|

An aid package worth RM150bil has been unveiled to help the people, businesses, as well as those vaccinated under Phase One of the National Recovery Plan to curb the spread of Covid-19.

The government will also provide a total amount of RM10bil direct fiscal injection. In a special address, Prime Minister Tan Sri Muhyiddin Yassin on Monday (June 28) listed a number of initiatives under the package known as the "Pakej Perlindungan Rakyat dan Pemulihan Ekonomi (Pemulih)”. Here are the highlights: - The government will add up to RM500 for the Bantuan Prihatin Rakyat (BPR) for the month of July with payments to be made from June 29. The third phase of the BPR between RM100 and RM1, 400 will be paid in September. Payments for those who succeeded in the BPR appeals will also be paid out in September. Altogether, a total of RM4.9bil will be paid out for the BPR initiative. - Government to expand job seekers' allowance to Social Security Organisation (Socso) non-contributors especially to new graduates and informal sectors. They can register at MYFutureJobs and will receive an allowance of at least RM300. - Bantuan Khas Covid-19 (BKC) initiative for several categories. They are: 1) Households of hardcore poor will receive RM500 in August, RM500 in November, and RM300 in December. Singles from this category will receive RM200 in August and RM300 in November. 2) B40 households will receive RM500 in August and RM300 in December. Singles from this category will receive RM200 in August. 3) M40 households will receive RM250 while singles in this category will receive RM100 in August. The BKC is expected to benefit more than 11 million households and elderly as well as singles with an allocation of RM4.6bil. - The government will allocate a total amount of RM10mil to implement the food basket initiative especially for the Orang Asli - Government to allocate another RM1bil to ensure that the 1kg pollybag of cooking oil remains at RM2.50. - RM15mil will be allocated to non-governmental organisations to help out in social issues such as mental health, homelessness, and other issues. - To address the issue of cost of living, the government will maintain the retail price for RON95 petrol, diesel, and LPG, which is expected to involve a subsidy worth RM6bil this year. - The government will also implement a price control programme based on the threshold value of crude palm oil to control the price of one kilogramme to five kilogramme of cooking oil bottles. - A discount on electricity bills between 5% and 40% up to a maximum usage of 900kilowatt hours a month will be given. This includes a 40% discount for usage that is below 200kilowatt hours, and 15% discount for usage that is between 201kilowatt hours and 300kilowatt hours. All in, the rakyat is expected to save up to RM346mil in electricity bills for three months from July. - Economic sectors that have been badly hit, particularly hotel operators, theme park operators, convention centres, shopping malls, and tour operators will get a three month extension of electricity bills of 10% from October to December. - Telecommunications companies have agreed to extend the 1GB of daily free data until the end of the year. This initiative is estimated to be worth RM500mil and will benefit 44 million registered customers all over the country. - Additional RM500 to eligible recipients under the Prihatin Special Grant (GKP) 3.0 initiative, with payment expected to be made by mid-July this year. In total, the government had allocated a total of RM5.1bil via the GKP initiative. - Understanding the struggle of the SMEs, the government announced an additional payment of RM500 under GKP 4.0 to eligible recipients which will be paid in September and another RM500 in November this year. - The government will allocate RM18mil for local banks to provide about 30 units of mobile banks in Peninsular Malaysia, Sabah and Sarawak, which are expected to cover 250 rural localities. Through this initiative, various banking services including opening of accounts; savings, withdrawal and transfer of money; bill payments as well as digital banking can be accessed. - Government will continue Wage Subsidy Scheme for the fourth time with an allocation of RM3.8bil, expected to benefit more than 2.5 million workers. Through this scheme, the government will support up to 500 workers per employer with assistance of RM600 per worker for four months. This will be two months for every sector in the second phase of the National Recovery Plan, and another two months for the sectors categorised as negative in the third phase of the NRP. There are no salary limit conditions, and this means that employers can apply for the scheme even if their employers earn more than RM, 4000 a month. - Government will automatically exempt payments for the HRD levy for two months to employers who are not able to operate during the lockdown. - Employers from new sectors as a result of the expansion of the Human Resources Development Fund Act 2001 will be given a levy extension under Dec 2021. This initiative is estimated to be worth RM425mil. - Government agrees to extend the PenjanaKerjaya programme that is due to end in June with several improvements. This includes reducing the salary eligibility limit from RM1, 500 to RM1, 200 ringgit for the “Malaysianisation” programme to give more incentives to employers to replace foreign workers with local workers. The employment contract period will also be reduced from 12 months to six months for employees aged 50 and above, the disabled and ex-prisoners.

0 Comments

The government is expected to announce appropriate assistance, including on moratorium and the i-Sinar facility to alleviate the burden of the people affected by Covid-19 soon. Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz said the matter was discussed with Prime Minister Tan Sri Muhyiddin Yassin and the relevant agencies. "The government is listening to its people, as such appropriate assistance will be announced soon," he said in a Facebook post today. Yesterday, Tengku Zafrul in a Facebook post said the government will consider all proposals and solutions submitted by all parties to ease the burden of the people. "This is for Phase 1 and the next phases under the National Recovery Plan." Tengku Zafrul said among the requests often received by the ministry was on the extension of the i-Sinar and i-Lestari facilities. Previously, various parties had asked the government to implement an unconditional moratorium, as well as to extend the i-Sinar facility to help those affected by the implementation of the Movement Control Order to curb the spread of Covid-19. In earlier of the month, in a special message announcement on PKP 3.0 Assistance, under the assistance of the Strategic Program for Empowering the People and Additional Economy (Pemerkasa PLUS), the government has agreed to grant a loan repayment assistance to individuals who have lost their jobs, B40 recipients of BSH/BPR, SMEs and Microenterprises that are not allowed to operate during the MCO. Those affected will be given the option to get the approval of the - moratorium automatically for 3 months or- get a reduction in repayment in instalments of 50 percent for 6 months. Although it is announced that the moratorium will be given automatically, borrowers would still need to contact their respective banks to opt-in for this benefit. M40 and T20 borrowers who have experienced a reduction in income (including salary, allowances, commissions and household income) are also encouraged to apply for the loan repayment assistance. All you need to do is request a reduction in monthly instalments according to the reduced income. Providing relevant documents may further help with obtaining the assistance. This initiative will be implemented immediately in June and is expected to benefit more than 5 million borrowers. All you need to do is contact your respective bank to apply for this automatic moratorium as each bank has different terms and flexibility. These include moratoriums on home loans and car loans. Another important note is that borrowers’ CCRIS report will not be affected for selections made in 2021 so choose wisely and make the most out of this loan repayment assistance. Just contact your banks and choose. For further information, visit bnm.gov.my/RA Contact Agensi Kaunseling dan Pengurusan Kredit (AKPK) for advice and guidance at https://services.akpk.org.my/ The nationwide full lockdown will be extended for another two weeks starting June 15. Senior Minister Datuk Seri Ismail Sabri Yaakob said the decision was made after considering the high number of daily cases reported. He said the National Security Council’s special meeting chaired by the Prime Minister yesterday heard a report and proposal presented by the Health Ministry. “It has been decided that the lockdown will be extended for two weeks, taking effect from June 15 to 28, ” he said in a statement. The lists of positive and negative activities as well as standard operating procedure for manufacturing businesses and industries remain unchanged. “Since the dos and don’ts list as well as SOP are unchanged, I hope there will be no confusion in enforcing the SOP. “I do not want the public to be affected by the wrong interpretation of SOP by enforcement bodies, ” said Ismail Sabri. Sources said those who attended the meeting agreed that the lockdown should be extended. “After listening to the (Health) ministry’s presentation, everyone shared the same view that there is a need for (the lockdown) to continue for another two weeks to see if the number of daily cases can be brought down, ” said a source. On May 28, the Prime Minister announced that the country would go into a full lockdown for 14 days from June 1, with only essential economic and service sectors allowed to operate.

