|

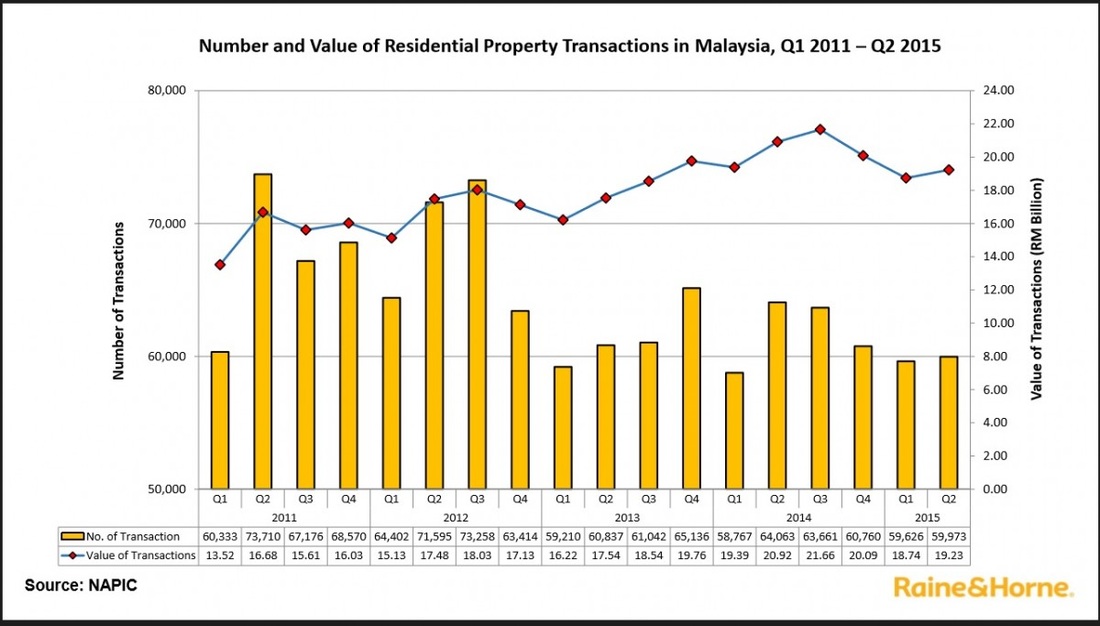

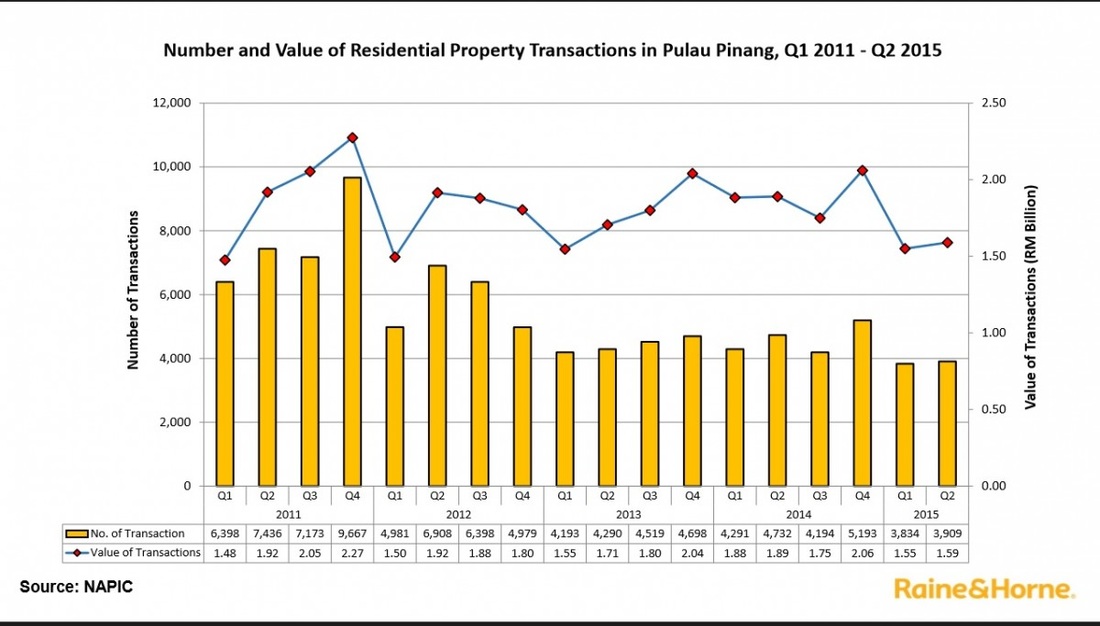

We are approaching the end of the year of 2015, a lot of people is saying the market is falling. Are we? Here's a great analysis from Raine & Horne International Zaki & Partners Sdn Bhd. Rising, falling, rising? Market observations for the first half of 2015 By Raine & Horne International Zaki + Partners Sdn Bhd Refer from http://www.theedgeproperty.com.my/content/rising-falling-rising-market-observations-first-half-2015 MALAYSIA: OVERALL RESIDENTIAL PROPERTY MARKET There was an overall contraction of the Malaysian residential property market in the first half of this year (1Q2015) compared with 1Q2014, according to figures released by the National Property Information Centre (Napic). The first half of 2014 (1H2014) recorded a total 122,830 transactions in the market worth a total RM40.31 billion. In comparison, 1H2015 recorded 119,599 transactions with a value of RM37.97 billion, or a 2.63% contraction. If we look at the quarterly comparison, the 1Q2015 saw a slight increase of about 1.46% to 59,626 transactions (RM18.74 billion), from 58,767 transactions (RM19.39 billion) in 1Q2014 . By 2Q2015, there is a noticeable contraction of 6.38% to 59,973 transactions, from 64,063 transactions in 2Q2014. Over the years, it is normal for the number of transactions to increase from the first to the second quarter, as seen in 2014 (from 58,767 to 64,063, worth RM20.92 billion). Looking at transaction history, the first quarter of every year usually sees a slight drop before the transactions spike in the second quarter. The residential property market in Malaysia hit its