|

KUALA LUMPUR: Sime Darby Bhd has entered into a conditional share purchase agreement to acquire Permodalan Nasional Bhd's (PNB) entire 61.2% sake in UMW Holdings Bhd for RM3.57bil cash or RM5 per share. Once the agreement becomes unconditional, the group said it will undertake a general offer for the remaining 38.8% stake it does not hold with the aim of delisting UMW from Bursa Malaysia. According to Sime Darby group CEO Datuk Jeffri Salim Davidson, the deal, which will bring the Toyota and Perodua brands into its portfolio, will cement the group's position as Malaysia's leading automotive player. "As a partner of choice to some of the most admired brands in the automotive sector, we are very excited to have the opportunity to work with Toyota, one of the world’s largest and most respected automakers," he said in a statement. He added that the acquisition is accretive to Sime Darby’s earnings per share and will enhance Sime Darby’s shareholders return. Sime Darby expects the acquisition of PNB’s stake to be completed within three months from the date of sales and purchase agreement subject to regulatory and shareholders’ approvals and customary closing conditions. State investment firm PNB is the largest shareholder in Sime Darby with a 50.3% stake. Meanwhile, PNB confirmed separately that the consolidation of the two leaders in the automotive industry is driven by opportunities to strengthen its local and regional presence in the automotive sector. It added that the merger will also provide a boost to the electrification agenda, which is expected to drive investment growth, enhance efficiency, and create value for our unit holders. "This strategic move is also in alignment with the Government's New Industrial Master Plan 2030, which will support the automotive sector’s further growth especially in positioning the country as the automotive hub for the region," it said in a statement. In another statement announcing its financial results for the fourth quarter of 2023, Sime Darby posted a net profit of RM622mil during the quarter, which was a leap from RM278mil in the same quarter in 2022. The group's earnings per share rose to 9.1 sen from 4.1 sen. Revenue, meanwhile, jumped to RM13.29bil from RM10.85bil in the comparative quarter. For the entire financial year, Sime Darby's net profit came to RM1.46bil, up from RM1.1bil, while revenue rose to RM48.29bil from RM42.5bil. The board of directors declared a second interim dividend of 10 sen per share, which brings the total dividend payout for the year to 13 sen per share, or RM886mil, representing a 61% net profit payout. On the positive performance, the group said it was owing to the improved results from the industrial division's Australasia operations, strong performance from the Motors business in Malaysia and a gain on the disposal of properties in Hong Kong. “Our strong performance is a testament to our resilience, driven by our strategy amidst a challenging market environment. "Despite the headwinds that we have been experiencing in China, our other markets have performed well,” said Jeffri Salim. During the lunch break, Bursa Securities suspended trading in Sime Darby's and UMW's securities and warrants at the request of the respective companies with effect from 2.30pm on Aug 24, 2023 (Thursday). The trading stock of Sime Darby was last traded one sen higher at RM2.11 a share on the back of 4.85 million units crossed while UMW's shares had risen seven sen to RM4.62 on 4.1 million shares done. The news article is refer from TheStar.com.my.

0 Comments

SHAH ALAM - The Council of Buildings (COB) of Kuala Lumpur City Hall (DBKL) has issued a notice forbidding landlords and homeowners from adding partitions (adding bedrooms) in commercial-titled apartments with strata status in Kuala Lumpur.

