|

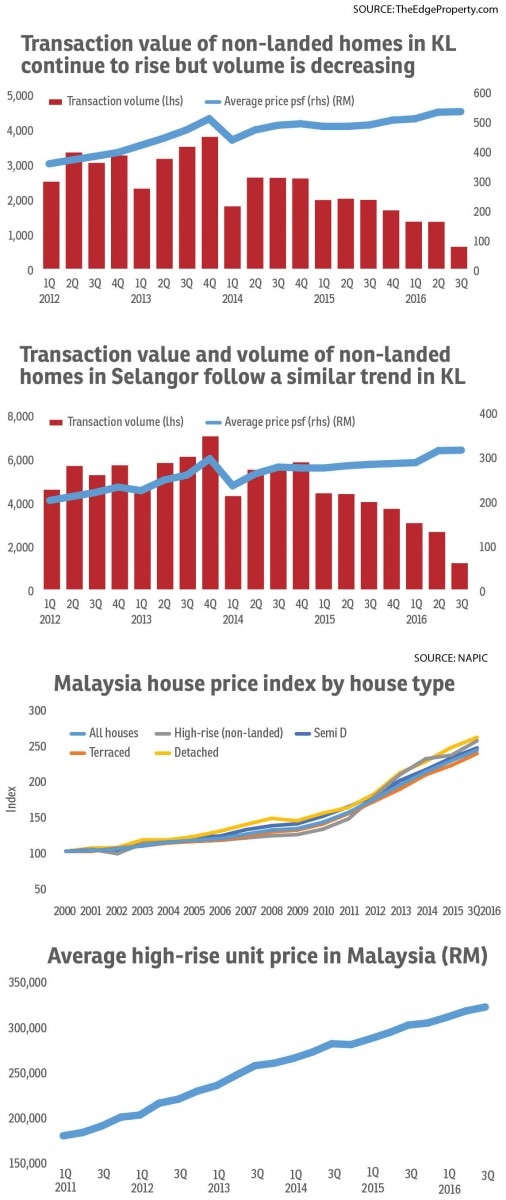

Shawn Ng | TheEdgeProperty.com Sunday, 2 April 2017 AS land costs in urban centres like Kuala Lumpur, Penang and Johor Bahru have risen significantly due to land scarcity, property developers have little choice but to go vertical and construct high-rise projects, be they residential, commercial or integrated developments. “Within the context of the current soft market conditions where affordability is a key consideration for both house buyers and investors, developers have been focusing more on smaller-sized units where the unit price is less prohibitive,” Henry Butcher (M) Sdn Bhd COO Tang Chee Meng tells TheEdgeProperty.com. A little bit further away from urban centres, new township developments still offer mainly landed homes, but within the city there has been a growing trend of small-sized units within high-rises, he says. “Studio units, 1-bedroom and 2-bedroom units — we are seeing more of these within the development mix of high-rise residential projects located within urban centres. “These high-rise homes cater to first-time homebuyers such as young singles and new couples as well as small families and elderly people whose children have all left the nest,” Tang adds. According to data from the National Property Information Centre (Napic), the total existing supply of non-landed/high-rise residential units in the country, including low-cost flats, flats, apartments and condominiums, stood at 1,422,560 units as at the third quarter of 2016 (3Q2016), which translates to about 28.99% of the total existing residential stock of 4,906,722 units in the country. If the existing supply was to include commercial-titled Small-office Home-office (SoHo) units and serviced apartments which totalled 89,359 units, the figure would rise to 1,511,919 units. Looking ahead, the future supply of all non-landed residential properties (not including SoHos and serviced apartments) stands at 523,645 units as at 3Q2016 consisting of incoming supply of 306,554 units and planned supply of 217,091 units. Meanwhile, the future supply of SoHos and serviced apartments are 269,507 units in total as at 3Q2016, and comprises incoming supply of 164,113 units and planned supply of 105,394 units. Nawawi Tie Leung Property Consultants Sdn Bhd managing director Eddy Wong points out that the future supply of high-rise properties shows a significant number especially considering the prevailing weak market sentiment amid tight credit conditions. “There will be a significant pressure on prices to adjust, though the actual impact on the various sub-markets would vary depending on locality, demographics and income levels,” he says. Interestingly, based on the Malaysian House Price Index, the high-rise residential sub-sector has registered the second highest price growth among all residential property types from 2000 to 3Q2016, coming in next after detached houses. According to data from TheEdgeProperty.com, over the years, the average transacted price of non-landed residential properties in KL had risen by RM176 or 49.72% to RM530 psf in 3Q2016, from RM354 in 1Q2012. Similarly in Selangor, the average transacted price had shot to RM313 psf as at 3Q2016, RM113 or 56.5% higher than RM200 psf in 1Q2012. However, since 4Q2014, the average transacted price has seen no significant growth in Selangor. Meanwhile, as at 3Q2016, the transaction volumes of non-landed residential properties in KL and Selangor had declined 68.33% and 70.07% respectively year-on-year, to 623 and 1,196 transactions, respectively. Looking for good buys Wong notes that the current slowdown in the property market is a good opportunity to look for good buys, as developers are more amenable to offering good incentives to move their inventory. He advises investors to consider the key factors such as location, connectivity and accessibility to amenities when selecting what