|

More LRT Station is opening... Another four LRT stations in Puchong to open next week BY MENG YEW CHOONG Refer from http://www.thestar.com.my/metro/community/2016/03/24/puchonglrt/ Four more stations of the Ampang LRT line - IOI Puchong Jaya, Pusat Bandar Puchong, Taman Perindustrian Puchong, and Bandar Puteri - will open for service by next Thursday (March 31).  The announcement was made during a presentation by the Malaysian delegation at the two-day Asia Pacific Rail 2016 conference that ended on Wednesday in Hong Kong. The delegation was led by Prasarana Malaysia Bhd’s president and group CEO Datuk Azmi Aziz, who came with Rapid Rail Sdn Bhds CEO, Ahmad Nizam Mohamed Amin. With 33 stations operational next week, the Ampang line promises to bring much relief to those living and working in Puchong, especially the Bandar Puchong Jaya area. Three of the four stations mentioned above are located parallel to Lebuhraya Damansara-Puchong (LDP), which is constantly congested at the Puchong stretch. However, some commuters feel let down that the opening of the final three stations - Puchong Perdana, Puchong Prima, and Putra Heights - are delayed. "Of course, I am disappointed. But then, I suppose that having four stations open next week is still better than not having anything at all," said Gloria Ngu, 21, a student who lives at Putra Heights. Puchong Perdana and Puchong Prima are the stations that will complete the LRT loop at Putra Heights via the Putra Heights interchange station. The Putra Heights interchange will seamlessly link the Ampang line with the Kelana Jaya line. According to sources familiar with the matter, the opening of the last three stations of Ampang line will most probably happen by June. June also happens to be the timeline for the 14 LRT stations of the Kelana Jaya to open for service. The opening of these 14 stations will mark the completion of the sorely-needed LRT extension programme first announced in 2006. Azmi, who fielded questions on customer management issues at the conference, reaffirmed the role of both social and mainstream media in managing expectations of an increasingly demanding customer base. "We recognise that it is important to communicate clearly and quickly in order to get our message across. In this regard, all forms of media have their place," he said. Asia Pacific Rail is an influential annual meeting or rail professionals that attracts over 1,000 attendees from across the globe each year. In Oct last year, four stations – Awan Besar, Kampung Muhibbah, Alam Sutera and Bandar Kinrara 5 (BK5) began operations. The Ampang Line Extension starts from Sri Petaling Station, passes through Kinrara and ends at Putra Heights in Puchong. The extension is 18.1km long with 12 stations. Combined with the existing line, the total length of Ampang Line after the completion of LEP will be 45.1km.

