|

The question of where to live has different answers for everyone. Some people want to buy an affordable home on the outskirts of town, while others are on the hunt for an awesome condo to rent in downtown KL. In meeting those needs, more and more Malaysians are deciding to rent property rather than buy, whether for economic or individual reasons. Affordable homes have been a big part of the conversation in Malaysia over the last decade. As house prices have risen, so too has the pressure on the nation’s rental market. The question of rental practice, and tenancy agreements in Malaysia, can sometimes seem a little confusing though. So in order to clear up the complications of rental practice, we’ve created a comprehensive guide to tenant rights and the role of a rental agreement in Malaysia. What Are Your Rights As A Tenant Tenant rights in Malaysia are something of a complicated picture. While there’s currently no specific legislation covering rental agreements, a study is underway to introduce a much-anticipated Residential Tenancy Act in the next few years. This act is not only designed to protect tenants but to ensure a fair market for landlords too. As things currently stand, there’s no single regulatory framework or mandatory contractual obligation for a specific tenancy agreement. You can meet Ali on the street and agree to move into his apartment, creating an oral agreement for tenancy. Of course, you’d be mad not to check the house first! So what laws impact the rights and responsibilities of tenants and landlords? Here’s a quick list:

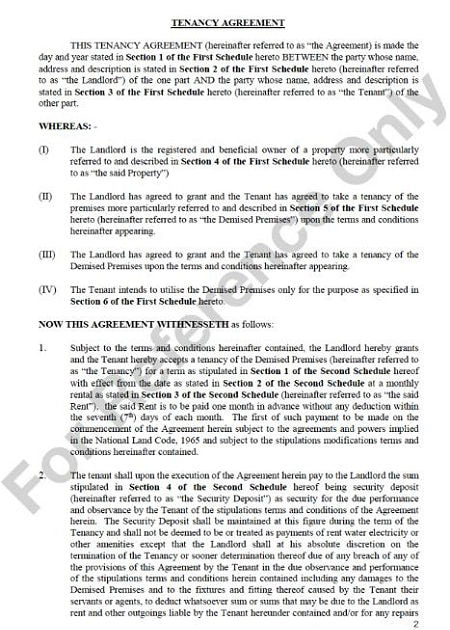

One crucial piece of legislation to note is the definition of a tenancy itself. Under the National Land Code, any rental under three years is defined as a ‘tenancy’, and does not require registration. Any lease for a period longer than three years is technically defined as a ‘lease’, and would require registration. So with all these complications, how best to protect yourself? Well, a tenancy agreement is a good place to start. Here are more details of the tenancy agreement, and a tenancy agreement sample below: This kind of rental contract lays out the terms and conditions agreed upon by the landlord and tenant at the start of a rental period. It’s an important document to ensure that both parties understand their responsibilities, and both parties have their rights protected. While the sample rental agreement above offers a general template, the nuts and bolts of an agreement are down to you and the landlord. That can include standard clauses such as rental cost and rental period, but also cover oddly specific things such as whether your goldfish is allowed to stay, or even if you’re allowed to decorate your bedroom. It’s common for landlords or letting agencies to offer an existing tenancy agreement template, but don’t be afraid to ask for additional clauses if you really want to make sure things you’ve discussed are set down in stone. Make sure you check the property thoroughly before signing the agreement too – often you’re accepting the property as it currently is, meaning if you miss out on a broken air-cond now, you might be charged for it later. Now, here are some of the things you should look for in a rental agreement:

Early Termination Of Tenancy Agreement In Malaysia This is a question that gets asked a lot, so it’s worth highlighting clearly. Under current contract law in Malaysia, if you sign a two-year rental agreement, and then choose to cancel after one year, you may be liable for the 12 months of outstanding rent Since the original tenancy agreement covered a two-year period, then contractually you are obliged to fulfil that obligation! Sucks? Sure does. There’s also a situation where a change of ownership may cause issues. If a rental agreement is registered as a lease, then in the event a property is sold, the new owner is automatically tied to that agreement. If the property is rented for less than three years, and the owner claims no knowledge of the rental agreement, the buyer may have the right to remove the tenant. Such problems can be smoothed over if the original owner sets out terms as part of the Sale and Purchase Agreement to allow the tenancy to run its course. What Your Landlord Should Expect Of You Don’t forget – landlords have their own rights too! Many of those rights will be set out in the rental agreement itself, but a common understanding of a tenant’s duty of care and respect for property can be summarised fairly simply with the following expectations:

