partners Sdn Bhd Refer from http://www.theedgeproperty.com.my/content/rising-falling-rising-market-observations-first-half-2015 MALAYSIA: OVERALL RESIDENTIAL PROPERTY MARKET There was an overall contraction of the Malaysian residential property market in the first half of this year (1Q2015) compared with 1Q2014, according to figures released by the National Property Information Centre (Napic). The first half of 2014 (1H2014) recorded a total 122,830 transactions in the market worth a total RM40.31 billion. In comparison, 1H2015 recorded 119,599 transactions with a value of RM37.97 billion, or a 2.63% contraction. If we look at the quarterly comparison, the 1Q2015 saw a slight increase of about 1.46% to 59,626 transactions (RM18.74 billion), from 58,767 transactions (RM19.39 billion) in 1Q2014 . By 2Q2015, there is a noticeable contraction of 6.38% to 59,973 transactions, from 64,063 transactions in 2Q2014. Over the years, it is normal for the number of transactions to increase from the first to the second quarter, as seen in 2014 (from 58,767 to 64,063, worth RM20.92 billion). Looking at transaction history, the first quarter of every year usually sees a slight drop before the transactions spike in the second quarter. The residential property market in Malaysia hit its peak in 2Q2011, when transactions spiked to a high of 73,710 (RM16.68 billion) from 60,333 (RM13.52 billion) previously. Similarly, 1Q2012 saw a total of 64,402 transactions (RM15.13 billion), which spiked in 2Q2012 to 71,595 transactions (RM17.48 billion). After the market hit its peak period between 2011 and 2012, it began to drop in 2013 and reached a four-year, all-time low in 1Q2014. The market picked up in 2Q2014 and 3Q2014 by recording 64,063 transactions (worth RM20.92 billion) and 63,661 transactions (RM21.66 billion), respectively. By 4Q2014, the market had again dropped, to 60,760 transactions (RM20.09 billion) and continued to drop in 1Q2015 before increasing slightly in 2Q2015. In summary, the overall residential property market in Malaysia in the last four years up to the first half of this year saw the market spiking in 2011 and 2012 before it contracted in 2013. While picking up slightly in 2014, it again showed a contraction in the first half of this year. Raine & Horne International Zaki + Partners Sdn Bhd senior partner, Michael Geh, attributes the overall contraction in the market to strict loan requirements. "The low loan approvals due to stricter loan requirements has taken a toll on the property market," he says. PENANG RESIDENTIAL PROPERTY MARKET In Penang, the residential property market contracted by almost half since the hitting its peak in 2011. The market recorded a total of 9,667 transactions in 4Q2011, its highest in four years, before seeing a drastic drop of about 48.47% in 1Q2012, to just 4,981 transactions. The corresponding value of transactions dropped to RM1.5 billion in 1Q2012, from RM2.27 billion in 4Q2011.

The market saw fluctuations in 2012. In 2Q2012, the number of transactions increased by about 38.68% to 6,908 valued at RM1.92 billion before dropping slightly to 6,398 in 3Q2012. The market plunged again in 4Q2012 by 22.17%, to 4,979 transactions. The market continued to contract in 1Q2013, when the number of transactions dropped slightly to 4,193 (worth RM1.55 billion) but remained stable with slight increases throughout the next three quarters of the year, bringing the total transactions to 17,700 units (RM7.1 billion). In 2014, the pattern of transactions was interesting. It dropped slightly by about 8.66% to 4,291 transactions in 1Q2014 from 4,598 transactions in 4Q2013, before increasing by about 10.27% to 4,732 in 2Q2014, valued at RM1.89 billion. By 3Q2014, the number of transactions had dropped to 4,194 (RM1.75 billion), before surging 23.82% to 5,193 transactions (RM2.06 billion) in 4Q2014. By 1Q2015, the market had plunged again by about 26.17% to 3,834 transactions (RM1.55 billion) compared with 4Q2014. A year-on-year (y-o-y) comparison with 1Q2014 also saw a market contraction of about 10.65%. In 2Q2015, the market improved slightly on the previous quarter, to 3,909 transactions (RM1.59 billion). However, in a y-o-y comparison with 2Q2014, the market contracted by 17.39% or 823 transactions. Geh believes the market contraction in Penang could also be due to strict loan approval criteria and fewer loan approvals. He adds that the long delay in the issuance of the advertising permit and developers licence (APDL) had also taken a toll on the Penang residential property market. "I believe the demand for projects in the pipeline in Penang is good but the sales process cannot commence due to the delay in the APDL," he says. Developers must obtain the APDL from the Housing Ministry before the sale process and the signing of the sales and purchase agreement for any development project. The issuance of the APDL in Penang for many projects by local developers has been delayed for more than a year. |

