|

Budget 2016 is already announce on 23/10/2015. So what is related to home buyer? Are you more afford to buy a home now? Here's a very great article and analysis from iMoney.my on this topic.

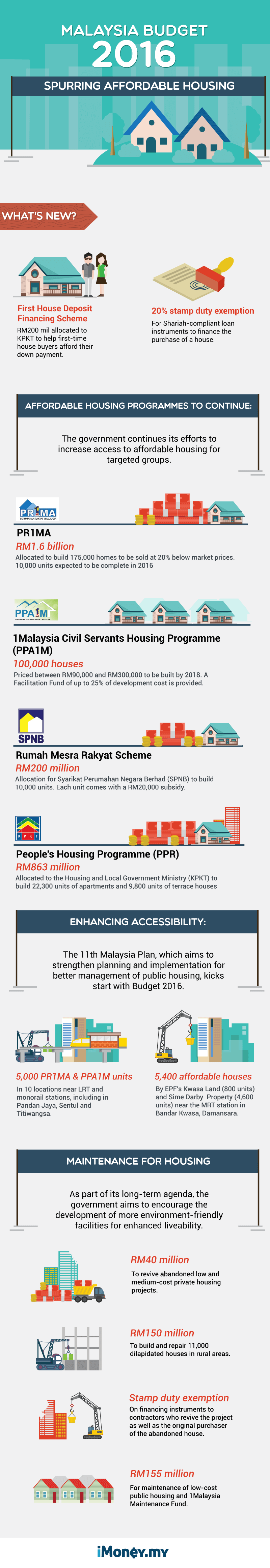

Budget 2016: Can You Afford A House Now? Refer from https://www.imoney.my/articles/budget-2016-can-you-afford-a-house-now Written by Fiona Ho Soaring property prices have been a long standing issue among aspiring Malaysian home owners, who find themselves having to scrape together a larger capital than ever to own a house. A recent study by Demographia (a US-based urban developer researcher) further confirms what we already know – it found that Malaysia had a “severely unaffordable” residential homes market, with prices hovering at 5.5 times of median income, compared to Singapore’s 5.1 times. Property value is considered no longer affordable when it reaches three times or more than that of median annual income. In response to skyrocketing home prices, the Government had announced cooling measures for Budget 2014 to curb speculation that has been driving up house prices across the nation. They include the cessation of the Developer Interest-Bearing Scheme (DIBS) – a scheme in which developers bear the interest on buyers’ housing loans until the project’s completion, and an increase in Real Property Gains Tax (RPGT) from 15% to 30% to discourage price-flipping upon completion. RPGT is a tax on chargeable gains derived from the disposal of property within a set period. A chargeable gain is the profit when the disposal price is more than the purchase price of the property. Meanwhile, to address housing affordability issues, the Government had geared the 10th Malaysia Plan (2011 – 2015) toward providing quality and environmentally sustainable housing for both rural and urban communities in line with their development objectives. Initiatives like the Youth Housing Scheme (YHS), 1Malaysia People’s Housing (PR1MA), and the Rent-to-Own (RTO) scheme were introduced to facilitate easy access to loans and to increase housing needs for the masses. Programmes like the Private Affordable Ownership Housing Scheme (MyHome) and the My First Home Scheme were also intended to make home ownership a possibility for the average wage-earning Malaysian. These initiatives will continue as the 11th Malaysia Plan (2016 – 2020) unfolds next year. Budget 2016 continues efforts to provide affordable housingOptimistic: Prime Minister Datuk Seri Najib Razak tabled the 2016 Budget in the Dewan Rakyat today amid a challenging economic outlook from falling oil revenue to weakening Ringgit. The 2016 Budget, announced on October 23, will continue to focus on providing affordable housing to meet increasing housing needs, particularly among the poor, and low-and middle-income households in line with the 11th Malaysia Plan. The Real Estate and Housing Developers’ Association Malaysia (REHDA) views the 2016 Budget as positive and helpful for promoting home ownership for the nation, especially for the low and middle income group. “The allocation of RM200 million for deposit for first time house buyers is definitely good news to the industry especially in this current trying times. Payment for deposit has always been the biggest barrier to house entries and we fervently hope that the deposit will help spur home ownership amongst the rakyat,” REHDA’s president Datuk Seri Fateh Iskandar Mohamed Mansor said in a press release. REHDA also lauds the Government’s move in making affordable housing a priority, saying it is indeed a step in the right direction towards encouraging the people to own properties. What should first-time home buyers look out for? With these various initiatives, owning a home is now more feasible than ever. However, many first-time buyers are unaware of the “true” cost of home ownership. When it comes to purchasing property, the first thing that comes to mind is always the initial down payment. Most banks in Malaysia offer up to 90% of the property’s price (margin of financing) for your first two residential properties. If you receive 90% financing, you need to pay 10% cash for the rest of the property’s price. So for example, if you are eyeing an apartment unit in Puchong for approximately RM400,000, you will need to pay a minimum RM40,000 upfront. The First House Deposit Financing Scheme announced in Budget 2016 will assist first-time home buyers in making the down payment. However, the mechanism and the bracket for house prices under the scheme is still unclear. It could also be rolled out later in the year such as the Youth Housing Scheme, which was announced in Budget 2015, but was only introduced in July this year. Buying and financing a home takes a lot more than just paying the deposit and the loan. Far from it, it also involves a number of miscellaneous fees and charges that many first-time home buyers tend to overlook. What are the miscellaneous fees and charges that home buyers need to look out for?

