|

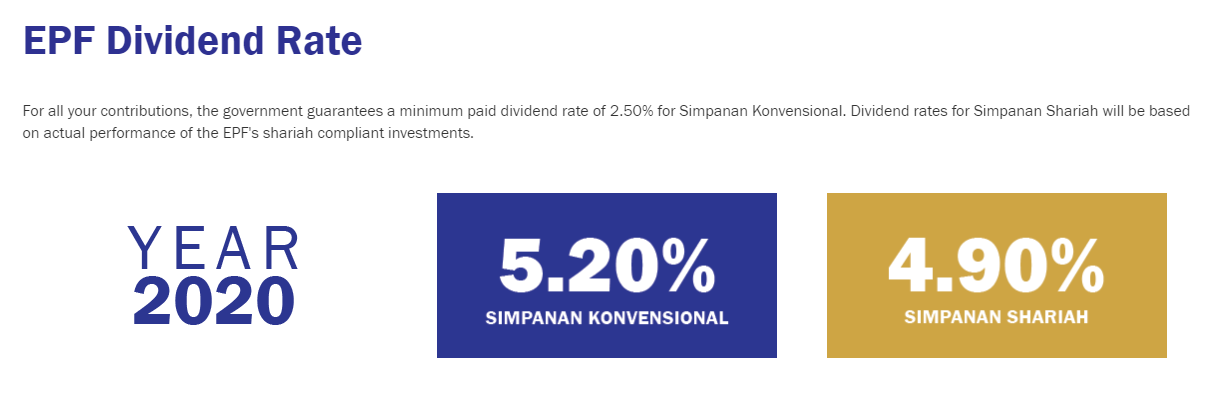

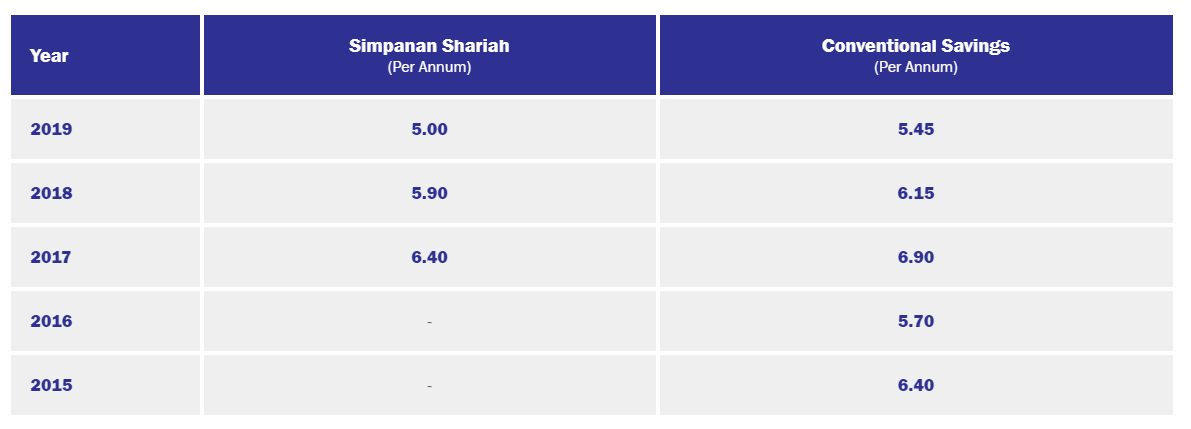

As from the declaration from KWSP in their website www.kwsp.gov.my on 24th Feb 2021, the EPF Dividend Rate for 2020 will be 5.20%. This for the first time EPF had outperformed PNB's benchmark Amanah Saham Bumiputera (ASB). Permodalan Nasional Bhd’s (PNB) dividend for 2020 is declare at 4.25%.