0 Comments

Good news good news! MRT is Good To Go!! This definitely going to help the infrastructure and connectivity within the suburb area Construction of MRT Line 2 to proceed - Najib Bernama | March 16, 2016 KUALA LUMPUR: The government will go ahead with the construction of the second line of the Mass Rapid Transit (MRT Line 2) despite the current global economic problem, said Prime Minister Datuk Seri Najib Razak. He said it was the government's commitment to ensure the project could be carried out smoothly for the benefit of all, including in terms of providing employment opportunities and income. "This clearly shows that Malaysia is not a failed country as claimed by certain politicians and the government is not facing any financial crisis," said Najib in his blog posting at www.najibrazak.com. Najib, who chaired a discussion on acquisition for the MRT Line 2 construction Tuesday, said it also proved that the government always gave priority to initiatives pertaining to the country's development. "I want to say again that we will continue to spend prudently, especially for people-centred projects, like infrastructure and transportation," he added. For MRT Line 1, Najib said 43 per cent of the total value of the package had been given to Bumiputera contractors as an initiative to ensure the agenda on bumiputera economy. "For Line 2, the government continues to encourage bumiputera participation with at least 45 per cent of the total value of the package to be given to them, apart from the minimum requirement of 30 per cent of consultancy work for bumiputera contractors as set by MRT Corp," he added.The prime minister also gave the assurance that the government would continue with efforts to improve the public transportation system in the country. Follow up from our previous sharing. Here's another view from another leading expert in the field. They think the Real Estate could having a turnaround. Who's they? And Why?  Slowdown may have reached the bottom, says research house Slowdown may have reached the bottom, says research house Slowdown may have reached the bottom, says research house PETALING JAYA: The slowdown in the local property sector could be reaching an inflection point based on promising economic data, according to Affin Hwang Capital. The research house, in a report yesterday, said the local property sector could see a turnaround following three consecutive quarters of subdued transactions. “After three quarters of contraction in the number of properties transacted, we believe this could almost be the bottom, as historically, over the past 10 years, the industry has only suffered at most, four quarters of negative growth (namely from the fourth quarter of 2012 until the third quarter of 2013). “In the fourth quarter of 2015, the residential housing starts fell substantially to around 34,000 units, which may suggest that property developers are delaying launches and this may cap new incoming supply, and hence minimising the risk of a prolonged oversupply.” Affin Hwang Capital also said it sees signs of an improving macro environment. Malaysia’s real gross domestic product growth is estimated to soften from 4.6% year-on-year in the second half of 2015 to around 4.3% in the first half of 2016, before recovering to 4.7% in the second half, bringing full year growth of 4.6% in 2016. “This is at the high end of the official Government forecast of 4% to 4.5%,” said the research house. However, on a more positive note, Affin Hwang added private consumption had rebounded to 4.9% in the fourth quarter of 2015 from a trough of 4.1% in the third quarter of 2015.” In addition, the research house also said payrolls continued to expand, with the average wages of 4.6% year-on-year in the fourth quarter of 2015 and 4% for 2015. “High employment coupled with wage growth should be supportive of consumption activity, once consumer sentiment improves. As of the fourth quarter of 2015, unemployment rate remained healthy at 3.2%, while total employment has reach an all-time high of 13.9 million people. “Labour force participation rate continues to hover not far below its record high at 68%,” which the research house believed would sustain the improvement of private consumption.” Overall, Affin Hwang Capital said it is maintaining its “overweight” call on the local property sector. “We believe the bottom is approaching and that further downside risk to share prices is limited. “Property sales will be supported by healthy existing unbilled sales, as well as new launches,” it added. The research house said key downside risk to its recommendation included a sharper-than-expected slowdown in the domestic property market, prolonged downturn in the property market and a sharp deterioration in property prices. By Jonathan de Ho Its often I hear this year that everyone is saying property is going slow and going to crash this year in 2016. From our analysis, its not going to crash. Yeah its cooling down, that's for sure but just that. Crash is not something I expect to happen in Real estate in Malaysia. Why so? From my point of view, we may not having a great economy but we are heading to stability. Its all inter-related with other profession as well. Its slowing down, but everyone is