|

The price of a new apartment has risen to an average of RM582,887 in Malaysia, according to data released by global real estate network IQI.

IQI, which is a member of the international real estate technology group Juwai IQI, said in its Residential Sales Market Report for Malaysia’s first quarter of 2024 that this figure was above the National Property Information Centre’s (NAPIC) 2023 average house price, which was RM467,144. According to Juwai IQI co-founder and group ceo Kashif Ansari, the average subsale sales price across Malaysia in the first quarter of the year was RM521,614 and was highest in Kuala Lumpur. “It is no surprise that Kuala Lumpur has the most expensive property in the country. The average subsale home price in Kuala Lumpur is RM801,557. New homes are somewhat more affordable, with an average price of RM708,462. “After Kuala Lumpur, the three most expensive states for subsale homes are Sarawak (RM572,680), Sabah (RM526,510), and Johor (RM447,727). The next three most expensive states for new home sales are Johor, Sabah, and Kedah,” he said in a statement. The report is based on the analysis of more than 70,000 residential sales in the subsale and new project markets across Malaysia since 2018. Melaka is the least expensive state for new units. The average price of a new unit home in Melaka is RM305,463. After Melaka, the next least expensive states in which to buy a new unit are Pahang (RM338,690), Perak (RM343,028), and Kelantan (RM352,970). Terengganu is the least expensive state for subsale homes, with an average price of RM293,714 followed by Perak (RM322,256), Kedah (RM323,399) and Pahang (RM346,144). According to Kashif, the majority of transactions fall within the lower price ranges, with over half of new unit buyers and nearly half of subsale buyers spending RM500,000 or less. He said this indicates a well-balanced market catering to buyers across different income brackets. In terms of affordability, IQI’s report highlighted the advantage of purchasing over renting. “If a buyer puts down RM30,000 on a RM300,000 home, their monthly mortgage expense would be RM1,228 per month. That makes buying an affordable home significantly cheaper than the average rental, which is RM1,975. “Buying an affordable home would save you RM747 per month compared to paying the average rent. The data on monthly expenses can help buyers understand their financial position when considering the purchase of a home. “You need to know your budget when assessing long-term affordability and pay-off amidst fluctuating economic conditions. We continue to believe that owning your own home is the shortest route to financial security and independence for most Malaysians,” he added. The article is refer from www.malaymail.com

0 Comments

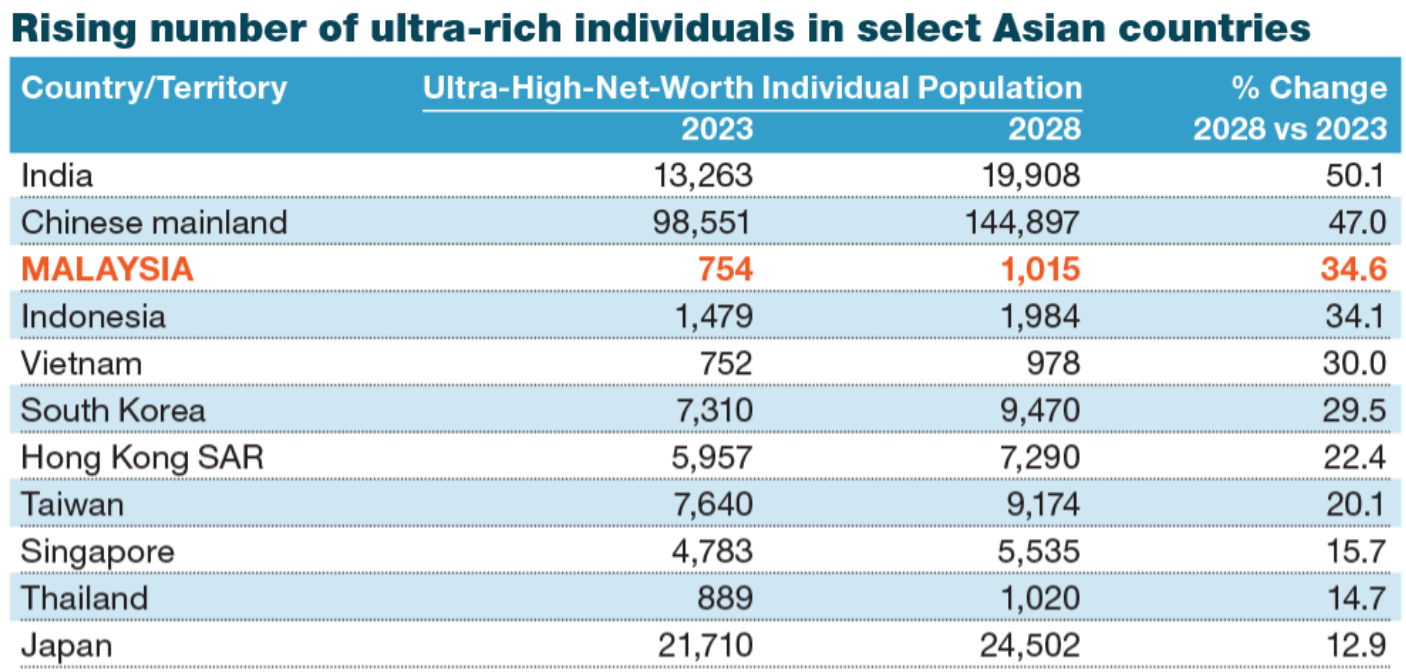

Malaysia has come third among selected Asian countries to witness significant growth in its population of ultra-high-net-worth individuals — those with a net worth of US$30 million (RM140.43 million) or more — from 2023 to 2028, according to global real estate consultancy Knight Frank. Based on Knight Frank's wealth sizing model, Malaysia is projected for a substantial 34.6% growth in the population of ultra-high-net-worth individuals. India has led the list with 50.1%, followed closely by China at 47%. Other Southeast Asian regional peers which are included in the analysis are Indonesia with a growth rate of 34.1%, Vietnam at 30%, Singapore at 15.7%, and Thailand at 14.7%. “With the mobility of wealth increasing all the time, a key question is whether future growth remains within these and other high-growth markets, or whether there is a leakage of talent to Europe, Australasia or North America,” said Knight Frank in its latest wealth report. The wealth sizing model, created by Knight Frank’s data engineering team, measures the size of high-net-worth individuals (whose net worth hits US$1 million or more), ultra-high-net-worth individuals, and billionaire cohorts in more than 200 countries and territories. Globally, Knight Frank expected the number of wealthy individuals to rise by 28.1% during the five years, with Asia leading the growth. “Outside Asia, strong growth is focused on the Middle East, Australasia and North America, with Europe lagging and Africa and Latin America likely to be the weakest regions,” it added. The global rate of expansion, while positive, remained relatively slower than the 44% increase during the five years leading up to 2023. It said the global economy will likely be impacted by higher inflation in the medium term, leading to a lower growth outcome compared to the historical trends. Delving into Asia’s real estate landscape, Knight Frank’s head of Asia-Pacific research Christine Li pointed out that Southeast Asia, especially Thailand and Malaysia, has fallen out of favour with Chinese buyers. She said Chinese buyers have become much more selective following the slowdown in consumer and investor confidence due to the liquidity crisis in China’s property companies. “In contrast, Japan and UAE have seen increased Chinese purchases, while Australia maintains its position as the top choice for overseas property purchases,” she added in the report. Touching on the Malaysian front, Knight Frank Malaysia’s group managing director Keith Ooi said there has been a notable shift in investor sentiment with the living sector topping the investor wishlist for the first time in four years. “This surge in interest resonates globally, with strong investor enthusiasm emanating from Europe, the Middle East, North America, and Asia, signifying a remarkable opportunity for Malaysia's real estate sector to attract diverse investment,” he said in a statement on Thursday. Stern action will be taken against premises owners who rent out “grave-like” rooms, says the Local Government Development Ministry.