To put things into perspective, a home valued at RM400,000 with 90% margin of financing will come close to about RM20,000 in fees and charges – that’s how much more you will have to pay beyond the down payment to make the sale happen! Then there is the question of choosing the right home loan for you once you’ve gotten these details down. Younger home buyers will have the advantage of stretching their home loan tenure to a maximum of 35 years. This means lower monthly repayment, making the dream of owning a home a much more attainable one. First time home buyers with good credit rating will also be offered 90% financing, which brings the down payment down to the minimum of 10%. Also, do you want it fixed or variable? The interest rate for a fixed loan will remain constant throughout your tenure, which is good if interest rate spike, but if the rate drops, you will miss out on any savings. You will need to weigh all the pros and cons for your individual circumstances to get the lowdown on the benefits of both types of loan. Meanwhile, getting a flexible mortgage scheme features lower rates and payments early on in the loan term. However, rates and payments can rise significantly over the life of the loan. Compare the best mortgage loans in Malaysia using our home loan calculator. Affordable housing by the Government can only do so much, if you don’t have the proper financial planning to own a home, you will still not be able to buy one. There is nothing you can do about the flailing economy, but you can find a way to make your money work harder for you by using the right credit card.

0 Comments

MRT Sungai Buloh-Serdang-Putrajaya Line approved Refer from Paultan.org By Gregory Sze / 23 October 2015 9:36 am The Land Public Transport Commission (SPAD) has provided the thumbs-up for the KL MRT Line 2, also known as the Sungai Buloh-Serdang-Putrajaya Line (SSP), railway scheme, according to a report by The Star. “With the final approval obtained, MRT Corp will now proceed with the construction of the SSP Line which is the second line of the Klang Valley MRT Project,” said the firm in a statement. With the approval given, construction is expected to commence in June 2016. Earlier this year, a three-month public inspection from May to August this year received positive feedback with more than 90% of the general public signalling their approval on the line. The final alignment saw minute changes at two location in Kuchai Lama and Sungai Besi to allow for optimum usage of the land. Additionally, another station will be established within the vicinity of Technology Park Malaysia (TPM), between stations S25 at Sungai Besi and S26 at Serdang Raya North. The new station will service TPM as well as the population around the developing Sungai Besi area. All in all, the SSP Line will now have 37 stations in total. Of said figure, 25 stations will be elevated while 11 will be built underground – the remaining one station will adopt a “half-sunken” layout whereby it will be constructed on the ground below the current level. It’s also worth noting that the MRT SSP Line will integrate with the proposed Kuala Lumpur-Singapore High Speed Rail (HSR). Lengthwise, the entire line is expected to span a distance of 52.2 km with 38.7 km of said line elevated – the remaining 13.5 km will be underground. The average travel time between each stop is expected to take between two to three minutes with the entire journey, end to end, taking an estimated 84 minutes. As mentioned earlier, construction of the MRT SSP Line is expected to begin in the middle of next year with the first phase (between Sungai Buloh and Kampung Batu) slated to begin operating in July 2021. The remaining section from Kampung Batu to Putrajaya Sentral is expected to be operational by July 2022. Indonesia, please resolved your haze & fire problem as soon as possible, we your neighbor is suffering a lot here...