to buy. “High-rise developments which are centrally located, with good connectivity and with easy access to amenities such as shopping, dining and entertainment, are very well sought-after. Meanwhile, the properties around the RM500,000 price point is currently very popular given the tight credit condition which places a constraint in the purchasing power among homebuyers,” he says. Meanwhile, Tang says investors should look for areas that offer good growth potential. In the Klang Valley, such areas include Cheras, Kepong, Setapak, Wangsa Maju, Ampang, Bukit Jalil, Puchong, Old Klang Road and Bandar Malaysia, he offers. These areas, he adds, are able to cater to the middle income group and will see vast improvements in infrastructure and accessibility especially areas along the mass rapid transit (MRT) lines as well as the recent light rail transit (LRT) extensions. Based on his observations of new launches over the past year, Tang says smaller-sized units with built-ups of less than 1,000 sq ft and priced in the RM300,000 to RM600,000 price segment appear to have recorded the best sales in the Klang Valley. Outlook In the mid to longer term, the market for non-landed residential property in KL and Selangor looks positive, says Wong. He believes the market will be supported by its young demographic and the growth in household incomes. Tang concurs. Although demand may be temporarily disrupted due to the slowdown in the economy, tighter credit availability and poorer consumer sentiments, the future will see high-rise residences becoming a more popular choice among developers and homebuyers. “As land cost is not likely to go down, we foresee that high-rise residential properties will remain the affordable option for residents in the main urban centres,” Tang says, adding that this high-rise residential property development trend will also likely continue. Tolerance and understanding ensure harmony

High-rise living is becoming a norm as increasingly more people are moving into high-rise homes nowadays. However, when large groups of people live close together and share the same facilities, there may be some discomfort and strain due to the differences in age groups, cultures and behavioural preferences. Hence, Nawawi Tie Leung Property Consultants Sdn Bhd managing director Eddy Wong says the residents should have tolerance and understanding plus civic-mindedness to ensure a happy and pleasant living experience for everyone in the community. This is especially crucial when dealing with disputes that may arise. According to Henry Butcher (M) Sdn Bhd COO Tang Chee Meng, one way to overcome the challenges of living in high-rises is to outsource and employ a good and effective manager who is firm, fair and able to secure everyone’s cooperation while implementing rules and policies according to what has been set by the Joint Management Body or Management Corporation. The common problems faced when staying in high-rises involve getting all residents to pay their maintenance fees on time; and residents who lack civic-consciousness and a sense of pride and ownership of the common facilities like the lifts and recreational equipment. There could also be difficulties getting the full cooperation of residents in following house rules like keeping pets, parking of vehicles in the designated bays and adhering to security arrangements, Tang says. Hence, he urges every owner to play their part in observing house rules and paying their maintenance fees and sinking fund in full and on time, otherwise the management and maintenance of the property will deteriorate due to lack of funds and in the long term this could have an adverse impact on the property’s value. In addition, adequate and clear communication between the management team and the residents is also very important, he adds. This story first appeared in TheEdgeProperty.com pullout on March 31, 2017.