At the time, the healthcare system was thought to be near breaking point as the number of Covid-19 cases had breached the 8, 000 mark and new variants had emerged. Tan Sri Muhyiddin Yassin had said then that should the first phase of lockdown succeed in reducing the number of daily cases, the government would move to a second phase of four weeks with certain economic sectors to open, provided no large gatherings are involved and physical distancing is practised. “After that, Phase Three would start with the implementation of a movement control order where no social activities are allowed, ” he had added. Refer from thestar.com.my Despite the challenges of Covid-19, Kuala Lumpur-headquartered real estate technology company Juwai IQI reports that Malaysian residential real estate sales in specific market segments are growing quickly.

The company transacted 293% more new project sales in 2021 to date, compared to the same period of 2020. The 2021 sales are 247% higher than during the corresponding period in 2019. The latest coronavirus restrictions have not caused sales to drop. Juwai IQI Group Co-Founder and CEO Kashif Ansari said: "The MCO (movement control order) didn't hurt Juwai IQI's sales in Malaysia as one might have expected. On the contrary, our sales went up during that period. "This is because our technology platform made it possible for us to continue to serve buyers despite the MCO. Since then, we have continued to invest in technology and are building a 1000-person global technology and data team here in Kuala Lumpur. "Paradoxically, it is because of Covid that many people believe this is a good time to purchase homes. Malaysians have been spending less due to the pandemic-related restrictions. As a result, they have built up more savings and want to put that money to good use by buying a stake in the property market." Ansari said their recent consumer survey found that 70% of Malaysians have neither lost a job nor had to close a business during the pandemic. "Most Malaysians are still earning their income but are not spending as much as before the pandemic. Many are using the money for down payments on property instead. "What many see as the upcoming property boom is another reason people are buying property today. Observers expect that economic, employment and income growth should increase more rapidly in the post-pandemic rebound than the pre-Covid rate," he said. These conditions tend to coincide with rising property demand and prices, said Ansari, adding that the demand was fuelled by the low interest rates, reintroduction of the Home Ownership Campaign and other property-related initiatives introduced in Budget 2021. "We foresee a robust market post-pandemic, in which the best positioned and best-designed properties will sell more rapidly and at higher prices. Less attractive homes will also benefit to some degree from the rising demand. MCT Bhd is looking to launch seven new developments, worth RM2.2 billion in total, this year. These launches comprise residential units and commercial projects.

These seven launches include Aetas Damansara in Tropicana Golf & Country Resort, Damansara; Alira in Metropark, Subang as well as Sanderling Lakefront Residences in Cyberjaya. Other projects include a boutique commercial centre at Lakefront Cyberjaya; the maiden phase of Cybersouth Town Centre in Dengkil as well as new residential developments in USJ Subang and Cybersouth, respectively. CEO Teh Heng Chong expects the property market to continue its path towards recovery as the global economy is gaining steady progress following the recent Covid-19 vaccine roll-out. The low interest rate environment and reintroduction of the Home Ownership Campaign, he said, present good buying opportunities, and more homebuyers are searching for their dream homes. “Recognising the prevailing uncertainties in the environment, we have quickly pivoted to broaden our product offerings to support future growth and build business resiliency. Over the past few years, we have been growing our presence in the southern region of the Klang Valley, focusing on residential developments in Cyberjaya and our first township development in Cybersouth,” he said in a press release. “Moving forward, we aim to expand our development footprint, targeting prime areas within the Klang Valley, in order to reach out to various market segments. We are also actively pursuing joint venture and land acquisition opportunities to fuel future growth.” MCT currently has an undeveloped land bank of 289.5 acres with a total gross development value (GDV) of about RM11.4 billion. Aetas Damansara will be officially launched this month, offering 226 condominium units priced from RM1.97 million. The RM564 million project spans 1.76 acres in Tropicana Golf & Country Resort. The developer’s maiden luxury residential project is also a joint development with Ayala Land, Inc. Teh explained that Aetas Damansara echoes MCT’s new vision to set a new benchmark of living spaces anchored on three key elements — bespoke design, efficient space planning and best-in-class fittings. Each unit has an exclusive private lift lobby, which is further enhanced with a multi-tier security system. Also, phase one of Alira in Metropark Subang is targeted for launch in the first quarter. With a GDV of RM316 million, it consists of 492 apartment units, with built-up areas from 695 to 1,048 sq ft. Sanderling Lakefront Residences will have 606 units of condominiums priced from RM475,000. To be launched in the second quarter, the development is surrounded by universities and technology-related workplaces. In 2020, the group has handed over 3,053 units to homeowners of Selangorku PR1MA Lakefront Homes, Lakefront Residence (Phase Two) in Lakefront Cyberjaya as well as Casa Bluebell and Casawood landed residential developments in Cybersouth township. There is a crane incident at The Exchange TRX. The good news is there is no one injured in the incident. "No one was injured in a crane incident at The Exchange TRX project site yesterday", said property developer Lendlease. A heavy storm started at approximately 6pm and it has been established that the crane jib had come down during this storm event. No one was injured during this incident," said the group said in a statement. “A team has been assembled to manage the situation and we are working closely with the relevant authorities. The team is unable to provide further details, as investigations are ongoing. “The safety and well-being of our workers onsite remain our top priority,” added Lendlease. The Exchange TRX, formerly known as the Lifestyle Quarter, is located within the 70-acre Tun Razak Exchange (TRX) development. The retail component will offer 1.3 million sq ft of net lettable area.

