|

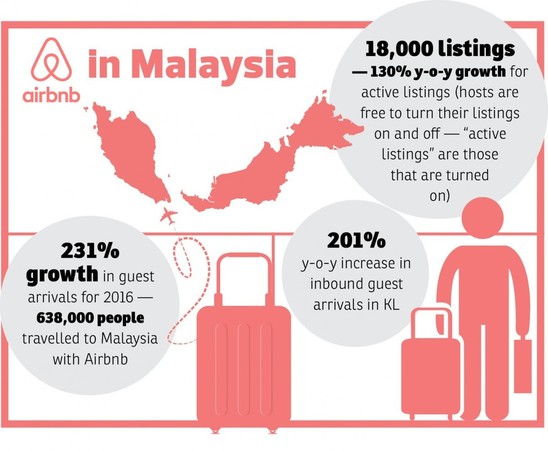

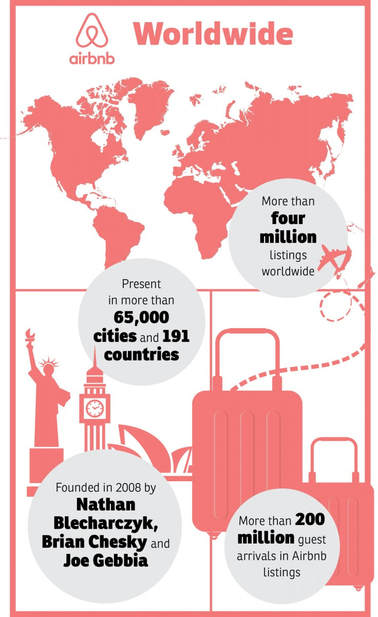

Written by Jonathan de Ho Lets see some of the facts on Airbnb on Malaysia. 1. Growing Rapidly - Malaysia is enjoying 130% y-o-y growth in terms of Airbnb listing in Malaysia. 2. In Malaysia, home-sharing services remain unregulated. 3. Revenue from Airbnb, should it be take into calculation for income tax purpose? While all these regulation and taxes issues is yet to be regulate, it seems Malaysia is enjoying this period. But beware on your investment into this module. I foresee this will not be a long term strategy as you have to take into consideration of the safety of local residence, housing regulation and high rise community regulation. Especially to those under HDA regulation, they have the highest chance of being phase out if action is taken. Airbnb attract a lot of stranger into the residential community, safety issues have to be taken seriously into consideration. Consider there is always new faces in where you stay, with your love one, do you feel safe when you are away? Perhaps those property not regulate under HDA will be a safer bet. Anyhow, while Malaysia still Boleh, perhaps those involve should take into consideration how fast you get back your investment and start profiting. Is it worthy for you to spend the time and effort with the return you get? Also taking rental income into taxes inclusion. So is it good or bad for Airbnb in Malaysia so far? What do you think? Airbnb listings in Malaysia increasing rapidlyUber. Grab. CouchSurfing. HomeAway. Airbnb. Having taken the world by storm, the adoption of the sharing economy has been pushed forward by factors such as trust, convenience and a sense of community, according to accounting and consulting giant PwC in its “Consumer Intelligence Series: The Sharing Economy” report. As of July, Airbnb has about 18,000 active listings in Malaysia, which is a 130% y-o-y growth, says Airbnb Southeast Asia, Taiwan and Hong Kong country manager Robin Kwok. Offering income opportunities Kwok tells TheEdgeProperty.com that there are more than four million listings on Airbnb, in 65,000 cities and 191 countries globally. “This figure means we offer a huge variety of accommodation options depending on what travellers are looking for — whether it’s a spare room in a host’s house, an entire place to themselves or a serviced apartment. Hence, there’s plenty of space and opportunity for different types of hosts to benefit from Airbnb,” she says. The majority of hosts — in Malaysia and around the world — use Airbnb to share the primary space in which they live. “[On average], a typical host earns RM5,569.20 [annually] and many hosts tell us that this is a vital supplemental income, helping them support themselves as well as their families and make ends meet. “Our hosts come from all walks of life. Some are freelancers, who use the extra [income] to pursue their own passion or start their own businesses; others are senior hosts who use the additional income to support themselves in their retirement. Home-sharing is also an opportunity for them to be an ambassador of their own city,” she adds. Founded in San Francisco, US, Airbnb has seen a 231% growth in guest arrivals to Malaysia in 2016 — 638,000 travellers to Malaysia last year utilised the online hospitality service, Kwok says. “Unsurprisingly, Kuala Lumpur is a huge draw, with a 201% y-o-y increase in inbound guest arrivals, but people from all over the world are also attracted to lesser-known tourist spots, such as Ipoh, Cameron Highlands, Port Dickson and Lumut,” she adds. At the same time, Kwok notes that Malaysians are equally eager to experience life as locals around the world where Airbnb saw a 169% outbound increase from 2015, with Tokyo, Osaka, Taipei, Seoul, Kyoto and Bangkok being top destinations. “Malaysians aren’t just using Airbnb to see the rest of the world; they’re also exploring the best of what their own country has to offer. Domestic travel is also thriving, with KL, George Town, Ipoh, Melaka and Johor Bahru emerging as favourite destinations [among Malaysians],” she adds. The significant market for the home-sharing leader plays a key part in Southeast Asia’s tourism growth. “We can continue to grow in Malaysia because tourists increasingly want unique and authentic experiences when they travel. Known for its rich culture and traditions, it’s not surprising that Malaysia is particularly popular and one of our top destinations in Southeast Asia,” shares Kwok. Wait… Is Airbnb legal in Malaysia? In the Asia-Pacific region, Japan is the first to legalise home-sharing in June 2017, allowing proprietors to let their properties to guests for up to 180 days a year. Homeowners will have to register with local authorities and are subject to the local government’s restrictions and rules. “This is an important milestone that gives hosts — and people who want to be hosts — in Japan the clarity and certainty they need. It’s also great for guests who increasingly want new, adventurous and local experiences when they travel,” says Kwok. Besides Japan, Airbnb has reached agreements with policymakers in over 275 jurisdictions where London, Chicago and Tasmania have passed “fair and progressive rules” for home-sharing, she shares.