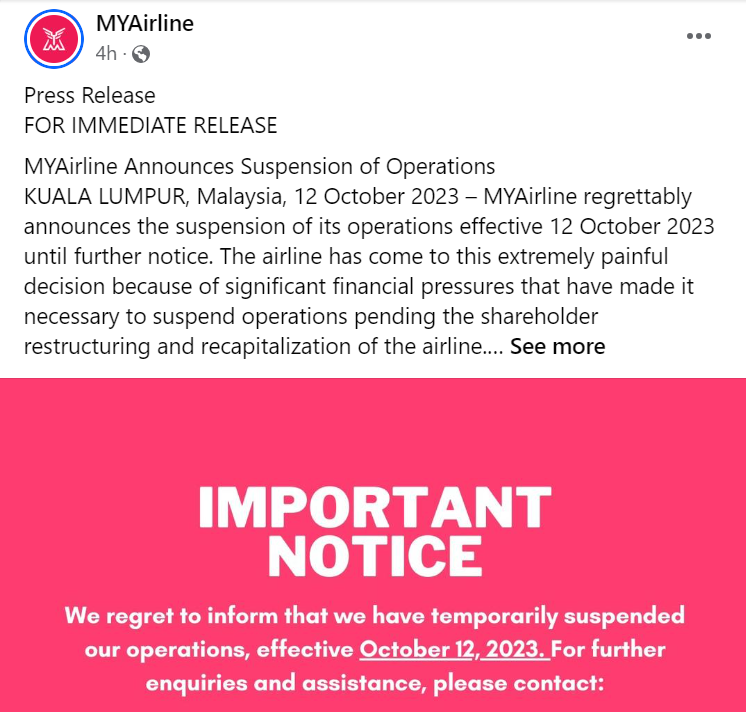

Its minister Nga Kor Ming said the ministry would be working together with local councils and other agencies to monitor those involved in the issue. "Some of these rented rooms are narrow and small. There is no proper ventilation and windows that might lead to health and fire risks. "For now, we are giving these premises owners a stern warning first before taking action," he told reporters after attending the ground-breaking ceremony at Pasir Pinji temporary market site here on Sunday (Oct 15). On Tuesday (Oct 10), Sinar Harian reported that the rooms were initially built for foreign workers but were now mostly rented by university students, ehailing and food delivery riders. It is learned that all 38 cage-like rooms, measuring 126 sq m per room, were located at a double-storey shop lot in the Klang Valley. The rent was between RM300 and RM350 a month, inclusive of electricity and water supply. Tenants shared a common lounge room, drying area, kitchen and WiFi connection. Nga said several actions could be taken against the irresponsible premises owners including demolishing the structure and fines. "There are relevant acts that we can take for example the Street, Drainage and Building Act 1974 (Act 133) Section 79, where local authority or agencies may remove any partitions, compartments, ceiling and other structures. "The owner shall pay the local authority the cost of expenses of demolishing the structure and more. "Under the same section, any party can be fined not more than RM500 if convicted and shall also be liable to a further fine not exceeding RM100 every day during which the offence is continued after conviction," he said, adding that those with information about similar issues may lodge reports to the ministry. "The reports can be made to the Public Report Management System or through the i-Tegur mobile application," he said. The article is refer from Thestar.com.my KUALA LUMPUR: MYAirline has suspended its operations effective Thursday (Oct 12) until further notice. The airline said it made the decision because of significant financial pressures. "It has made it necessary to suspend operations pending the shareholder restructuring anrecapitalisation of the airline," it said in a Facebook post. MYAirline's board of directors, in a statement on Thursday, said it regrets the decision and apologises for the impact it will have on its passengers, employees and partners. "We have worked tirelessly to explore various partnership and capital-raising options to prevent the suspension. "Unfortunately, time constraints have left us with no alternative but to take this decision. "We understand the inconvenience this may cause and are committed to assisting you. The airline said it would be working tirelessly to resume operations as quickly as possible but, at this stage, could not commit to any timeline. It said the public can reach out to [email protected], and our support team will be readily available to provide their assistance. "We are advising affected passengers to not head to the airport and seek alternative travel arrangements to their destinations," it added. This article is refer from thestar.com.my

KUALA LUMPUR: Sime Darby Bhd has entered into a conditional share purchase agreement to acquire Permodalan Nasional Bhd's (PNB) entire 61.2% sake in UMW Holdings Bhd for RM3.57bil cash or RM5 per share. Once the agreement becomes unconditional, the group said it will undertake a general offer for the remaining 38.8% stake it does not hold with the aim of delisting UMW from Bursa Malaysia. According to Sime Darby group CEO Datuk Jeffri Salim Davidson, the deal, which will bring the Toyota and Perodua brands into its portfolio, will cement the group's position as Malaysia's leading automotive player. "As a partner of choice to some of the most admired brands in the automotive sector, we are very excited to have the opportunity to work with Toyota, one of the world’s largest and most respected automakers," he said in a statement. He added that the acquisition is accretive to Sime Darby’s earnings per share and will enhance Sime Darby’s shareholders return. Sime Darby expects the acquisition of PNB’s stake to be completed within three months from the date of sales and purchase agreement subject to regulatory and shareholders’ approvals and customary closing conditions. State investment firm PNB is the largest shareholder in Sime Darby with a 50.3% stake. Meanwhile, PNB confirmed separately that the consolidation of the two leaders in the automotive industry is driven by opportunities to strengthen its local and regional presence in the automotive sector. It added that the merger will also provide a boost to the electrification agenda, which is expected to drive investment growth, enhance efficiency, and create value for our unit holders. "This strategic move is also in alignment with the Government's New Industrial Master Plan 2030, which will support the automotive sector’s further growth especially in positioning the country as the automotive hub for the region," it said in a statement. In another statement announcing its financial results for the fourth quarter of 2023, Sime Darby posted a net profit of RM622mil during the quarter, which was a leap from RM278mil in the same quarter in 2022. The group's earnings per share rose to 9.1 sen from 4.1 sen. Revenue, meanwhile, jumped to RM13.29bil from RM10.85bil in the comparative quarter. For the entire financial year, Sime Darby's net profit came to RM1.46bil, up from RM1.1bil, while revenue rose to RM48.29bil from RM42.5bil. The board of directors declared a second interim dividend of 10 sen per share, which brings the total dividend payout for the year to 13 sen per share, or RM886mil, representing a 61% net profit payout. On the positive performance, the group said it was owing to the improved results from the industrial division's Australasia operations, strong performance from the Motors business in Malaysia and a gain on the disposal of properties in Hong Kong. “Our strong performance is a testament to our resilience, driven by our strategy amidst a challenging market environment. "Despite the headwinds that we have been experiencing in China, our other markets have performed well,” said Jeffri Salim. During the lunch break, Bursa Securities suspended trading in Sime Darby's and UMW's securities and warrants at the request of the respective companies with effect from 2.30pm on Aug 24, 2023 (Thursday). The trading stock of Sime Darby was last traded one sen higher at RM2.11 a share on the back of 4.85 million units crossed while UMW's shares had risen seven sen to RM4.62 on 4.1 million shares done. The news article is refer from TheStar.com.my.

SHAH ALAM - The Council of Buildings (COB) of Kuala Lumpur City Hall (DBKL) has issued a notice forbidding landlords and homeowners from adding partitions (adding bedrooms) in commercial-titled apartments with strata status in Kuala Lumpur.

English daily, New Strait Times (NST) reports that the prohibition was effective from Aug 1, 2023, and it was communicated by the chairman of all Joint Management Bodies (JMB), Management Corporations (MC), and Sub Management Corporations (Sub-MC) in the Federal Territory of Kuala Lumpur. Kuala Lumpur Mayor Datuk Kamarulzaman Mat Salleh stated that the ban was provided to hinder landlords from converting living rooms and dining rooms into additional bedrooms in an apartment or SOHO unit. "All service apartments and SOHOs with strata titles in the city are prohibited from building walls to create more bedrooms. "This would be in violation of the original Development Order (DO) approved by the relevant authorities, including DBKL," he said. Kamarulzaman pointed out that adding partitions would mean an increased number of occupants and insufficient natural light for the inhabitants. "Adding more bedrooms would make it appear that they were being rented out for extra cash," he said to NST. According to the notice, this prohibition is meant to avoid the existence of residential units intended for commercial use, such as hostels, as well as a rise in traffic and density, which would cause problems for the adjacent people. The prohibition was issued on July 21, 2023, and it was made available for download on the DBKL's official website. The real estate market has been on edge since Bank Negara Malaysia (BNM) announced an unexpected increase of 25 basis points on the overnight policy rate (OPR) on May 3. Much to the relief of many, the OPR rate was maintained at 3% in early July, but an analyst is already foreseeing another hike in the next round of review. However, despite the spectre of increased lending rates, some property analysts are still optimistic, albeit cautiously, about the real estate market. “In 2022, despite the OPR being increased four times, with a total hike of 1% from 1.75% to 2.75%, the market still registered the highest volume of transactions, standing at 389,107 transactions, which is the highest ever recorded since 2012,” ESP Global Services Sdn Bhd chief executive officer, who is also Esprit Estate Agent Sdn Bhd managing director, Aldrin Tan, told EdgeProp.my. He explained that while hikes in the OPR are one of the measures used to manage inflationary pressure, which leads to a higher cost of financing and mortgages, there may also be a short-term effect of increased demand for housing due to anticipation or sentiment of a price hike. “While we do not have the full data of the volume of transaction for 1H2023, 1Q2023 registered 89,182 transactions. Though it was down by 5.7% from 94,526 in 1Q2022, the volume in 1Q2023 surpassed the pre-pandemic level of 1Q2020 at 72,867, 1Q2019 at 84,424, and 1Q2018 at 79,480. “Unless there is a further slowdown of momentum in volume of transaction in 2Q2023, we can safely say that based on volume of transactions on 1H to 1H data, we are likely to see 1H2023 perform better than pre-pandemic 1H2020, 1H2019 and 1H2018, and this may likely reflect an overall post-pandemic recovery of the Malaysian property market,” added Tan. “I am cautiously optimistic on the Malaysia property market going forward in the short-term perspective,” he said. Home prices likely to grow Meanwhile, Juwai IQI co-founder and group managing director, Daniel Ho, said the residential property market rebounded strongly in 2022, and “we expect it to show further gains in the remainder of this year”. “A range of positive conditions support the market, despite moderately lower economic growth. First-time homebuyer purchases have increased, driven by factors such as weddings that were delayed due to Covid-19 closures. “The full opening of international borders has put Malaysia in the radar of regional and international investments, particular from China. We forecast a home price growth of 1.5% to 4% during the second half of the year compared to a year earlier,” he told EdgeProp.my. “In 2022, transaction volume climbed by 47% to 42,000, and total transaction value rose by 38% to RM12.8 billion compared to the prior year. For 2023, the official data are not available yet, but Juwai IQI’s internal metrics are all up,” Ho revealed. “Sales volume is up and prices are inching up on certain property types such as D'Ivo Residences, Mossaz @ Empire City, The Fiddlewoodz @ KL Metropolis, D'Starlingtton. We see more cross-border buyers in Johor, increased demand in Kuala Lumpur and Selangor, and a reduction in the property overhang by as much as 35%, although that varies by state,” he added. Declining inflation rates raise consumer confidence As for interest rates and inflation, Ho is of the view that “compared to many other countries, Malaysia has a significant advantage because it has already tamed inflation. BNM was one of the first in Asia to begin raising rates in 2022 and now has lifted the OPR to 3.0%. That means BNM has reversed all the pandemic-era lowering of interest rates. The economy has recovered sufficiently and no longer needs that extra boost”. "Falling inflation rates improve consumer confidence, and can raise the prospect of stable or lower interest rates. Core inflation fell from 3.1% to 2.9% in the first quarter. We believe inflation has been tamed and will continue to drop moderately in the six months ahead. “The property market has absorbed the OPR increases without much impact on demand due to strong household finances and employment,” he said. On the other hand, Tan expects some turbulence ahead as “Malaysia’s GDP (gross domestic product) is also expected to undergo contraction under the Budget 2023 – from 5.6% in 2022, to 5.0% in 2023 and down to 3.2% in 2025, due to global concerns and pressure of inflation”. To him, a shrinking economy in the near-term outlook will lead to a reduction in consumer expenditure and a lack of confidence, which may affect the property market negatively. Opportunity to buy Nevertheless, both Tan and Ho think it is a good time for homebuyers to commit to a purchase over the next six months. “This is a good market for buyers. While the market has recovered, in most property types, prices are still stable or only slowly increasing. That creates an opportunity to purchase. “Of course, we always advise buyers to have a good understanding of their finances and to not overstretch themselves. Owning property is the time-honoured way to build financial security and family wealth. Today’s buyers will likely benefit from increased values over the next few years,” Ho said.

