|

Have you apply for MyDeposit yet? Don't loss out and miss this chances. Go apply for MyDeposit and enjoy the perks now! Action now, don't complain later that you can't afford any home. This is a great chance to own a home. I do advised my buyer to get their first home using this advantage. Bear in mind, this is solely for own stay. Not short term investment purpose as there is a catch on the lock in period from selling your unit. Here's the update on MyDeposit MyDeposit scheme attracts 1,046 successful applicants National Housing Department Director-General Mohamad Yusoff Ghazali announced that they have received 1,046 completed applications for the First House Deposit Financing (MyDeposit) scheme since it was opened on 6 April. But after the application deadline on 30 June, as much as 7,000 people are expected to take advantage of the programme, which will help people buy a home by providing a subsidy of up to RM30,000 or 10 percent of the property’s price. Most of the applicants so far are from Selangor, said Yusoff. The second most numerous are from Putrajaya, followed by Johor and Penang. “We give the public until the end of June and the incentive is given to those qualified, based on first come, first served basis,” he told reporters. But if there is strong demand for the MyDeposit scheme, the agency would urge the federal government to raise the allocation so more people can apply. Funded by a RM200 million allocation from Putrajaya, the scheme is open to first-time home buyers seeking to purchase a property with a maximum price of RM500,000, on the condition that the house must not be sold or rented out for 10 years. It is open Malaysians aged 21 and above whose families have a gross monthly income of RM3,000 to RM10,000. Those interested to apply, may submit their applications at http://ehome.kpkt.gov.my/ “The deposit is paid by the government directly to the developers for new projects or lawyers for the purchase of secondary houses and need not be repaid by the buyers.” “We expect it will take a month to process every application and the offer letter to the buyer will be given as early as the end of this month,” added Yusoff. Mangalesri Chandrasekaran, Editor at PropertyGuru, edited this story

0 Comments

It's really good to hear that the line extension project (LEP) for the Kelana Jaya Line is going to operating very soon. It's been something that we waiting for a while. This will benefit not only the residence nearby but also boost for property value nearby. It's bring goods in overall. Kelana Jaya LRT extension to be ready by June

The line extension project (LEP) for the Kelana Jaya Line is poised to open as scheduled on 30 June, according to Prasarana. Datuk Zohari Sulaiman, CEO of Prasarana rail and Infrastruture Projects Sdn Bhd (PRAISE), revealed that the extension of the Light Rail Transit (LRT) is nearly complete and they are mostly doing testing, touch-up and cleaning works. “We have carried out the Emergency Response Plan (ERP) exercise as part of requirement set up by the governing authority for public transport, Land Public Transport Commission (SPAD).” The ERP, which was held at the Subang Alam station, aims to check the readiness of the facilities and system, as well as test the preparedness of the operations team Spanning 17.4 kilometres, the LEP began from the Kelana Jaya station and covered twelve new stations, including those in Ara Damansara, Subang Jaya and USJ before finishing at Putra Heights. Aside from the aforementioned stations, the development also involved the stations in Lembah Subang, Ara Damansara, Glenmarie, Subang Jaya, SS 15, SS 18, USJ 7, Taipan, Wawasan, USJ 21 and Alam Megah. To further improve connectivity, the extended line was also linked with the Bus Rapid Transit-Sunway Line at USJ 7 station and the KTM Komuter network at the Subang Jaya station. With this longer network, the Kelana Jaya Line will have an overall length of 46.4 kilometres, snaking through the high-populated areas of Bangsar, Taman Melati, Setiawangsa, Petaling Jaya and Kuala Lumpur’s central business district (CBD). Mangalesri Chandrasekaran, Editor at PropertyGuru, edited this story. In a bid to diversify its assets, the Employees Provident Fund (EPF) plans to increase its property investments by two-fold over the next few years, reported Bloomberg.

