|

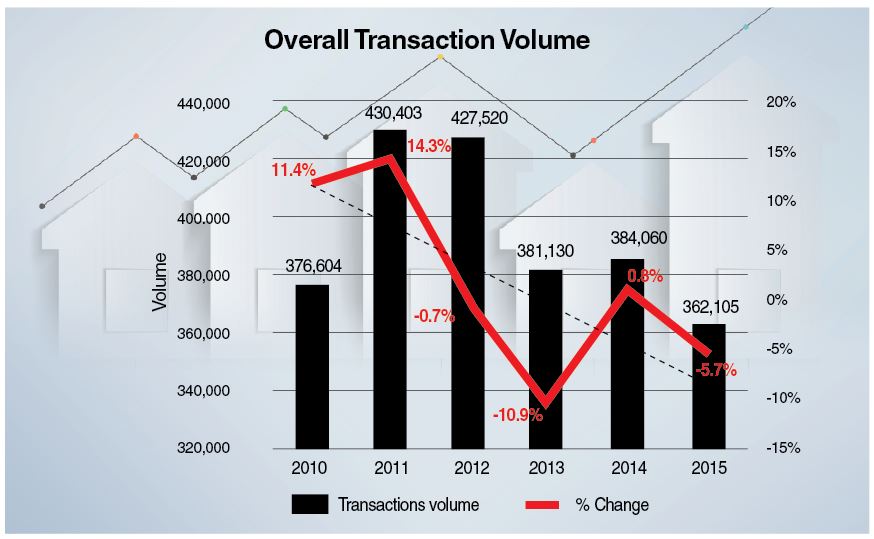

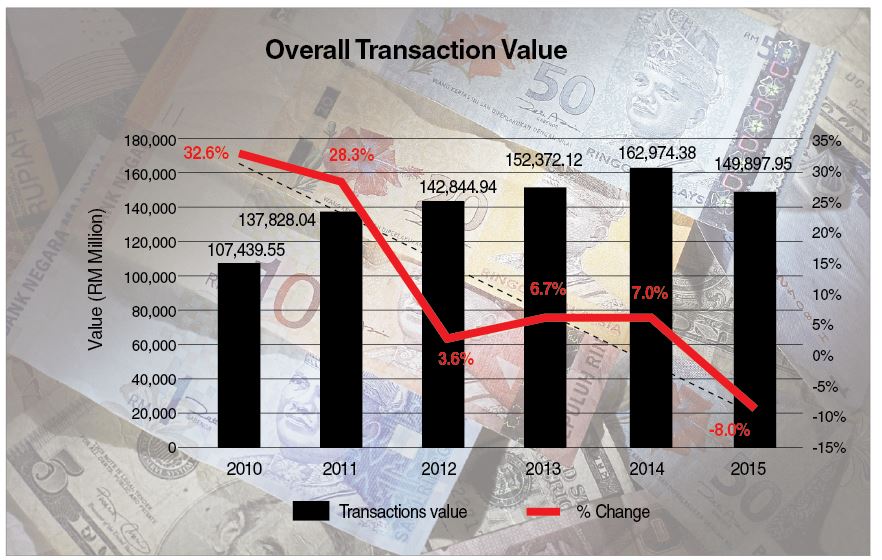

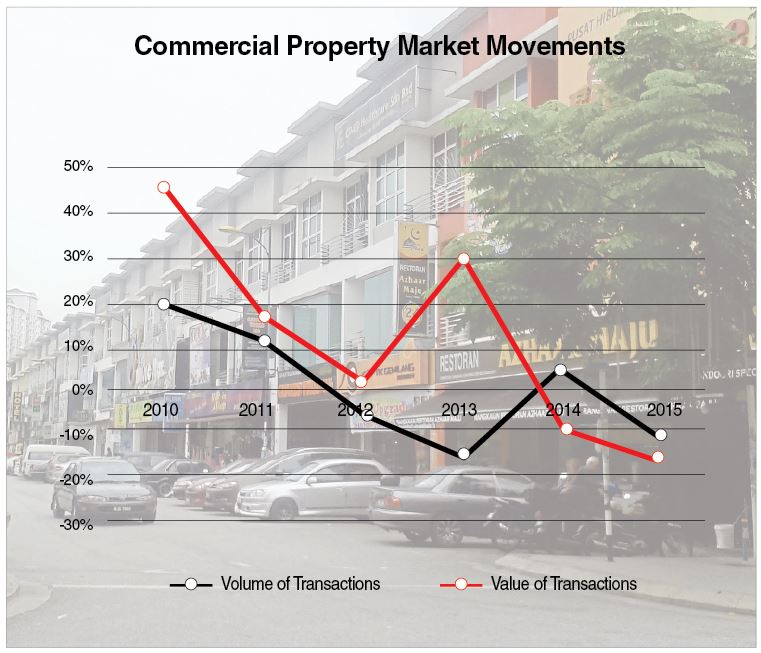

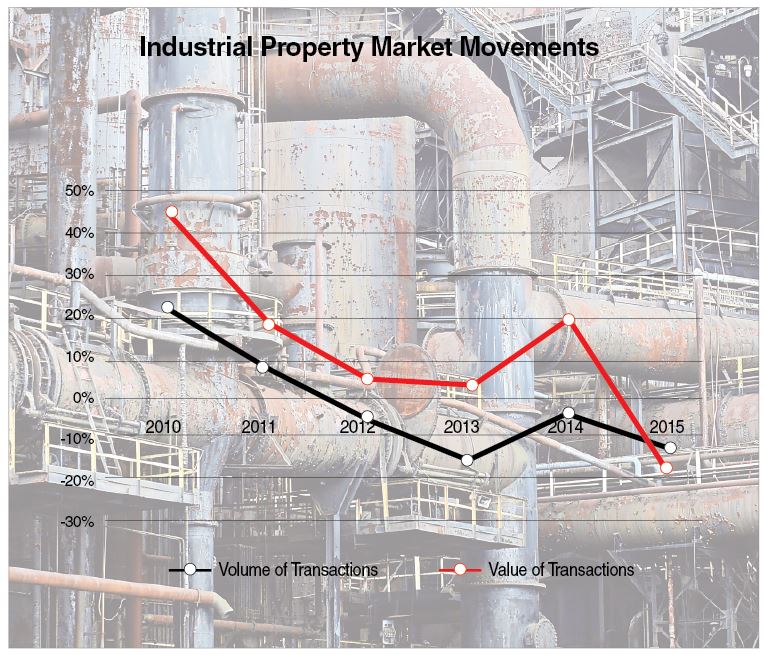

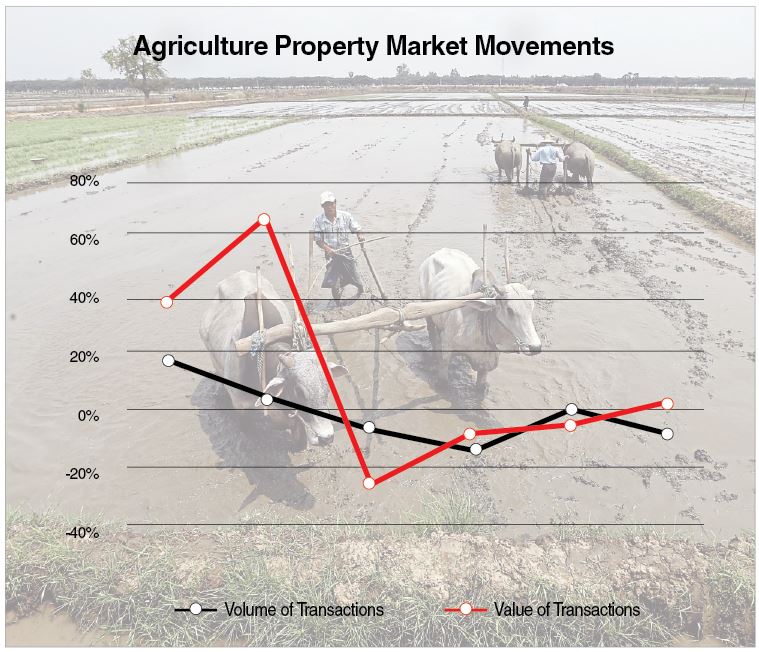

A very good insight and data from Mak Kum Shi. Read through it and you will know more about the market. But of course, there also clear sign of the effect after GST is implemented. That's the data for 2015. What will it looks like in 2016? Time will tell but I believe all of you have feel it. Moderate property market in 2015 Topic : Featured, Property News, Special Focus. The Star A softening property market, bleak household sentiments, dwindling business confidence, cooling measures, drop in tourist arrivals and volatile commodity prices had impacted various property sub-sectors. BY MAK KUM SHI [email protected] ALTHOUGH economic sentiments have impacted various property sub-sectors in 2015, there have been silver linings, particularly in retail and offices. The National Property Information Centre (Napic) from the Ministry of Finance’s Valuation and Property Services Department had indicated a slight downturn in property market activity last year. Market volume recorded at 362,105 transactions worth RM149.9bil in 2015, a marginal reduction of 5.7% in volume and 8.0% in value, compared to 2014. The residential sub-sector recorded a slight downturn by 4.6% and 10.5% in volume and value respectively. The commercial, industrial, agricultural and development land sub-sectors were also down by 10.6%, 13.0%, 7.5% and 2.4% respectively. Bleak household sentiments In line with the market softening and bleak household sentiments, the primary market reacted accordingly, as the number of new launches reduced to 70,273 units, down by 19.2% against 2014 (86,997 units). Most states, particularly major ones, saw substantial declines in their new launches. New launches in Johor and Penang saw declines of 42.8% to 9,428 units and 47.5% to 2,348 units respectively. The overall sales performance for the country hovered at 41.4% (29,089 units sold), lower than 45.4% (39,491 units sold) in 2014. The residential overhang situation took a downturn as more units were recorded. There were 11,316 overhung units worth RM5.9bil, up by 16.3% in volume and 56.0% in value. Holding 21.9% of the national overhang, Johor saw its overhang increased to 2,483 units. This increased by 8.5%, compared to 2014, due to higher unsold units in terrace and service apartment types. On a similar trend, the unsold units under construction recorded an increase of 28.6% to 68,760 units, due to the large number of unsold condominium and service apartment units. The fewer number of new launches partly helped contain the unsold units that were not constructed, down by 20.5% to 10,704 units. Construction activities were generally on a low tone with the exception of starts. Completions were down by 25.0% (80,850 units), whereas starts recorded a 10.3% increase over 2014, as higher numbers of service apartments in Johor Bahru (20,914 units) and Kuala Lumpur (13,197 