Tan agreed, saying, “The property market has been experiencing a soft landing since the peak of 2011/12, and as global economies are rebounding after the pandemic, coupled with a decline in Malaysia's overhang properties and a consistent upward trend in the property market since 3Q2020, it's probable that property prices are pushing upwards. “Consequently, it might make sense for prospective buyers who have been waiting on the sidelines to take the plunge and commit to a purchase now,” he added. The above article is refer from edgeprop.my KUALA LUMPUR (Aug 4): Malaysia will submit a new proposal regarding the Kuala Lumpur-Singapore High-Speed Rail (HSR) project to Singapore after an initial decision on it is made by the government, Prime Minister Datuk Seri Anwar Ibrahim (pictured) said.

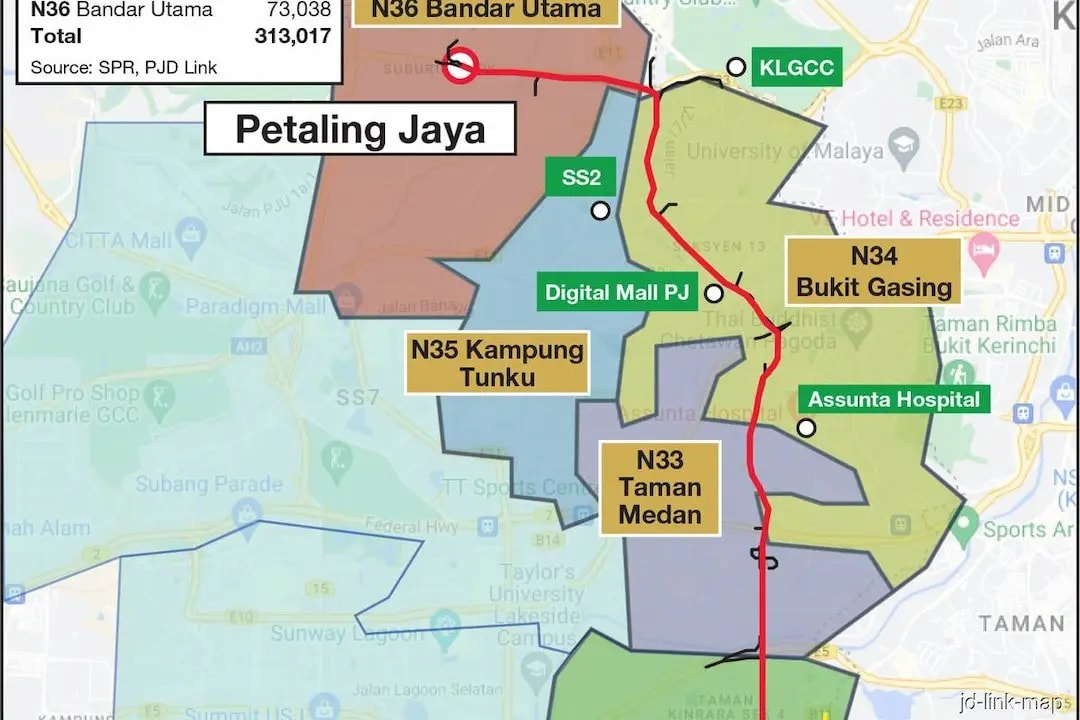

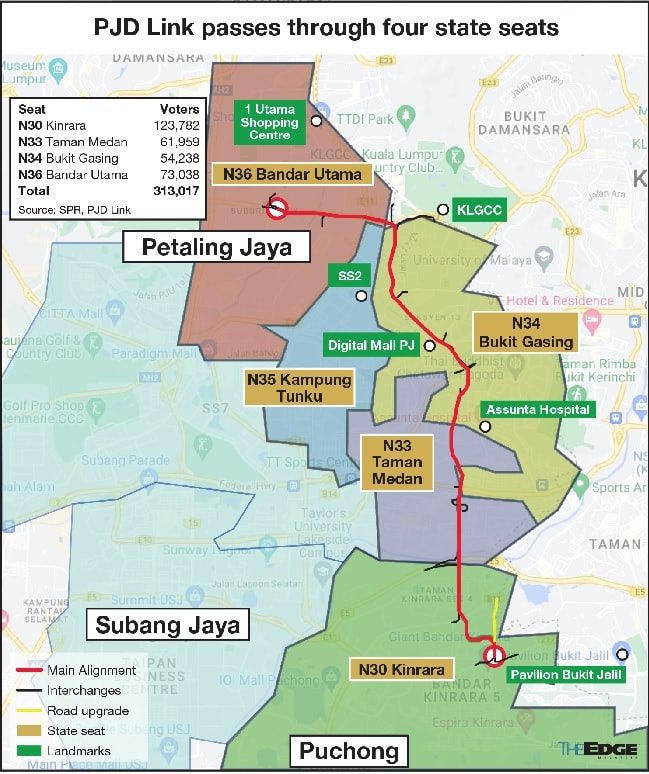

He said the new proposal would then be brought forth by Transport Minister Anthony Loke Siew Fook for Singapore’s consideration. “It’s still [being deliberated] at our level. Once we have the initial decision, the minister, Anthony Loke, will bring it to Singapore’s attention,” Anwar told reporters after opening the Malaysian Commercialisation Year Summit 2023 here on Friday (Aug 4). Prior to this, the media reported that Singapore had yet to receive any new proposal from Malaysia regarding the HSR project. According to acting Singapore Transport Minister Chee Hong Tat, Singapore is ready to discuss the implementation of the project with Malaysia. Article is refer from EdgeProp  While the termination of the controversial Petaling Jaya Dispersal (PJD) Link was welcomed by many Petaling Jaya residents and non-governmental organisations who have been calling for the project to be scrapped due to environmental and social concerns, Parti Pribumi Bersatu Malaysia (Bersatu), one of the main component parties of Perikatan Nasional (PN), has questioned the right of the caretaker Selangor government led by Menteri Besar Datuk Seri Amirudin Shari in making such an impactful decision ahead of the polls The termination of the controversial Petaling Jaya Dispersal (PJD) Link project by the Selangor state government, with less than two weeks before the state polls on Aug 12, is perhaps an indication of just how much is at stake for the Pakatan Harapan-led (PH) government that is trying to keep the state under its administration. While the move was welcomed by many Petaling Jaya residents and non-governmental organisations who have been calling for the project to be scrapped due to environmental and social concerns, Parti Pribumi Bersatu Malaysia (Bersatu), one of the main component parties of Perikatan Nasional (PN), has questioned the right of the caretaker Selangor government led by Menteri Besar Datuk Seri Amirudin Shari in making such an impactful decision ahead of the polls. Bersatu also slammed Amirudin for saying that the PJD Link project might be revived if it complied with requirements set by the state government. The party, however, did not state its stance on the project, which was approved under the PN-Barisan Nasional (BN) government in April 2022. Should the project materialise, it would cut through four constituencies within the state — N30 Kinrara, N33 Taman Medan, N34 Bukit Gasing and N36 Bandar Utama — that is home to over 300,000 voters. The four constituencies are located within three Parliamentary seats, namely P105 Petaling Jaya, P104 Subang and P106 Damansara. With 313,017 voters representing roughly 8.3% of 3.75 million Selangor voters, the four state seats will see the PH-BN unity government, PN and the Malaysian United Democratic Alliance (Muda) vying for votes in the coming days. While Kinrara and Taman Medan will be a straight fight between PH-BN and PN, Bukit Gasing and Bandar Utama will be three-cornered fights as Muda has fielded candidates there. All four state seats were dominated by PH in the last state election in 2018, with Bandar Utama recording the highest winning margin among the four, at 81.4%, after PH-DAP candidate Jamaliah Jamaluddin secured 90.5% of the votes cast, defeating the BN candidate. This time, Jamaliah will be defending her seat against Muda’s Lim Hooi Sean and PN-Gerakan's Nur Aliff Mohd Taufid. In Bukit Gasing, Ranjiv Rishyakaran (PH-DAP) is up against Nallan Dhanabalan (PN-Gerakan) and Kalyana Rajasekaran Teagarajan (Muda). Ranjiv won the seat in 2018 after securing 29,366 votes or 86.9% of the total, with a winning margin of 76.5%. Over in Kinrara, the incumbent Ng Sze Hen (PH-DAP) will be taking on Wong Yong Kan (PN-Bersatu). Ng took the seat in 2018 with 52,207 votes polled, or 83% of the total, with a winning margin of 71.8%. For Taman Medan, PH-PKR has nominated Ahmad Akhir Pawan Chik as its candidate, replacing Syamsul Firdaus, who secured 21,712 votes or 57.8% of the total votes in the predominantly Malay area to win the seat in 2018 with a margin of 29.1%. Ahmad Akhir will contest against PN-Bersatu candidate Afif Bahardin. PJD Link is also in close proximity to N35 Kampung Tunku, which has 58,357 voters — 15.7% of which are Malay voters. This election, in terms of number of voters, Kinrara has the highest among the four at 123,782, while the number of Malay voters is highest in Taman Medan, at 68% of 61,959 voters. Amirudin said his administration cancelled the project as it was not satisfied with the impact assessment reports submitted by the concessionaire, PJD Link (M) Sdn Bhd, and because it did not meet certain conditions set by the state government, particularly the social impact assessment reports. RTO of Scomi Energy cancelled The proposed PJD Link is a 25.4km elevated highway with two-lane dual carriageway (four lanes). Aimed at dispersing traffic congestion in Petaling Jaya by providing major connection with existing roads and highways, the project was first approved in principle by the Cabinet during BN's administration in November 2017, before the state government then approved it in principle in September 2020 — subject to satisfactory impact assessments done. The highway, which was to be 100% privately funded, was to start after the North Klang Valley Expressway (NKVE) toll plaza on the SPRINT Highway, Damansara and end at the Bukit Jalil highway interchange. With the project in the pipeline then, the concessionaire PJD Link (M) Sdn Bhd announced in October 2022 that it was seeking a listing on Bursa Malaysia via the reverse takeover (RTO) of Practice Note 17 (PN17) company, Scomi Energy Services Bhd, whose share surged following the announcement. The RTO was to be part of the regularisation plan that would lift Scomi Energy from its PN17 status. In June this year, the concessionaire also said it had secured RM922 million