Schools in several haze-hit states to remain closed tomorrow by joseph kaos jr PUTRAJAYA: Schools that were closed in several states on Monday due to the haze will continue to be closed on Tuesday as the air quality shows little improvement. The Education Ministry, in a statement Monday, announced that schools in Malacca, Negri Sembilan, Selangor, Kuala Lumpur, Putrajaya, Kuching and Samarahan in Sarawak, and Tawau in Sabah, will remain closed. In addition, schools in Lahad Datu, Semporna and Kunak in Sabah, as well as Muar, Ledang and Segamat in Johor, have also been instructed to close on Tuesday. "Based on the ministry's observation at 1pm today, the API (Air Pollution Index) level at the affected areas remained 'Unhealthy'. "The closure will affect 1,909,842 students in 3,029 schools nationwide," the ministry said. News refer from http://www.thestar.com.my/news/nation/2015/10/19/haze-schools-closure-tuesday/ 5 BEST WAYS TO INCREASE HOME"S VALUE Posted on October 9, 2015 BY NURUL ASMUI MD AZMI asmui@ocision.com Refer from http://www.starproperty.my/index.php/articles/living/5-best-ways-to-increase-homes-value/ Selling or renting out a home can be a long, rocky process. It pays to improvise your home to increase its value and make it more attractive to potential buyers and tenants. Inspect your house and list all the things that need to be repaired or changed. Then, draw up a checklist according to how much they’ll cost, and the time required to attend to them. Avoid unnecessary spending by keeping a watchful eye on your financial position as you progress along. To get the most out of your home improvement, consider these five ways to increase your home’s value. 1. Appealing paint colour A simple fresh coat of paint can transform a space from mundane to inspiring! A new coat of paint could be one of the simplest and least expensive improvement methods. A home that is freshly painted will look new, clean and refreshed. The trick to finding the perfect paint for your home is to select a neutral colour. The colour should make someone feel comfortable and calm when entering the home. Neutral colour is known to appeal to many people, and it makes the house more desirable. Select from among neutral, warmer colours, such as pale yellow, light brown, beige, grey and even soft blue. 2. Kitchen upgrade Remodelling can transform a once dreary kitchen into a stunning new space. Boost the appearance of your kitchen to maximise your home’s value. The kitchen is an important part of a house that need to be spruced up before it is opened up for sale or rent. If you are looking to make minor changes, new curtains, wallpapers or light fixtures will be an ideal modification. However, if your kitchen is worn out, it is best to fork out extra budget to change the cabinets, swap sink with new stainless model, get a top-performing refrigerator, and new modern tabletops for a fresher look in the kitchen. 3. Replace worn flooring Refinishing flooring can help make your floor look as good as new. Replacing outdated carpet, or simply refinishing wood flooring is one of the smart ways to spend your money on little home improvement. Walking into a house with stained, worn flooring is not a pleasant sight. The thought of needing to replace the flooring can turn off potential buyers. Ideally, it will be better if you can replace all of the flooring in the house, but if you have a limited budget, start by replacing the one that shows the most wear and tear. 4. Beautify bathroom Increase home value by transforming an outdated bathroom into a sleek, modern space. Of all the rooms, bathroom is usually the workhorse. This is where most of the damage is done so upgrade your bathroom and keep it functioning well to make it look valuable. Even if you can’t afford a full remodel, it is always worthwhile to undertake small fixes that will ensure the bathroom runs well. Try these small changes, such as substituting dated wallpaper with a faux or textured finish, replacing old lighting to lighten up the space, adding new tiles to give your bathroom an updated and modern appearance. Regardless of what you are planning for your bathroom, keep in mind that replacing old plumbing is a must. 5. Extension and expansion Install mirrors to reflect light and maximise space in your home.