Your Obligations As A Tenant We sometimes think of our obligations (while we’re tenants) as simply financial one. It’s true though, that the landlord is going to come looking for you if you don’t pay your monthly rent! You also have obligations to ensure you maintain that property at a good standard and care for it during your tenancy. Those responsibilities can include:

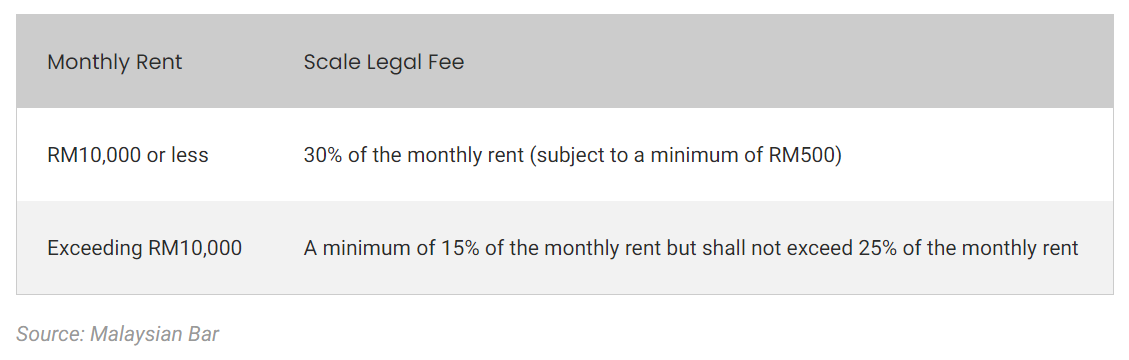

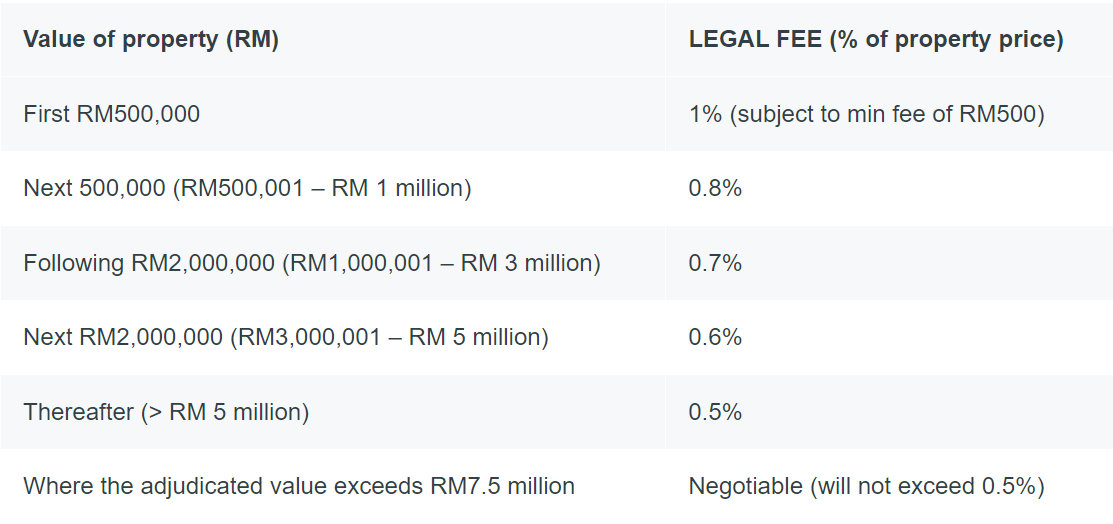

Rental Fee And CostsThere’s that little matter of deposits or booking fees to consider when signing up for a rental property. The rent might be RM1,000 a month, but chances are you will need a more substantial deposit upfront. This is typically in the form of a security deposit, committing an amount that goes towards any repairs in the event you cause damage to the property. This is often set at the equivalent cost of 2 months rental. So if your rent is RM1,000, the deposit would be RM2,000. The earnest deposit is another element of the rental market worth noting. This is often priced at an amount equivalent to the first month’s rent and is considered a holding fee to note your intent for a property and ensure the landlord doesn’t rent it out elsewhere. This should be paid to a reputable agent, who acts as a responsible (and NEUTRAL) third-party holding this fee. Make very certain you understand the terms and conditions around the earnest deposit, what it counts towards, and what happens once the full agreement is complete. A utility deposit may also be taken, which would provide payment security against any unpaid utility bills at the time the rental agreement ends. Stamping fees and administrative charges may also be required, and relate to legal review and stamping of the rental contract agreement. This means a lawyer has reviewed and certified the tenancy agreement. It’s worth discussing where this obligation for these fees will sit, since in some cases a landlord would shift those to a tenant rather than pay themselves. Often the legal fees are paid by the landlord, and the stamping duty by the tenant. 