in funding from MCC Overseas (M) Sdn Bhd — a subsidiary of China Metallurgical Group Corp — as part of its project financing for the project. But Scomi Energy suddenly announced on July 17 that the framework agreement it inked with the concessionaire for the RTO had been "mutually terminated with immediate effect", but did not elaborate. The concessionaire is a private construction company with Amrish Hari Narayanan as its chief executive officer. He was previously involved in the now-defunct RM2.42 billion Kinrara Damansara Expressway (Kidex), which was rejected by the then Pakatan Rakyat-led Selangor government in 2015 due to its failure to submit traffic, social and environmental impact assessments within the stipulated deadline. Scomi Energy's shares had been suspended since July 24 as it had failed to submit its regularisation plan to Bursa Securities on time and could not secure another extension of time to do so. Delisting was possible on July 26, but it had submitted an appeal to the regulator to prevent that. Scomi Energy's shares were last traded at half a sen apiece, giving it a market capitalisation of RM2.34 million. Kuala Lumpur, 1st June 2023 – KL Wellness City (KLWC), the first purpose-built township project in Southeast Asia to cultivate a lifestyle fully integrated with healthcare and wellness, marked its official launch today at the KL Wellness City Gallery in Bukit Jalil. The ceremony welcomed the Minister of Health, YB Dr Zaliha Mustafa as its Guest of Honour to officiate the momentous occasion. With a gross development value (GDV) of RM11 billion and spanning over 26.49 acres, the development is a world-class medical and wellness living at its core. The project features a well-rounded ecosystem primed for wellbeing and health – The Nobel Healthcare Park, the KL International Hospital (KLIH), innovation laboratories, clinical R&D facilities, healthcare company office towers, a retirement resort, a Healthcare Hub, wellness-centric serviced apartments, a fitness-based Central Park, and more. For the past few years, during the pandemic, Malaysia has been fighting hurdles in keeping up infrastructure development with patient load, retaining our medical talents, maintaining continuance of care in preparation for an ageing nation and a continuous war against Non-Communicable Diseases (NCD). Positioning Malaysia as a hub for Medical Tourism “In full support of Malaysia’s national plan to be recognised as one of the best places for medical tourism, KL Wellness City is designed to provide and prioritise health and wellbeing as the heart of its development, through its vision of a 360-degree wellness hub centred around its township which encompasses all aspects of medical care, health, wellness, fitness, and business, complete with residential, retail, and commercial offerings,” said KL Wellness City Managing Director, Dato’ Dr Colin Lee. In line with the national vision of solidifying Malaysia’s position and track record as the top destination for medical tourism in mind, KL Wellness City will serve as the ultimate one-stop oasis for the body and mind for both domestic and international travellers. Preparing for an Ageing NationOther than being a cornerstone for healthcare travel, according to Dato’ Dr Colin, the KLWC project is also an initiative that is built with an ageing nation in mind. Malaysia, having attained its status as an ageing nation, has an ageing population growing at a faster-than-expected rate where more than 15% of its population will be above the age of 65 by 2050. In response to this shift in population demographics, Malaysia is currently in pursuit of WHO’s Universal Health Coverage and Sustainable Development Goals, that is to provide equitable healthcare and wellness for all. “The KL Wellness City master plan incorporates thousands of facilities and residences. This township is a significant step towards embracing an ageing nation, with facilities for comprehensive healthcare dedicated to wellbeing through elderly care, retirement resorts, as well as independent and assisted living.” Dato’ Dr Lee added. Retaining and Cultivating Local Medical TalentsThe flagship KL International Hospital (KLIH), approved as a tertiary hospital with 624 beds and scalable to 1,000-bed capacity, will be on the same ranks as renowned institutions like Thailand’s Bumrungrad International Hospital, as well as Mount Elizabeth Novena, Singapore.

Some of the of medical equipment and facilities to be equipped in the KL International Hospital will be amongst the first in the Southeast Asia region, offering a fully comprehensive and integrated ecosystem of healthcare services including wellness and fitness facilities across diverse areas, including cardiology, spine health, neuro health, sports medicine, cosmetic surgery, and fertility, with R&D laboratories and facilities for clinical studies. With the support of the Malaysian Investment Development Authority (MIDA) towards the KLIH, the new private hospital will be built within the mixed development of KL Wellness City in Kuala Lumpur with proposed investment of RM860 million. The project, set to be in operation in the first half of 2026, will create over 3,000 job opportunities for medical professionals, including medical specialists, doctors, nurses, pharmacists, technicians, and others. “The commitment of KLWC to raising the bar for healthy living and wellbeing resonates with the Ministry of Health’s whole-of-system approach. It aligns perfectly with our national vision and the direction set forth in the 12th Malaysia Plan. Undoubtedly, I have faith that KLIH will attract multidisciplinary leading specialists to practice in a single hospital location, shortening turnaround time for both local and foreign patients, optimising patient care and experience. We foresee KLIH filling in that gap for Malaysians, and we stand in support of KLWC resonating with their purpose. The Ministry applauds the efforts of the tertiary hospital to maintain our leading position in this region and globally. We will continue to endorse KL International Hospital’s commitment,” said YB Dr Zaliha Mustafa, Minister of Health Malaysia. Dato’ Dr Colin also expressed his gratitude for the support of the Malaysian Government for the ground- breaking project. “We are honoured by the presence of the esteemed Minister of Health, YB Dr Zaliha Mustafa, which further exemplifies our shared commitment to make Malaysia stand among the best in the SEA region.” Article refer from yahoo.com KL Wellness City (KLWC), the first purpose-built township project in Southeast Asia to cultivate a lifestyle fully integrated with healthcare and wellness, marked its official launch today (June 1) at the KL Wellness City Gallery in Bukit Jalil.