Developed and managed by LQ Retail Sdn Bhd, The Exchange TRX is a joint venture between international property and infrastructure group Lendlease (60%) and TRX City Sdn Bhd (40%), the master developer of TRX. TRX City is wholly owned by the Ministry of Finance. CapitaLand Malaysia, a unit of Singapore-listed CapitaLand Ltd, said it is the first mall operator in Malaysia to onboard seven malls within its portfolio onto Grab's Malls by GrabMart platform.

The seven malls comprise Queensbay Mall in Penang, Melawati Mall in Taman Melawati and five owned by CapitaLand Malaysia Mall Trust (CMMT) — Gurney Plaza (pictured) in Penang, a majority interest in Sungei Wang Plaza in Kuala Lumpur, 3 Damansara in Petaling Jaya, The Mines in Seri Kembangan and East Coast Mall in Kuantan. In a press release, CapitaLand Malaysia’s head of retail Eddie Lim said an omnichannel strategy to support shoppers and retailers was catalysed by the greater adoption of digitalisation in the retail sector during the Covid-19 pandemic. Consumers opted to stay at home as movement restriction orders were in place, leaving a significant impact on many businesses. Shoppers can now enjoy the convenience of shopping at CapitaLand malls within a digital space in the comfort of their homes. With more than 50 CapitaLand tenants listed on Malls by GrabMart, shoppers can mix and match their orders from different stores in the same mall and have the orders delivered, and pay only one delivery fee. Grab Malaysia head of commercials JJ Tan said: “With popular household brands under CapitaLand’s list of merchants on Malls by GrabMart, we are confident that shoppers will find it more convenient to shop online from these merchants and have their purchases delivered right to their doorstep in a single order with one delivery fee. This would definitely be a much safer and cost-efficient way to purchase a variety of items from different shops from the same shopping mall.” CMMT is listed on Bursa Malaysia and has a market capitalisation of RM1.46 billion. The article is refer from edgeprop.my Penang is honorably being ranked No.3 in Global for being 2021 BEST Islands in the World to Retire On. Wow what an honor for us. Its not just the heaven for great food but its heaven for retiree to retire in. International Living listed Penang as the 3rd best island in the world to retire in, after Malta and Mallorca, Spain. International Living consists of “in-the-know professionals” who have been covering overseas retirement trends for over 40 years. The list listed Top 15 Islands in the World to Retire On. The criteria for the list include “the ability to live a simpler, more peaceful life without breaking the bank”. George Town, Penang is “home to eclectic architecture, a vibrant art scene, and the best street food in the world”.

There are 3 other Asian countries that made the list as well, aside from Penang, Malaysia. They are Bali (9th place), Koh Samui, Thailand (10th place), and Phu Quoc, Vietnam at 15th place. Here's the Full List of Top 15 Island in the World to Retire On:

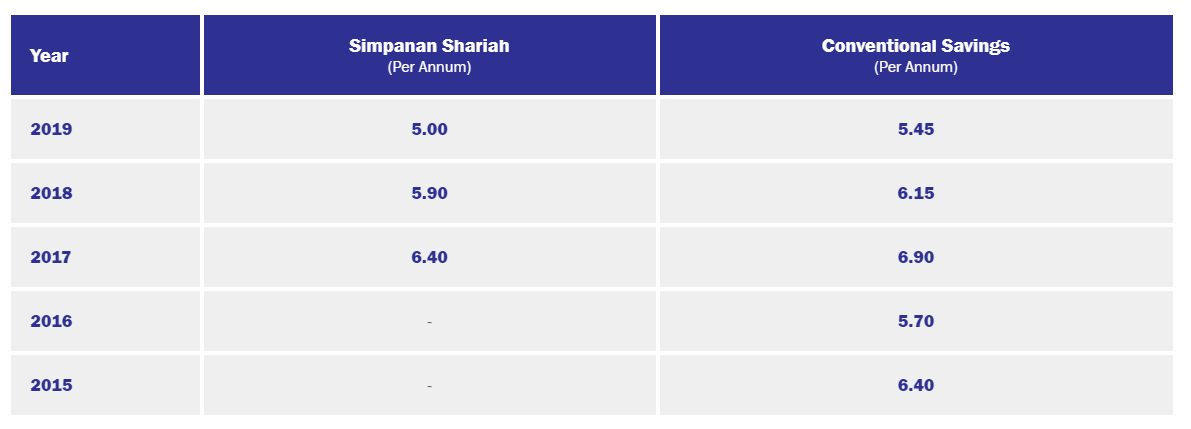

Great news that MRT 3 is reviving and MRT 2 is completing soon and operating in August 2021. That will make our public transportation coverage much wider and much further. Thus this will further benefit Malaysians where our Public Transport system is much better than ever. Back to 7th November 2020, Malaysia government had announced in Budget 2021 that they are reviving the multi-billion ringgit Mass Rapid Transit Line 3 (MRT 3) under the Budget 2021. "Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz says the government has allocated RM15bil for transport infrastructure projects for 2021 as part of the government’s commitments that will benefit the people. Aside the MRT 3 project, the government will fund projects like Pan Borneo Highway, Rapid Transit System Johor–Singapore, first phase of Klang Valley Double Track (KVDT) and Gemas-Johor double tracking." Today, it is announce by Transport Minister Datuk Seri Dr Wee Ka Siong that the construction of the Mass Rapid Transit Line 3 (MRT3) project, which was suspended by the previous government, will begin in the second half of this year. Transport Minister Datuk Seri Dr Wee Ka Siong said as such, the ministry had given Mass Rapid Transit Corporation Sdn Bhd (MRT Corp) three months to update the studies conducted previously on the implementation of the project, to be presented to the Cabinet.

“In the recent cabinet meeting, the government agreed to go ahead with the MRT3 Circle Line and MRT Corp was given three months to update the studies which include the cost of this project,” he told reporters here today. He said this after inspecting the operational availability of the first phase of the Putrajaya MRT Line from the Sri Damansara Sentral MRT Station to the Kampung Batu MRT Station, Kuala Lumpur. On the Putrajaya MRT Line, Wee said the project had reached 97% in construction progress, and is expected to begin operations in August. He said the remaining 3% of the 17.5km MRT line project only involves testing and commissioning of mechanical and electrical systems as well as trial operations. Wee said the second phase of the project from Kampung Batu to Putrajaya, which had recorded an overall progress of 87%, is scheduled to start operations in January 2023. The total construction cost of the Putrajaya line is RM30.53 billion. Bank Negara Malaysia has maintained the Overnight Policy Rate (OPR) at 1.75 per cent at its second Monetary Policy Committee (MPC) meeting today. The central bank’s MPC considers the stance of monetary policy to be appropriate and accommodative. “Given the uncertainties surrounding the pandemic, the stance of monetary policy going forward will continue to be determined by new data and information, and their implications on the overall outlook for inflation and domestic growth. “The bank remains committed to utilising its policy levers as appropriate to foster enabling conditions for a sustainable economic recovery,” it said in a statement BNM said, domestically, the latest indicators point to improvements in external demand and continued consumer spending.