English daily, New Strait Times (NST) reports that the prohibition was effective from Aug 1, 2023, and it was communicated by the chairman of all Joint Management Bodies (JMB), Management Corporations (MC), and Sub Management Corporations (Sub-MC) in the Federal Territory of Kuala Lumpur. Kuala Lumpur Mayor Datuk Kamarulzaman Mat Salleh stated that the ban was provided to hinder landlords from converting living rooms and dining rooms into additional bedrooms in an apartment or SOHO unit. "All service apartments and SOHOs with strata titles in the city are prohibited from building walls to create more bedrooms. "This would be in violation of the original Development Order (DO) approved by the relevant authorities, including DBKL," he said. Kamarulzaman pointed out that adding partitions would mean an increased number of occupants and insufficient natural light for the inhabitants. "Adding more bedrooms would make it appear that they were being rented out for extra cash," he said to NST. According to the notice, this prohibition is meant to avoid the existence of residential units intended for commercial use, such as hostels, as well as a rise in traffic and density, which would cause problems for the adjacent people. The prohibition was issued on July 21, 2023, and it was made available for download on the DBKL's official website. The real estate market has been on edge since Bank Negara Malaysia (BNM) announced an unexpected increase of 25 basis points on the overnight policy rate (OPR) on May 3. Much to the relief of many, the OPR rate was maintained at 3% in early July, but an analyst is already foreseeing another hike in the next round of review. However, despite the spectre of increased lending rates, some property analysts are still optimistic, albeit cautiously, about the real estate market. “In 2022, despite the OPR being increased four times, with a total hike of 1% from 1.75% to 2.75%, the market still registered the highest volume of transactions, standing at 389,107 transactions, which is the highest ever recorded since 2012,” ESP Global Services Sdn Bhd chief executive officer, who is also Esprit Estate Agent Sdn Bhd managing director, Aldrin Tan, told EdgeProp.my. He explained that while hikes in the OPR are one of the measures used to manage inflationary pressure, which leads to a higher cost of financing and mortgages, there may also be a short-term effect of increased demand for housing due to anticipation or sentiment of a price hike. “While we do not have the full data of the volume of transaction for 1H2023, 1Q2023 registered 89,182 transactions. Though it was down by 5.7% from 94,526 in 1Q2022, the volume in 1Q2023 surpassed the pre-pandemic level of 1Q2020 at 72,867, 1Q2019 at 84,424, and 1Q2018 at 79,480. “Unless there is a further slowdown of momentum in volume of transaction in 2Q2023, we can safely say that based on volume of transactions on 1H to 1H data, we are likely to see 1H2023 perform better than pre-pandemic 1H2020, 1H2019 and 1H2018, and this may likely reflect an overall post-pandemic recovery of the Malaysian property market,” added Tan. “I am cautiously optimistic on the Malaysia property market going forward in the short-term perspective,” he said. Home prices likely to grow Meanwhile, Juwai IQI co-founder and group managing director, Daniel Ho, said the residential property market rebounded strongly in 2022, and “we expect it to show further gains in the remainder of this year”. “A range of positive conditions support the market, despite moderately lower economic growth. First-time homebuyer purchases have increased, driven by factors such as weddings that were delayed due to Covid-19 closures. “The full opening of international borders has put Malaysia in the radar of regional and international investments, particular from China. We forecast a home price growth of 1.5% to 4% during the second half of the year compared to a year earlier,” he told EdgeProp.my. “In 2022, transaction volume climbed by 47% to 42,000, and total transaction value rose by 38% to RM12.8 billion compared to the prior year. For 2023, the official data are not available yet, but Juwai IQI’s internal metrics are all up,” Ho revealed. “Sales volume is up and prices are inching up on certain property types such as D'Ivo Residences, Mossaz @ Empire City, The Fiddlewoodz @ KL Metropolis, D'Starlingtton. We see more cross-border buyers in Johor, increased demand in Kuala Lumpur and Selangor, and a reduction in the property overhang by as much as 35%, although that varies by state,” he added. Declining inflation rates raise consumer confidence As for interest rates and inflation, Ho is of the view that “compared to many other countries, Malaysia has a significant advantage because it has already tamed inflation. BNM was one of the first in Asia to begin raising rates in 2022 and now has lifted the OPR to 3.0%. That means BNM has reversed all the pandemic-era lowering of interest rates. The economy has recovered sufficiently and no longer needs that extra boost”. "Falling inflation rates improve consumer confidence, and can raise the prospect of stable or lower interest rates. Core inflation fell from 3.1% to 2.9% in the first quarter. We believe inflation has been tamed and will continue to drop moderately in the six months ahead. “The property market has absorbed the OPR increases without much impact on demand due to strong household finances and employment,” he said. On the other hand, Tan expects some turbulence ahead as “Malaysia’s GDP (gross domestic product) is also expected to undergo contraction under the Budget 2023 – from 5.6% in 2022, to 5.0% in 2023 and down to 3.2% in 2025, due to global concerns and pressure of inflation”. To him, a shrinking economy in the near-term outlook will lead to a reduction in consumer expenditure and a lack of confidence, which may affect the property market negatively. Opportunity to buy Nevertheless, both Tan and Ho think it is a good time for homebuyers to commit to a purchase over the next six months. “This is a good market for buyers. While the market has recovered, in most property types, prices are still stable or only slowly increasing. That creates an opportunity to purchase. “Of course, we always advise buyers to have a good understanding of their finances and to not overstretch themselves. Owning property is the time-honoured way to build financial security and family wealth. Today’s buyers will likely benefit from increased values over the next few years,” Ho said.