taking measures to handle the situation and move towards stability. What do you think? Auction market is having more and more property under auction. More and more unit is unsold or yet rented out. Yet funny statistic shows about half of the investor think that new launches will remain equal with and without launches. Have you heard stories that most of the great company actually appear during the most difficult time of the economy? That's what I believe in, that good time, yes many people is smiling all the way even without investment knowledge. But then what happen when come to bad time? Its about the knowledge you possess and also are you prepare for the bad times? A lot of experience investor already collecting and ready their bullet and pounce on the soft market especially on Urgent Sales. Its about looking to niche and opportunities arise during this period. Have you ready for it? Have you done any preparation for the past year? It's ok if not. There's always time to rise as long as you start action and do something about it. Here I share some of the news that experts also believe in opportunity and turnaround of the market. Most experts rule out the possibility of a property crash BY THEAN LEE CHENG Refer from www.thestar.com.my dated 12th March 2016 AT a property forum recently, a participant asked a panel of five speakers if Malaysia was already looking at a crash in the property sector. “There are fewer launches. More than 60% of loan applications are rejected by the banks and fewer units are being sold today. Are we in a property crash?” he asked during a question-and-answer session at theProperty Market 2016: What to Expect? forum session organised by the Real Estate and Housing Developers Association (Rehda). “Or are we going to keep on saying that maybe at the end of this year, things should bottom out,” said Andaman Property Group managing director Datuk Seri Vincent Tiew, one of the many developers and property consultants who attended the one-day event. The rout in the oil prices and the ringgit started in October last year. Since then, the effects of external and internal factors affecting the economy have started to bite. Developers are feeling the pain. Today’s sales launches are a far cry from the rah-rah years of 2011, 2012 and 2013 when units were snapped up within just a couple of weeks, or days even. Even then, property consultants had questioned the sustainability of that period as house prices escalated phenomenally. In a recent survey for the second half of 2015 conducted by Rehda in 12 states among 159 respondents, more than three quarters of developers expect to have sales of below 50% in the first six months of the launch. While developers bemoan the slow sales, the second half of 2015 fared better than the first half. More than half of the 9,938 units launched were sold in the second half compared to only 40% sold out of the 10,829 units launched in the first half. According to the survey, end-financing and loan rejection topped the reasons for unsold units. Developers also complained that the cost of doing business has gone up. The conclusion was that 70% of the respondents were pessimistic about the first half, with the level of optimism expected to return in the second half of the year. Andaman’s Tiew brought up two issues: Are we already in a crash? Are we going to comfort ourselves that things will be better by the end of this year? At the forum session, moderator Datuk Soam Heng Choon, who is also Rehda deputy president, says there is no crash. “If you look at the Asian Financial Crisis (1997/1998), out of 10, you had five who reneged on their purchases. Prices were down by 30%-40%. Non-performing loans (NPLs) were high. “These are the indications of a crash. We are only going through a lull,” Soam, who is IJM Corp Bhd CEO and managing director, says. Forum speaker Christopher Boyd, Savills executive director, said a crash is marked by a sudden sharp drop in prices and a sharp rise in interest (currently about 4.5%), compared to the double-digit interest rates in 1998. Hamirullah Boorhan, Maybank head of community financial services, says the 1997 crisis was marked by a lot a property auctions and high NPLs. Today, NPLs are less than 2%. Although it is expected to increase gradually to between 2% and 2.5% over the next two years, this increase will likely be manageable. Says Hamirullah: “So, it is not a crash.” Malaysian Institute of Estate Agents’ Erick Y.T. Kho, who is also the CEO of Mapleland Properties, is of the view that while things may not turn around so quickly, there will be opportunities in the second half of the year. “There will always be opportunities in the secondary market. The market is going to bottom out (in the second half),” says Kho. Out of the five forum speakers, four together with forum moderator Soam were of the view that things would be better in the second half, that unsold properties will be absorbed by then and that there was no need to give up on commodities, and oil and gas stocks. Only Khazanah Research Institute managing director Datuk Charon Wardini is of the view that things will continue to go downhill right into 2017. Charon says global economists are of the view that the global economic situation