MPIG NewsIn this section we will be sharing on articles & news update related real estate and some other interesting topics. Archives

May 2024

Categories |

- Home

-

New Property Launch

- Lakeside Freehold Fully Residential Private Lifestyle Condominium in Cyberjaya

- Spacious 2024 Completion KL Condo Fully Residential KLCC View

- RUMAWIP Bukit Jalil (Bumi Only)

- Lake City @ KL North NEW PHASE FROM RM380k

- Alora Residences – Inspired living within greenery in Subang Jaya

- PJ Spacious and Affordable 5 Star Condo

- Best Investment 2022 PJ Damansara Low Risk Low Entry Price High ROI

- 2022 PJ Rumah Mampu Milik RM270k Damansara

- Bangsar South 2 Rooms from RM390k BELOW Market Price

- 10% ROI PJ Project near Ikea and One Utama Mall

- Mid Valley Seputeh New Launch

- Pavilion Damansara Heights 柏威年 白沙罗岭 马来西亚 吉隆坡 精选楼盘

- 马来西亚RM300千的PJ屋子-首购族,年轻人月入3千能买房

- 2021 Penang Most Awaited Project

- 2021 New Launch - KL Metropolis

- Freehold LRT Linked 3 Room Suites in Glenmarie

- New SPACIOUS Kepong Landed 6 Room 6 Bath

- Bangsar Last Piece Land New Launch

- Avara Seputeh (Mid Valley)

- Project Announcement Registration. Malaysia New Property Launch

-

Existing & Past Project

- 2020 Lowest Risk & Price in Klang Valley with Great ROI

- Kiara East Suite Dex

- 2019 SAFEST PROFITABLE HIGH CASHBACK INVESTMENT

- Best Property Investment Projects in 2018

- KL City Freehold Spacious Affordable 3 room Project

- Jalan Kuching Freehold New Office & Shoplot

- Jalan Ipoh New Freehold Shoplot & Offices

- RM300k KL Sentral New Prelaunch

- The Olive Condo, Sunsuria City

- Prelaunch Landed House Bukit Rahman Putra

- RM260k No Downpayment Puchong South Suites

- PJ North RM400k High Cash Back Project

- Denai Sutera @ Alam Sutera, Bukit Jalil

- First Phase of Banting New Township

- Neu Suites 3rdNVenue @ Embassy Row by Titijaya & CREC

- COURT 28, Jalan Ipoh KL City New Property Launch Service Apartment. Malaysia New Property Launch

- Semanja Kajang New FREEHOLD Kajang Double Storey Houses. Malaysia New Property Launch

- M Suite @ Desa Park North

- BIJI LIVING @ Sek 17 PJ City by Conlay. Malaysia New Property Launch

- Amani Residence Bandar Puteri Puchong New Freehold Service Apartment. Malaysia New Property Launch

- SFERA RESIDENCY @ Puchong South. Malaysia New Property Launch

- KL North Last Release

- PreLaunch Freehold Double Storey

- LAND

- News & Articles

- Other Reference Link & Services

- Referral

- Career

- MPIG

- Get Professional Advice

- PJ八打灵全新地产项目分析手册

Hours

M-S: 9.30am - 9pm

|

Telephone

+60 12 3760864

|

Email

|

RSS Feed

RSS Feed