Meanwhile, in Malaysia, home-sharing services remain unregulated. Kwok says Airbnb “is having meaningful and productive conversations with Malaysian authorities, who are excited by the prospect of home-sharing and the benefits Airbnb is already bringing to tourism in Malaysia”. “We look forward to working with them [Malaysian authorities] to help them maximise this potential to allow everyone to get the best out of home-sharing,” she says. The firm is also aware that every city is unique and has its own set of challenges and priorities. “What works in Tokyo may not work in Chicago, and what suits London might not be right for Malaysia. That’s why we strive to work closely with governments and policymakers in every city we operate in to develop clear and simple frameworks that work for them while addressing local needs.” Airbnb wants to pay taxes Working closely with governments also means paying taxes. “Airbnb wants to pay taxes,” Kwok stresses. “We’ve partnered with governments all over the world to make it easier for our hosts and guests to pay their fair share.” “As of May 1, 2017, we have collected and paid more than US$240 million (RM1.03 billion) in hotel and tourist taxes on behalf of our host community, ensuring a simple and streamlined process for them and lightening the administrative burden for authorities. “We’re continuously working with governments and policymakers around the world to expand our programme and find a proper way to collect fair tax revenue from our host community — and Malaysia is no exception. “Travel and hospitality in Malaysia are showing no signs of slowing down, and we believe in working hand-in-hand with governments to develop fair regulation and taxation to help contribute to this positive and sustainable growth,” she says. On news reports of guests having caused damage to Airbnb hosts’ properties, Kwok states that out of more than 30 million trips in 2016, significant property damage — claims reimbursed that are over US$1,000 under its Host Guarantee programme — was reported in only 0.009% of stays. “At that rate, you could host a new reservation every single day for over 27 years without expecting to file a significant property damage claim under our Host Guarantee,” she adds. Clashing with the hotel industry? There have been more than 200 million guests using Airbnb worldwide since it was founded in 2008. However, Kwok says that “even as more people share their homes, traditional hotels around the world continue to take in robust profits with consistently high occupancy rates”. “We believe that for us to win, no one has to lose. Home-sharing helps more people travel, meet new people and experience different cultures, and that should be good news for everyone. “Around 74% of Airbnb listings are outside of traditional hotel districts, so travellers get to experience neighbourhoods that they otherwise would not have seen,” she says. According to Kwok, Airbnb’s mission is to democratise travel including in Southeast Asia. “Travellers are no longer satisfied with the usual cookie-cutter experiences and increasingly want to live like a local — discovering hidden gems that only locals know about and having a more social travel experience. “By giving curious travellers the opportunity to explore cities and communities outside the traditional tourist traps, Airbnb is driving more footfalls to local businesses that don’t normally benefit from tourist spending. “With Airbnb, guests also tend to stay longer in cities than when they stay in hotels — 4.2 nights compared with 3.6 nights — and spend more during their stay, supporting local coffee shops, boutiques or independent bookshops. The increased economic activities are great boosts for cities around the world,” she claims. Charting further growth Until recently, the home-sharing platform has been about homes, transforming people’s travel experiences through where they stay. “Last year, we launched Trips, where we expanded beyond accommodation. Trips brings together amazing homes, authentic local experiences, tips and recommendations from local insiders and social events all into one place, and all powered by local people. “Specifically for Experiences (which is one of the features under Trips), travellers can book unique activities — designed and led by local experts — that you won’t find anywhere else, like a pottery-making class at Singapore’s last remaining dragon kiln, or a Muay Thai master class in Bangkok led by a professional fighter,” she says. Airbnb has over 1,800 Experiences available to book in more than 30 cities. This includes Singapore, Bangkok and Ho Chi Minh City — all launched this year — and it hopes to have Experiences in 50 cities by end-2017. This story first appeared in TheEdgeProperty.com pullout on Aug 18, 2017