is expected to worsen and Malaysia will be affected by the negative currents. “If anything, it may be going further down,” he laments. Earlier, Charon said there seemed to be a dichotomy in terms of how people view the economy. “People tend to look at the economy from the viewpoint of the gross domestic product. However, a growing economy is about households and their income, and the increase of that income.” He said there are three household expenses, namely, transport, housing and food. The question is, what can be done about the housing cost? House prices should be three to four times the median household income. This is the acceptable threshold, he said. However, it does not mean that every house built must be three to four times the annual median household income, Charon says. But the overall rise in house prices the last several years has exceeded that threshold of three to four times. It is this issue which society is facing today and which must be addressed. Charon says that in the last couple of years, the cost of steel has dropped or has not gone up, likewise with other materials. Soam counters Charon’s argument by saying that salaries in Malaysia have not increased in tandem with the cost of living. To that, Charon says: “We are looking at house prices and household income. It is not an accusation. If we talk about lowering house prices, what is the best way to do it? The best way is to build houses faster and cheaper. One of the ways is by using Industrial Building Systems (IBS). The Chinese developers and the Philippnes are doing it (building faster and cheaper). “If the Philippines can come up with their own system of IBS, why not us?” Charon asks. IBS is a construction technique which modernises and speeds up the building of properties. In terms of quality, it is better than the conventional way of building which Malaysian developers are used to. It also helps to reduce the labour cost and foreign labour, another issue that is challenging Malaysia today, says the Construction Industry Development Board. Tips to sell homes for a higher price... That's something everyone waiting for. Are you sure? Here's how. 5 tips to sell homes for a higher price! Refer from StarProperty  Like many other industries, real estate is driven by the cardinal rule of the market: Buy low, sell high. We all know this. And lately there are a couple of ways to give your sales an edge that stands out. Presenting these five tips to your potential customers will help sell your properties faster and for a higher profit. 1 Smart homes sell faster Research suggests that homes sell more quickly when they are equipped with the right technology that homebuyers seek. Many buyers are looking for the newest gadgets so that they won’t have to pay to have them installed later. They prefer that their new homes come equipped with the technology that they see in other new homes right now. Homebuyers are more interested in homes featuring smart features and tech than two to five years ago. 2 Staging matters Every agent knows the old adage, “Homes that don’t show well don’t close well.” But yet, time and time again we see sellers rail against the time and cost associated with staging a home. After all, if they love their home as it is, why shouldn’t everyone else? If you have a particularly staging-averse client, take them on a two-home showing: one where the home is staged and one where the home is not. 3 The market sets the price, not the owner It’s understandable that many home sellers think that their home is above the price that the market dictates. Sentimental value often translates into an inflated sense of the home’s worth, but when it comes price, the winning opinion is always the market’s opinion. Agents know it’s impossible to effectively price a home without taking into account the competition. Unfortunately, too many sellers don’t. First, it’s essential to determine how much the seller thinks their home is worth. If their expectation is wildly inappropriate, it may be worth taking the clients to see a home that is on the market and priced at their expectation. Then, take the seller to a comparable home that is priced similarly to where you feel their home should be priced. Take the time to both educate them on the competition and give them expert home pricing tips to help them understand your pricing strategy. 4 Small renovations may mean big bucks In many cases, the cost of repairing a home is less than what a potential buyer may estimate. If buyers overestimate the cost of fixing the problem, it may negatively impact the offer amount and end up costing the seller more in the long run. Be upfront with your seller clients when you spot unsightly blemishes that could cost your clients the deal. Before you list and start marketing the property, counsel your sellers on the improvements you know will make a difference when it comes to price. 5 Real estate is a local business The last few years have turned real estate headlines into high-profile news. Home prices are on the rise. Be sure to remind your sellers that real estate is a local industry and that asking price isn’t everything. To do this, consider posting your own local market updates on your personal social media or real estate blog.