peak in 2Q2011, when transactions spiked to a high of 73,710 (RM16.68 billion) from 60,333 (RM13.52 billion) previously. Similarly, 1Q2012 saw a total of 64,402 transactions (RM15.13 billion), which spiked in 2Q2012 to 71,595 transactions (RM17.48 billion). After the market hit its peak period between 2011 and 2012, it began to drop in 2013 and reached a four-year, all-time low in 1Q2014. The market picked up in 2Q2014 and 3Q2014 by recording 64,063 transactions (worth RM20.92 billion) and 63,661 transactions (RM21.66 billion), respectively. By 4Q2014, the market had again dropped, to 60,760 transactions (RM20.09 billion) and continued to drop in 1Q2015 before increasing slightly in 2Q2015. In summary, the overall residential property market in Malaysia in the last four years up to the first half of this year saw the market spiking in 2011 and 2012 before it contracted in 2013. While picking up slightly in 2014, it again showed a contraction in the first half of this year. Raine & Horne International Zaki + Partners Sdn Bhd senior partner, Michael Geh, attributes the overall contraction in the market to strict loan requirements. "The low loan approvals due to stricter loan requirements has taken a toll on the property market," he says. PENANG RESIDENTIAL PROPERTY MARKET In Penang, the residential property market contracted by almost half since the hitting its peak in 2011. The market recorded a total of 9,667 transactions in 4Q2011, its highest in four years, before seeing a drastic drop of about 48.47% in 1Q2012, to just 4,981 transactions. The corresponding value of transactions dropped to RM1.5 billion in 1Q2012, from RM2.27 billion in 4Q2011.