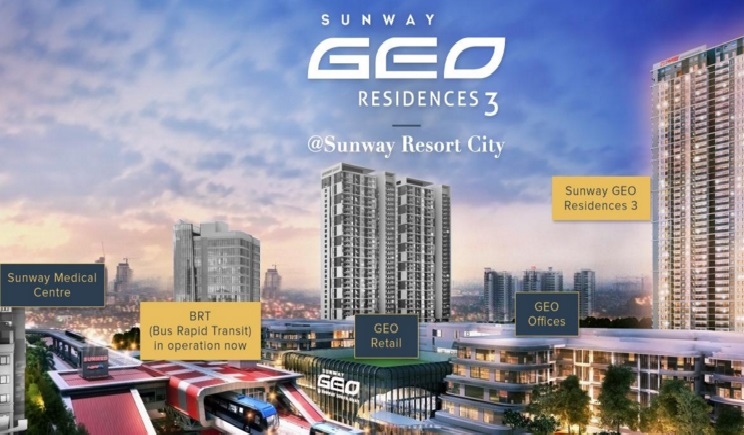

According to its CEO Shahril Ridza Ridzuan, the fund is currently planning to acquire more real estate in continental Europe to add to its existing overseas properties, including the Battersea Power Station project and 11-12 St James Square in London. “Our real estate exposure is very small, less than four percent, at this point in time,” he said. “It’s the fastest growing part of our business. The goal is for private market assets to take about 10 percent of the total fund size in five to seven years.” With this uptick in foreign property acquisitions, the EPF joins other sovereign wealth funds with a similar strategy. The world’s largest wealth fund Oslo-based Norges Bank Investment Management plans to spend S$8 billion annually to acquire such assets, while Singapore’s GIC has set its sights on real estate in gateway cities and major markets. On average, the EPF’s investments in offshore properties and infrastructure projects have surged by over 50 percent per year, revealed its 2014 annual report. Notably, it has been purchasing real estate since 2009 to protect its money against inflation. As for the rest of its portfolio, 42 percent of its investments consists of equities as of December 2014, while fixed income instruments account for 51 percent. The EPF oversees the retirement savings of over 13 million Malaysians. Mangalesri Chandrasekaran, Editor at PropertyGuru, edited this story. Written By Lianna Brinded Refer from Businessinsider.my The 17 countries with the highest level of government debt All eyes are back on Greece in April as the country tries to unlock more funds from international creditors to help mend its battered economy. But despite racking up huge amounts of government debt — Greece is not the most indebted country in the world. The World Economic Forum’s Global Competitiveness Survey looks at the financial health and risks of countries around the world. One of the most interesting and important rankings is actually the level of government debt. By looking at level of gross government debt as a percentage of GDP, it can indicate how able a country is to pay back debts without incurring further debt. Basically the lower the debt-to-GDP ratio the better. Take a look to see who made the top 17 and who beat Greece for the top spot 17. Iceland – 90.2%. Prior to the credit crisis in 2007, government debt was a modest 27% of GDP. Eight years on and the country is still dealing with the collapse of the banking system. 16. Barbados – 92.0%. The tax haven nation is the wealthiest and most developed country in the Eastern Caribbean but its growth prospects look weak due to austerity measures to combat the effects of the credit crisis eight years ago. 15. France – 93.9%. The eurozone’s second-biggest economy has been recovering “in fits and starts,” says country’s statistical agency. But this month it put out some good news — PMI services came in better than expected and retail sales are rising. 14. Spain – 93.9%. S&P is confident that Spain’s buoyant growth prospects and labour market reforms will boost its outlook. In the second quarter, Spain’s economy grew 3.1% year-on-year. 13. Cape Verde – 95.0%. The island nation is a service-orientated economy and suffers from a poor natural resource base. This means it has to import 82% of its food, leading to vulnerability to market fluctuations. 12. Belgium – 99.8%. The country is known as “the sick man of Europe” as although the government managed to reduce the budget deficit from a peak of 6% of GDP in 2009 to 3.2% — its debt is still incredibly high. 11. Singapore – 103.8%. It’s one of the wealthiest countries in the world but the island nation suffers from high debt. The government is now trying to find new ways to grow the economy and raise productivity. 10. United States – 104.5%. The US is on the cusp of raising interest rates for the first time in seven years. However, some analysts warn that this could trigger another financial crisis due to the hike in repayments people will face in paying back debt. 9. Bhutan – 110.7%. The small Asian economy is closely linked to India and depends heavily on it for financial assistance and foreign labourers for infrastructure. 8. Cyprus – 112.0%. The country’s excessive exposure to Greece hit it hard when the European sovereign debt crisis rippled across the world in 2010. Like Greece, it had to be bailed out by international creditors and enforce capital controls and austerity measures to get funding. 