“The market is sluggish as a result of the ongoing global economic uncertainty. Consumers are cautious in buying new properties,” he said in an email interview. Beh said they saw good opportunities to present a compelling product to a less cluttered market, as well as a discerning market of buyers who were interested in strong products and good investment opportunities. “We always believe in our products’ strength and their ability to attract buyers,” he said. Novum, which means “new innovation” in Latin, seeks to redefine Bangsar South, one of the city’s prestige precincts with a bold, innovative architecture and lifestyle offering. Each unit, with built-up areas ranging between 641sq ft and 1,441sq ft, is averagely priced at RM900 per sq ft (psf). The project is a stone’s throw from Mid Valley Megamall and The Gardens, and adjacent to the Federal Highway and LRT station. Beh said Novum’s unique design – interlocking shapes and wave forms that create “clusters of villages” high in the sky – would complement the nearby TM tower, one of KL’s more recognisable landmarks.

“Having developments in Kuala Lumpur and Sungai Petani provide us with a diversified source of income to hedge against the volatility of the markets.

“In Sungai Petani, we have a good mix of products – high-end luxury houses and mass housing – which spread our risk in times of bearish markets,” he said. Since the group started operations in 1986, it has built more than 20,000 homes in Sungai Petani and Seberang Prai. Its 18-storey Sky Residences in Sungai Petani was the country’s first LEED-certified (Leadership in Energy and Environmental Design) building in the country, LEED is the green building rating system in the United States that is widely used in different parts of the world. In 2014, Eupe was awarded the title of Malaysia’s top developer.  Is this the good news that everyone waiting for? DIBS to make a comeback? There could be a chance that DIBS is making a comeback according to REHDA. DIBS to make comeback? Refer from Starproperty.my BY THEAN LEE CHENG PETALING JAYA: The Real Estate and Housing Developers Association (Rehda) is in discussion with the Government to bring back the developers interest bearing scheme (DIBS) in a certain form for first-time house buyers of a certain price, Datuk Soam Heng Choon said at a property forum. Soam, who is also IJM Corp Bhd CEO and managing director, told participants this while moderating a forum session at the Rehda Property Forum 2016 yesterday. “We are engaging with the Government on this,” he said. The scheme, which allows a house buyer to pay a downpayment of between 5% and 10%, and the rest on completion of the property was banned on Jan 1, 2014 because it was deemed to encourage speculation. It was the first cooling measure to be banned in Singapore in its fight against rising house prices. While the removal of the scheme and macro-prudential measures weeded out speculation, it came at the expense of plummeting sales. Earlier, Rehda president said a survey conducted among 159 developers in 12 states in the second half of 2015 showed that properties between RM250,000 and RM700,000 had the highest loan rejection rate. He said 67% respondents believe end-financing was the culprit for unsold units. He said unsold stock would rise and will also affect affordable housing. “Loan rejections rate is more than 50%,” he said. Unsold units for the first half of 2015 was manageable with 68% of respondents having up to 30% of unsold units. Residential sales rose by a fifth in the second half compared with the first six months, although launches slowed. Respondents with unsold units mainly in Selangor, Johor and Pahang decreased from 78% in the first half to 62% in the second half of 2015. Respondents were also pessimistic about the first half of 2016. Soam said stringent lending conditions will come at the cost of high home ownership. Although Malaysia has a high household debt against gross domestic product of close to 90%, the highest in South-East Asia, on closer scrutiny, only 50% of this debt were mortgage-related while in Singapore and the US, mortgage debt make up 74% of their household debts. There is therefore room for mortgage debt to go up. “Curtail unproductive loans,” he said. Two of the forum panel speakers Maybank Malaysia head of community financial services Hamirullah Boorhan and Khazanah Research Institute managing director Datuk Charon Wardini, however, said home ownership should not be achieved at the expense of high household debt. Instead, one of the ways, Charon said, was to modernise and cut house prices by building housing cheaper and faster using Industrial Building Systems (IBS), a housing construction technique used by the Chinese and a company in the Philippines. “If Philippines can do it, why can’t we?” he asked. Charon also said social housing – or affordable housing – at RM500,000 were “not affordable to many.” “It should (be capped) at RM300,000,” he said. Charon said in order to put the housing sector into its proper perspective of demand and supply, what is needed is a national housing survey. “You cannot talk about the Malaysian housing market per se but you can talk about the Kuala Lumpur housing market, or the Johor or Penang market,” Charon said. It has to be very location-based because the median household in Kuala Lumpur is much higher comparative to some locations outside the Klang Valley, he said. It is very common that you heard a lot of Mortgage Loan rejected case nowadays. Do you know why? If you don't, here you must read this to further enhance your knowledge. Or else you will be the next! Top 10 Reasons Your Loan Application Was Rejected by Gary Chua Rfr from Proprty Guru “Your mortgage application is rejected!” The above phrase is quite frightening, but this does not mean you can't get a loan or mortgage anymore. The good old days where an officer judged and evaluated your loan application based on how they felt about you has gone. Due to the fast-paced economic growth we are experiencing, the banking industry has become more competitive. Therefore, banks have picked a systematic approach in processing mortgage / loan today. This systematic approach has led to complex banking conditions, where the banks initiated policies and credit scoring system to decide if the bank would like you to be their mortgage customer, the amount of credit lines you deserve, as well as predicts the chances of you default the repayment. Knowledge is the key and ensuring you have a flawless financial record will increase your chances greatly with banks. This translates into banks granting you more credit lines to leverage on your biggest investment. However, as of today, approximately 50% of mortgage applications are rejected. We are pretty sure that the majority of mortgage applicants today have the repayment capability and can afford the said property, but are still being rejected. All this boils down to the fact that we need to be well-organized in managing our finances. Here are several reasons pertaining your loan rejection: 1. Applying at the wrong bank What? All banks don’t apply the same policies? The answer is ‘No’. Each bank follows a different set of requirements. You may get your loans approved in one bank but may not get it in another. The problem starts when you keep on applying in several banks at the same time, without realizing the consequences. Do you know that Bank Negara Malaysia (BNM) tracks all our loan applications and their statuses? If you started off wrongly by getting the first few banks to decline your application, the record sticks there and you may not get your future loans approved at the subsequent banks, even when you fit their requirements. Come on, would you lend money to someone who has records of rejected loans? All banks have different risk appetites. You may get rejected for holding too many credit cards and you may also get rejected for not holding any credit card; both situations can occur based on the bank requirements. Keeping your Central Credit Reference Information System (CCRIS) clean will ensure the banks favour you, as you will have the right profile which fits them well. Some of the common "not preferred segments" are as follows:

Understanding these reasons are vital to prevent time wastage by submitting and applying at banks, which results in a higher possibility of rejection. 2. Low application score Banks are getting more efficient and complex these days. Gone were the days where human judgement and manual eyeballing were done to accept or decline an application. Most banks have implemented a scores engine called application score, which analyses the customer's profile - your age, where do you stay, education level, marital status and so on. Ever wondered why the bank application form is lengthy with numerous questions about you? Most of this information is collected and in each query, a score is given based on the details you provide. Well, it is not as simple as giving a random score for each question, but scores based on a detailed algorithm combining the details. 3. Unfavourable Credit Score Banks rely heavily on the credit score engine nowadays in decision-making. Credit score engine analyses your repayment behaviour based on your CCRIS. Basically, a credit score denotes an indication on how wisely you manage your money in the past. However, the policies and requirements differ from bank to bank, as each bank has its own risk appetite. There are many ways to skin your CCRIS and some of the below may cause your loan to fail:

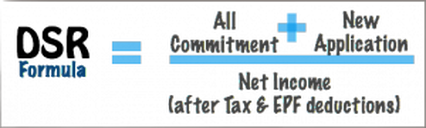

For a person with ‘thick bureau’, the bank will first consider your payment priority in the event of any misfortune. Managing your CCRIS well is important to prevent from having your loans rejected. 4. Denied due to Credit Rule On top of credit scoring, banks may still reject your application with a set of credit rules – missed payment for more than 3 times in the last 6 months, missed your current monthly payment and so on. Credit problems often stand in the way of a mortgage loan approval. Whilst some cases require extensive credit improvements, others can be resolved quickly. Banks look at your past performance to gauge your future performance. Banks will also look at your leveraging level. If you had a poor repayment track record, chances are you will not get your loan approved. Repayment trend can be easily obtained through CCRIS. Showing any delinquency of 2 months and above will greatly reduce your chance of getting that loan approved. Matters become worse if you already have an existing loan in the bank you are currently applying for. Your entire repayment behaviour will be reviewed, with your payment pattern. This will affect your current loan application – in a good or bad way. 5. Bad status in CCRIS If you have any accounts which repayments were not made over a prolong period (normally more than 6 months for a personal loan or credit card, potentially longer for a secured loan), your record may be red flagged as a "special attention account" in your CCRIS. Generally, banks will not proceed with your loan approval upon seeing any red flags, even though you have a good track record for your other credit facilities in your CCRIS. If you approached the bank before the event of default or went into any legal battles with the bank, expressing your difficulties in meeting your monthly repayments, some banks may offer to restructure or reschedule your loans. These usually are done by extending your tenure to lower down your monthly repayments. Such acts are deemed as potential financial distress and despite you continue to make prompt repayments under these schemes; banks have a duty to report your facility as being restructured. Other banks may not want to grant you any new mortgage facility because you will be perceived as not being able to manage your existing debts. Other warning signs from your CCRIS are items such as enrolling yourself into AKPK (a debt management service under the arms of BNM), or legal actions taken against you previously. Such remarks will not be erased from the system despite regularizing your payments for more than 12 months. 6. De-Cheque Maintaining discipline in your cheque facility is important. If you have 2 or more bounced cheques in the past 12 months, most banks will not proceed with your mortgage application. The record will remain, regardless of the affected current account is closed or the account is not from the bank you are applying for the loan. 7. Bankruptcy If you are officially declared a bankruptcy, you will not be able to get any new loans, refinance or top-up any mortgage facilities. Bankruptcy status is published in the newspaper daily. If you have been declared bankrupt, either by a particular bank, individual or by an organization, your record will be available permanently in CTOS for reference. CTOS captures and compiles bankruptcy status, which are published in the public sources. CCRIS only captures the bankruptcy status, if you are declared bankrupt by a bank. 8. Debt Service Ratio (DSR) Knowing the ratio of your debt to income is important and key in getting your loan approved. This is a formula used by banks to evaluate your affordability level. The DSR is calculated based on the total of all your monthly debt obligations - often called recurring debt / commitment, which includes your total loan on mortgage, car loans, personal loans, your minimum monthly payments on any credit card debts, your other loans, together with the monthly commitment for the current application, divided by the net income - after the deduction of income tax / KWSP/ SOSCO (where applicable). This has become the most common rejection reason, where approximately 35% to 40% of loans are rejected due to this. Different banks have a different DSR cut-off or capping (eg: 60%, 70%, or some even up to 80%). There are 2 key elements in improving your DSR ratio, Firstly, having the bank recognizes your best and highest income is key as it ensures your DSR ratio gets lower. Next, is to manage your monthly commitments / debts. There are several schools of thoughts in managing your debts. Here are some common ones:

9. Not submitting the ‘right’ income documents and other required documents Sometimes, all it takes is a bad scanning or photocopy, and out goes your application. Before we discuss further on that, here are a basic list of paperwork required:

Income documentation is the most common area where an application may be declined. Different banks have different income documentation requirements and will also have a different method of deriving income from the documents submitted. This means that from the same document you have provided, banks may derive income with a variance of up to 50%. This is often the case when you did not provide sufficient documentation or it is variable (fluctuates in nature). Generally, for a fixed income earner, the key item to show here is that you contribute EPF and pay your taxes. This would be stated in your pay slips if that is the required income document. For variable income earners / commission earners (which includes fixed income earners with a portion of the income contributed by allowances or incentives), the key here is to show income stability. Banks will need sufficient months’ of income, typically over 6 month period. Where there is a high volatility in your income (in certain months), you should provide more documentation to justify your income stability. Ensure your bank knows if you are on a quarter, half or yearly commission schemes, as you do not want to be viewed as an individual with very high variances in monthly earnings. For business owners, improper maintenances of your business paperwork may lead you towards not getting any loans approved. Typically you will need to have a business with at least 2 years in operation, on top of a good audited P&L or good transactions (proved in bank statements). This is to demonstrate that the business has a stable income. Similar to a commission earner, proving income stability is vital. 10. Employment You may need at least 3 to 6 months of employment history in order for you to obtain your very first loan. Having a job that provides EPF contribution even though your income is not high is vital. Certain banks may not offer you a loan if your salary is paid by cash deposit. Just landing on your next big job with a 50% increment in salary may not necessarily mean that you increase your chances of getting a mortgage loan. Continuity of employment and how long have you worked with an employer is an important factor in getting that loan approved. Other substantiations can also help justify if you are in this scenario. For example justifying that you are progressing to a new job in the same industry with a better remuneration helps. Other documents to support your applications such as employment confirmation letter or previous employment income history may also help. The pièce de résistance of maintaining a good financial track record If you are deeply indebted or have too many credit problems, regardless of how many banks you might have tried, you might not succeed in obtaining a mortgage approval. In this scenario, you will need to get your finances in order first. Especially, when you wanted to buy a new property. All the above reasons that might cause your mortgage application decline can be mitigated or overcome. There are many ways where you can start preparing and getting yourself accepted by the banks. So step up and grab the next big deal that comes to you. 'Good things come to those who wait. But better things come to those who work for it'. Start improving and get yourself prepared to be loan-able. Get your money management right and be ready to own your dream property when the time comes! ****************************************************************************************************************** Gary has more than 11 years of banking experience, both in local and international banks. He turns his extensive knowledge and banking experience into his benefits and SMART financing that has given him an edge in his property investment journey. He contributes his views, comments and insights to property magazines & conventions. He is the CEO of SMART Financing where he shares his financial knowledge and experiences with his members and helps them master the skills on achieving financial freedom via responsible & smart leveraging. Article refer from http://www.propertyguru.com.my/resources/mortgage-guide/top-10-reasons-your-loan-application-was-rejected  Chris Tan from Chur Associates Chris Tan from Chur Associates Its a headache when you have a very bad tenant. You still have to pay your installment but your tenant not paying your rental and worst owe thousands in electrical and water bills. What can you do about it? Here's some useful piece of advise from Chris Tan, property lawyer from Chur Associates. This articles is refer from starproperty.my. Q&A: How can I evict my tenant for not paying rental? Q: Dear support team, I wish for your advice on the right process to reclaim back my shop premises after my tenant has not paid the rental for three consecutive months. Please advise. Thanks. A: Dear reader, Property lawyer Chris Tan from Chur Associates who has previously written on the subject shares his advice on the matter: A tenancy agreement allows the landlord to evict the tenant and/or to recover possession of the demised premises upon the non-payment of rent, nonetheless the landlord is prohibited from evicting the tenant and/or to recover possession of the demised premises without a court order. Section 7(2) of the Specific Relief Act states that “where a specific immovable property has been let under a tenancy, and that tenancy is determined or has come to an end, but the occupier continues to remain in occupation of the property or part thereof, the person entitled to the possession of the property shall not enforce his right to recover it against the occupier otherwise than by proceedings in the court.” Hence, it is advisable for the landlord to:- 1. Issue an eviction notice in accordance to the tenancy agreement to the defaulting tenant giving the tenant certain grace period to handover vacant possession and pay all overdue rental; 2. If the tenant remains in occupation of the premise after the expiry of such notice, the landlord may claim double rental from the date of the expiry of the eviction notice until date of delivery of the vacant possession to landlord; 3. the landlord may file an eviction order against the tenant in court for the outstanding rental, double rental and recovery of the vacant possession; and 4. the eviction order could take three to six months at Sessions Court and the costs of the proceeding would varies from RM7,000-RM25,000 depending on whether the tenant is contesting the said summon. Under Section 28(4) of the Civil Law Act: “Every tenant holding over after the determination of his tenancy shall be chargeable, at the option of his landlord, with double the amount of his rent until possession is given up by him or with double the value during the period of detention of the land or premises so detained, whether notice to that effect has been given or not”. Self-help measures In most circumstances, where the tenant left the demised premises without informing the landlord, the landlord would proceed with self-help measures. If the landlord breaks the lock to take possession of the demised premises himself, the landlord might be slapped with a civil suit by the tenant claiming for an exorbitant amount for the landlord’s purported “self-help” however. The current practice is for the landlord to lodge a police report and break the lock in the presence of a police officer and other independent witnesses in order to avoid further complications. A prudent landlord would take as many as possible photos of the interior of the demised premises to ensure that the tenant would not later claim loss of properties. It is also advisable to place a notice on the front of the property informing the tenant if he wants to take back his assets in the house, he shall contact the landlord within 1 or 2 weeks’ time. Besides, you may also place a photocopy of the landlord’s police report together with the notice to indicate that the landlord had made the police report. It is pertinent to note that shutting off the utilities is not advisable because it would put the landlord at a greater risks for being sued for damages for the electronic items etc, worse still if the tenant is bed-ridden and relying on the life-support machine. Refer from http://www.starproperty.my/index.php/articles/investment/qa-how-can-i-evict-my-tenant-for-not-paying-the-rent/ |