2023 Rental Legal Fees What Happens In A Tenancy Dispute Good communication is the first step to preventing any disputes! Be honest and open with your landlord or landlord’s letting agent. That means if accidents happen or things break down, you should tell them. Likewise, it’s important your landlord keeps you informed of any problems. If they’re sending around a repairman to upgrade or fix something in the house, they should tell you in advance, and not just assume you’re happy that some random plumber turns up without warning. These are basic examples, but paint a picture of the importance of good communication. Discussion should always be the first step in any dispute. It may be that a verbal agreement can fix a problem far better than any legal action. Many such disputes will already be covered by the terms and conditions of a good tenancy agreement. Common Legal Problems For Renters The most common legal problem for renters is the question of early termination of the contract outlined above. Let’s stress again – if you terminate a rental contract agreement early, you may be liable for the full rental payments due for the remaining term of the contract. Early termination by the landlord is another common problem. Your tenancy agreement should cover this situation also. It is unlawful for a landlord to evict a tenant randomly, without a court order, as covered in the Specific Relief Act 1950. This legal cover also includes your landlord making the property inaccessible by changing the locks. If, however, you fail to pay your rent on time or damage the property, there is likely to be a clause of termination as a result. The landlord can serve you with a payment notice, and then seek eviction if you fail to pay. This process is a lengthy and often costly one for the landlord. Tenant Do’s and Don’ts With all the considerations you need to make as a tenant, let’s explore a quick reference list of Do’s and Don’ts to help you through Disclaimer: The information is provided for general information only. mpighome.com makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.