0 Comments

Leave a Reply. |

MPIG NewsIn this section we will be sharing on articles & news update related real estate and some other interesting topics. Archives

May 2024

Categories |

- Home

-

New Property Launch

- Lakeside Freehold Fully Residential Private Lifestyle Condominium in Cyberjaya

- Spacious 2024 Completion KL Condo Fully Residential KLCC View

- RUMAWIP Bukit Jalil (Bumi Only)

- Lake City @ KL North NEW PHASE FROM RM380k

- Alora Residences – Inspired living within greenery in Subang Jaya

- PJ Spacious and Affordable 5 Star Condo

- Best Investment 2022 PJ Damansara Low Risk Low Entry Price High ROI

- 2022 PJ Rumah Mampu Milik RM270k Damansara

- Bangsar South 2 Rooms from RM390k BELOW Market Price

- 10% ROI PJ Project near Ikea and One Utama Mall

- Mid Valley Seputeh New Launch

- Pavilion Damansara Heights 柏威年 白沙罗岭 马来西亚 吉隆坡 精选楼盘

- 马来西亚RM300千的PJ屋子-首购族,年轻人月入3千能买房

- 2021 Penang Most Awaited Project

- 2021 New Launch - KL Metropolis

- Freehold LRT Linked 3 Room Suites in Glenmarie

- New SPACIOUS Kepong Landed 6 Room 6 Bath

- Bangsar Last Piece Land New Launch

- Avara Seputeh (Mid Valley)

- Project Announcement Registration. Malaysia New Property Launch

-

Existing & Past Project

- 2020 Lowest Risk & Price in Klang Valley with Great ROI

- Kiara East Suite Dex

- 2019 SAFEST PROFITABLE HIGH CASHBACK INVESTMENT

- Best Property Investment Projects in 2018

- KL City Freehold Spacious Affordable 3 room Project

- Jalan Kuching Freehold New Office & Shoplot

- Jalan Ipoh New Freehold Shoplot & Offices

- RM300k KL Sentral New Prelaunch

- The Olive Condo, Sunsuria City

- Prelaunch Landed House Bukit Rahman Putra

- RM260k No Downpayment Puchong South Suites

- PJ North RM400k High Cash Back Project

- Denai Sutera @ Alam Sutera, Bukit Jalil

- First Phase of Banting New Township

- Neu Suites 3rdNVenue @ Embassy Row by Titijaya & CREC

- COURT 28, Jalan Ipoh KL City New Property Launch Service Apartment. Malaysia New Property Launch

- Semanja Kajang New FREEHOLD Kajang Double Storey Houses. Malaysia New Property Launch

- M Suite @ Desa Park North

- BIJI LIVING @ Sek 17 PJ City by Conlay. Malaysia New Property Launch

- Amani Residence Bandar Puteri Puchong New Freehold Service Apartment. Malaysia New Property Launch

- SFERA RESIDENCY @ Puchong South. Malaysia New Property Launch

- KL North Last Release

- PreLaunch Freehold Double Storey

- LAND

- News & Articles

- Other Reference Link & Services

- Referral

- Career

- MPIG

- Get Professional Advice

- PJ八打灵全新地产项目分析手册

Hours

M-S: 9.30am - 9pm

|

Telephone

+60 12 3760864

|

Email

|

RSS Feed

RSS Feed