7. Ireland – 122.8%. The country exited its bailout programme two years’ ago but still faces a huge debt pile. But it’s on the right track. Ireland has already had success in refinancing a large amount of banking-related debt. 6. Portugal – 128.8%. Portugal exited its own bailout programme in the middle of 2014. However, GDP was still 7.8% lower than it was at the end of 2007. 5. Italy – 132.5%. The country’s proportion of debt to GDP is the second highest in the Eurozone. It spiked earlier this year because the Treasury increased its available liquidity. 4. Jamaica – 138.9%. The services industry accounts for 80% of GDP but high crime, corruption, and large-scale unemployment drag the country’s growth down. The International Monetary Fund said Jamaica has to reform its tax system amongst other things. 3. Lebanon – 139.7%. The country used to be a tourist destination but war against Syria and domestic political turmoil has led to a lack of an official budget for months. 2. Greece – 173.8%. The country has taken over €320 billion worth of bailout cash and it’s looking increasingly impossible to pay it all back – especially since it has had to implement painful austerity measures to get its loans. But it’s surprisingly not the worse country in the world for government debt. 1. Japan – 243.2%. The country is in a troubling spot. Its economy is growing very slowly and now the central bank has implemented negative interest rates. MPIG comment: It's a real surprise that Greece is not on the first spot where a traditional strong country like Japan taking the first spot. Anyone of you have guess on this? We know Japan is not having a good time lately but we don't expect them on the first spot. And to be relieve, Malaysia is not among the top 17. Thought we don't know about how transparency and how accuracy the data is. A country debt is closely relate to jobs, economy, happiness of the population, growth etc... So you can expect those in the list is having not a good time at the moment. Written by Jonathan de Ho MyDeposit is officially launch by Prime Minister Datuk Seri Najib Tun Razak on 7th April 2016. It is announced during Budget 2016, the scheme is aimed to help the lower income group with a household income of RM10,000 and below. The scheme, said a contribution of 10% from the sale price or maximum of RM30,000 (whichever is lower), will be given to first-time buyers looking for homes priced below RM500,000. First, the main issue now is high property price and many of the young Malaysian not afford to own a house. This you also can translate to many of them not able to get loan approval and root of the cause is the household income and commitment. The loan reject cases is higher than ever, many buyer cant get mortgage loan approve as Bank also become more cautious and thee regulation is more strict than ever. Why? Why would bank do that? Its because they too also feel its risky to approved mortgage loan to the lower income group or high commitment group. So the root of the cause is low income. Instead of giving some gimmicks (yes it will help some but not majority) in MyDeposit with contribution up to RM30,000 or 10% of sales price, it should focus on increase Malaysian economy and income. As nowadays a lot of new project launching come with No Money Down package or high rebates which you don't need to pay much up front. Another way of solution is increase awareness and more proper education on lifestyle changes and money management. Some family with RM10,000 still also cannot own a house as their expenses and commitment is also high as well. Perhaps government should focus on getting Malaysia economy back on track and also lesser intake of foreigner worker. Large intake of foreigner worker not only reduce the job opportunity but it also directly increase Malaysia social problems such as criminals. Back to topic, Malaysian education also should educate more on money management and living a modest lifestyles. MyDeposit from my opinion only help solve small portion of issue but not really treating the root of cause. Even if Bank Negara loosen the mortgage loan approval regulation also not really solving the issue. Property price is already at that so call "High" level, but if compare among the region we are still among the cheaper property price per square feet nation. So you can expect property price wont really going to reduce much even the market now is soft. Main solution is how to make Malaysia a high income country, how to educate majority to become high income group. That's all for my sharing today. Here's today news in The Star Online on MyDeposit: Najib launches MyDeposit Refer from The Star Online, 7th April 2016 KUALA LUMPUR: The First Home Deposit Funding Scheme (MyDeposit) has been launched. Announced