2 Comments

WHAT does the term “affordable homes” mean? After all, what determines whether a house is affordable is based on the income of the targeted consumers.

According to Khazanah Research Institute and Bank Negara Malaysia, the sign of a well-functioning and affordable home market is when the median price for the housing market is three times the gross annual household income. Bank Negara would add that the monthly payment for the house should not be more than 30 per cent of the income. Payments of more than 30 per cent would be considered overburdening for the consumer. Based on the above criteria, Bank Negara would suggest that an affordable home in Malaysia, based on the monthly median income of RM4,585 and the annual median income of RM55,020, is between RM165,000 and RM242,000. In Malaysia, house prices are 4.4 times the median income. Further, zeroing in on the states, house prices in Kuala Lumpur are 5.4 times, 5.2 times in Penang Island, 4.2 times in Johor and in Selangor, four times the median income. While, according to Bank Negara, the affordable home is priced at RM242,000, in actual fact, the average price of houses in Kuala Lumpur is RM490,000; in Selangor RM300,000; Johor, RM260,000; and Penang Island, RM295,000. To put it simply, houses in Malaysia are simply not affordable. Efforts should be made to reduce the prices of houses to an affordable range of about RM250,000 to RM300,000. Yet in 2014, only 21 per cent of new housing launches were priced below RM250,000. There was a gross oversupply of houses above RM500,000 and an undersupply of houses below RM250,000. No wonder there is a mismatch between demand and supply. Bank Negara would suggest that between 2012 and 2014, there was a housing supply average of 85,000 units, while 118,000 households were formed. Instead of putting policy interventions into place to reduce the prices of houses, developers are putting pressure on banks to give loans to consumers who cannot afford these expensive homes. They want banks and Bank Negara to ease lending practices to make it easy for house owners to own properties. The principle seems to be not to build houses that consumers can afford, but to build overpriced houses, and then put pressure on the lending institutions to give loans to the consumers. Never mind the risks to the banks and the financial burden to consumers. Developers want to sell the overpriced homes that they have built. There have even been proposals to set up a fund so that consumers can save early to afford overpriced homes. The risks and burden is being pushed to the banks and consumers, while developers can continue to build overpriced homes. The Federation of Malaysian Consumer Associations (Fomca) calls on the government to ensure that priority is given to homes Malaysians can truly afford. The number of 1Malaysia People’s Housing (PR1MA) homes being built is way below the demand for new households. The government needs to intervene and regulate the private sector to supply more affordable homes. The government also needs to strengthen measures to eliminate speculation in the market, which inflates home prices. Polices should make speculation expensive to protect first-time home buyers. Housing is a basic right of consumers. It is the government’s role to ensure that all Malaysian have access to affordable homes. The government should also focus on promoting a thriving rental market so that renting becomes a viable option for consumers. Fomca proposes that government invests more in financial education for all consumers, especially young workers, to create awareness and build knowledge and skills on prudent financial management and making informed decisions in the market, including purchasing major assets such as houses. DATUK PAUL SELVA RAJ Secretary-general, Federation of Malaysian Consumer Associations Refer from www.nst.com.my |