The market saw fluctuations in 2012. In 2Q2012, the number of transactions increased by about 38.68% to 6,908 valued at RM1.92 billion before dropping slightly to 6,398 in 3Q2012. The market plunged again in 4Q2012 by 22.17%, to 4,979 transactions. The market continued to contract in 1Q2013, when the number of transactions dropped slightly to 4,193 (worth RM1.55 billion) but remained stable with slight increases throughout the next three quarters of the year, bringing the total transactions to 17,700 units (RM7.1 billion). In 2014, the pattern of transactions was interesting. It dropped slightly by about 8.66% to 4,291 transactions in 1Q2014 from 4,598 transactions in 4Q2013, before increasing by about 10.27% to 4,732 in 2Q2014, valued at RM1.89 billion. By 3Q2014, the number of transactions had dropped to 4,194 (RM1.75 billion), before surging 23.82% to 5,193 transactions (RM2.06 billion) in 4Q2014. By 1Q2015, the market had plunged again by about 26.17% to 3,834 transactions (RM1.55 billion) compared with 4Q2014. A year-on-year (y-o-y) comparison with 1Q2014 also saw a market contraction of about 10.65%. In 2Q2015, the market improved slightly on the previous quarter, to 3,909 transactions (RM1.59 billion). However, in a y-o-y comparison with 2Q2014, the market contracted by 17.39% or 823 transactions. Geh believes the market contraction in Penang could also be due to strict loan approval criteria and fewer loan approvals. He adds that the long delay in the issuance of the advertising permit and developers licence (APDL) had also taken a toll on the Penang residential property market. "I believe the demand for projects in the pipeline in Penang is good but the sales process cannot commence due to the delay in the APDL," he says. Developers must obtain the APDL from the Housing Ministry before the sale process and the signing of the sales and purchase agreement for any development project. The issuance of the APDL in Penang for many projects by local developers has been delayed for more than a year.

0 Comments

Leave a Reply. |

MPIG NewsIn this section we will be sharing on articles & news update related real estate and some other interesting topics. Archives

May 2024

Categories |

- Home

-

New Property Launch

- Lakeside Freehold Fully Residential Private Lifestyle Condominium in Cyberjaya

- Spacious 2024 Completion KL Condo Fully Residential KLCC View

- RUMAWIP Bukit Jalil (Bumi Only)

- Lake City @ KL North NEW PHASE FROM RM380k

- Alora Residences – Inspired living within greenery in Subang Jaya

- PJ Spacious and Affordable 5 Star Condo

- Best Investment 2022 PJ Damansara Low Risk Low Entry Price High ROI

- 2022 PJ Rumah Mampu Milik RM270k Damansara

- Bangsar South 2 Rooms from RM390k BELOW Market Price

- 10% ROI PJ Project near Ikea and One Utama Mall

- Mid Valley Seputeh New Launch

- Pavilion Damansara Heights 柏威年 白沙罗岭 马来西亚 吉隆坡 精选楼盘

- 马来西亚RM300千的PJ屋子-首购族,年轻人月入3千能买房

- 2021 Penang Most Awaited Project

- 2021 New Launch - KL Metropolis

- Freehold LRT Linked 3 Room Suites in Glenmarie

- New SPACIOUS Kepong Landed 6 Room 6 Bath

- Bangsar Last Piece Land New Launch

- Avara Seputeh (Mid Valley)

- Project Announcement Registration. Malaysia New Property Launch

-

Existing & Past Project

- 2020 Lowest Risk & Price in Klang Valley with Great ROI

- Kiara East Suite Dex

- 2019 SAFEST PROFITABLE HIGH CASHBACK INVESTMENT

- Best Property Investment Projects in 2018

- KL City Freehold Spacious Affordable 3 room Project

- Jalan Kuching Freehold New Office & Shoplot

- Jalan Ipoh New Freehold Shoplot & Offices

- RM300k KL Sentral New Prelaunch

- The Olive Condo, Sunsuria City

- Prelaunch Landed House Bukit Rahman Putra

- RM260k No Downpayment Puchong South Suites

- PJ North RM400k High Cash Back Project

- Denai Sutera @ Alam Sutera, Bukit Jalil

- First Phase of Banting New Township

- Neu Suites 3rdNVenue @ Embassy Row by Titijaya & CREC

- COURT 28, Jalan Ipoh KL City New Property Launch Service Apartment. Malaysia New Property Launch

- Semanja Kajang New FREEHOLD Kajang Double Storey Houses. Malaysia New Property Launch

- M Suite @ Desa Park North

- BIJI LIVING @ Sek 17 PJ City by Conlay. Malaysia New Property Launch

- Amani Residence Bandar Puteri Puchong New Freehold Service Apartment. Malaysia New Property Launch

- SFERA RESIDENCY @ Puchong South. Malaysia New Property Launch

- KL North Last Release

- PreLaunch Freehold Double Storey

- LAND

- News & Articles

- Other Reference Link & Services

- Referral

- Career

- MPIG

- Get Professional Advice

- PJ八打灵全新地产项目分析手册

Hours

M-S: 9.30am - 9pm

|

Telephone

+60 12 3760864

|

Email

|

RSS Feed

RSS Feed