during Budget 2016 last October, the scheme is aimed at helping the lower income group with a household income of RM10,000 and below. Prime Minister Datuk Seri Najib Tun Razak, who launched the scheme yesterday, said a contribution of 10% from the sale price, or maximum of RM30,000 (whichever is lower), will be given to first-time buyers looking for homes priced below RM500,000. He said they could apply for the scheme online starting today through the National Housing Department website. He also said his announcement under the Budget Recalibration 2016 that houses priced up to RM300,000 will be reserved for first-time buyers will take off this month. Najib was speaking to reporters after chairing the National Housing Council meeting at Parliament building yesterday. Also present was Urban Wellbeing, Housing and Local Government Minister Datuk Abdul Rahman Dahlan.  It’s a deal: PR1MA chief executive officer Datuk Abdul Mutalib Alias (left) exchanging documents with Tenaga Nasional Berhad (TNB) chief corporate officer Datuk Wira Roslan Ab Rahman during a memorandum exchange ceremony between PR1MA and TNB. Looking on from left are TNB chairman Tan Sri Leo Moggie, Najib and Abdul Rahman. The meeting was also informed that as of Dec 31 last year, 17% or 183,755 units have been completed out of the one million affordable homes under the project set to be achieved by 2018. Nineteen percent (214,011 units) were being built while 28% or 309,571 units were in various planning stages. Najib also witnessed the signing of an agreement between Tenaga Nasional Bhd (TNB) and Perbadanan PR1MA Malaysia (PR1MA) to develop a plot of land in Kajang owned by TNB. The project, mooted by the late PR1MA chairman Tan Sri Jamaluddin Jarjis, will see PR1MA working with a private developer. Two blocks consisting of 786 units, have been planned with 50% allocated for TNB employees and the other 50% for those eligible. The project is expected to be completed by the end of 2019. Sunway offers own loans up to 88% and deferred payment plan for homebuyers Refer from www.ptlm.com.my Property heavyweight Sunway Bhd has introduced special offerings under its Sunway Property Certainty Campaign today, which includes up to 88% financial assistance to home buyers under a unique ownership campaign as the developer seeks to boost sales. The campaign – which will offer (1) guaranteed loan, (2) deferred payment plan and a (3) voluntary exit plan – covers all Sunway projects in Malaysia from today until 31 September. "We are still seeing demand for good and well-located properties in the market. People are looking to upgrade, invest and own a home in a well-planned environment,” said Sunway Malaysia and Singapore property development division managing director Sarena Cheah. “However, with the uncertain times now, the timing of people's commitment in properties is something of great concern," she added. Stricter lending imposed by banks meant some buyers were unable to obtain the financing needed to complete their home purchases. According to Sunway Integrated Properties Sdn Bhd marketing and sales general manager Gerard Yuen, the guaranteed loan scheme is a 12:88 plan, with Sunway providing financing of up to 88% of the property price from its internal funds. Under the newly-introduced scheme, buyers are given the options to apply loan with commercial banks or with Sunway. The guaranteed loan by Sunway is offered on a first-come, first-served basis for Sunway’s launched and on-sale projects. It will have a fixed interest rate based on a commercial basis and subject to certain criteria. He said to qualify for the loans, applicants must be above 18 years old and not bankrupt, among other things. The loans are available to both Malaysians and foreigners. "For homebuyers who meet the basic criteria, we are happy to assist them by providing a certainty package, enabling them to own their dream home with a greater sense of comfort," said Yuen. "We are not trying to play the bank’s role, we just want to assist those who want to buy a Sunway unit but are having temporary financial difficulties," he stressed. Meanwhile, the deferred payment scheme offers zero payment for a period of 12 or 24 months following an inital downpayment of 3% or 6%. The voluntary exit plan allows buyers to withdraw or terminate from the sale and purchase agreement owing to unforeseen circumstances such as loss of employment. At the press conference, the Group also unveiled the third and final phase of the Sunway Geo Series in Sunway South Quay, where it has received an average of more than 95% take-up rates for its previous launches. Sunway