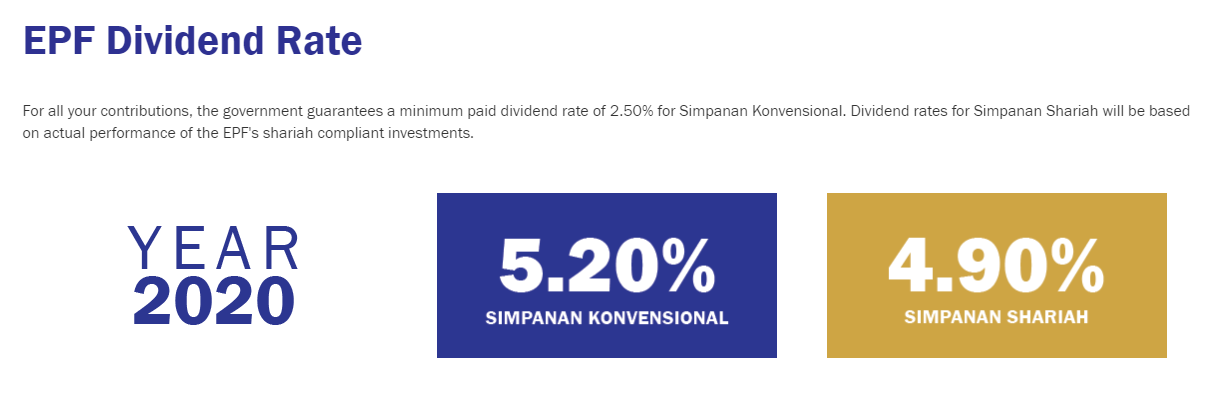

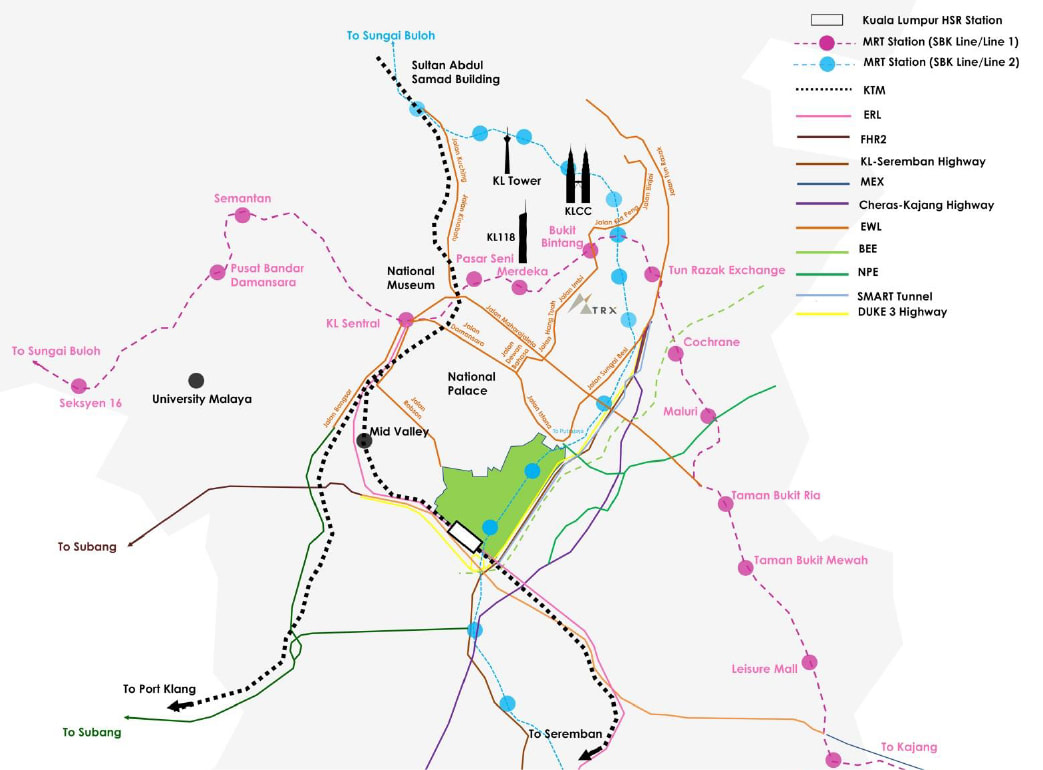

The reimposition of containment measures will affect growth in the first quarter but the impact is expected to be less severe than that experienced in the second quarter of 2020. “Going forward, growth is projected to improve from the second quarter onwards, driven by the recovery in global demand, increased public and private sector expenditure amid continued support from policy measures and more targeted containment measures,” the central bank said. The growth will also be supported by higher production from existing and new manufacturing facilities, particularly in the electrical and electronic and primary-related sub-sectors, as well as oil and gas facilities. “The rollout of the domestic Covid-19 vaccine programme will also lift sentiments and economic activity. “The growth outlook, however, remains subject to downside risks, stemming mainly from ongoing uncertainties in developments related to the pandemic, and potential challenges that might affect the rollout of vaccines both globally and domestically,” it noted. Meanwhile, the headline inflation in 2021 is projected to average higher, primarily due to higher global oil prices. In terms of trajectory, headline inflation is anticipated to temporarily spike in the second quarter of this year due to the lower base from the low domestic retail fuel prices in the corresponding quarter of 2020, before moderating thereafter. Underlying inflation is expected to remain subdued amid continued spare capacity in the economy, it said, adding that the outlook, however, is subject to global oil and commodity price developments. BNM said the global economic recovery, while uneven, is gaining momentum, supported by steady improvements in manufacturing and trade activity. The ongoing rollout of vaccination programmes in many economies, together with policy support, will further facilitate an improvement in private demand and labour market conditions. “While financial markets have experienced bouts of volatility, financial conditions remain supportive of economic activity. “Risks to the growth outlook have abated slightly, but remain tilted to the downside, primarily due to uncertainty over the path of the Covid-19 pandemic and effectiveness of the vaccination programmes,” it added. As from the declaration from KWSP in their website www.kwsp.gov.my on 24th Feb 2021, the EPF Dividend Rate for 2020 will be 5.20%. This for the first time EPF had outperformed PNB's benchmark Amanah Saham Bumiputera (ASB). Permodalan Nasional Bhd’s (PNB) dividend for 2020 is declare at 4.25%.