With a gross development value (GDV) of RM11 billion and spanning over 26.49 acres, the development is a world-class medical and wellness living at its core. The project features a well-rounded ecosystem primed for wellbeing and health – The Nobel Healthcare Park, the KL International Hospital (KLIH), innovation laboratories, clinical R&D facilities, healthcare company office towers, a retirement resort, a Healthcare Hub, wellness-centric serviced apartments, a fitness-based Central Park, and more. Positioning Malaysia as a hub for Medical Tourism “In full support of Malaysia’s national plan to be recognised as one of the best places for medical tourism, KL Wellness City is designed to provide and prioritise health and wellbeing as the heart of its development, through its vision of a 360-degree wellness hub centred around its township which encompasses all aspects of medical care, health, wellness, fitness, and business, complete with residential, retail, and commercial offerings,” said KL Wellness City Managing Director, Dato’ Dr Colin Lee. Retaining and Cultivating Local Medical Talents The flagship KL International Hospital (KLIH), approved as a tertiary hospital with 624 beds and scalable to 1,000-bed capacity, will be on the same ranks as renowned institutions like Thailand’s Bumrungrad International Hospital, as well as Mount Elizabeth Novena, Singapore. Some of the of medical equipment and facilities to be equipped in the KL International Hospital will be amongst the first in the Southeast Asia region, offering a fully comprehensive and integrated ecosystem of healthcare services including wellness and fitness facilities across diverse areas, including cardiology, spine health, neuro health, sports medicine, cosmetic surgery, and fertility, with R&D laboratories and facilities for clinical studies. With the support of the Malaysian Investment Development Authority (MIDA) towards the KLIH, the new private hospital will be built within the mixed development of KL Wellness City in Kuala Lumpur with proposed investment of RM860 million. The project, set to be in operation in the first half of 2026, will create over 3,000 job opportunities for medical professionals, including medical specialists, doctors, nurses, pharmacists, technicians, and others. “The commitment of KLWC to raising the bar for healthy living and wellbeing resonates with the Ministry of Health’s whole-of-system approach. It aligns perfectly with our national vision and the direction set forth in the 12th Malaysia Plan. Undoubtedly, I have faith that KLIH will attract multidisciplinary leading specialists to practice in a single hospital location, shortening turnaround time for both local and foreign patients, optimising patient care and experience. We foresee KLIH filling in that gap for Malaysians, and we stand in support of KLWC resonating with their purpose. The Ministry applauds the efforts of the tertiary hospital to maintain our leading position in this region and globally. We will continue to endorse KL International Hospital’s commitment,” said YB Dr Zaliha Mustafa, Minister of Health Malaysia. Article refer from businesstoday.com.my The healthcare industry has boomed since the onset of the pandemic. Its growth has also created opportunities for medical real estate. While the focus of Malaysian property investors has primarily been on residential and commercial properties, medical real estate is the next property type to look out for. KL Wellness City (KLWC), which offers holistic facilities and services that encompass healthcare, wellness and fitness involving both Western and alternative medicine, is billed as the first-of-its-kind development in Southeast Asia. It strives to establish a comprehensive, fully integrated and interconnected system of medical care, wellness and fitness. According to KL Wellness City Sdn Bhd managing director Datuk Dr Colin Lee, KLWC is a 26.5-acre, healthcare-themed development in Bukit Jalil, Kuala Lumpur. Spread across seven parcels, the components will include a 624-bed tertiary hospital (with capacity of up to 1,000 beds), 379 medical specialist suites, retirement resorts for independent and assisted living, a healthcare mall, residential units, commercial shoplots offering health and fitness-centric retail as well as food and beverage outlets, a Multimedia Super Corridor-designated office space, and a central park with cycling and jogging tracks. Medical Real Estate The first phase consists of the hospital and The Nobel Healthcare Park, both of which will be connected by a link bridge. Launched in April, The Nobel Healthcare Park - which has a gross development value of RM1 billion - will comprise 379 medical suites in two blocks, 512 wellness suites in one block, and office space and retail shops on the ground floor of these blocks. The whole phase will be completed by end-2025. The medical suites, which range from 248 to 1,500 sq ft, will be sold at an average price of RM1,500 psf. Meanwhile, the wheelchair-friendly, healthcare-focused wellness suites will have built-ups of 268 and 386 sq ft, and will be sold from RM1,300 psf. Lee says these two real estate properties present a good investment opportunity for investors. "Being a medical specialist myself, I know what is required. Many specialists want their own clinic where they are able to prescribe medicine, charge the fees they want, and perform small procedures and laboratory tests. They can also do corporate planning, and engage junior doctors as they get older and become more established," he explains. Lee adds that under the system in Malaysia, medical specialists get to rent clinic space in a hospital while everything else is controlled by the hospital. They are bound by various regulations for the procedures, charges, lab tests, drugs and hiring. "Many specialist doctors would like to have their own clinic, but the current situation is that if they do own one, it will be located far away from the private hospital. Whenever they have patients in the hospital, and quite often these are emergency cases, they have to travel back and forth. This is very inconvenient for both doctors and patients." The medical suites in The Nobel Healthcare Park cater for such demand. Specialists can acquire and operate their own clinic, thus giving them the freedom to run it as they wish. They are able to see patients in their clinic and then walk over to the hospital to check on other patients. The medical suites can also be used by other medical and wellness-related businesses such as physiotherapy, chiropractic, medical device supplies, pharmaceutical and spa. The upcoming KL International Hospital is a benchmark against top hospitals in the region and is set to leverage on Malaysia's position as the top world destination for medical tourism, says Lee. He notes that Malaysia has been receiving medical tourists from various countries, including Indonesia, Singapore, Australia and China, for its affordable and good healthcare. Travelling with them are their families, who will need accommodation. The wellness suites in The Nobel Healthcare Park may thus be ideal. Healthcare-focused wellness suites; high rental return "There are doctors and healthcare workers who want to live there. When the hospital is fully operational, we expect 8,000 units of accommodation will be needed per night due to the demand from medical tourists. The whole KLWC won't have that many number of units, so we expect the wellness suites to be fully occupied," he says. The suites also cater for patients who are in step-down care - those who have been discharged from hospital but are still recovering and may require some assistance such as daily physiotherapy or rehabilitation. Property investors can rent out the hotel-like wellness suites to the families of medical tourists. The suites are even equipped with a kitchenette and fridge, which is convenient should they prefer to cook their own food. As doctors can also acquire the wellness suites for their own use, coupled with the anticipated demand, Lee expects these suites to be fully occupied. "The wellness suites could see a high rental return… The yield for a wellness suite could be 15% to 18% [if one manages the unit himself]. Aside from doctors, other buyers include property investors," he says. Wellness redefined

Lee observes that people have become more health-conscious since the onset of the Covid-19 pandemic, realising the need to live healthily. It so happens KLWC was conceptualised based on the fact that people want to live well. "We have made an effort to design and build to enable wellness living. We have increased the ratio of green, thus allowing more sunlight and ventilation, which can increase the value of the property," he says. "It is a healthcare city where all kinds of medical facilities and services are available. For The Nobel Healthcare Park, however, it is not just about the services - it is part of an ecosystem that covers all aspects of healthcare, including acute medical care, emergency care, wellness and fitness. It is designed and built for medical professionals and seekers, both local and abroad." BOUSTEAD Properties Bhd, the property arm of diversified group Boustead Holdings Bhd, is planning to redevelop the eCurve mall in Mutiara Damansara, Petaling Jaya, into a high-rise residential development that supports multigenerational living. Industry estimates peg the gross development value (GDV) of the redevelopment — sited on 3.87 acres of freehold land — at between RM500 million and RM700 million. eCurve had housed mmCineplexes, Ampang Superbowl and retail outlets such as Mr DIY, Tony Roma’s and The Manhattan Fish Market before it was permanently closed in March last year for the redevelopment. eCurve is connected to The Curve, which will continue operating as the main neighbourhood mall.