units) commenced construction. On the contrary, new planned supply was on a four-year low at 139,189 units, down by 31.8%. As at end-2015, there were 4.93mil existing residential units with nearly 0.89mil in the incoming supply and 0.64mil in the planned supply. The Malaysian House Price Index sustained its moderating trend. As at Q4 2015, the Malaysian All House Price Index stood at 227.5 points (at base year 2020), up by 5.8% on annual basis. The annual rate of increase for Malaysian House Price Index has been on a decelerating trend since Q4 2013, resulting from the various cooling measures to contain the spiralling prices. On quarterly movements, the index points contracted by 0.8% against Q3 2015. Lacklustre commercial sub-sector There were 31,776 transactions worth RM26.4bil recorded, down by 10.6% in volume and 17.1% in value. Major states recorded lacklustre performance with Johor recording the highest decrease of 21.9%, followed by Kuala Lumpur at 15.0%, Selangor at 11.1% and Penang at 10.7%. In terms of transactions value, Penang had an increase of 19.0%, in spite of fallen market activity. Other major states succumbed to double-digit declines. Dwindling business confidence The shop sub-sector recorded 17,181 transactions worth RM13.31bil in 2015. This consisted 54.1% of commercial property transactions and 50.4% of the total value. Compared to 2014, market activity was reduced by 14.7% in volume and 11.2% in value. Penang and Selangor contributed higher market volume to the national total, each with 18.8% and 16.9% market share. Performance-wise, Johor recorded a drop of 29.3%, while Selangor saw a 10.0% fall. The shop overhang recorded 4,972 units worth RM2.25bil, up by 15.0% in volume and 50.1% in value. Similarly, the unsold (units) under construction and not constructed were also on uptrend, nearly double the amount to record at 12,882 units and 2,459 units respectively. Improvements in retail occupancy The retail sub-sector recorded a slight improvement from 81.8% in 2014 to 82.4% in 2015, with a take-up amounting to more than 780,000 sq m. Higher take-up spaces were observed in Selangor with more than 200,000 sq m, while Sarawak and Penang each secured more than 100,000 sq m. Apart from Kelantan which recorded negative take-up rates, all other states recorded positive results. Occupancy rates remained encouraging with nine states securing above 80.0% mark. Kuala Lumpur saw a slight decline from 89.8% to 87.4%. Selangor improved further from 84.7% to 87.7%. Johor sustained at 74.8% compared to 74.9% in 2014. Penang improved to 71.8% from 66.1% in 2014. Construction activity continued to see new entrants in the year. In terms of space, completions declined by 9.2% to record at 645,878 sq m. Starts increased by 68.7% to 621,165 sq m as five complexes in Johor with a combined space of more than 200,000 sq m commenced construction. As at end-2015, there were 13.83 mil sq m of existing retail space from 932 shopping complexes. There were another 64 complexes (1.51mil sq m) in incoming supply and 38 complexes (1.03mil