One of the main factor is that EPF's asset are in Bonds and Overseas investment, unlike PNB portfolios. The highest payout of EPF is declare at 6.9% dated in 2017. Last month, PNB announced a distribution payout of 4.25 sen per unit plus an “Ehsan” payment of 0.75 sen for the first 30,000 units for its flagship fixed-price unit trust fund ASB for the financial year ending Dec 31, 2020 Over the years, there have been many suburbs that have seen a surge in property value and market demand due to a host of factors such as the introduction of infrastructure developments, retail developments that draw in a crowd as well as unique residential and commercial developments that add to the profile of the location. StarProperty takes a look at the eight suburbs that are showing promises for the near future based on Compound Annual Growth Rate (CAGR) of terraced houses, shop lots and condominiums as well as existing and incoming infrastructure developments. Kota DamansaraKota Damansara has been an increasingly popular choice over the years due to its number of condominiums and connectivity to shopping malls and offices within the TTDI, Mutiara Damansara and Bandar Utama area. Kota Damansara has also seen an influx of office spaces but it is the residential developments that are thriving with terraced houses enjoying a staggering 6.5% CAGR increase in the same period. Damansara Heights Damansara Heights has always been known for its luxurious catalogue of bungalows stacked along windy roads that are home to affluent individuals. The residential houses within the area have always had a huge price tag with even smaller units running into the millions. In the beginning of 2016, terraced houses saw a dip in price under RM1,000 per sq ft (psf) until the MRT Line 1 was launched later in the year. As of 2019, the average price has returned to over RM1,000 psf and is on a steady incline. Taman Tun Dr Ismail (TTDI) TTDI has a reputation for quality neighbourhoods that have stood the test of time mostly consisting of terraced houses. Over recent years, there have been an influx of office towers like Menara KEN TTDI and Menara LGB, boasting tenants that include Deloitte and CIMB. Shop offices here have seen a 1.5% CAGR increase between 2015 and 2019 with an average transacted price of RM4.75mil. TTDI’s reputation for residential developments is further reinforced by the 1.6% CAGR increase in the same period. The influx of businesses is further complemented by the accessibility to the MRT Line 1. Mont KiaraThis township went from an isolated rubber estate to a condominium haven within 30 years. Mont Kiara is a unique location with the large number of expatriates residing there, namely from South Korea and Japan. Despite the large number of condominiums within the area, these developments are still holding their value and seeing price appreciation. Between 2015 and 2019, the average transacted price for a condominium increased by 1.3% CAGR lingering above the RM650 psf mark. Shop offices here have seen a 2.5% CAGR increase within the same period. Mont Kiara is, however, an evolving location that is expanding on its reputation as a condominium hub with the entry of projects like The MET Corporate Towers, a Grade-A stratified office tower, set to be completed in 2022. KepongFormerly recognised for tin mining until the emergence of Desa Park City that transformed this suburb into an upper class neighbourhood. Although the surrounding developments are not as refined or conceptually sound as those in Desa Park City, they have enjoyed an increase in property value. For instance, shop offices in Bandar Manjalara saw a 2.3% CAGR increase in average transacted price between 2015 and 2018. Additionally, terraced houses here have seen a 4.6% CAGR increase to approximately RM600 psf. Things are looking even better with the introduction of Kiara Bay, a RM15bil mixed development and the incoming MRT Line 2. Sri HartamasSri Hartamas is one of the smaller townships on this list, but one with solid landed residential developments and excellent connectivity especially to the NKVE and Penchala Link. Recognised as a high-end community with luxurious developments, the introduction of Somerset Sri Hartamas, a serviced apartment with 308 units, is expected to spur demand further. The existing number of condominiums within the area have enjoyed a 2.4% CAGR increase between 2015 and 2019 while terraced units have increased at the same amount within the same period. Bukit JalilBukit Jalil is mainly known for the National Sports Stadium that has held many events over the years. As of late, there have been more commercial developments emerging in the area providing businesses with more options to house their operations. Between 2015 and 2019, shop offices here have seen a 1.6% CAGR increase with an average transacted price of RM1.96mil. The incoming MRT Line 2 will also complement the township with increased connectivity. BangsarBangsar is known to many as a high-end location with a reputation for pricey food and beverage options just outside the city centre area. Home to many expatriates and high networth individuals, it is a township that has commanded a great deal of demand over the years. Although residential developments have seen a drop in price over the last few years, shop offices within the area have seen a sizeable increase of 3% CAGR with an average transaction value of RM7.2mil as of 2018. This article is refer from www.starproperty.my

Here the summaries of the Budget 2021 Announcement. KUALA LUMPUR (Nov 3): Bank Negara Malaysia (BNM) has decided to maintain the Overnight Policy Rate (OPR) at 1.75% today as the country’s economic activity is projected to improve further and as the central bank expects the nation’s underlying inflation to remain subdued as the world economy contends with the resurgence in Covid-19 cases.

In a statement today, BNM said the global economy continues to recover, led by improvements in manufacturing and export activity although the resurgence in Covid-19 cases suggests that the global economic recovery will likely remain uneven in the near term. "For Malaysia, the latest indicators point towards significant improvement in economic activity in the third quarter. The introduction of targeted measures to contain Covid-19 in several states could affect the momentum of the recovery in the fourth quarter. Nonetheless, growth for the year 2020 is expected to be within the earlier forecasted range. "For 2021, economic activity is projected to improve further. This will be underpinned by the recovery in global demand, turnaround in public and private sector expenditure amid continued support from policy measures, and higher production from existing and new facilities. Nevertheless, the pace of recovery will be uneven across sectors, with economic activity in some industries remaining below pre-pandemic levels, and a slower improvement in the labour market. Downside risks to the outlook remain, stemming mainly from ongoing uncertainties surrounding the pandemic globally and domestically,” BNM said in the statement, which was issued following the conclusion of its Monetary Policy Committee's (MPC) final meeting for 2020 today. On Malaysia’s inflation, BNM said that in line with earlier assessments, headline inflation is likely to average negative this year given the substantially lower global crude oil prices. For 2021, headline inflation is projected to average higher. The country’s inflation outlook will continue to be significantly affected by global oil and commodity prices, according to BNM. "Underlying inflation is expected to remain subdued in 2021 amid continued spare capacity in the economy,” BNM said. According to BNM, the MPC considers the current stance of the central bank’s monetary policy to be appropriate and accommodative. "The cumulative 125 basis points reduction in the OPR this year will continue to provide stimulus to the economy. The MPC will continue to assess evolving conditions and their implications on the overall outlook for inflation and domestic growth. "The bank (BNM) remains committed to utilise its policy levers as appropriate to create enabling conditions for a sustainable economic recovery,” BNM said. The MPC had also during its meeting today approved the schedule of its meetings for 2021. BNM said that in accordance with the Central Bank of Malaysia Act 2009, the MPC will convene six times during 2021. "The meetings will be held over two days, with the monetary policy statement released at 3pm on the second day of the MPC meeting,” the central bank said. The articles is referred from theedgemarkets.com KUALA LUMPUR: The government just announced that Kuala Lumpur, Selangor and Putrajaya will be placed under Conditional Movement Control Order (CMCO) effective midnight Oct 14.