Tan agreed, saying, “The property market has been experiencing a soft landing since the peak of 2011/12, and as global economies are rebounding after the pandemic, coupled with a decline in Malaysia's overhang properties and a consistent upward trend in the property market since 3Q2020, it's probable that property prices are pushing upwards. “Consequently, it might make sense for prospective buyers who have been waiting on the sidelines to take the plunge and commit to a purchase now,” he added. The above article is refer from edgeprop.my KUALA LUMPUR (Aug 4): Malaysia will submit a new proposal regarding the Kuala Lumpur-Singapore High-Speed Rail (HSR) project to Singapore after an initial decision on it is made by the government, Prime Minister Datuk Seri Anwar Ibrahim (pictured) said.

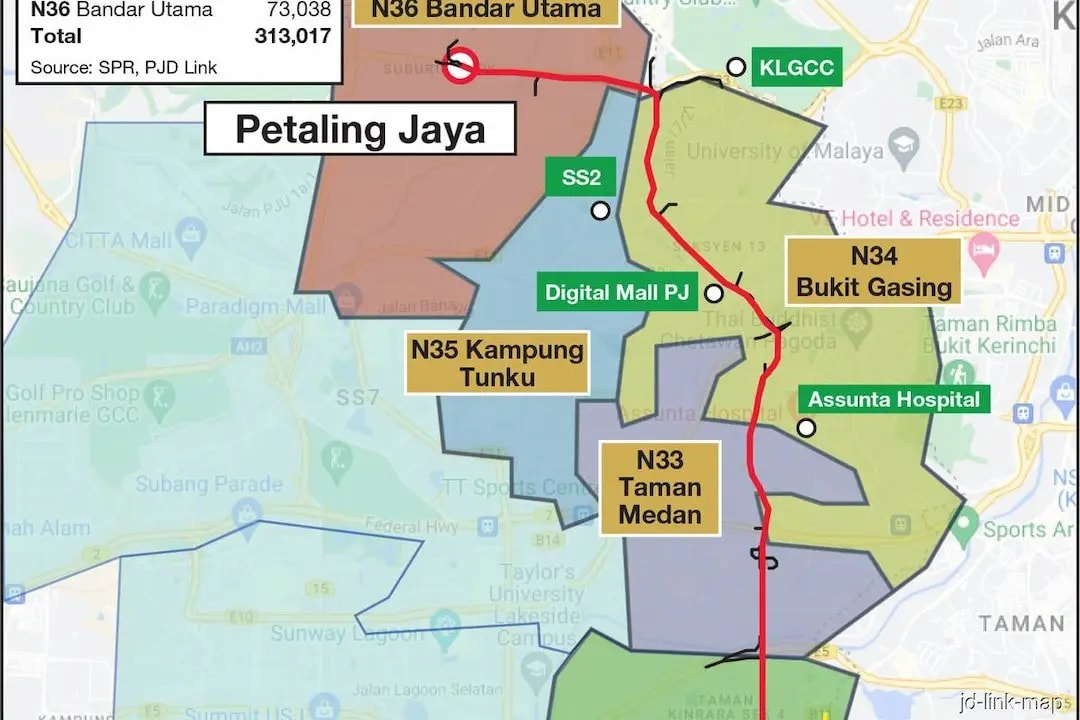

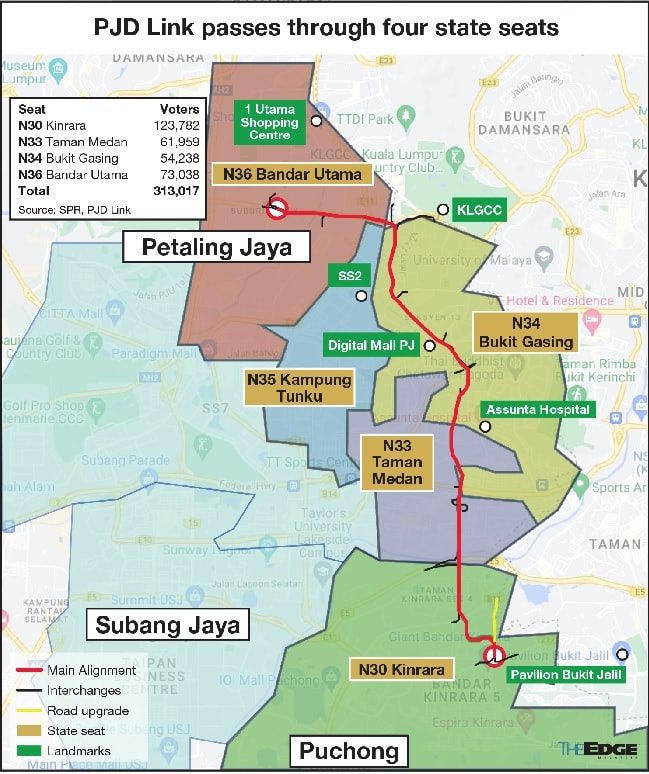

He said the new proposal would then be brought forth by Transport Minister Anthony Loke Siew Fook for Singapore’s consideration. “It’s still [being deliberated] at our level. Once we have the initial decision, the minister, Anthony Loke, will bring it to Singapore’s attention,” Anwar told reporters after opening the Malaysian Commercialisation Year Summit 2023 here on Friday (Aug 4). Prior to this, the media reported that Singapore had yet to receive any new proposal from Malaysia regarding the HSR project. According to acting Singapore Transport Minister Chee Hong Tat, Singapore is ready to discuss the implementation of the project with Malaysia. Article is refer from EdgeProp  While the termination of the controversial Petaling Jaya Dispersal (PJD) Link was welcomed by many Petaling Jaya residents and non-governmental organisations who have been calling for the project to be scrapped due to environmental and social concerns, Parti Pribumi Bersatu Malaysia (Bersatu), one of the main component parties of Perikatan Nasional (PN), has questioned the right of the caretaker Selangor government led by Menteri Besar Datuk Seri Amirudin Shari in making such an impactful decision ahead of the polls The termination of the controversial Petaling Jaya Dispersal (PJD) Link project by the Selangor state government, with less than two weeks before the state polls on Aug 12, is perhaps an indication of just how much is at stake for the Pakatan Harapan-led (PH) government that is trying to keep the state under its administration. While the move was welcomed by many Petaling Jaya residents and non-governmental organisations who have been calling for the project to be scrapped due to environmental and social concerns, Parti Pribumi Bersatu Malaysia (Bersatu), one of the main component parties of Perikatan Nasional (PN), has questioned the right of the caretaker Selangor government led by Menteri Besar Datuk Seri Amirudin Shari in making such an impactful decision ahead of the polls. Bersatu also slammed Amirudin for saying that the PJD Link project might be revived if it complied with requirements set by the state government. The party, however, did not state its stance on the project, which was approved under the PN-Barisan Nasional (BN) government in April 2022. Should the project materialise, it would cut through four constituencies within the state — N30 Kinrara, N33 Taman Medan, N34 Bukit Gasing and N36 Bandar Utama — that is home to over 300,000 voters. The four constituencies are located within three Parliamentary seats, namely P105 Petaling Jaya, P104 Subang and P106 Damansara. With 313,017 voters representing roughly 8.3% of 3.75 million Selangor voters, the four state seats will see the PH-BN unity government, PN and the Malaysian United Democratic Alliance (Muda) vying for votes in the coming days. While Kinrara and Taman Medan will be a straight fight between PH-BN and PN, Bukit Gasing and Bandar Utama will be three-cornered fights as Muda has fielded candidates there. All four state seats were dominated by PH in the last state election in 2018, with Bandar Utama recording the highest winning margin among the four, at 81.4%, after PH-DAP candidate Jamaliah Jamaluddin secured 90.5% of the votes cast, defeating the BN candidate. This time, Jamaliah will be defending her seat against Muda’s Lim Hooi Sean and PN-Gerakan's Nur Aliff Mohd Taufid. In Bukit Gasing, Ranjiv Rishyakaran (PH-DAP) is up against Nallan Dhanabalan (PN-Gerakan) and Kalyana Rajasekaran Teagarajan (Muda). Ranjiv won the seat in 2018 after securing 29,366 votes or 86.9% of the total, with a winning margin of 76.5%. Over in Kinrara, the incumbent Ng Sze Hen (PH-DAP) will be taking on Wong Yong Kan (PN-Bersatu). Ng took the seat in 2018 with 52,207 votes polled, or 83% of the total, with a winning margin of 71.8%. For Taman Medan, PH-PKR has nominated Ahmad Akhir Pawan Chik as its candidate, replacing Syamsul Firdaus, who secured 21,712 votes or 57.8% of the total votes in the predominantly Malay area to win the seat in 2018 with a margin of 29.1%. Ahmad Akhir will contest against PN-Bersatu candidate Afif Bahardin. PJD Link is also in close proximity to N35 Kampung Tunku, which has 58,357 voters — 15.7% of which are Malay voters. This election, in terms of number of voters, Kinrara has the highest among the four at 123,782, while the number of Malay voters is highest