One of the main factor is that EPF's asset are in Bonds and Overseas investment, unlike PNB portfolios. The highest payout of EPF is declare at 6.9% dated in 2017. Last month, PNB announced a distribution payout of 4.25 sen per unit plus an “Ehsan” payment of 0.75 sen for the first 30,000 units for its flagship fixed-price unit trust fund ASB for the financial year ending Dec 31, 2020

0 Comments

Over the years, there have been many suburbs that have seen a surge in property value and market demand due to a host of factors such as the introduction of infrastructure developments, retail developments that draw in a crowd as well as unique residential and commercial developments that add to the profile of the location. StarProperty takes a look at the eight suburbs that are showing promises for the near future based on Compound Annual Growth Rate (CAGR) of terraced houses, shop lots and condominiums as well as existing and incoming infrastructure developments. Kota DamansaraKota Damansara has been an increasingly popular choice over the years due to its number of condominiums and connectivity to shopping malls and offices within the TTDI, Mutiara Damansara and Bandar Utama area. Kota Damansara has also seen an influx of office spaces but it is the residential developments that are thriving with terraced houses enjoying a staggering 6.5% CAGR increase in the same period. Damansara Heights Damansara Heights has always been known for its luxurious catalogue of bungalows stacked along windy roads that are home to affluent individuals. The residential houses within the area have always had a huge price tag with even smaller units running into the millions. In the beginning of 2016, terraced houses saw a dip in price under RM1,000 per sq ft (psf) until the MRT Line 1 was launched later in the year. As of 2019, the average price has returned to over RM1,000 psf and is on a steady incline. Taman Tun Dr Ismail (TTDI) TTDI has a reputation for quality neighbourhoods that have stood the test of time mostly consisting of terraced houses. Over recent years, there have been an influx of office towers like Menara KEN TTDI and Menara LGB, boasting tenants that include Deloitte and CIMB. Shop offices here have seen a 1.5% CAGR increase between 2015 and 2019 with an average transacted price of RM4.75mil. TTDI’s reputation for residential developments is further reinforced by the 1.6% CAGR increase in the same period. The influx of businesses is further complemented by the accessibility to the MRT Line 1. Mont KiaraThis township went from an isolated rubber estate to a condominium haven within 30 years. Mont Kiara is a unique location with the large number of expatriates residing there, namely from South Korea and Japan. Despite the large number of condominiums within the area, these developments are still holding their value and seeing price appreciation. Between 2015 and 2019, the average transacted price for a condominium increased by 1.3% CAGR lingering above the RM650 psf mark. Shop offices here have seen a 2.5% CAGR increase within the same period. Mont Kiara is, however, an evolving location that is expanding on its reputation as a condominium hub with the entry of projects like The MET Corporate Towers, a Grade-A stratified office tower, set to be completed in 2022. KepongFormerly recognised for tin mining until the emergence of Desa Park City that transformed this suburb into an upper class neighbourhood. Although the surrounding developments are not as refined or conceptually sound as those in Desa Park City, they have enjoyed an increase in property value. For instance, shop offices in Bandar Manjalara saw a 2.3% CAGR increase in average transacted price between 2015 and 2018. Additionally, terraced houses here have seen a 4.6% CAGR increase to approximately RM600 psf. Things are looking even better with the introduction of Kiara Bay, a RM15bil mixed development and the incoming MRT Line 2. Sri HartamasSri Hartamas is one of the smaller townships on this list, but one with solid landed residential developments and excellent connectivity especially to the NKVE and Penchala Link. Recognised as a high-end community with luxurious developments, the introduction of Somerset Sri Hartamas, a serviced apartment with 308 units, is expected to spur demand further. The existing number of condominiums within the area have enjoyed a 2.4% CAGR increase between 2015 and 2019 while terraced units have increased at the same amount within the same period. Bukit JalilBukit Jalil is mainly known for the National Sports Stadium that has held many events over the years. As of late, there have been more commercial developments emerging in the area providing businesses with more options to house their operations. Between 2015 and 2019, shop offices here have seen a 1.6% CAGR increase with an average transacted price of RM1.96mil. The incoming MRT Line 2 will also complement the township with increased connectivity. BangsarBangsar is known to many as a high-end location with a reputation for pricey food and beverage options just outside the city centre area. Home to many expatriates and high networth individuals, it is a township that has commanded a great deal of demand over the years. Although residential developments have seen a drop in price over the last few years, shop offices within the area have seen a sizeable increase of 3% CAGR with an average transaction value of RM7.2mil as of 2018. This article is refer from www.starproperty.my