This was decided upon following advise from the Health Ministry after Covid-19 cases continue to increase in several districts within the Klang Valley namely Klang, Petaling and Hulu Langat, said Senior Defence Minister Datuk Seri Ismail Sabri Yaakob in a live broadcast today. The CMCO will come into effect at 12.01am Oct 14 until Oct 27. Inter-district travelling will be barred during this period and workers will need to show their work pass or consent letter from employers in order to move from one district to another. Ismail Sabri said only two persons from a household will be allowed to go out and buy essentials. All schools, higher learning institutions, skills training institutes, kindergarten, nursery, tahfiz centres, public parks and recreational parks will close as well as mosques and non-Muslim houses of worship. All sports activities, recreational, social, cultural and wedding receptions are not allowed to take place and entertainment centres and night clubs are not allowed to operate, he informed. However, all economic activities in Selangor, KL and Putrajaya can proceed as usual with a more detailed standard operating procedure (SOP) to be announced by the National Security Council soon. Refer from www.nst.com.my SCAM CALL have been getting more aggressive than ever in lately period.

Author just got a SCAM CALL and this encourage me to share to the public to help raise awareness about it. Do you know Malaysia is the Top 20 Nation in the global that is most affected by scam calls? The below is part of the Articles I refer from nst.com.my. “Malaysia is the market that receives the biggest percentage of scam calls in the world at 63 per cent. “Most of the calls are from financial services (21 per cent), insurance (10 per cent), operators (five per cent) and debt collectors (one per cent). “For the past 12 months, Malaysia has seen a 24 per cent increase in spam calls, from 6.7 to 8.3 spam calls per month. Scam calls from fake insurance and debt collectors are common. The Macau and Astro scams too have been flooding the market over the past year." And this is my experience over the Scam Call which claim to be calling from Public Bank. The guy have mention my name in Full and saying that I have not been paying the credit card bill for two months. I told him that I don't even have a credit card and he mention that in his system showed that I have a credit card under Public Bank and my name is Mr XXX. (Then I think this is the next step where he is going to ask me for personal details to clarify and perhaps offer me some good deal or card number etc.) Then I mention to him that I dont even have a Public Bank account. He mention that in the system have and bla bla bla... End up I told him, is it according to your Fraud List system, then suddenly he just hung up. The number showed in is 03-9418 5197. Well folks, just be more careful and Bank will never call in to ask for very detailed personal details for clarification. If you worry on what being mention in the phone call, you can go to the bank and verify. So PLEASE DO NOT give any sensitive personal details in Phone Call! The 486-acre Bandar Malaysia development is more than a financial and business centre; the development comprises offices, retail, residential, arts and entertainment, medical and education components that offer convenience to the residents and working population there. Another key feature that enabled IWH-CREC Sdn Bhd to win the Bandar Malaysia deal is the idea of creating an underground canal city — an inspiration which executive chairman of Iskandar Waterfront Holdings Sdn Bhd and chairman of Ekovest Bhd, Tan Sri Lim Kang Hoo obtained during a holiday in Montreal, Canada. The plan is to turn the underground space into a 24-hour retail and entertainment centre that caters to the needs of the working population in Bandar Malaysia.

Designed as an integrated terminus, the connectivity and accessibility to public transportation and road system are the greatest advantages of Bandar Malaysia. It comprises multi-level public transport networks including the upcoming Kuala Lumpur-Singapore High Speed Rail (HSR), soon-to-be-completed electrified double-tracking project, KTM Komuter, MRT and LRT, Monorail and Express Rail Link. In terms of road connectivity, it is easily accessible via Duke 3, KL-Seremban Highway, SMART tunnel, Maju Expressway, East-West Link Expressway and future elevated highways. This is one of the most positive and happiest video I ever watch in past months... Its not 100% successful but its positive enough for every single one of us. What if we finally get the vaccine? Will all of us get back to normal life? Or there new norm is still within our life? Lets enjoy this wonderful video done by Nas Daily. The below video is done by Nas Daily (2020, Aug 8th). "The Exciting Covid-19 Vaccine!" Retrieved from https://youtu.be/lJaR-tkiwV8. How about the effect on property? Once the vaccine is ready and work well. I suppose a lot of thing will back to the old norm but mixture with the new norm such E-Commerce and online meeting will be even more popular than ever. Tourism will back to close to old norm with more safety measures taken. Once tourism is back, short term stay especially in Tourism Spot will be back in business as well. Suppose more cleaning measures will be taken but that's the necessity for it to work. During this tough period since MCO started in Malaysia, there shall be more units been auction in the market. There is secret buyers group who are secretly but aggressively increase their portfolio during these hot period of Auction Market which lots of under value properties is in the Auction Market. Once the tourism market is back, short term stay such as AirBNB etc will be back and shall thrive as many is already itch for travelling. Currently, its the local tourism within Malaysians that getting attractive with lots of promotion in rushing to market. So lets the time tell if these vaccines be ready soon so we can get partial of our old norm back. At least life without MASK. Especially we are living in such a warm country. Aren't you enough of the MASK? Selamat Hari Raya Haji to all our muslim friends, colleagues and family

🌈 Travel Safely if any of you balik kampung For the rest of us Happy Holiday, Keep Safe, Keep Health and Keep in touch!😃 Bank Negara seen cutting key rate again as pandemic persistsKUALA LUMPUR: Malaysia's central bank is expected to cut interest rates to a historic low next week, according to a slim majority in a Reuters poll, as it seeks to protect Southeast Asia's third largest economy from the fallout of the coronavirus pandemic.