sq m) in the planned supply. Selangor dominated the existing retail space while Kuala Lumpur dominated the incoming and planned supply. Moderate performance for office sub-sector The office sub-sector saw a slight downturn in the overall occupancy rate at 83.7%, down from 84.9% in 2014. Although the annual take-up rate was positive at 262,202 sq m in 2015, it was lower than 867,979 sq m that was recorded in the previous year. Occupancy rates for government buildings was at 98.7%, which helped to cushion the moderate performance of private office buildings at 78.5%. Private buildings supplied nearly 75.0% of existing space and 70.0% of occupied space nationally. State performance was commendable with 14 states having secured more than 80.0% occupancy. Perlis obtained full occupancy and eight other states obtained more than 90.0% occupancy. The state office sub-sector was mostly dominated by government office buildings. The new office supply was on an uptrend. There were 27 new completions offering a total space of 520,718 sq m, an increase of 17.3% against 2014 (443,792 sq m). There were 16 buildings commenced construction (481,642 sq m), more than double the space recorded in 2014 (183,395 sq m). Seven of these starts were in Kuala Lumpur. New planned supply, on the other hand, recorded eight buildings against 13 last year but did not run far in terms of space. Six of these newly approved building plans are in the capital city. As at end-2015, there were 20.13 million sq m of existing office space from 2,434 buildings. There were another 62 buildings (1.67 million sq m) in incoming supply and 17 buildings (0.41million sq m) in planned supply. Kuala Lumpur dominated all three supply categories. Tourist arrivals drop impacting leisure sub-sector In tandem with the drop in tourist arrivals for 2015, the average occupancy rates of hotels saw a slight decline from 62.6% in 2014 to 61.0% in 2015, as reported by Tourism Malaysia. The hotel sub-sector recorded 40 new completions (4,716 rooms), down by 29.5% when compared to 2014. Starts recorded an increase of 12.3% to 4,340 rooms, but new planned supply decreased by 30.2% (4,342 rooms). As at end-2015, there were 2,857 hotels across the country offering 208,747 rooms. Another 116 hotels (24,069 rooms) were in the incoming supply at a national level. Kuala Lumpur led other states with an incoming supply of 5,125 rooms. There were another 85 hotels (16,341 rooms) at the planned supply stage. Plateau in industrial property sub-sector The positive performance for the industrial property sub-sector that was recorded in the first half of 2015 did not sustain till year-end. The industrial sub-subsector recorded 7,046 transactions worth RM11.97bil, down by 13.0% in volume and 17.5% in value. Selangor continued to dominate the market, with 28.9% of the nation’s volume, followed by Johor and Perak, each with 16.1% and 9.6% market share respectively. The industrial overhang saw a slight increase to record 243 units worth RM240.57mil, up by 7.5% in volume and nearly triple the value of 2014.