|

MPIG NewsIn this section we will be sharing on articles & news update related real estate and some other interesting topics. Archives

May 2024

Categories |

- Home

-

New Property Launch

- Lakeside Freehold Fully Residential Private Lifestyle Condominium in Cyberjaya

- Spacious 2024 Completion KL Condo Fully Residential KLCC View

- RUMAWIP Bukit Jalil (Bumi Only)

- Lake City @ KL North NEW PHASE FROM RM380k

- Alora Residences – Inspired living within greenery in Subang Jaya

- PJ Spacious and Affordable 5 Star Condo

- Best Investment 2022 PJ Damansara Low Risk Low Entry Price High ROI

- 2022 PJ Rumah Mampu Milik RM270k Damansara

- Bangsar South 2 Rooms from RM390k BELOW Market Price

- 10% ROI PJ Project near Ikea and One Utama Mall

- Mid Valley Seputeh New Launch

- Pavilion Damansara Heights 柏威年 白沙罗岭 马来西亚 吉隆坡 精选楼盘

- 马来西亚RM300千的PJ屋子-首购族,年轻人月入3千能买房

- 2021 Penang Most Awaited Project

- 2021 New Launch - KL Metropolis

- Freehold LRT Linked 3 Room Suites in Glenmarie

- New SPACIOUS Kepong Landed 6 Room 6 Bath

- Bangsar Last Piece Land New Launch

- Avara Seputeh (Mid Valley)

- Project Announcement Registration. Malaysia New Property Launch

-

Existing & Past Project

- 2020 Lowest Risk & Price in Klang Valley with Great ROI

- Kiara East Suite Dex

- 2019 SAFEST PROFITABLE HIGH CASHBACK INVESTMENT

- Best Property Investment Projects in 2018

- KL City Freehold Spacious Affordable 3 room Project

- Jalan Kuching Freehold New Office & Shoplot

- Jalan Ipoh New Freehold Shoplot & Offices

- RM300k KL Sentral New Prelaunch

- The Olive Condo, Sunsuria City

- Prelaunch Landed House Bukit Rahman Putra

- RM260k No Downpayment Puchong South Suites

- PJ North RM400k High Cash Back Project

- Denai Sutera @ Alam Sutera, Bukit Jalil

- First Phase of Banting New Township

- Neu Suites 3rdNVenue @ Embassy Row by Titijaya & CREC

- COURT 28, Jalan Ipoh KL City New Property Launch Service Apartment. Malaysia New Property Launch

- Semanja Kajang New FREEHOLD Kajang Double Storey Houses. Malaysia New Property Launch

- M Suite @ Desa Park North

- BIJI LIVING @ Sek 17 PJ City by Conlay. Malaysia New Property Launch

- Amani Residence Bandar Puteri Puchong New Freehold Service Apartment. Malaysia New Property Launch

- SFERA RESIDENCY @ Puchong South. Malaysia New Property Launch

- KL North Last Release

- PreLaunch Freehold Double Storey

- LAND

- News & Articles

- Other Reference Link & Services

- Referral

- Career

- MPIG

- Get Professional Advice

- PJ八打灵全新地产项目分析手册

Hours

M-S: 9.30am - 9pm

|

Telephone

+60 12 3760864

|

Email

|

RSS Feed

RSS Feed