Bank Negara Malaysia (BNM) will cut its overnight policy rate (OPR) by at least 25 basis points (bps) to 1.75%, according to seven out of the 12 economists polled, with two of them betting on a bigger 50 bps rate reduction. The remaining five economists expected interest rates to stay at 2.00%, already a record low, after three consecutive rate reductions in as many meetings this year. Alex Holmes, Asia economist for Capital Economics, was one of the analysts who forecast a bigger move in the upcoming meeting. "Given the poor outlook for growth and deeply negative inflation, we suspect the BNM will make use of its policy space and opt for a 50bp cut," he said. Malaysia began easing some lockdown measures imposed to contain the spread of the Covid-19 coronavirus in May. After growing just 0.7% in the first quarter, BNM said Malaysia is in an "unprecedented economic crisis" and was poised for a contraction in April-June. While trade-reliant Malaysia had begun a "long and slow" recovery after some lockdown curbs were relaxed, Holmes said poor external demand and deflation warranted more policy easing. Malaysia's exports fell 25.5% in May, its biggest drop in 11 years. The consumer price index fell 2.9% in May from a year earlier, as the economy grappled with subdued consumption for a third straight month. The government in March rolled out a 260 billion ringgit ($60.69 billion) stimulus package to offset a sharp slowdown in domestic economic activity, and steep declines in tourism and demand for its commodities such as palm oil, crude oil and natural gas. ($1 = 4.2840 ringgit) - Reuters Refer from thestar.com.my KWASA Damansara City Centre (KDCC) forms the vibrant nucleus of the sprawling Kwasa Damansara integrated masterplan. It comprises retail spaces, offices, civic centres and residential component interlaced with pristine urban parks and lush landscaped green surroundings. The offices are situated on a 29.8-acre of land, a fully commercial component undertaken by Kwasa Land Sdn Bhd, while the remaining 64 acres of land will be developed by its project delivering partner, MRCB Land, into a mixed development that will form the entire KDCC. Planned and created by the pioneer of TOD developer, MRCB, the grand master plan of KDCC principally revolves around five distinct futuristic visions namely Green, Connectivity, Inclusive, Sustainability and Futuristic. KDCC will be a green metropolis masterpiece with a healthy 25% of the entire master plan being dedicated to green spaces and parks. The city centre is set to become Malaysia’s first integrated township development featuring elevated walkways with easy access to public transportation and major highways. Its inclusiveness cuts across the community; all walks of life can enjoy the wide public spaces, elevated walkways and lush urban parks. It is also being built to encompass multiple aspects of sustainability that include energy efficiency, the use of eco-materials, bio-climatic buildings, and landscape designs. KDCC is envisaged to be an integrated ICT smart township with state-of-the-art digital systems and infrastructure complete with broadband and high-speed fibre wire connectivity. It will incorporate multiple transport solutions that cater to the needs of large commuter traffic volumes. "KWASA DAMANSARA CITY CENTRE, A LANDMARK IN THE MAKING, ENCOURAGES VISION AND POSSIBILITIES" Project Name: Kwasa Damansara City Centre

Holding Company: MRCB Land Project Location: Kwasa Damansara Project Launch Date: 2020 Award Won: The Proximity Award With all the pressures felt by the property sector in a time when it is already in a lull period, it is of paramount importance that investors fully understand the real estate that they hold or plan to acquire. From the US-China trade war to an oversupply of several property categories and a weakening economy, the situation was worsened by the arrival of the Covid-19 pandemic. But that is not to say that there are no longer any opportunities in real estate, said CBD corporate services head Victor Lim, adding that information is the key that can unlock the potential of real estate. For investors looking at improving their income, he said they need to do their due diligence in gathering details of market comparison rental rates in the local area that apply to properties of similar type and age. Information gathering is essential “Survey the existing properties and new developments nearby. Get the required details of current sales and rents on offer,” he said, adding that landlords should take note of neighbouring properties coming up for sale or lease. Investors can check for new property developments details or changes in property zoning from the local planning office. “You will need to offer attractive leasing packages such as longer rent-free periods, improve or renovate your property, and keep the landscaping neat and trim,” he said. Lim, who is also a registered real estate negotiator specialising in office market particularly in the prime areas of Klang Valley, pointed out that investors need to look at the property type and customise them to suit what is in demand. “For example, consider furnishing up the bare spaces and amortised the cost into the rent, as the demand for fitted offices still remained strong,” he said. Information gathering is essential “Survey the existing properties and new developments nearby. Get the required details of current sales and rents on offer,” he said, adding that landlords should take note of neighbouring properties coming up for sale or lease. Investors can check for new property developments details or changes in property zoning from the local planning office. “You will need to offer attractive leasing packages such as longer rent-free periods, improve or renovate your property, and keep the landscaping neat and trim,” he said. Lim, who is also a registered real estate negotiator specialising in office market particularly in the prime areas of Klang Valley, pointed out that investors need to look at the property type and customise them to suit what is in demand. “For example, consider furnishing up the bare spaces and amortised the cost into the rent, as the demand for fitted offices still remained strong,” he said. Tenant movements As retaining good tenants is essential in ensuring a constant flow of revenue, he pointed out that it is always better to proactively reach out to tenants before the lease is up for renewal. “Seek professional help to market the property immediately after the tenant gives notice as this is to minimise the vacancy time and the flow of your income stream,” Lim said. Changes to the tenant mix may help the landlords with net income results, especially when the property is of a retail nature. “Research customer demographics that apply to the local population and the business community, and consider the potential trends and changes that will arise in the coming years,” he said. Minimise expenses As property expenses and outgoings will impact the net income, landlords need to keep track of their costs. “Review those outgoings. Compare the amount with the local market trends and that you are not spending more than the average when it comes to property operating costs,” Lim stressed. Diversification in property portfolio ownership will spread the risk of income exposure and minimise the risk. Diversifying across different locations and having a right mix of different property types will ensure that the portfolio as a whole continues to grow in terms of investment and financial goals. “By investing across a different price range, investors can increase the liquidity of their portfolio. For example, if you needed cash, you could dispose of one lower cost asset rather than if you were just holding one higher value property. “Moreover, commercial or industrial properties can be a great source for tax benefits, a retirement strategy, or paying mortgages on your other investments. Another option is investing in real estate investment trusts (REITs) for those looking to spread their investment portfolio across different markets,” he said. New opportunities