The article above is refer from propertyguru.com.my

0 Comments

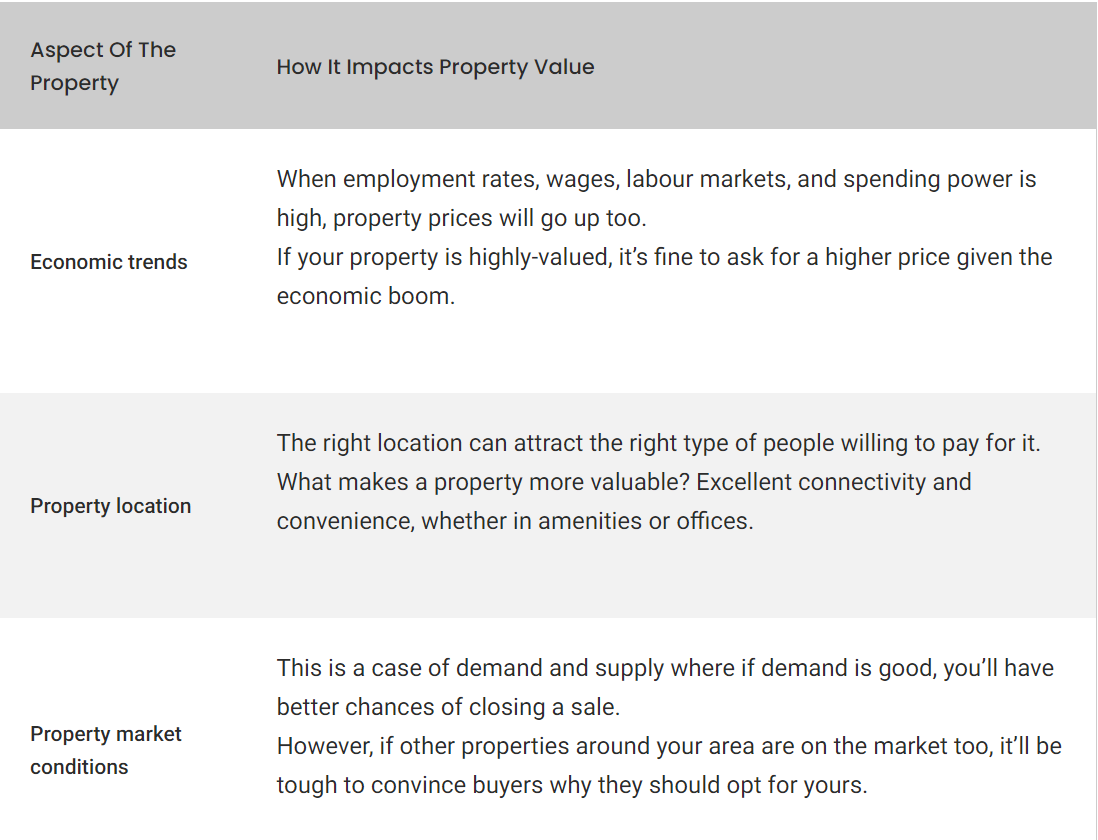

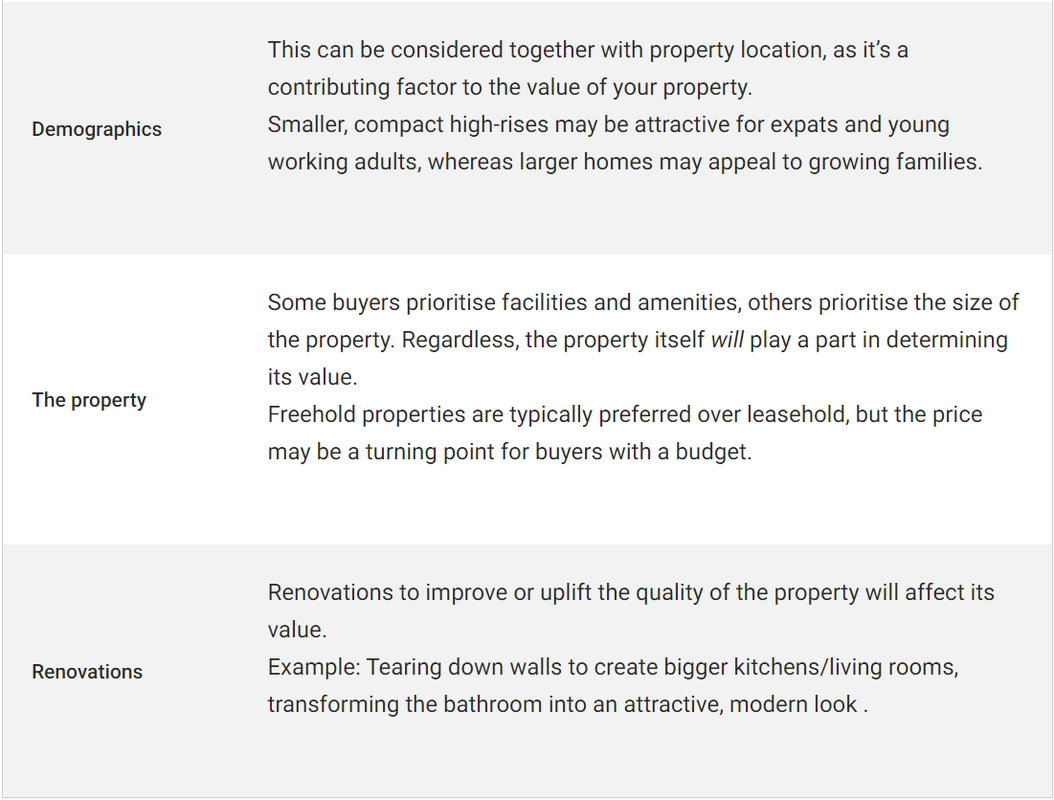

If you have plans of selling your home in the future, you’re gonna need to find out how much your house is worth, yes? Well, property valuation, also known as real estate appraisal, is the process of evaluating how much the house would be worth if it were placed on the market for sale. Estimating the price of your property is the first step towards attracting prospective homeowners to take an interest in what you have to offer. Here’s more information of what exactly property valuation entails, and the factors affecting the process! First, you need to know a little more about property valuation Market value: This is the estimated amount that the property is likely to fetch on the day both parties (namely, the buyer and seller) enter into an agreement. It’s the price which has been agreed upon by all parties involved in the transaction. This is different from the asking price, which is the amount that the seller of the property quotes to potential buyers when negotiating the exchange process. The actual valuation process is an estimation of how much money the property is likely to be worth. A valuation is carried out by authorised firms and their representatives (usually banks and their associated valuation experts) after having taken into consideration recent property transaction prices, as well as other market factors. Benefits of having your property evaluated There are several instances when you’d need to know your current property valuation. For example, you may be planning to carry out major renovations in the near future, prior to selling your home. In this instance, you must find out the value of your home after having altered it, or after having lived in it for a considerable amount of time. This is to make sure that you know exactly how much your house is worth so that you can maximise your profits in the event that you wish to sell your home, and sell it fast. Factors that affect property value 1. General economic trendsPeople will be more inclined to buy homes in cases of an economic boom, where employment, salary levels and labour markets are all on the rise. During these times, people will also be more willing to spend more on properties, which will likely drive up the prices. As a result, it wouldn’t be unreasonable to ask for a higher price, especially if you’ve received a high valuation. 2. Location of propertyIs your property located in a neighbourhood that is highly coveted by prospective homeowners for the amenities, or is a stone’s throw away from major central landmarks, offices, and buildings of public interest? Or perhaps it’s very well connected, with a variety of buses and trains which serve the area? These are some factors that can make a property highly valuable and attractive in the eyes of many interested buyers. 