MPIG NewsIn this section we will be sharing on articles & news update related real estate and some other interesting topics. Archives

May 2024

Categories |

- Home

-

New Property Launch

- Lakeside Freehold Fully Residential Private Lifestyle Condominium in Cyberjaya

- Spacious 2024 Completion KL Condo Fully Residential KLCC View

- RUMAWIP Bukit Jalil (Bumi Only)

- Lake City @ KL North NEW PHASE FROM RM380k

- Alora Residences – Inspired living within greenery in Subang Jaya

- PJ Spacious and Affordable 5 Star Condo

- Best Investment 2022 PJ Damansara Low Risk Low Entry Price High ROI

- 2022 PJ Rumah Mampu Milik RM270k Damansara

- Bangsar South 2 Rooms from RM390k BELOW Market Price

- 10% ROI PJ Project near Ikea and One Utama Mall

- Mid Valley Seputeh New Launch

- Pavilion Damansara Heights 柏威年 白沙罗岭 马来西亚 吉隆坡 精选楼盘

- 马来西亚RM300千的PJ屋子-首购族,年轻人月入3千能买房

- 2021 Penang Most Awaited Project

- 2021 New Launch - KL Metropolis

- Freehold LRT Linked 3 Room Suites in Glenmarie

- New SPACIOUS Kepong Landed 6 Room 6 Bath

- Bangsar Last Piece Land New Launch

- Avara Seputeh (Mid Valley)

- Project Announcement Registration. Malaysia New Property Launch

-

Existing & Past Project

- 2020 Lowest Risk & Price in Klang Valley with Great ROI

- Kiara East Suite Dex

- 2019 SAFEST PROFITABLE HIGH CASHBACK INVESTMENT

- Best Property Investment Projects in 2018

- KL City Freehold Spacious Affordable 3 room Project

- Jalan Kuching Freehold New Office & Shoplot

- Jalan Ipoh New Freehold Shoplot & Offices

- RM300k KL Sentral New Prelaunch

- The Olive Condo, Sunsuria City

- Prelaunch Landed House Bukit Rahman Putra

- RM260k No Downpayment Puchong South Suites

- PJ North RM400k High Cash Back Project

- Denai Sutera @ Alam Sutera, Bukit Jalil

- First Phase of Banting New Township

- Neu Suites 3rdNVenue @ Embassy Row by Titijaya & CREC

- COURT 28, Jalan Ipoh KL City New Property Launch Service Apartment. Malaysia New Property Launch

- Semanja Kajang New FREEHOLD Kajang Double Storey Houses. Malaysia New Property Launch

- M Suite @ Desa Park North

- BIJI LIVING @ Sek 17 PJ City by Conlay. Malaysia New Property Launch

- Amani Residence Bandar Puteri Puchong New Freehold Service Apartment. Malaysia New Property Launch

- SFERA RESIDENCY @ Puchong South. Malaysia New Property Launch

- KL North Last Release

- PreLaunch Freehold Double Storey

- LAND

- News & Articles

- Other Reference Link & Services

- Referral

- Career

- MPIG

- Get Professional Advice

- PJ八打灵全新地产项目分析手册

Hours

M-S: 9.30am - 9pm

|

Telephone

+60 12 3760864

|

Email

|

RSS Feed

RSS Feed