The significant increase in value was contributed by cluster industrial properties, which accounted for 45.6% of the national overhang value and were solely in Johor. The unsold units under construction also observed similar trends, up by 29.7% to 1,731 units, whereas unsold units that were not constructed reduced to 87 units, down by 41.2%. Remaining firm in 2016 While the global and local economic and financial environment is expected to be challenging this year, the recalibration of the Malaysian annual budget 2016 is intended to ensure the country remains firm to brave such challenges. The residential sub-sector is expected to experience further softening in 2016, in view of various internal and external uncertainties foreseeable in the coming year. Issues on affordable housing and affordability of home purchasers will continue to top the national agenda. The measure that states that all new housing projects priced up to RM300,000 be limited to first-time homebuyers was recently announced in the budget recalibration. The outlook for the commercial sub-sector is expected to be equally or more challenging when compared to the residential sub-sector. The retail sector is likely to moderate as cautious sentiment on consumers’ spending is expected to continue due to increasing costs of living. However, the performance of hypermarkets looks more positive due to the nature of goods, such as necessities, being sold in these premises. The performance of the office market is expected to plateau. Downward pressure on rental may be felt by buildings, particularly those with tenants that are related to the oil and gas industry. At the same time, the ample office space supply should send some cautionary signals to the authority before approving new developments. The leisure sub-sector is expected to remain positive. The allocation of RM1.2bil to the Ministry of Tourism and Culture to implement programmes and events to achieve the targeted tourist arrivals at 30.5mil in 2016 may help support the sub-sector and industries such as hospitality. The industrial property sub-sector is expected to remain moderate for the year. The establishment of Principal Hub scheme, which offers multiple advantages to multi-national companies that uses Malaysia as a base for their regional and global business operations, will entail better prospects for the industrial sub-sector. The flexibility of the scheme that allows companies to decide on the locations of their preference is another plus point for the sub-sector. The agriculture sub-sector is expected to remain stable in the coming year. RM5.3bil allocated to the Ministry of Agriculture and Agro-based Industry for the proposed 2016 programmes is expected to support the sub-sector. Several infrastructure projects such as public transport networks are expected to help boost values in areas where the networks run. Such networks include the Ampang-Putra Heights, Kelana Jaya-Putra Heights and Bandar Utama to Johan Setia LRT Lines, Sg Buloh-Kajang and Sungai Buloh -Serdang-Putrajaya MRT Lines, Kuala Lumpur-Singapore High Speed Rail, and the Pan-Borneo Highway. Although the property sector may see moderation in market activity for 2016, the slowdown would still be manageable. The property sector will be able to endure this challenging period with adjustments and corrections expected from both the demand and supply side. >> Mak Kum Shi is the content and consumer engagement manager for the property business unit of Star Media Group.