is alo gearing up for more central region launches during the early half of the year with two brand new developments in Mont Kiara and Bangi. It is part of the Group’s plan to launch properties with a gross development value (GDV) of RM1.6 billion in the Klang Valley (central region), Iskandar Malaysia (southern region), Ipoh and Penang (northern region). The developer also has a presence in Singapore and China. Currently, Sunway has landbank of 3,304 acres, with a total GDV of RM47.7 billion and a development period up to 15 years. For this year, she said 70% of the launches will be focused in Klang Valley, totalling RM1 billion. It will launch Sunway Geo Residences 3 – which has a gross development value (GDV) of RM535 million – next month, and plans to launch Sunway Brook Residences (RM200 million GDV) in Mont’Kiara, a block of office suites at Sunway Velocity (RM200 million GDV) and 259 units of serviced apartments in Sunway Gandaria (RM200 million GDV) in Bangi. For the southern region, Sunway plans to launch RM400 million of mixed development in Iskandar Malaysia, Johor while in Ipoh, the group aims to launch Lost World Residences, comprising 262 units of serviced apartments with a total GDV of RM100 million. In Penang, the developer would be launching 48 units of two-storey semi-detached homes in Sunway Cassia, Batu Maung Phase 3 worth RM100 million. Sitting on a 6.64-acre freehold land within Sunway South Quay, the Sunway Geo Residences 3 is a 44-storey condominium project housing 420 units. It has built-ups ranging from 988 sq ft to 1,772 sq ft. It is slated to be completed by October 2019. Indicative selling price start from RM850,000. Sunway South Quay is a 178-acre international neighbourhood within the flagship Sunway Integrated Resort City, comprising a variety of residential and commercial developments. Facilities of Sunway Geo Residences 3 include a seamless infinity pool, kid's pool, rock jacuzzis, one-acre park and an award-winning landscape. The project will be directly linked to Sunway Geo Retail, with 200 outlets, and Sunway Geo Offices, with 600 offices, as well as to the bus rapid transit (BRT) SunMed station, and is just three stops away from the new Kelana Jaya LRT extension and Sunway-Setia Jaya KTM Station. It also has amenities nearby, such as an international school, two universities, a large regional shopping mall and a medical centre. As at today, the first two phases of Sunway Geo Residences have already achieved about 95% sales. Sunway Geo development recently won Excellence in 'The Just-Walk Award' under the best integrated development category at the inaugural StarProperty.my Awards 2016. The greater Sunway Resort City also won Excellence in 'The Five Elements Award' under the best township development category. Meanwhile, Sunway Brook Residences in the upclass surburb of Mont Kiara offers 288 units of luxury condominiums suitable for working professionals and upgraders. The Sunway Gandaria Residences in the heart of Pusat Bandar Baru Bangi offers 259 units of serviced apartments housed in a 38-storey tower and integrated with Sunway Gandaria Retail, consisting of 34 units of retail shops below. It will become the tallest landmark in Bangi. It was reported that Sunway Gandaria Retail has been fully taken up since its preview in mid-December last year. The residences which will offer sizes of 949 sq ft to 1,405 sq ft with an indicative selling price starting from RM500,000. It will have a number of facilities including a 50m lap pool, a gym overlooking the pool, and round-the-clock three-tier security. There is also a range of amenities nearby such as schools and universities, financial institutions, shopping malls, and overlooking the Cempaka Lake Gardens and the Bangi Golf Course. The development can be accessed via eight major highways and it is also expected to benefit from its proximity to the MRT Line 1 Kajang station, which is scheduled to be operational by 2017, the proposed MRT Line 2 Putrajaya Sentral station and the future Putrajaya-Kajang BRT line. In 2017, Sunway plans to launch the Phase 1 of its recently acquired 17-acre land in Kelana Jaya. Preliminary information shows that Phase 1 will consist of two blocks of 45- and 46-storey serviced apartments consisting of 442 units and 452 units respectively. The Group has plans for an integrated mixed development in the yet-to-be-named project comprising seven residential blocks and a commercial podium with a GDV of RM1.8 billion. - See more at: Link: http://www.ptlm.com.my/index.php/component/k2/11-insider/sunway-offers-own-loans-up-to-88-and-deferred-payment-plan-for-homebuyers |