The size of your home can significantly stifle its value. This does not apply only to the square footage, but also visual space and how large your home feels. The key is to make sure that each room feels larger. Some rooms can benefit from vertical blinds, shutters or light curtains to let the light in. Sunny rooms will feel more spacious and open. Sometimes, adding a single large mirror can also do the trick. It helps in visually doubling the space so the room feels larger. Another method is to have a clutter-free home, which will definitely make your home appearing cleaner and larger. So spend some time to “unclutter” your home. Spend a weekend or two to figure out the changes that you need to do. If you really can’t find some free time, then maybe hire a professional to “audit” your home will be a good start. Although the process can be stressful, the effort is necessary if you want to increase the chances of your home being sold or rented out. However, before you start refurbishing or getting the builders in, do some research on the property price in your area to make sure that renovation does not cost more than what you are likely to make.  Which toll will have increase price in this coming Thursday? Twelve highways see hikes in toll rates – NPE, DUKE, MEX, SMART now costlier, highest at RM1.10 By Graham Chin / 12 October 2015 Referred from paultan.org Well, there we have it folks, a total of 12 highways have registered a toll hike. The highways include AKLEH, Besraya, DUKE, Guthrie Corridor Expressway, Kajang SILK, Karak, LATAR, LEKAS, LKSA, MEX, NPE and the SMART tunnel – the hikes will be in effect from October 15 onwards. All Class 1 passenger vehicles will now need to pay hikes ranging from RM0.20 to RM1.10. The lowest toll adjustment comes from the Kajang-Seremban Highway (LEKAS) for the Semenyih toll plaza (from RM1.10 to RM1.30), while for its Setul toll plaza, the toll rates have been hiked up by as much as RM1.10 (from RM4.90 to RM6.00) Elsewhere, ringgit hikes include the Ampang-Kuala Lumpur Expressway (AKLEH) from RM1.50 to RM2.50, the Kuala Lumpur-Karak Expressway at the Gombak toll plaza from RM5.00 to RM6.00, the Salak Selatan toll plaza on the Maju Expressway (MEX) from RM2.50 to RM3.50, and the SMART tunnel from RM2.00 to RM3.00. No change in rates have been registered for the Kundang Timur and Kundang Barat toll plazas on the Kuala-Lumpur-Kuala Selangor Expressway (LATAR) which stays the same at RM1.30. Similarly, the same goes to the PJS 2 toll plaza on the New Pantai Expressway (NPE) which continues on with the same rate at RM1.00. Refer to the table below to see the rate hikes for Class 1 vehicles: A lot of client have ask us on is it this year market will drop and when is best time to buy?