0 Comments

EPF’s investment income falls 36% in Q1, braces for tough year The Star KUALA LUMPUR: The Employees Provident Fund (EPF) recorded an investment income of RM6.78bil for its fiscal first quarter (Q1) ended March 31, 2016, a 36.21% decline year-on-year compared with RM10.63bil in Q1 2015. Chief executive officer Datuk Shahril Ridza Ridzuan said in a statement: “The investment climate in this quarter was significantly different from the first quarter last year which benefited from better returns from our global investment, particularly from developed equity markets, which compensated for the weak domestic equity market.

“The first quarter of this year had almost all global equity markets, including the FBM KLCI, recording declines leading to lower income contribution from our total equity portfolio. Accordingly, the contribution of global assets to total income decreased to about 22% compared with 47% last year due to lower capital and foreign exchange gains.” During the quarter under review, equities, which made up 41.43% of the EPF’s total investment asset, contributed RM2.55bil, representing 37.56% of the total income. The income generated was 59.98% lower compared to RM6.36bil recorded in the same corresponding period in 2015. While income deriving from dividend payouts has been stable and consistent with last year’s first quarter, the drop in share prices globally and domestically has led to fewer opportunities for the EPF to realise trading income during Q1 2016. “The lower returns from our equity investments was mitigated by the income from our fixed income and inflation assets which remained resilient and stable throughout the quarter. Our strategic asset allocation, which allocates more than half of our investment asset in fixed income, played its role in providing sustainable long term returns for our investment,” added Shahril. As at end March 2016, fixed income instruments represented 51.72% of the EPF’s total investment size emerged as the main contributor of income for Q1 2016. The asset class contributed a total of RM3.74bil of investment income or equivalent to 55.15% of the quarterly income. Malaysian Government Securities generated RM1.87bil in income during the quarter under review, up 9.80% or RM166.74mil, compared with RM1.70bil in Q1 2015. Meanwhile, loans and bonds recorded an investment income of RM1.87bil compared with RM2.03bil in Q1 2015. The EPF’s investment in money narket instruments, which currently stands at a healthy RM22.58bil, contributed RM110.25mil of income while real estate & infrastructure, which made up 3.54% of the total investment asset, yielded a total income of RM377.84mil in Q1 2016 following income received from rentals and income recognised by its associate companies. “We are bracing for a difficult year in global and domestic markets given the ongoing investment climate and poor corporate results. The uncertainties in the world economy, following prolonged slower growth in major economies and high volatility in the equity markets and commodity prices, are expected to remain throughout the year. It is critical for us to continue to be disciplined in our multi-asset class and diversified approach to meet our strategic objectives,” Shahril said. According to him, the current economic condition presents some opportunities for the country’s biggest retiremenht fund to rebalance portfolios and simultaneously increase exposure to inflation asset classes, including real estate and infrastructure, which potentially are able to provide stable and continuous stream of income. “Our real estate exposure is relatively small at this point of time at less than 4%, but it is the fastest growing part of our business. The goal is for inflation linked assets to reach about 10 per cent of the total fund size in five to seven years,” said Shahril. Contrary to focusing on short term returns, the EPF, as a retirement savings fund, has always been focusing on sustainable long term returns by targeting a 2% real dividend over a three-year rolling period, it said. This is in line with the EPF’s investment objective of not only preserving but also enhancing the value of members’ savings. Great news!!! We are please to share something great to you.