MPIG NewsIn this section we will be sharing on articles & news update related real estate and some other interesting topics. Archives

August 2023

Categories |

- Home

-

New Property Launch

- Lake City @ KL North NEW PHASE FROM RM380k

- Alora Residences – Inspired living within greenery in Subang Jaya

- PJ Spacious and Affordable 5 Star Condo

- Best Investment 2022 PJ Damansara Low Risk Low Entry Price High ROI

- 2022 PJ Rumah Mampu Milik RM270k Damansara

- Bangsar South 2 Rooms from RM390k BELOW Market Price

- 10% ROI PJ Project near Ikea and One Utama Mall

- Mid Valley Seputeh New Launch

- Pavilion Damansara Heights 柏威年 白沙罗岭 马来西亚 吉隆坡 精选楼盘

- 马来西亚RM300千的PJ屋子-首购族,年轻人月入3千能买房

- 2021 Penang Most Awaited Project

- 2021 New Launch - KL Metropolis

- Freehold LRT Linked 3 Room Suites in Glenmarie

- New SPACIOUS Kepong Landed 6 Room 6 Bath

- Bangsar Last Piece Land New Launch

- Avara Seputeh (Mid Valley)

- Project Announcement Registration. Malaysia New Property Launch

-

Existing & Past Project

- 2020 Lowest Risk & Price in Klang Valley with Great ROI

- Kiara East Suite Dex

- 2019 SAFEST PROFITABLE HIGH CASHBACK INVESTMENT

- Best Property Investment Projects in 2018

- KL City Freehold Spacious Affordable 3 room Project

- Jalan Kuching Freehold New Office & Shoplot

- Jalan Ipoh New Freehold Shoplot & Offices

- RM300k KL Sentral New Prelaunch

- The Olive Condo, Sunsuria City

- Prelaunch Landed House Bukit Rahman Putra

- RM260k No Downpayment Puchong South Suites

- PJ North RM400k High Cash Back Project

- Denai Sutera @ Alam Sutera, Bukit Jalil

- First Phase of Banting New Township

- Neu Suites 3rdNVenue @ Embassy Row by Titijaya & CREC

- COURT 28, Jalan Ipoh KL City New Property Launch Service Apartment. Malaysia New Property Launch

- Semanja Kajang New FREEHOLD Kajang Double Storey Houses. Malaysia New Property Launch

- M Suite @ Desa Park North

- BIJI LIVING @ Sek 17 PJ City by Conlay. Malaysia New Property Launch

- Amani Residence Bandar Puteri Puchong New Freehold Service Apartment. Malaysia New Property Launch

- SFERA RESIDENCY @ Puchong South. Malaysia New Property Launch

- KL North Last Release

- PreLaunch Freehold Double Storey

- LAND

- News & Articles

- Other Reference Link & Services

- Referral

- Career

- MPIG

- Get Professional Advice

- PJ八打灵2021全新地产项目分析手册

RSS Feed

RSS Feed