|

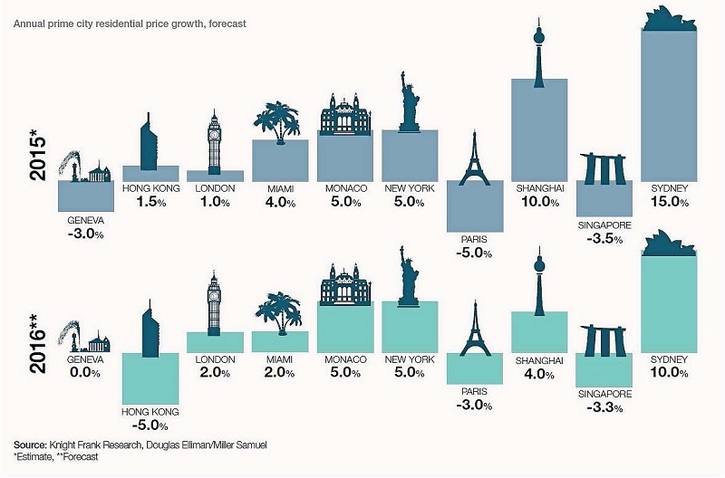

Here's some global market outlook from professional. What do you think? Global Property Market Outlook 2016 BY MAK KUM SHI Slowing China economy and speed of further US interest rate rises will determine performance of global property markets. DEVELOPMENTS in the global economy and currency markets will determine the performance of property markets across developed and emerging markets alike for 2016. FXTM chief market analyst Jameel Ahmad shared that year 2015 saw emerging currencies challenged by a resurgent US dollar rising alongside the US economic recovery. There were additional concerns over how a slowing China economy would impact general sentiment towards emerging markets. These developments added to challenges faced by emerging economies linked to commodities amid a global slowdown in oil and gold prices. Ahmad said, “The results were a clear downward trend for emerging currencies and we continued to highlight emerging market currency weakness as a global phenomenon throughout 2015. The emerging market currencies that were the most heavily crushed during the year were those that belonged to economies dependent on commodity exports.” Ahmad added that concerns surrounding the China economy entering a deep slowdown was another contributor behind losses in emerging market currencies. “A slowing down China economy was not a problem for China itself, but for all those economies reliant on trade with China.” Knight Frank global head of research Liam Bailey and Knight Frank international residential research Kate Everett-Allen shared that the scale of the slowdown in China and the speed of further US interest rate rises will determine the performance of property markets across developed and emerging markets alike over the next 12-18 months. They expect the strongest and weakest performing prime markets to be separated by around 20 percentage points by the end of 2015. They expect this figure to slip to 15 points in 2016 as price growth converges. The pace of price growth in Sydney is expected to slow from 15% year-on-year in 2015 to 10% in 2016. Australia’s economic slowdown, weaker stock market performance in recent months and the introduction of foreign investment fees explain the lower rate of growth in 2016. Hong Kong is forecast to overtake Singapore as the weakest performing luxury residential market in 2016. A number of new developments are due to enter the market in 2016. This new supply, together with a strengthening HK dollar, will see prime property prices soften.

The price decline seen in Singapore’s prime residential market is expected to persist at least until the end of 2016, following the government’s assertion that it has no plans to relax its property market cooling measures. Ahmad commented that the major turning point for all the emerging currencies will in some ways be in response to higher interest rates from the United States. While falls in emerging market currencies were due to external factors, such factors could transform into internal and domestic pressures, such as reduced spending power and reduced budgets that might lead to jobs being lost. The continued depression in commodity markets is also going to limit potential for a recovery in fortunes. Ahmad said, “Slowing growth will continue to occur in China and will likely be a threat to India, although it is possible that the proactive easing of monetary policy from the Reserve Bank of India might encourage borrowing domestically and help drive growth. It is worth remembering that the central banks in China and India have been actively intervening to shore up their own economies through monetary easing. There will be some hope that this could help drive industry growth. As commodity importers, the lower import costs should help create budget for investment elsewhere.” Colliers International head of UK research and forecasting Mark Charlton, Colliers International senior research analyst EMEA (Europe, Middle East and Africa) and forecasting EMEA Bruno Berretta, and Colliers International director of UK research and forecasting Walter Boettcher cited in Colliers International’s Global Investment Outlook (GIO) that investors, globally, still wish to invest in real estate. Transaction volumes across regions are expected to increase, with fewer investors expecting to be net buyers. Allocations to direct property by multi-asset funds will continue to increase globally. The most liquid markets, found in gateway cities such as London, New York and Tokyo, will continue to appeal to cross-border investors. Increasingly, investors are looking to partner with local expertise to provide greater confidence in overseas diversification. Macroeconomic and political threats, such as further interest rate hikes in the US, or Chinese economic uncertainty, as well as geopolitical risks, will see investors curb their risk appetite in some markets. More investment decisions will be made on a long-term basis. Hence prices for matching assets will rise further, especially in safe haven markets. They concluded, “While the next 12 months will pose macro challenges for investors, the overall positive mood shown by most respondents offers a compelling case for supporting direct real estate investment’s continued growth.”