in Taman Medan, at 68% of 61,959 voters. Amirudin said his administration cancelled the project as it was not satisfied with the impact assessment reports submitted by the concessionaire, PJD Link (M) Sdn Bhd, and because it did not meet certain conditions set by the state government, particularly the social impact assessment reports. RTO of Scomi Energy cancelled The proposed PJD Link is a 25.4km elevated highway with two-lane dual carriageway (four lanes). Aimed at dispersing traffic congestion in Petaling Jaya by providing major connection with existing roads and highways, the project was first approved in principle by the Cabinet during BN's administration in November 2017, before the state government then approved it in principle in September 2020 — subject to satisfactory impact assessments done. The highway, which was to be 100% privately funded, was to start after the North Klang Valley Expressway (NKVE) toll plaza on the SPRINT Highway, Damansara and end at the Bukit Jalil highway interchange. With the project in the pipeline then, the concessionaire PJD Link (M) Sdn Bhd announced in October 2022 that it was seeking a listing on Bursa Malaysia via the reverse takeover (RTO) of Practice Note 17 (PN17) company, Scomi Energy Services Bhd, whose share surged following the announcement. The RTO was to be part of the regularisation plan that would lift Scomi Energy from its PN17 status. In June this year, the concessionaire also said it had secured RM922 million in funding from MCC Overseas (M) Sdn Bhd — a subsidiary of China Metallurgical Group Corp — as part of its project financing for the project. But Scomi Energy suddenly announced on July 17 that the framework agreement it inked with the concessionaire for the RTO had been "mutually terminated with immediate effect", but did not elaborate. The concessionaire is a private construction company with Amrish Hari Narayanan as its chief executive officer. He was previously involved in the now-defunct RM2.42 billion Kinrara Damansara Expressway (Kidex), which was rejected by the then Pakatan Rakyat-led Selangor government in 2015 due to its failure to submit traffic, social and environmental impact assessments within the stipulated deadline. Scomi Energy's shares had been suspended since July 24 as it had failed to submit its regularisation plan to Bursa Securities on time and could not secure another extension of time to do so. Delisting was possible on July 26, but it had submitted an appeal to the regulator to prevent that. Scomi Energy's shares were last traded at half a sen apiece, giving it a market capitalisation of RM2.34 million. |