Old dated buildings that have low occupancy can be repurposed for new alternative uses depending on the location, neighbourhood and surrounding developments. With the current drop in property prices, it is a good time to track down such properties that can be used to generate a profitable income. For businesses which are facing financial difficulties, they should consider a sale and leaseback opportunities to free their cash flows, Lim said. “Such a move would lower fixed costs, and release capital for re-investment into their core businesses,” Moreover, there is no moving cost as these businesses can continue to operate from the same premise after their sale, he said. There will always be new opportunities, but the key is knowing where to look. Refer from starproperty.my KUALA LUMPUR (May 20): Fire broke out at the construction site of Millerz Square on Old Klang Road, Kuala Lumpur at around 9.30am today. Developer Exsim Group said in a statement that no injuries have been reported so far. “The local police and Bomba services were immediately alerted and the fire has now been put under control. Investigation on the cause of fire is ongoing. “Our sincere apology to those who have been affected by this mishap, especially to the immediate neighbours,” the developer said in a statement on its website. Thick smoke from the construction site of the mixed development could be seen from afar this morning. “We will provide updates as and when more information is made available, we will be delivering further updates,” the developer said. Refer from edgeprop.my

Wow! Bank Negara Malaysia have decide to further reduce the Overnight Policy Rate (OPR) by 50 basis point to 2% ONLY. Its ALL TIME LOW! Monetary Policy StatementAt its meeting today, the Monetary Policy Committee (MPC) of Bank Negara Malaysia decided to reduce the Overnight Policy Rate (OPR) by 50 basis points to 2.00 percent. The ceiling and floor rates of the corridor of the OPR are correspondingly reduced to 2.25 percent and 1.75 percent, respectively.

Global economic conditions have weakened significantly. Measures to contain the COVID-19 pandemic have disrupted economic activity across most economies. Recent indicators show that the global economy is already contracting, with global growth projected to be negative for the year. Financial conditions have also tightened amid elevated risk aversion and uncertainty. Substantial policy stimuli introduced by many economies, coupled with the gradual easing of containment measures globally, would partially mitigate the economic impact of COVID-19. Growth prospects should improve in 2021 with the expected containment of the pandemic. For Malaysia, domestic economic conditions have similarly been affected by the pandemic. Widespread containment measures globally, international border closures and the consequent weak external demand environment will exert a larger drag on domestic economic activity. The Movement Control Order, while necessary to contain the spread of the virus, has also constrained production capacity and spending. Labour market conditions are also expected to weaken considerably. Economic conditions would be particularly challenging in the first half of the year. The fiscal stimulus measures, alongside monetary and financial measures will, however, offer some support to the economy. With more businesses allowed to operate under the Conditional Movement Control Order, economic activity is projected to gradually improve. The outlook for growth continues to be subject to a high degree of uncertainty, particularly with respect to developments surrounding the pandemic. Inflationary pressures are expected to be muted in 2020, with average headline inflation likely to be negative this year, due mainly to projections for substantially lower global oil prices. Nevertheless, the outlook remains significantly affected by global oil and commodity prices, as well as evolving demand conditions. Underlying inflation is expected to be subdued given the projections of weaker domestic growth prospects and labour market conditions. The financial sector is sound, with financial institutions operating with strong capital and liquidity buffers. Liquidity remains ample, augmented by liquidity injections by Bank Negara Malaysia. Since March 2020, Bank Negara Malaysia has provided additional liquidity of approximately RM42 billion into the domestic financial markets, via various tools including outright purchase of government securities, reverse repos and the reduction in Statutory Reserve Requirement. Bank Negara Malaysia stands ready to provide liquidity in the interbank market to ensure orderly market conditions, conducive to support financial intermediation activity. With the decision today, the OPR has been reduced by a total of 100 basis points, complementing other monetary and financial measures by Bank Negara Malaysia as well as fiscal measures this year. Together, these measures will cushion the economic impact on businesses and households and support the improvement in economic activity. The MPC will continue to monitor the outlook for domestic growth and inflation. The Bank will utilise its policy levers as appropriate to create enabling conditions for a sustainable economic recovery. Bank Negara Malaysia 05 May 2020 Refer from bnm.gov.my |

MPIG NewsIn this section we will be sharing on articles & news update related real estate and some other interesting topics. Archives

August 2023

Categories |

- Home

-

New Property Launch

- Lake City @ KL North NEW PHASE FROM RM380k

- Alora Residences – Inspired living within greenery in Subang Jaya

- PJ Spacious and Affordable 5 Star Condo

- Best Investment 2022 PJ Damansara Low Risk Low Entry Price High ROI

- 2022 PJ Rumah Mampu Milik RM270k Damansara

- Bangsar South 2 Rooms from RM390k BELOW Market Price

- 10% ROI PJ Project near Ikea and One Utama Mall

- Mid Valley Seputeh New Launch

- Pavilion Damansara Heights 柏威年 白沙罗岭 马来西亚 吉隆坡 精选楼盘

- 马来西亚RM300千的PJ屋子-首购族,年轻人月入3千能买房

- 2021 Penang Most Awaited Project

- 2021 New Launch - KL Metropolis

- Freehold LRT Linked 3 Room Suites in Glenmarie

- New SPACIOUS Kepong Landed 6 Room 6 Bath

- Bangsar Last Piece Land New Launch

- Avara Seputeh (Mid Valley)

- Project Announcement Registration. Malaysia New Property Launch

-

Existing & Past Project

- 2020 Lowest Risk & Price in Klang Valley with Great ROI

- Kiara East Suite Dex

- 2019 SAFEST PROFITABLE HIGH CASHBACK INVESTMENT

- Best Property Investment Projects in 2018

- KL City Freehold Spacious Affordable 3 room Project

- Jalan Kuching Freehold New Office & Shoplot

- Jalan Ipoh New Freehold Shoplot & Offices

- RM300k KL Sentral New Prelaunch

- The Olive Condo, Sunsuria City

- Prelaunch Landed House Bukit Rahman Putra

- RM260k No Downpayment Puchong South Suites

- PJ North RM400k High Cash Back Project

- Denai Sutera @ Alam Sutera, Bukit Jalil

- First Phase of Banting New Township

- Neu Suites 3rdNVenue @ Embassy Row by Titijaya & CREC

- COURT 28, Jalan Ipoh KL City New Property Launch Service Apartment. Malaysia New Property Launch

- Semanja Kajang New FREEHOLD Kajang Double Storey Houses. Malaysia New Property Launch

- M Suite @ Desa Park North

- BIJI LIVING @ Sek 17 PJ City by Conlay. Malaysia New Property Launch

- Amani Residence Bandar Puteri Puchong New Freehold Service Apartment. Malaysia New Property Launch

- SFERA RESIDENCY @ Puchong South. Malaysia New Property Launch

- KL North Last Release

- PreLaunch Freehold Double Storey

- LAND

- News & Articles

- Other Reference Link & Services

- Referral

- Career

- MPIG

- Get Professional Advice

- PJ八打灵2021全新地产项目分析手册

RSS Feed

RSS Feed