“We are currently focusing on the high-rise residential development that will support multigenerational lifestyles. Upon completion, it will be a prominent new landmark and is set to raise the liveability standards in Mutiara Damansara,” Boustead Properties CEO Khairul Azizi Ismail tells The Edge. Multigenerational-living units typically house two or three generations under one roof. A household may comprise adults living with their parents or adults bringing their parents to live with them to help with childcare. Single units are sometimes designed to offer privacy for each couple and even include separate entrances. Boustead Properties’ new plan appears to be in line with the opinions of industry experts that a high-rise residential is the best fit for the site, based on the location as well as market sentiments. The developer plans to apply for a higher plot ratio for the site and monetise it. “Due to the proximity to the [Surian] mass rapid transit station, the area is gazetted as a transit-oriented development (TOD). As with any other TOD, location-wise, this development will have significant potential in addition to accessibility and being surrounded by plenty of good amenities. Hence, we will be submitting for a higher plot ratio, in compliance with any requirements by the local authorities,” says Khairul. It is learnt that the plot ratio for the site is 1:4. A source tells The Edge that Boustead Properties is likely to apply for an increase in plot ratio to at least 1:6. As Boustead Properties is in the process of preparing the technical submissions, it has yet to submit the redevelopment plans to the Petaling Jaya City Council for approval. Khairul says he is unable to share when the project is likely to be launched. “As we have yet to submit our plans, we will only have more visibility once such a step has been undertaken.” On how Boustead Properties plans to finance the construction, Khairul says it will be through the sale of the residential units. In the event the developer manages to obtain a 1:6 plot ratio and the units can be sold for prices similar to those in nearby Taman Tun Dr Ismail or Empire City Damansara, the 168,577 sq ft site could have a GDV of RM500 million to RM700 million, depending on the price of the units, a back-of-the-envelope calculation shows. Glomac Damansara in TTDI, for example, is going for RM700 to RM800 psf, while Exsim Group’s Mossaz in Empire City Damansara, which are leasehold units, are priced at around RM900 psf. Last March, Boustead Properties had closed down the 14-year-old eCurve for the redevelopment. In its annual report for the financial year ended Dec 31, 2020, Boustead Holdings says, “In line with the group’s Reinventing Boustead strategy, we aim to refresh our property brand and accelerate digitalisation. As part of this, we are embarking on the redevelopment of eCurve. Drawing on 14 years of success, our aim is to rejuvenate and revitalise the mall as a dynamic landmark in our Mutiara Damansara township, bringing enhanced liveability and new offerings.” An industry source agrees that it is time for Boustead Properties to review the asset. He highlights that in comparison to some malls within the Klang Valley, eCurve is rather small. He cites Sunway Pyramid, Mid Valley Megamall/The Gardens Mall, Suria KLCC and Pavilion KL, noting that each mall offers over one million sq ft of retail space. “These malls are vacuum cleaning the industry,” he says, referring to the bigger malls pulling crowds away from the smaller ones. “One cannot remain as a small mall anymore. Boustead Properties would have to look at the best solution for the site,” he adds. Still, more new malls are sprouting up in the country. LaLaport Bukit Bintang City Centre opened its doors in January, while Phase 2 of IOI City Mall opened in August. Next year, The Exchange TRX, with 1.3 million sq ft of net lettable area, is slated for opening, while Pavilion Damansara Heights Mall has announced its opening in May 2023 with 533,361 sq ft of NLA in Phase 1 and another 529,353 sq ft in Phase 2. It is worth noting that in the vicinity of eCurve, apart from The Curve, there are three other popular retail malls — IKEA, IPC Shopping Centre and Lotus’s hypermarket. eCurve, which opened in 2006, was formerly known as Cineleisure Damansara. It was a joint venture between Boustead Properties and Singapore’s Cathay Organisation Holdings Ltd. It was reported then that the mall’s NLA was 232,000 sq ft. In 2009, Boustead Properties took full ownership of the mall and renamed it eCurve. Five years later, the mall’s focus was changed to entertainment and leisure, while The Curve took over the role of the neighbourhood mall. A source tells The Edge that once Boustead Properties had decided to shut the mall, it weighed the possibility of holding the upcoming asset as an investment or selling it. A decision was then made to monetise it. Asked to comment by The Edge, real estate agency Rahim & Co CEO Siva Shanker says he believes that the most suitable commercial asset to be built on eCurve would be serviced apartments or condominiums with a niche. He does not think that building a hospitality component on the site would be a good option as Boustead Properties already operates two hotels — Royale Chulan The Curve and Royale Chulan Damansara — in the vicinity. “There’s also an office space glut and people are giving up office space,” he adds. “Based on highest and best use, serviced apartments may be the best option,” Siva says, adding that the product and timing of the launch are crucial. “Luxury homes have a snob appeal. Many affluent empty nesters are giving up their large houses and moving into apartments. They could build something for the rich,” he says. He elaborates that these can be large units with luxury interior design. According to Siva, small units are not selling as well anymore given the rising cost of living. “The immediate area is well known as a thriving commercial hub with The Curve, IKEA and Lotus’s anchoring as crowd pullers. The surrounding areas in the locality of Mutiara Damansara and Kota Damansara are generally quite established and densely populated. This provides an opportunity for a mixture of nest leavers and upgraders who may be looking for suitable accommodation with features which address post-pandemic needs and demand,” ExaStrata Solution Sdn Bhd CEO and chief real estate consultant Adzman Shah Mohd Ariffin tells The Edge. “Any mixed-use development — with residential and limited commercial components that can serve the immediate resident population would be good, and able to fill the gaps and be in line with the present trends — stands a good chance of success.” Financing and launch Companies Commission of Malaysia (SSM) data shows that Boustead Properties made a net loss of RM334.21 million on revenue of RM370.18 million in the financial year ended Dec 31, 2020 (FY2020). It had total liabilities of RM2.844 billion and total assets of RM4.03 billion as at end-December 2020. It had an accumulated profit of RM439.44 million. In FY2021, parent Boustead Holdings had total liabilities of RM10.98 billion, of which RM7.53 billion were current. Total assets stood at RM16.44 billion. On the timing of the launch, Siva says given the global uncertainties, a potential risk of a global recession in 2023 and what appears to be now a two-year property cycle (2021 and 2022), “perhaps if they launch in 2024, the property market may have started to see an improvement”. What’s next for Boustead Properties after eCurve’s transformation? Industry sources believe that the focus is likely to be on renovating and upgrading The Curve. “At The Curve, there are currently many dead corners and there are offices located on the upper floors [with no relation to retail],” an industry observer says, adding that these can be redesigned and rejuvenated to attract foot traffic. The plot ratio can be maximised too. Experts note that with rising competition in the shopping centre market, it is time for a rejuvenation of The Curve. This is especially so since there has been an evolution in the retail industry where department stores are not performing as well as before, hypermarkets are getting smaller and there is a focus on premium grocers. According to Boustead Properties’ Khairul, The Curve has had regular maintenance and refurbishment to ensure that it is in good condition to meet its patrons’ comfort, convenience and safety requirements. After re-strategising its tenancy mix, following the pandemic, occupancy level at The Curve is expected to rise to 93% by end-2022 from 89% now. One of its newer tenants is the KMT Group’s flagship premium Korean grocery store. It occupies some 30,000 sq ft of prime space on the ground floor, which is about 5% of The Curve’s NLA. Article refer from theedgemarkets.com The KL Wellness City mega project in Bukit Jalil, Kuala Lumpur, is envisioned as a world-class medical and wellness township with a gross development value (GDV) of nearly RM12 billion. According to Datuk Dr. Colin Lee, managing director of KL Wellness City Sdn Bhd (KLWC), the 10.73-hectare development will be the first in Southeast Asia to cultivate a lifestyle fully integrated with healthcare. KLWC is the master developer and owner of KL Wellness City. The land was purchased in 2015 by the company from the Lembaga Tabung Angkatan Tentera, also known as the Armed Forces Fund Board. The idea to develop the medical township was mooted by Lee, who began his career as a medical doctor from the University of New South Wales, Australia. According to Lee, the development of the KL Wellness City project would take about 10 years, divided into two major phases. Construction on phase one, which includes a 517-bed International Hospital and the Nobel Healthcare Park, began about six months ago and spans seven acres, he said. According to Lee, the gross development cost (GDC) for the phase one development is around RM600 million. "The International Hospital will be built in two stages. The first phase will include 517 beds and is expected to cost around RM360 million. Phase two will see the hospital expanded to around 1,000 beds. The Nobel Healthcare Park's GDC is estimated to be around RM230 million," he said. Phase one will be completed by the end of 2024, and both the International Hospital and the Nobel Healthcare Park will open in early 2025, he said. Nobel Healthcare Park will have a GDV of RM1 billion and three towers of medical and wellness suites, he said. The medical suites, according to Lee, are built in accordance with Ministry of Health specifications and are designed in a modular format, allowing specialists to choose the ideal size for their practise. The suites start at 223 square feet and they are selling from RM414,000. The medical suites, according to Lee, are designed based on the core management team's own experience in the medical field. "We have infused the design and elements that offer practising medical specialists the flexibility to optimise the use of space to suit their precise requirements and the freedom to make changes according to evolving needs. "We are confident this will enhance the specialists' interest to own the suites as an investment in addition to running a practice here. We expect a take-up rate of 80 per cent, within the first three months of the first phase's official launch," he said. Nobel Healthcare Park's wellness suites are fully equipped. The suites provide adaptable living spaces that are suitable for owner occupancy, home office use, or short-term stays such as step-down care and healthcare traveller accommodations. These suites, which come in 268 sq ft and 386 sq ft sizes, start at RM338,000 Self-sustaining township with GBI-rated properties

Datuk Sri Dr. Vincent Tiew, KLWC executive director (branding, sales, and marketing), said that the International Hospital and Nobel Healthcare Park are pursuing Green Building Index (GBI) certification. Tiew said GBI is a big deal for hospitals and healthcare components. He also said that whatever the company builds in KL Wellness City will be one-of-a-kind: the International Hospital, which will be rebranded, will be the first of its kind in Southeast Asia, and the healthcare mall, which we will developed under phase two, will be the first of its kind in the world. "Generally speaking, you will not be able to build this type of medical township if you are a typical property developer. If you are a hospital-related organisation, you will not be constructing a city or a township. You will be extremely hospital- or medical-driven. "What we are doing here is constructing an ecosystem that is fully integrated between five components. We have wellness, medical tourism, lifestyle (healthcare mall), a property component with serviced suites, lifestyle homes, retirement homes, and, most importantly, a true International Hospital. "Why are we optimistic about the retirement home market? Because we will be the sole owners of our International Hospital. It is not a small facility. It will be huge, with 1,000 beds and 22 operating theatres. Overall, we are very optimistic because we believe we have the right product to market and the right people in the company to take it forward," Tiew said. Tiew, who was previously the managing director of the Andaman Property Group of Companies, said that the healthcare mall in phase two development will include several proposed medical and hospital outfits, including a leading oncology centre (cancer centre) in Southeast Asia. It will also include other components, such as a hotel and retail, to round out and improve the overall ecosystem. "We believe KL Wellness City will be self-sustaining. This is something that everyone is looking forward to. Malaysia is known for having some of the best medical facilities in the world, and what we offer at KL Wellness City is one-of-a-kind. Furthermore, we have an ageing population that requires such facilities and treatment," he explained. Article refer from nst.com.my Mah Sing Group Bhd planned to launch M Nova mixed development in Kepong, Kuala Lumpur, with an estimated gross development value of RM790 million in the third quarter next year.