3. Conditions of general property marketAnother thing to consider is demand and supply patterns in the property market. Do check to see if houses in your particular area are preferred by buyers, as opposed to other neighbourhoods. But, if nearly every other house in the area where your property is located goes on the market at the same time, you’ll have a harder time trying to convince potential homeowners why yours is the superior one. 4. General demographicsIs your property in an area occupied mostly by expats? Then they might be interested in smaller, more compact high-rises where they can be part of a larger community and with multiple tiers of security. If it’s situated in a neighbourhood with young professionals and growing families, then prospective buyers may prefer larger homes to accommodate more people. 5. The property itselfNaturally, a bigger property (more floor space) will command a higher valuation than a smaller one in the same neighbourhood. If the property has any amenities such as around-the-clock security, swimming pools, gyms and/or parking spaces, buyers will be willing to part with a larger sum just to secure these extra perks. Additionally, whether it’s a freehold or leasehold property will also influence people’s purchasing decisions. While the owner of a freehold title owns the property indefinitely, the owner of a leasehold title ceases to own it after the tenure has expired. As a result, more people typically prefer to purchase freehold homes. 6. Recent renovationsIf you’ve recently made renovations to the place, particularly major ones such as upgrading materials or erecting a partition in one portion of the house to create more private spaces, the valuation of the property will be affected. Even touch-ups to improve and uplift the overall quality of the property for the new owners will contribute to a higher valuation for the property. The Property Valuation Process in MalaysiaIf you’re interested in purchasing a property in Malaysia and wish to apply for a home loan from the bank of your choice, they’ll conduct an independent valuation of the property you intend to buy. A bank-appointed valuation expert will arrive at a final valuation of the property after taking into consideration recently transacted sales of similar properties, as well as inspecting the property to know more about its current conditions, liveability and renovations. These recorded sales can be found with the Valuation and Property Services Department (JPPH). Once everything is complete, their findings will be detailed in a valuation report, which will then be submitted to the bank. Do note that any home loan the banks lend you will be based on this valuation figure, and that you’ll also have to pay a valuation fee to the people providing the service. While there’s no way to determine exactly which valuation method might be preferred by the people who are in charge of the valuation process, here are a few commonly employed ones:

To sum it all up, the selling price of your property can be affected by many factors and depending on the valuation method chosen, it could either leave you with extra cash or less. So when it comes to investing in property or selling your current one in hopes of reaping great returns one day, don’t forget to consider all these factors that come into play: As long as you do all your research and engage the right professionals to assist you with the property valuation process, you’ll find that putting up your property for sale in Malaysia is not that big of an ordeal (plus less headache too)!