MPIG NewsIn this section we will be sharing on articles & news update related real estate and some other interesting topics. Archives

May 2024

Categories |

- Home

-

New Property Launch

- Lakeside Freehold Fully Residential Private Lifestyle Condominium in Cyberjaya

- Spacious 2024 Completion KL Condo Fully Residential KLCC View

- RUMAWIP Bukit Jalil (Bumi Only)

- Lake City @ KL North NEW PHASE FROM RM380k

- Alora Residences – Inspired living within greenery in Subang Jaya

- PJ Spacious and Affordable 5 Star Condo

- Best Investment 2022 PJ Damansara Low Risk Low Entry Price High ROI

- 2022 PJ Rumah Mampu Milik RM270k Damansara

- Bangsar South 2 Rooms from RM390k BELOW Market Price

- 10% ROI PJ Project near Ikea and One Utama Mall

- Mid Valley Seputeh New Launch

- Pavilion Damansara Heights 柏威年 白沙罗岭 马来西亚 吉隆坡 精选楼盘

- 马来西亚RM300千的PJ屋子-首购族,年轻人月入3千能买房

- 2021 Penang Most Awaited Project

- 2021 New Launch - KL Metropolis

- Freehold LRT Linked 3 Room Suites in Glenmarie

- New SPACIOUS Kepong Landed 6 Room 6 Bath

- Bangsar Last Piece Land New Launch

- Avara Seputeh (Mid Valley)

- Project Announcement Registration. Malaysia New Property Launch

-

Existing & Past Project

- 2020 Lowest Risk & Price in Klang Valley with Great ROI

- Kiara East Suite Dex

- 2019 SAFEST PROFITABLE HIGH CASHBACK INVESTMENT

- Best Property Investment Projects in 2018

- KL City Freehold Spacious Affordable 3 room Project

- Jalan Kuching Freehold New Office & Shoplot

- Jalan Ipoh New Freehold Shoplot & Offices

- RM300k KL Sentral New Prelaunch

- The Olive Condo, Sunsuria City

- Prelaunch Landed House Bukit Rahman Putra

- RM260k No Downpayment Puchong South Suites

- PJ North RM400k High Cash Back Project

- Denai Sutera @ Alam Sutera, Bukit Jalil

- First Phase of Banting New Township

- Neu Suites 3rdNVenue @ Embassy Row by Titijaya & CREC

- COURT 28, Jalan Ipoh KL City New Property Launch Service Apartment. Malaysia New Property Launch

- Semanja Kajang New FREEHOLD Kajang Double Storey Houses. Malaysia New Property Launch

- M Suite @ Desa Park North

- BIJI LIVING @ Sek 17 PJ City by Conlay. Malaysia New Property Launch

- Amani Residence Bandar Puteri Puchong New Freehold Service Apartment. Malaysia New Property Launch

- SFERA RESIDENCY @ Puchong South. Malaysia New Property Launch

- KL North Last Release

- PreLaunch Freehold Double Storey

- LAND

- News & Articles

- Other Reference Link & Services

- Referral

- Career

- MPIG

- Get Professional Advice

- PJ八打灵全新地产项目分析手册

Hours

M-S: 9.30am - 9pm

|

Telephone

+60 12 3760864

|

Email

|

RSS Feed

RSS Feed