In a media statement today, the property developer announced its third land acquisition today (Nov 30), securing a piece of 8.09-acre plot with approved development order (DO) in Kepong for RM95 million. According to the company, the land cost of RM95 million is inclusive of 50% of the relevant development charges, deposit and contribution of Improvement Service Fund (Roads & Drains) pursuant to the DO paid by the vendor to the relevant authorities. In its preliminary plan, the development comprises serviced residences with indicative built-up sizes ranging between 700 sq ft and 1,000 sq ft (priced from RM318,000), and some retail units. This will be Mah Sing’s third project in Kepong. Mah Sing’s Founder and group managing director Tan Sri Leong Hoy Kum said the group’s previous projects in Kepong - M Luna and Lakeville Residence, have received strong take-up rate, this showed demand for residential properties in this area remained intact, for its amenities and easy accessibility. “We will leverage the spillover demand from M Luna as well as the catchment from the surrounding neighbourhood by putting an irresistibly affordable price tag for M Nova, complementing the well-designed features we are developing. This is in line with our efforts to continue focusing on affordable range products under M-Series, meeting the needs of the mass market,” he added. He observed that M Nova will be able to enjoy a large captive market as the land straddles the well-established neighbourhoods of Kepong, Taman Selayang Jaya, Batu Caves, Bandar Menjalara, Segambut, Taman Seri Gombak and Sentul, and is only 12.9km away from KLCC. On top of this, M Nova is located 6.9km from the upcoming Metro Prima MRT2 Station, and 3.1km from the Taman Wahyu KTM station. Meanwhile, Mah Sing announced the group recorded approximately RM1.28 billion sales in the first nine months this year, this also means the group has achieved 80% of its 2021 sales target of RM1.6 billion. In the first nine months of 2021, Mah Sing registered a 65% increase in profit before tax (PBT) of RM166.4 million on the back of revenue of RM1.2 billion as compared to PBT of RM100.6 million and revenue of RM1.1 billion in the corresponding period a year ago. The group attributes the improved sales to its M-Series of affordable high rises in the central business district and landed properties located in strategic locations with good catchment areas. For instance, the group’s 2-storey link homes in Johor Bahru i.e Phase 1 of Erica@Meridin was fully taken up during its launch, and Phase 2 is now open to meet the demand. Besides, M Adora in Wangsa Melawati which was launched last year also recorded strong take-up rates of approximately 90%. In addition, Mah Sing has received overwhelming interest for its two newly acquired lands in 2021 – M Senyum in Sepang and M Astra in Setapak, which the Group targets to launch in the first half of next year. Including all three new lands acquired to-date - M Senyum in Sepang, M Astra in Setapak and M Nova in Kepong, Mah Sing has a remaining landbank of 2,051 acres with a remaining GDV and unbilled sales of approximately RM24.98billion. “Encouraged by the positive track record and rapid turnaround time of our projects, we are continuously eyeing for more land with Greater Kuala Lumpur, Klang Valley, Johor and Penang being the focus areas, as well as looking at other property hotspots in Seremban, Melaka and Perak to develop affordable landed homes.” said Leong. Refer from edgeprop.my Paramount Corp has proposed to dispose of a 4.7ha piece of land in Pekan Hicom, Section 26, Shah Alam for RM90 million.

The land has a net book value of RM76.7 million as at Dec 31, 2020, and was acquired in 2012 for RM48.42 million, the group said in a bourse filing on Nov 29. The independent valuation of RM90 million was appraised by Rahim & Co International Sdn Bhd, it added. The buyer is Goodhart Management Sdn Bhd, whose directors include SKP Resources Bhd chairman and managing director Datuk Gan Kim Huat. Paramount said RM50 million of the proceeds of the disposal will be used for the repayment of bank borrowings, while RM37.8 million will go towards working capital purposes. “The proposed disposal is in line with Paramount’s plan to improve the operational performance of its property division by focusing on property developments that are able to generate returns within a shorter turnaround time, particularly in times of economic uncertainty. “This plan includes monetising some of the group’s land bank that are zoned for commercial use, and utilising the cash proceeds to repay bank borrowings previously taken for the acquisition of residential land as well as to improve cash liquidity for the group’s integrated developments,” it said. The group expects the disposal to be completed by the first quarter of 2022. Articles is refer from edgeprop.my AGROCHEMICAL company Hextar Global Bhd is exploring an entry into the retail scene through the acquisition of a stake in the yet-to-be-completed Empire City Damansara Mall in Petaling Jaya, Selangor, sources say.

It is understood that Hextar, in which businessman Datuk Ong Choo Meng has combined direct and indirect interests of 69.02%, could buy a “substantial stake” in the mall and that an announcement on the matter may be made soon. The RM500 million mall is part of the larger Empire City Damansara (ECD1) project — which has a gross development value of RM5 billion — developed by Mammoth Empire Holdings Sdn Bhd (MEH). The project also comprises hotels, offices and apartments. MEH was founded by low-profile businessman Datuk Sean Ng Yee Teck and his partner Datuk Danny Cheah. It also developed Empire Hotel and Empire Shopping Gallery in Subang Jaya. Details of the deal remain sketchy but it is learnt that the parties have been negotiating a deal for over three months and talks are now at an advanced stage. Empire City Damansara Mall, located along Lebuhraya Damansara-Puchong, has a net lettable area of 2.5 million sq ft. It is understood that its value now is about RM500 million. The new opening date for the partially completed mall is expected to be 2023. “The mall will be operated by MEH,” a source tells The Edge. When contacted for confirmation, Ong, who is the executive director of Hextar, declined to comment. This is not Ong’s first retail foray. He recently emerged as the substantial unitholder of retail asset-focused KIP Real Estate Investment Trust (KIP REIT), which owns a portfolio of seven malls and has RM808 million in assets under management. Ong has a 20.087% stake in the REIT. Last month, The Edge reported that his entry into KIP REIT will allow him to act as a sponsor, and potentially inject his portfolio of factories and warehouses under his other businesses into the REIT. Ong’s business ventures are diversified and include glove manufacturing, furniture, and plastic and industrial products. Meanwhile, Hextar, which is involved in the entire agrochemical supply chain, from research and development to manufacturing and distribution, announced that it was also looking to establish a Syariah-compliant digital bank. In July, together with Fass Payment Solutions Sdn Bhd’s SPV Ihsan Equit Sdn Bhd, it entered into a consortium agreement with Dagang NeXchange Bhd’s major shareholder, Arcadia Acres Sdn Bhd. In the first half ended June 30, 2021, Hextar posted a net profit of RM18 million on the back of RM213.52 million in revenue. This compares to a net profit of RM20.56 million and revenue of RM205.28 million achieved a year ago. In the financial year ended Dec 31, 2020, Hextar posted a net profit of RM44.48 million and revenue of RM418.64 million. It is unclear how Hextar plans to finance the purchase. As at June 30, 2021, its total short- and long-term borrowings stood at RM106.07 million. It also had cash and cash equivalents of RM28.89 million as at June 30. As for MEH, this is not the first asset it has sold in recent years. In the past, it had disposed of several of its commercial assets and land to pare down debts and for working capital. In 2017, the Empire Shopping Gallery was sold to Pelaburan Hartanah Bhd (PHB) for RM570 million cash, with a call option to buy back the mall on the fifth anniversary of the sale. MEH also has the right of first refusal should PHB decide to dispose of the asset within five years. MEH currently operates this mall. In 2019, MEH sold the four-star Wolo Bukit Bintang in Kuala Lumpur to HYM Group for RM115 million. In the same year, the company offloaded its 61-acre tract of land in Damansara Perdana, Selangor, to Exsim Development Sdn Bhd for RM760 million. The parcel was originally earmarked for the development of ECD2. Exsim also purchased another 4.5 acres adjacent to ECD1. Apart from the land purchase, Exsim also entered into an agreement with MEH to complete several of the outstanding developments within ECD1. MEH, which at the time had decided to wholly own and operate the mall, is now selling a portion of it to Hextar. MEH is understood to still be in control of two hospitality components — McGuffin Hotel and Autograph. On Friday, shares of Hextar closed at RM1.25, valuing the company at RM1.6 billion. Article Refer from www.theedgemarkets.com/article/hextar-mulls-acquisition-stake-pj-mall 东盟一直是全球供应链上重要的一环,而马来西亚凭借本国出色的工业基础和基建实力,在东盟中扮演着制造业排头兵的角色。在新冠疫情导致全球供应链紊乱,从而带来芯片荒、大宗商品涨价、海运价格暴涨的背景下,外资似乎已经提前看到了大马的优势和潜力,纷纷开始投资建厂。 大马在2021年上半年的外来直接投资表现强劲,与2020年上半年相比飙升了223.1%,这显示外国投资者对马来西亚稳定且有利的经济环境和商业生态系统充满信心。大马在制造业、服务业和初级产业取得外来直接投资和国内直接投资的批准投资总额达1075亿令吉,较去年同期大幅增长 69.8%。 在充满挑战的全球经济形势下,这些投资涉及2110个项目,预计将在大马创造4万4994个就业机会。马来西亚贸工部高级部长拿督斯里阿兹敏表示,今年上半年批准总值669亿令吉的367个制造项目,将创造3万2220个不同职位的就业机会,引领高价值和技术就业的道路。他指出,获批投资所需的劳动力包括1367个管理职位和4031名电子电气、机械、化学和其他学科领域的工程师等技术专业人员,反映了制造业更高的价值链转型。获批的制造项目还需要4144名熟练工匠;以服务业和初级产业为首的国内投资总额为450亿令吉,占获批投资总额的41.9%。 今年上半年值得关注的批准项目包括韩国SK Nexilis新铜箔制造厂项目、东方日昇能源生产双面技术太阳能产品的拟议项目,以及OCIM拟议投资以扩大其太阳能级多晶矽产能的工厂。拿督斯里阿兹敏还表示,从国家投资局的战略角度,我们未来将继续追求高质量的投资,为国家和人民带来价值,不仅是在保住工作岗位,而且是在创造新的高附加值就业机会。 除此之外,专注于高性能跑车、运动型多功能车(SUV)和轿车的德国知名汽车制造商 Porsche AG(保时捷)宣布,他们将与森那美有限公司(Sime Darby Berhad)合作在马来西亚吉打设立生产工厂。保时捷为了扩大其在亚洲的业务,该公司将在上海开设研发中心,并在马来西亚设立一座工厂。 保时捷在一份声明中表示,上海研发中心将帮助该公司更好地理解中国客户以及他们的需求,并且改进本地的产品开发。而马来西亚工厂将于2022年开始运营,保时捷将与该国贸易集团Sime Darby Berhad合作运营该工厂。新工厂将负责针对亚洲市场推出的车型的最终装配工作。 保时捷(Porsche),德国大众汽车旗下世界著名豪华汽车品牌,总部位于德国斯图加特,是欧美汽车的主要代表之一。主要车型有911、Boxster、Cayman、Panamera、Cayenne、Macan。 保时捷这次选址在马来西亚设厂,是其在欧洲以外的第一家工厂。尽管全球经济形势充满挑战,但保时捷坚信大马是东盟市场的理想门户,这使得吉打汽车制造厂成为保时捷70多年历史以来,首次在欧洲以外设立的本地组装厂房。在马来西亚设厂被视为保时捷的一项战略决定,表明其致力于在东盟地区建立长期据点。 国际贸易及工业部长拿督斯里阿兹敏阿里在文告中指出,该项目反映了保时捷对马来西亚作为全球知名汽车原厂配件(OEM)首选制造中心的强大信心。保时捷选择大马作为其在欧洲以外的第一家生产工厂的决定,体现了公司对大马有利生态系统的信心,以及我们支持其长期发展的实力。 至于疫情方面,马来西亚新冠疫苗特别委员会9月9日宣布,根据统计,截止9日,全马新冠疫苗接种量为37714587剂,当中21082152人接种了首剂(成人人口的90%),16680780人接种了第二剂疫苗(成人人口71.3%)