0 Comments

Leave a Reply. |

MPIG NewsIn this section we will be sharing on articles & news update related real estate and some other interesting topics. Archives

May 2024

Categories |

- Home

-

New Property Launch

- Lakeside Freehold Fully Residential Private Lifestyle Condominium in Cyberjaya

- Spacious 2024 Completion KL Condo Fully Residential KLCC View

- RUMAWIP Bukit Jalil (Bumi Only)

- Lake City @ KL North NEW PHASE FROM RM380k

- Alora Residences – Inspired living within greenery in Subang Jaya

- PJ Spacious and Affordable 5 Star Condo

- Best Investment 2022 PJ Damansara Low Risk Low Entry Price High ROI

- 2022 PJ Rumah Mampu Milik RM270k Damansara

- Bangsar South 2 Rooms from RM390k BELOW Market Price

- 10% ROI PJ Project near Ikea and One Utama Mall

- Mid Valley Seputeh New Launch

- Pavilion Damansara Heights 柏威年 白沙罗岭 马来西亚 吉隆坡 精选楼盘

- 马来西亚RM300千的PJ屋子-首购族,年轻人月入3千能买房

- 2021 Penang Most Awaited Project

- 2021 New Launch - KL Metropolis

- Freehold LRT Linked 3 Room Suites in Glenmarie

- New SPACIOUS Kepong Landed 6 Room 6 Bath

- Bangsar Last Piece Land New Launch

- Avara Seputeh (Mid Valley)

- Project Announcement Registration. Malaysia New Property Launch

-

Existing & Past Project

- 2020 Lowest Risk & Price in Klang Valley with Great ROI

- Kiara East Suite Dex

- 2019 SAFEST PROFITABLE HIGH CASHBACK INVESTMENT

- Best Property Investment Projects in 2018

- KL City Freehold Spacious Affordable 3 room Project

- Jalan Kuching Freehold New Office & Shoplot

- Jalan Ipoh New Freehold Shoplot & Offices

- RM300k KL Sentral New Prelaunch

- The Olive Condo, Sunsuria City

- Prelaunch Landed House Bukit Rahman Putra

- RM260k No Downpayment Puchong South Suites

- PJ North RM400k High Cash Back Project

- Denai Sutera @ Alam Sutera, Bukit Jalil

- First Phase of Banting New Township

- Neu Suites 3rdNVenue @ Embassy Row by Titijaya & CREC

- COURT 28, Jalan Ipoh KL City New Property Launch Service Apartment. Malaysia New Property Launch

- Semanja Kajang New FREEHOLD Kajang Double Storey Houses. Malaysia New Property Launch

- M Suite @ Desa Park North

- BIJI LIVING @ Sek 17 PJ City by Conlay. Malaysia New Property Launch

- Amani Residence Bandar Puteri Puchong New Freehold Service Apartment. Malaysia New Property Launch

- SFERA RESIDENCY @ Puchong South. Malaysia New Property Launch

- KL North Last Release

- PreLaunch Freehold Double Storey

- LAND

- News & Articles

- Other Reference Link & Services

- Referral

- Career

- MPIG

- Get Professional Advice

- PJ八打灵全新地产项目分析手册

Hours

M-S: 9.30am - 9pm

|

Telephone

+60 12 3760864

|

Email

|

RSS Feed

RSS Feed