And we don't want you to miss out this good deals. This week we have two projects to propose, that it build just right up front of MRT 2 station. Where is the location? How much is it? Whats so good about it? Here's the link to both projects: (Just click on the location to explore) Jalan Ipoh Puchong South Be Excited... Be Very Excited About What You Going To See... Yes, we are talking on you securing your family interest. Why you don't do this simple action? This money is belong to you. For all EPF holder, please do fill in the benefitial column so your family wont loss out RM2,500. Dont lost out. 2,For the attention of EPF account holders – RM2,500 is yours No matter how old you are, no matter how long you have held your EPF account, no matter how much money you have in you EPF account, and no matter how long you have contributed to EPF, as per law, EPF will need to pay RM 2,500 to an EPF account holder’s family when he/she died (family members need to claim the RM 2,500 within 6 months). Very few people’s family did actually receive this RM 2,500 when his/her family member died because not many people know about this. So please bombard this info to all your families, relatives, collegues and friends, let them know about this info and remember to claim RM 2,500 when his/her family members demise. Info from KWSP official website: Death Benefit (Death Withdrawal) The Death Benefit is paid to the member’s dependant or next-of-kin, subject to consideration by the EPF, when the application for Death Withdrawal is made. The amount for Death Benefit is RM2,500.00. This benefit will be given once only, subject to the following conditions: Malaysian citizen; Member has not attained the age of 55 years at the time of death; Application for Death Withdrawal is made within 6 months of the date of demise of the member. – source: www.kwsp.gov.my Read more here Isn't it Amazing that Malaysia is at such high rank for infrastructure investment. And this results is from Arcadis, global design & consultancy firm. Lets hope that this will continue and develop our country towards success. The articles is refer from www.NST.com.my Malaysia ranks No 2 in Asia and No 5 globally for infrastructure investment BY RUPA DAMODARAN - 3 MAY 2016 KUALA LUMPUR: Malaysia ranks number two in terms of its attractiveness for infrastructure investment in Asia. It now sits in fifth place globally in the third edition of the Global Infrastructure Investment Index, according to Arcadis, a global design and consultancy firm. According to the report, Malaysia’s strong economic performance and continued long-term investment in infrastructure have made the market attractive for private/inward investment. The government’s 11th Malaysia Plan, published in May 2015, emphasised the importance of infrastructure in achieving Malaysia’s transformation into a fully developed nation by 2020. The plan sets out a continued focus on the strengthening of enabling infrastructure to boost productivity and support economic expansion. Major projects to be completed by 2020 include the Klang Valley MRT Line, the 2,000km Pan Borneo Highway and the West Coast Expressway. "Completed projects include 93,000km of new roads, increasing the road network by 68 per cent, while investment in urban rail saw a 32 per cent increase." It said, in the race to achieve the 2020 goals, a key challenge faced by Malaysia will be to ensure that the quality and sustainability of the new infrastructure are not compromised. Also, in the short term, investment is threatened by a number of risks, including its currency depreciation against the dollar and a corruption scandal that has delayed some projects. Neighbouring Singapore retained its position as the world’s most attractive market for infrastructure investment, with its stable political situation, secure business environment and strong growth potential. By comparison, in terms of economic scores, China ranks first among the 41 countries analysed, yet its less attractive business conditions and higher risk environment keep it ranked at number 17 in the index. Better Traffic? Better Property Value? Will the operating of Kelana Jaya LRT extension help out?5/4/2016 Good news to Subang Jaya residents. The Kelana Jaya Line LRT extension is going to operate on 30th June. Will this help to smooth the traffic congestion? Will this further increase the property value in this region? Whats your thought? Here's the news refer from The Rakyat Post. Kelana Jaya Line LRT extension to start operations on June 30 Come June 30, Subang Jaya residents can leave their vehicles at home and hop on the Kelana Jaya Line LRT extension to get to their destinations around the Klang Valley. Prasarana Malaysia Bhd group communications and strategic marketing executive vice president Lim Jin Aun said the Kelana Jaya Line extension project (LEP, from Lembah Subang until Putra Heights) will commence its operations by mid-year. “The test runs or testing of the trains for the Kelana Jaya LEP had started in February this year and is scheduled to be completed by mid-June. “The testing hours are from 9am until 7pm daily. From now onwards, the test runs will be conducted 24-hours daily until mid-June. We would like to thank the residents living along the track for their patience and understanding during this period.” Lim said the tracks from Lembah Subang until Putra Heights had been electrified to accommodate the testing of the trains. “Only two trains (one 2-car and one 4-car trains) are being used during the train testing period. These are the type of trains that will be used when the Kelana Jaya LEP opens for operations at the end of June. “A 2-car train can carry 472 passengers while a 4-car train can carry 922 passengers.” Lim said the rates and fares for the Kelana Jaya LEP had been approved by the Land Public Transport Commission (SPAD) and had been made public. The fares can be viewed at www.myrapid.com.my. “We have introduced ‘MyRapid Smart 7 Weekly’ and ‘MyRapid Smart 30 Monthly’ which offer discounts between 18% & and 35% from the new cash fares for regular commuters. “With the various concession cards that we have, senior citizens, people with disabilities and students will enjoy 50% discount from the cash fares. You can find out more about how to apply via our website.” Currently, eight LRT stations under the Ampang/Sri Petaling Line extension project are already in operation. These stations are Awan Besar, Muhibbah, Alam Sutera, Kinrara BK5, IOI Puchong Jaya, Pusat Bandar Puchong, Taman Perindustrian Puchong and Bandar Puteri. I couldn't be more agree with the Ms Tan Ai Leng article in TheEdgeProperty.com. During the era of DIBS, there are many follower who are not ready for property investment joining in to this investment game. Some of them is hit by the current economy situation. Some trading business owner is hit by the weak Malaysia currency. Summary is there are many people would like to cash in during the tough time. Play safe better right? There are also owner who are desperate to sell their properties as they need the cash. In the other end, there is another batch of opportunist which look into this opportunity to enter the market by buying low from these desperate sellers. Here's what Ms Tan Ai Leng written about this situation. Investment opportunities abound as DIBS property owners seek exit By Tan Ai Leng / TheEdgeProperty.com | April 30, 2016 11:58 AM MYT KUALA LUMPUR (April 30): Investors should keep an eye on the market as buyers of properties under the Developer Interest Bearing Scheme (DIBS) seek to unload their properties this year, said JLL Property Services (Malaysia) Sdn Bhd country head and managing director YY Lau (pictured).