全马成年人口接种率最高的地区是巴生谷区,达到了98.4%,其次是纳闽95.7%、砂拉越87.9%、森美兰85.1%。 Glove maker Rubberex ventures into property investment via strategic stake in Empire City Mall in PJ10/4/2021 Making its first foray and diversification into property investment, glove maker Rubberex Corp (M) Bhd is undertaking a joint collaboration with Alliance Premier Sdn Bhd, EXSIM Holdings Sdn Bhd and JT Momentum Sdn Bhd (EXDJ shareholders) for the development and operation of Empire City Mall in Petaling Jaya, Selangor.

In a statement on Monday, Rubberex said the collaboration will be done via a joint venture (JV) company, Alliance Empire Sdn Bhd, with Rubberex's executive director Lim Chee Lip spearheading the project. Rubberex on Monday entered into a subscription agreement with Alliance Empire to subscribe 200,000 new shares or a 20% equity interest in the latter for RM180 million cash. Alliance Premier will hold 60% and EXDJ shareholders the remaining 20%. The group said the diversification exercise comes at a time when the rubber glove industry's outlook seems to be waning from its peak of supernormal profits and high average selling prices as Malaysia and the rest of the world enter the endemic phase of the Covid-19 pandemic. Lim said Rubberex's diversification into property investment is in line with the group's long-term strategy of delivering sustainable growth, steady income and value creation to its shareholders. Spanning 9.536ha of land, the development of the Empire City Mall is ongoing with construction works at 83% completion as at Oct 1. The registered proprietor of the Empire City Mall is Cosmopolitan Avenue Sdn Bhd, which is a wholly-owned subsidiary of Mammoth Empire Holdings Sdn Bhd -- which was founded by low-profile businessman Datuk Sean Ng Yee Teck and his partner Datuk Danny Cheah. In a separate filing with Bursa Malaysia, Rubberex said prior to the entry of Rubberex as the shareholder of Alliance Empire, the latter will complete the acquisition of the Empire City Mall for RM480 million. It will then issue 600,000 shares and 200,000 shares in the company to Alliance Premier and EXDJ shareholders, respectively. Empire City Mall has been independently valued at RM1 billion and the proposed subscription would enable the group to acquire a strategic foothold and participate in a sizeable completed mixed property development project within a relatively short period of two years. "We are honoured to be collaborating with such established property players in the industry and look forward to elevating Empire City Mall to a premier retail destination when local and international borders reopen," said Rubberex's single largest shareholder Datuk Eddie Ong Choo Meng. The Edge weekly on Oct 4 reported that Ong could buy a "substantial stake" in the mall and that an announcement on the matter may be made soon. "This is not Ong's first retail foray. He recently emerged as the substantial unitholder of retail asset-focused KIP Real Estate Investment Trust, with a 20.087% stake," the report said. Meanwhile, Rubberex said the implementation of the proposed subscription and diversification exercises are expected to be completed by early 2022. In the statement, EXSIM Group managing director Lim Aik Hoe said the mall is set to be one of the iconic tourism hotspots in Malaysia. "Empire City Mall is a unique creation that would add value to the surrounding developments, with its distinctive architectural facade design," he said. Rubberex shares fell one sen or 1.67% to close at 59 sen, giving it a market capitalisation of RM540.15 million. Refer from www.theedgemarkets.com HAVING struggled with the imposition of the movement control order (MCO) in 2020 more than in 2021, Penang’s housing market is poised to recover in 2022 as signs of sales picking up are getting more obvious.

This follows the adaptation of online presentations, virtual showrooms and other advanced technology with most purchasers are willing to attend online presentations and subsequently proceed with a booking. “Developers have held firm on prices, even though activity has dropped. Rather than drastically dropping their selling prices, developers are providing all sorts of promotional packages to stimulate buyers,” observed Juwai IQI’s co-founder and group CEO Kashif Ansari. “Is this a good time to buy? Very much so. With lower interest rates, developer incentives, and the ongoing Home Ownership Campaign (HOC), this is perhaps the best time to purchase in several years. The HOC has already been extended twice and may be discontinued after December.” When economic growth climbs next year, Kashif expects property buyers to face more competition with rising construction costs which also suggests further rises in property prices. “In 2022, we expect residential real estate in Penang to bounce back more quickly than in any other part of Malaysia except Johor,” he projected. “By 2Q 2022, we expect borders to fully reopen and international visitor numbers to be trending towards pre-pandemic levels. Economic growth, employment, foreign investment, and tourism will recover. These trends will support further recovery in transaction volumes and prices.” As one of the smallest and most developed states with a prominent international reputation, Penang is one of the best-positioned states for the post-pandemic recovery, according to Kashif. “The pandemic is an external shock, and the subsequent drop in transactions and prices does not reflect any inherent weakness in the market,” he reckoned. “With the support of government initiatives and positive economic trends, the property market will recover along with the economy.” Moreover, the price of luxury condominium in Penang are lower than in competitor cities like Singapore, Bangkok and Jakarta where comparable residences there can be five-times more expensive. “As for the foreign buyer market, it will take time to gain back their full confidence. However, Penang’s high-tech manufacturing and unique tourism assets make it desirable for second homes, retirement, and investment. We expect foreign buying to come back to prior levels in time,” added Kashif. – Sept 30, 2021 The government will focus on several sectors which are badly affected by the Covid-19 pandemic, including tourism, retail, and small and medium enterprise (SME), in Budget 2022 to be tabled later this month, said Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz.

He said the government is optimistic that the country’s economy will recover next year in line with the positive growth projections made by the International Monetary Fund (IMF) and World Bank for 2022. Tengku Zafrul said this can be achieved through the government’s high commitment to revive all pandemic-affected sectors. However, he said, the recovery period may differ depending on economic sector. “In the budget, we will give attention and assistance to all sectors including the most badly affected sectors, which are tourism, retail and SME. "This year, Malaysia’s Gross Domestic Product is expected to grow between three and four per cent, while the IMF and World Bank are forecasting a five to six per cent growth for 2022. This shows that our economy will recover next year,” he told reporters after a working visit to the Orang Asli settlement in Kampung Limbahan/ Jeti Sudin near Tasik Bera on Saturday (Oct 2). Also present were Deputy Finance Minister I Mohd Shahar Abdullah and Pahang Menteri Besar Datuk Seri Wan Rosdy Wan Ismail. Tengku Zafrul added that the country’s latest economic growth forecast would be announced during the tabling of Budget 2022 on Oct 29, along with positive signs that could be seen following the government’s focus on reviving the economy. Refer from www.edgeprop.my Construction “giants” are said to be forming consortiums and JVs to prepare for the “eventual” construction tenders for the Klang Valley Mass Rapid Transit Line 3 (MRT3), The Edge Malaysia reported in its latest issue.

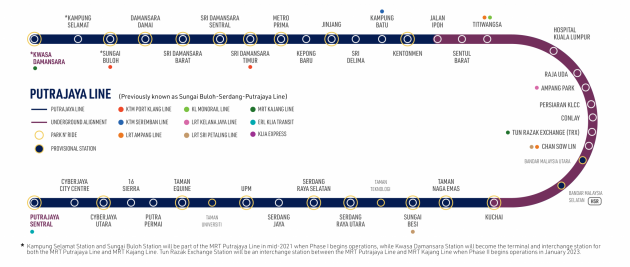

“YTL Corp is said to be partnering with Siemens and a bumiputera company, while SunCon [Sunway Construction Group] and IJM Corp are in a JV together. “This is, of course, in addition to MMC Corp Bhd and Gamuda Bhd coming together again to bid for the project,” wrote the weekly. MMC and Gamuda were the project delivery partners for the Sungai Buloh-Kajang Line (MRT1) and the turnkey contractor for the Sungai Buloh-Serdang-Putrajaya Line (SSP or MRT2). “Everybody is gunning for it. The big guns are preparing for it,” a source told The Edge. MRT3 will link the MRT1 and MRT2 lines as it will go around Kuala Lumpur city. Earlier reports have revealed that the line will have 30 stations, with 10 being interchange stations and other MRT, light rail transit and KTM Komuter lines. In April, MRT Corp CEO Mohd Zarif Mohd Hashim said the entire alignment will be about 50km, of which 40% will be underground. The project will take about a decade to be completed (initial plans said that it was seven years). A CGS-CIMB Research report has stated that the MRT3 project is estimated to cost between RM27 billion and RM32 billion. Under the 12th Malaysian Plan (12MP), ceiling prices for affordable housing will be introduced in the resale market in order to control house prices, especially in the urban areas, MalaysiaKini reported today.