Our advice to them is buy when you are ready. There is no right time or wrong time to buy. You cant predict the market. In general, Property is a LONG TERM investment, not a short term. For the past 60 years, the property price chart shows that its keep increasing in long run. Here you can see the outcome of the Star Property Fair in Queensbay Mall. You say it is slowing down and not a good time? Article from Star Property: HOMING IN ON HOT PICKS Posted on October 5, 2015 DEVELOPERS closed approximately RM153.7mil in sales during the four-day Star Property Fair at Queensbay Mall in Penang. EcoWorld Development Group Bhd (RM20mil), Asia Green Group (RM10.4mil), Tambun Indah Land Bhd (RM8mil), Ideal Property Group (RM29mil), Nusme-tro City Sdn Bhd (RM3.3mil) and Tropicana Ivory (RM3mil). Zeon Properties sold about RM80mil of properties from the developers it was represen-ting. The projects exhibited by Zeon were Ewein Zenith’s City of Dreams in Gurney Drive, Aroma Development Sdn Bhd’s Starhill in Sungai Ara, Bionic Land Bhd’s Prominence in Butterworth, Trimension Properties’ GMansion in Bukit Gambier and KB Group’s Sang Sarang in Lumut. Its chief executive officer Leon Lee said the sales generated this time showed that there was still confidence in the local property market, which would be boosted once the Penang Transport Master Plan, which promises an LRT system and trams, was realised. “In a time when prices of goods are going up, the property sector is still the best hedge against inflation. “Most of the properties that are in demand are those priced below RM1mil,” he said. Mah Sing Group Bhd chief executive officer Ng Chai Yong said the group managed to obtain over 1,000 registrations for its properties. Mah Sing showcased Kuala Lumpur projects such as the Lakeville Residence, Southville City@KL South and MCity. For Penang, the projects displayed were The Loft@Southbay, Ferringhi Residence, Southbay City and Legenda@Southbay. EcoWorld Development Group Bhd general manager Khoo Teck Chong said they achieved their target of RM20mil in sales for both the Eco Meadows and Eco Terraces projects, located in Bukit Tambun and Paya Terubong respectively. The Eco Meadows, compri-sing double-storey terraces, is a gated and guarded project, equipped with clubhouse facilities and located close to the first and second Penang bridges. “Bukit Tambun is very close to Batu Kawan, where notable projects such as the Eco World Premium Golf Resort, Columbia Hospital, Hull University and The SME Village are being carried out,” Khoo said. Asia Green director Tan Li Mei said the group sold RM10.4mil worth of properties from its Clovers condominium project in Sungai Ara. “The project is over 80% sold,” she added. Ideal Property general manager (sales and marketing) Nancy Teo said the sales were better than expected. “Our products from I-Santorini, Forest Ville, and One Foresta sold well because they are very affordable and strategically located,” she added. The I-Santorini in Tanjung Tokong and One Foresta in Bayan Lepas are priced at RM400,000, while the Forest Ville properties are priced between RM430,000 and RM530,000. Palmex Industries Sdn Bhd deputy general manager Lim Cheok Leng said there were many enquiries on its landed properties Cypress Villa and Stramax Residences in Desaria, Sungai Ara. She said they had also offered an easy payment package for those who failed to secure bank loans. “Quite a number of buyers have gone over to check out our Cypress Villa. “We believe we will be able to close deals within two weeks after the fair,” she said. Tropicana Corporation Berhad marketing and sales manager Amanda Lee Lingwei said they received about 240 registrations for Tropicana 218 Macalister in Macalister Road and The Residences @ KLCC. “Most of them came to check our Neo Suites of Tropicana 218 Macalister, which are commercial units. “It is a new concept, with work and play in mind for the occupants to enjoy the facilities,” she said. OSK Property Holdings Berhad sales assistant Danson Tan said they also received many enquiries on their landed properties in Yarra Park, Bandar Putri Jaya, Sungi Petani. “The properties here offer sound investment. “The prices are affordable,” he said. About 40,000 people turned up at the fair which ended yesterday to check out the best property bargains offered by Kuala Lumpur and Penang-based developers. Article Refer from : http://www.starproperty.my/index.php/articles/events/homing-in-on-hot-picks/  Good news for Middle Income Malaysians. Developers are looking into middle income groups market Developers roll out projects for middle-income Malaysians Posted on October 2, 2015 BY DAVID TAN, CHRISTOPHER TAN, AND JOLYN FRANCIS DEVELOPERS from Penang and Kuala Lumpur are showcasing approximately RM9.52bil worth of projects at the Star Property Fair 2015 at Queensbay Mall, Penang. The developers are EcoWorld Development Group Bhd (RM710mil), Mah Sing Group Bhd (RM4.32bil), Ewein Zenith Sdn Bhd (RM800mil), Seni Bahagia Sdn Bhd (RM72mil), Sunway Bhd (RM628mil), Asia Green Group (RM1.6bil), Aroma Development Sdn Bhd (RM500mil), Bionic Development Sdn Bhd (RM300mil), Trimension Properties Group (RM200mil) and KB Group (RM384mil). The projects are targeted mainly at the Malaysian market despite many would-be buyers having difficulty in obtaining bank loans. Mah Sing Group Bhd CEO Ng Chai Yong said the group believed there would still be a need for well-located property with mid-range prices for Malaysians in the middle-income segment. He said there was a supply and demand gap as only 70,000 to 80,000 new homes were completed each year, while approximately 200,000 units were required to meet new households arising from marriages. “We are very careful with the projects we roll out at the fair. “We believe they will do well as they are a good mix of investment grade property as well as residences in good locations, priced to attract the mass market. “The weakening ringgit may attract more foreign investors but it is also a compelling reason for local buyers to invest now to hedge against inflation and economic concerns,” Ng said. Zeon Properties Sdn Bhd chief executive officer Leon Lee said the local segment was still the market to go for because there were still many who had yet to own a home. “Most of our homes are priced below RM1mil and foreigners who are not registered under the Malaysian Second Home Programme cannot buy them. “The exceptions are City of Dreams units, which are priced between RM1.4mil and RM2.3mil, and some units of Sang Sarang and Starhill,” Lee said at the fair yesterday. The projects exhibited by Zeon are Ewin Zenith’s City of Dreams in Gurney Drive, Aroma Development Sdn Bhd’s Starhill in Sunga Ara, Bionic Land Bhd’s Prominence in Butterworth, Trimension Properties’ G Mansion in Bukit Gambier and KB Group’s Sang Sarang in Lumut. Meanwhile, EcoWorld Development Group Bhd sales assistant manager Juliet Ooi said both the RM310mil Eco Meadows and RM400mil Eco Terraces in Paya Terubong were targeted at local buyers. “The selling price for Eco Meadows’ two-storey terrace houses starts from RM708,000,” she said. Ooi said Eco Terraces located in Paya Terubong had already registered a take-up rate of 60%. BSG Property is displaying The Landmark in Tanjung Tokong, Middleton in Minden Heights, Oakridge in Sungai Nibong and Raffle Residence 199 in Minden Heights at the fair. BSG Property sales executive Eevonne Lim said The Landmark consisted of 308 commercial and residential units. “The built-up space ranges from 7,990sq ft to 3,004sq ft. “The minimum price starts from RM1.2mil due to the good location and every unit has a sea view,” she said. She added that the project, launched in 2013, was 60% to 70% sold. “We have both local and foreign investors for this project,” she said. “A total of 8% of our Middleton luxury condominium units in Minden Heights with a starting price of RM1.1mil have been sold. “Our Oakridge three-storey semi-detached homes in Sungai Nibong and our Raffel Residence 199 three-storey terrace units in Gelugor are almost sold out,” she said. Refer from http://www.starproperty.my/index.php/featured/developers-roll-out-projects-for-middle-income-malaysians/ Lots of IKEA fans in Cheras definitely be pleased by this news!