DIBS, where developers absorb the mortgage interest during construction, was halted by the government in 2014 over concerns that it encouraged speculation and pushed up property prices. “The impact of DIBS will be fully felt this year, and there will be a lot of choices for investors who are looking for opportunities,” she shared her view on “Market outlook: Where are we at the curve?” at The Edge Investment Forum on Real Estate 2016 (REIF 2016) today. Although investors are keen in buying properties but most of them are still reluctant to make any decision due to economic uncertainties. However, Lau pointed out that the current market condition is not as bad as most people imagine. “The economy is fundamentally sound and there will be no recession in the near term. We concur that the Malaysian economy will continue to grow but at a slower pace of 4% to 4.5% in 2016 as opposed to 5% in 2015,” she explained. She said the impact of the economic slowdown and the drop in transactions are already reflected in current property prices. For instance, prices of distressed assets or older high-end properties which are not well maintained saw their prices dip as much as 20% to 22% last year. Although property price growth has slowed down, Lau said the market is unlikely to see prices dropping as severely as they did during the Asian Financial Crisis (AFC) in 1998, where average property values plunged by a whopping 47.6%. She noted that the weakening ringgit has opened a window of opportunity to foreign investors especially for Singaporeans, but the weakening ringgit condition will not continue for long and investors should decide quickly if there are any good deals. Meanwhile, according to JLL’s data, Malaysia’s property market transaction volume fell by 8% in 2015. Lau expects the volume to continue to decrease this year due to dampened market sentiment, political uncertainties and a higher loan rejection rate. “The loan approval rate was about 50% in 2015, this means five out of 10 applicants for housing loans were rejected. The higher loan rejection rate has also prevented buyers from entering the market,” she added. She said although it is difficult to secure a loan but there are things prospective buyers can do to increase their chances of getting loans approved – such as managing their finances, reducing debts and having a joint income with others. |