MPIG NewsIn this section we will be sharing on articles & news update related real estate and some other interesting topics. Archives

May 2024

Categories |

- Home

-

New Property Launch

- Lakeside Freehold Fully Residential Private Lifestyle Condominium in Cyberjaya

- Spacious 2024 Completion KL Condo Fully Residential KLCC View

- RUMAWIP Bukit Jalil (Bumi Only)

- Lake City @ KL North NEW PHASE FROM RM380k

- Alora Residences – Inspired living within greenery in Subang Jaya

- PJ Spacious and Affordable 5 Star Condo

- Best Investment 2022 PJ Damansara Low Risk Low Entry Price High ROI

- 2022 PJ Rumah Mampu Milik RM270k Damansara

- Bangsar South 2 Rooms from RM390k BELOW Market Price

- 10% ROI PJ Project near Ikea and One Utama Mall

- Mid Valley Seputeh New Launch

- Pavilion Damansara Heights 柏威年 白沙罗岭 马来西亚 吉隆坡 精选楼盘

- 马来西亚RM300千的PJ屋子-首购族,年轻人月入3千能买房

- 2021 Penang Most Awaited Project

- 2021 New Launch - KL Metropolis

- Freehold LRT Linked 3 Room Suites in Glenmarie

- New SPACIOUS Kepong Landed 6 Room 6 Bath

- Bangsar Last Piece Land New Launch

- Avara Seputeh (Mid Valley)

- Project Announcement Registration. Malaysia New Property Launch

-

Existing & Past Project

- 2020 Lowest Risk & Price in Klang Valley with Great ROI

- Kiara East Suite Dex

- 2019 SAFEST PROFITABLE HIGH CASHBACK INVESTMENT

- Best Property Investment Projects in 2018

- KL City Freehold Spacious Affordable 3 room Project

- Jalan Kuching Freehold New Office & Shoplot

- Jalan Ipoh New Freehold Shoplot & Offices

- RM300k KL Sentral New Prelaunch

- The Olive Condo, Sunsuria City

- Prelaunch Landed House Bukit Rahman Putra

- RM260k No Downpayment Puchong South Suites

- PJ North RM400k High Cash Back Project

- Denai Sutera @ Alam Sutera, Bukit Jalil

- First Phase of Banting New Township

- Neu Suites 3rdNVenue @ Embassy Row by Titijaya & CREC

- COURT 28, Jalan Ipoh KL City New Property Launch Service Apartment. Malaysia New Property Launch

- Semanja Kajang New FREEHOLD Kajang Double Storey Houses. Malaysia New Property Launch

- M Suite @ Desa Park North

- BIJI LIVING @ Sek 17 PJ City by Conlay. Malaysia New Property Launch

- Amani Residence Bandar Puteri Puchong New Freehold Service Apartment. Malaysia New Property Launch

- SFERA RESIDENCY @ Puchong South. Malaysia New Property Launch

- KL North Last Release

- PreLaunch Freehold Double Storey

- LAND

- News & Articles

- Other Reference Link & Services

- Referral

- Career

- MPIG

- Get Professional Advice

- PJ八打灵全新地产项目分析手册

Hours

M-S: 9.30am - 9pm

|

Telephone

+60 12 3760864

|

Email

|

RSS Feed

RSS Feed