|

MPIG NewsIn this section we will be sharing on articles & news update related real estate and some other interesting topics. Archives

August 2023

Categories |

- Home

-

New Property Launch

- Lake City @ KL North NEW PHASE FROM RM380k

- Alora Residences – Inspired living within greenery in Subang Jaya

- PJ Spacious and Affordable 5 Star Condo

- Best Investment 2022 PJ Damansara Low Risk Low Entry Price High ROI

- 2022 PJ Rumah Mampu Milik RM270k Damansara

- Bangsar South 2 Rooms from RM390k BELOW Market Price

- 10% ROI PJ Project near Ikea and One Utama Mall

- Mid Valley Seputeh New Launch

- Pavilion Damansara Heights 柏威年 白沙罗岭 马来西亚 吉隆坡 精选楼盘

- 马来西亚RM300千的PJ屋子-首购族,年轻人月入3千能买房

- 2021 Penang Most Awaited Project

- 2021 New Launch - KL Metropolis

- Freehold LRT Linked 3 Room Suites in Glenmarie

- New SPACIOUS Kepong Landed 6 Room 6 Bath

- Bangsar Last Piece Land New Launch

- Avara Seputeh (Mid Valley)

- Project Announcement Registration. Malaysia New Property Launch

-

Existing & Past Project

- 2020 Lowest Risk & Price in Klang Valley with Great ROI

- Kiara East Suite Dex

- 2019 SAFEST PROFITABLE HIGH CASHBACK INVESTMENT

- Best Property Investment Projects in 2018

- KL City Freehold Spacious Affordable 3 room Project

- Jalan Kuching Freehold New Office & Shoplot

- Jalan Ipoh New Freehold Shoplot & Offices

- RM300k KL Sentral New Prelaunch

- The Olive Condo, Sunsuria City

- Prelaunch Landed House Bukit Rahman Putra

- RM260k No Downpayment Puchong South Suites

- PJ North RM400k High Cash Back Project

- Denai Sutera @ Alam Sutera, Bukit Jalil

- First Phase of Banting New Township

- Neu Suites 3rdNVenue @ Embassy Row by Titijaya & CREC

- COURT 28, Jalan Ipoh KL City New Property Launch Service Apartment. Malaysia New Property Launch

- Semanja Kajang New FREEHOLD Kajang Double Storey Houses. Malaysia New Property Launch

- M Suite @ Desa Park North

- BIJI LIVING @ Sek 17 PJ City by Conlay. Malaysia New Property Launch

- Amani Residence Bandar Puteri Puchong New Freehold Service Apartment. Malaysia New Property Launch

- SFERA RESIDENCY @ Puchong South. Malaysia New Property Launch

- KL North Last Release

- PreLaunch Freehold Double Storey

- LAND

- News & Articles

- Other Reference Link & Services

- Referral

- Career

- MPIG

- Get Professional Advice

- PJ八打灵2021全新地产项目分析手册

RSS Feed

RSS Feed