MPIG NewsIn this section we will be sharing on articles & news update related real estate and some other interesting topics. Archives

May 2024

Categories |

- Home

-

New Property Launch

- Lakeside Freehold Fully Residential Private Lifestyle Condominium in Cyberjaya

- Spacious 2024 Completion KL Condo Fully Residential KLCC View

- RUMAWIP Bukit Jalil (Bumi Only)

- Lake City @ KL North NEW PHASE FROM RM380k

- Alora Residences – Inspired living within greenery in Subang Jaya

- PJ Spacious and Affordable 5 Star Condo

- Best Investment 2022 PJ Damansara Low Risk Low Entry Price High ROI

- 2022 PJ Rumah Mampu Milik RM270k Damansara

- Bangsar South 2 Rooms from RM390k BELOW Market Price

- 10% ROI PJ Project near Ikea and One Utama Mall

- Mid Valley Seputeh New Launch

- Pavilion Damansara Heights 柏威年 白沙罗岭 马来西亚 吉隆坡 精选楼盘

- 马来西亚RM300千的PJ屋子-首购族,年轻人月入3千能买房

- 2021 Penang Most Awaited Project

- 2021 New Launch - KL Metropolis

- Freehold LRT Linked 3 Room Suites in Glenmarie

- New SPACIOUS Kepong Landed 6 Room 6 Bath

- Bangsar Last Piece Land New Launch

- Avara Seputeh (Mid Valley)

- Project Announcement Registration. Malaysia New Property Launch

-

Existing & Past Project

- 2020 Lowest Risk & Price in Klang Valley with Great ROI

- Kiara East Suite Dex

- 2019 SAFEST PROFITABLE HIGH CASHBACK INVESTMENT

- Best Property Investment Projects in 2018

- KL City Freehold Spacious Affordable 3 room Project

- Jalan Kuching Freehold New Office & Shoplot

- Jalan Ipoh New Freehold Shoplot & Offices

- RM300k KL Sentral New Prelaunch

- The Olive Condo, Sunsuria City

- Prelaunch Landed House Bukit Rahman Putra

- RM260k No Downpayment Puchong South Suites

- PJ North RM400k High Cash Back Project

- Denai Sutera @ Alam Sutera, Bukit Jalil

- First Phase of Banting New Township

- Neu Suites 3rdNVenue @ Embassy Row by Titijaya & CREC

- COURT 28, Jalan Ipoh KL City New Property Launch Service Apartment. Malaysia New Property Launch

- Semanja Kajang New FREEHOLD Kajang Double Storey Houses. Malaysia New Property Launch

- M Suite @ Desa Park North

- BIJI LIVING @ Sek 17 PJ City by Conlay. Malaysia New Property Launch

- Amani Residence Bandar Puteri Puchong New Freehold Service Apartment. Malaysia New Property Launch

- SFERA RESIDENCY @ Puchong South. Malaysia New Property Launch

- KL North Last Release

- PreLaunch Freehold Double Storey

- LAND

- News & Articles

- Other Reference Link & Services

- Referral

- Career

- MPIG

- Get Professional Advice

- PJ八打灵全新地产项目分析手册

Hours

M-S: 9.30am - 9pm

|

Telephone

+60 12 3760864

|

Email

|

RSS Feed

RSS Feed