Selling a house? Here’s what you need to know about the RPGT act in Malaysia so that you’re not caught unaware when it’s time for you to pay for the taxes! Disclaimer: The information is provided for general information only. mpighome.com makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions. Are you an expat looking to call Malaysia home? Check out our detailed investment guide which lays out the foreign ownership process, costs involved as well as the latest information on Malaysia My Second Home (MM2H) and Premium Visa Programme (PVIP). Over the past decade, quite a few expatriates in Malaysia have opted to purchase a residential property either as a second home or for retirement purposes. A haven for many things, Malaysia is one of the most favoured property markets in Southeast Asia, particularly in the past decade. Recently, the local media reported that Malaysia’s foreign buyers accounted for 10% to 15% of new and second-hand transactions in Malaysia’s largest cities. Many of these properties were residential units purchased as second homes, either for retirement or investment purposes. If you are one of those who have been smitten by the idea of putting down roots or expanding your investment portfolio in this country, here are some essential guidelines that can help you navigate your ventures in buying a house in Malaysia. 1. Can foreigners buy a property in Malaysia in 2023? The National Land Code (NLC) 1965, one of the primary property laws in Malaysia, defines a foreigner as any natural citizen who is not a permanent resident of Malaysia. In principle, foreigners can own any type of property (residential unit – both landed and highrise, commercial property and land, industrial property and land). The NLC also states a similar provision for foreign companies in acquiring property or land in this country. As Malaysia is governed under a federal system, land matters lie within the state government’s jurisdiction. The rules in the states of Peninsula Malaysia differ from those of Sabah and Sarawak. Each state has implemented different regulations governing foreign property acquisition i.e. types of property and application procedures. However, there are three types of properties that foreigners are not eligible to purchase:

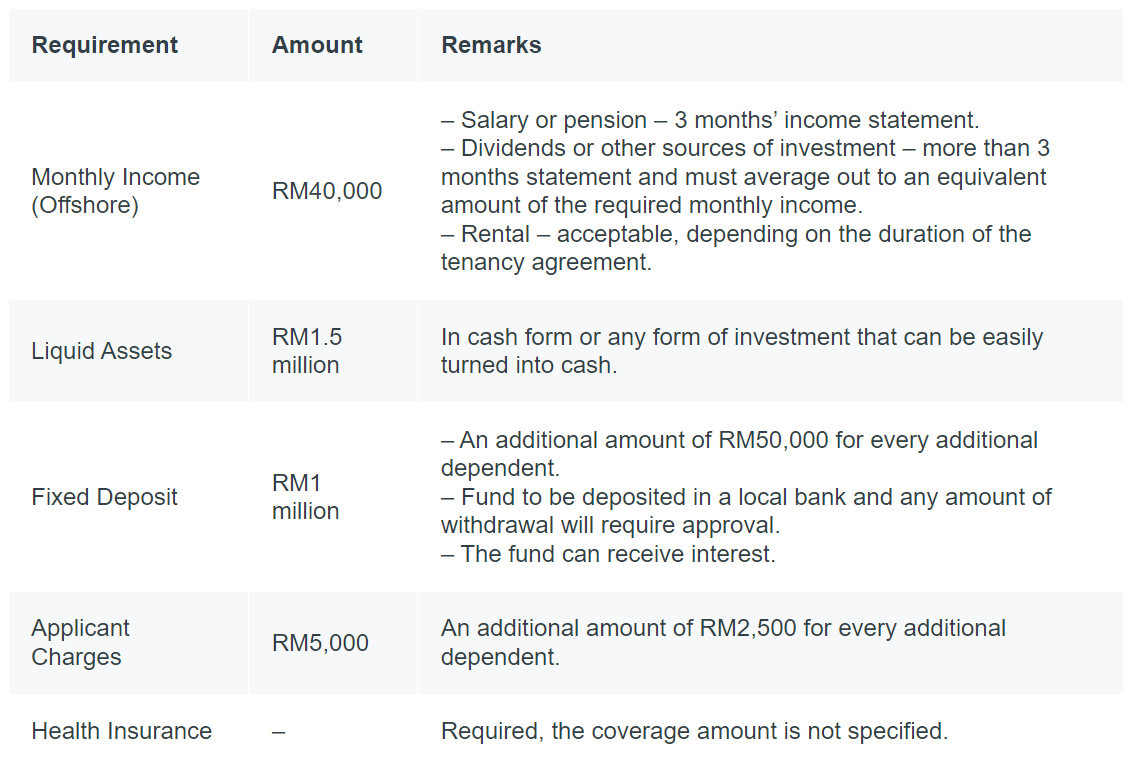

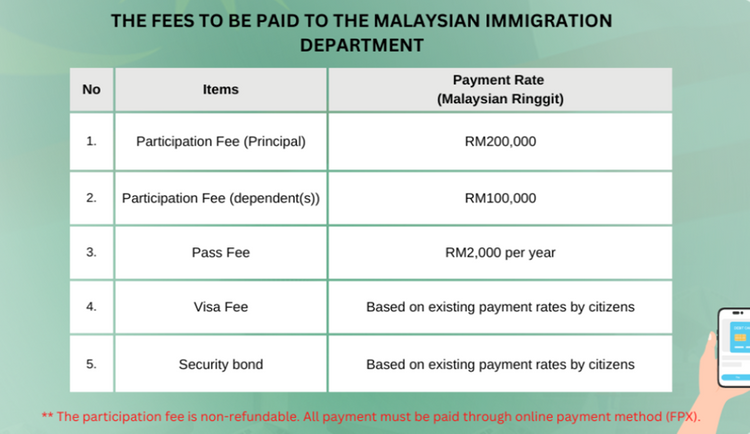

Foreigners are also not allowed to purchase agricultural land. Nevertheless, in respect of building land or agricultural land gazetted for development, they may do so after receiving consent from the relevant state authority. 2. How to buy a property under MM2H in 2023 Unlike other countries, Malaysia offers a special avenue for foreigners to purchase homes via Malaysia My Second Home (MM2H) programme. The scheme provides a renewable visa (5-year maximum) and applies to all the states in Peninsula Malaysia and Sabah (Sarawak has its own rule and requirement as the state controls their immigration). To learn more, check out this link: Sarawak MM2H (S-MM2H) You will need to be sponsored by a Malaysian citizen and in Peninsula Malaysia, a registered MM2H agent can replace a citizen sponsor. As MM2H visa holders, you will enjoy some benefits when it comes to owning houses in Malaysia, which include discounts on certain types of properties available in the market. The following are the revised requirements as of August 2021, applicable for those aged 35 and above: In addition to the above, MM2H visa holders must be in the country for at least 90 cumulative days in a year. Can a foreigner buy a property without MM2H? In September 2022, Malaysia introduced a Premium Visa Programme (PVIP), a long-term residency visa that enables foreign investors and entrepreneurs to live, work or study in this country. Open to all age categories, the programme provides visa approval for up to 20 years (valid for 5 years and issued at 5-year intervals up to a maximum of 4 times) and foreigners will be able to purchase real estate for residential, commercial or industrial purposes. There are two main conditions a foreigner must meet to be eligible for PVIP: 1. An offshore income of RM40,000 per month or RM480,000 annually 2. A fixed deposit account of RM1 million with a licensed bank in Malaysia All applications are required to be made through an authorised consultant or agency appointed by the Immigration Department of Malaysia. The participation fee for an applicant is RM200,000, while for every dependent is RM100,000. Payment of 10% initial participation fee of RM200,000 must be paid before the PVIP consultant/agency submits the online application. The remaining balance of the participation fee, pass fee, visa fee and security bond will be paid once the online application is approved. The following documents also needed to be provided to the PVIP consultant/agency that will be uploaded through the online application:

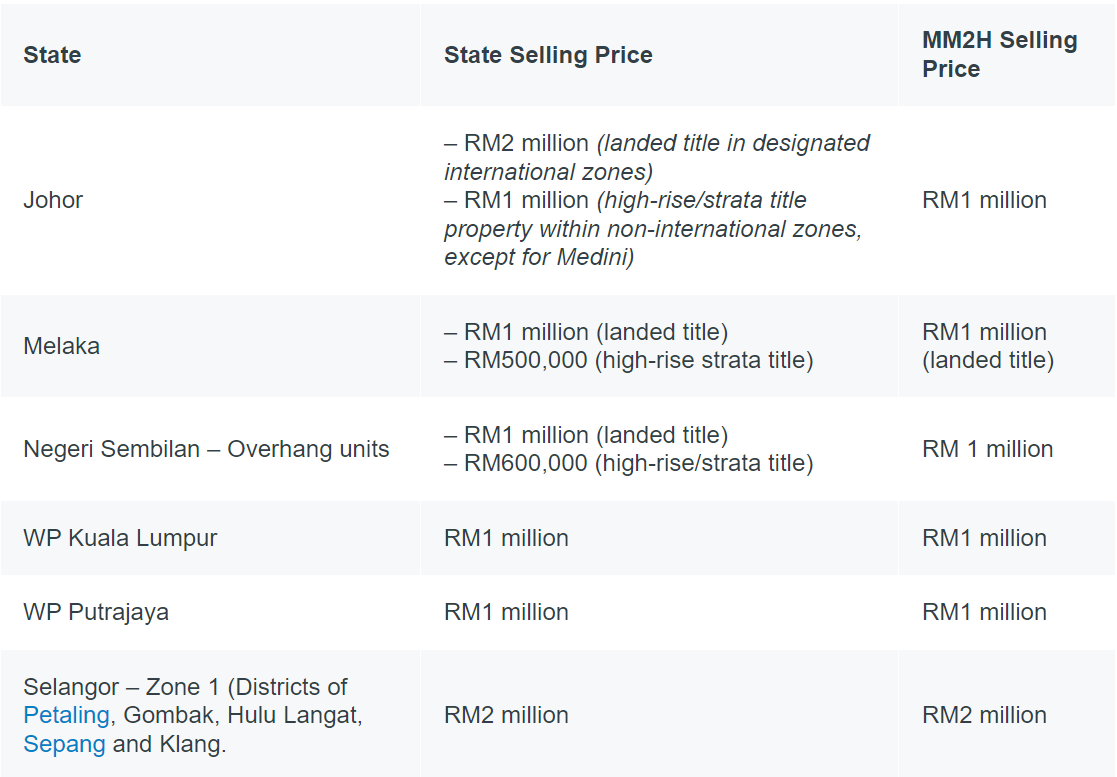

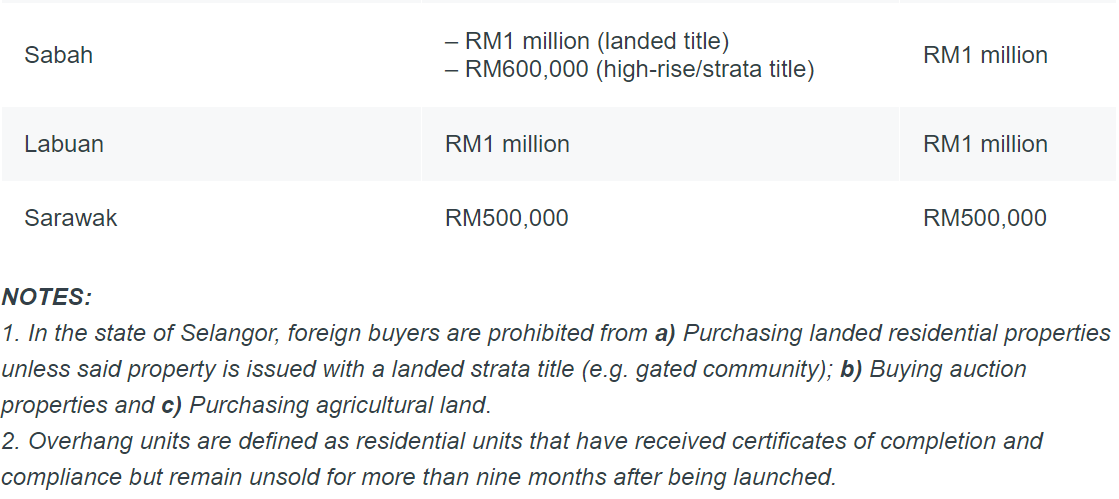

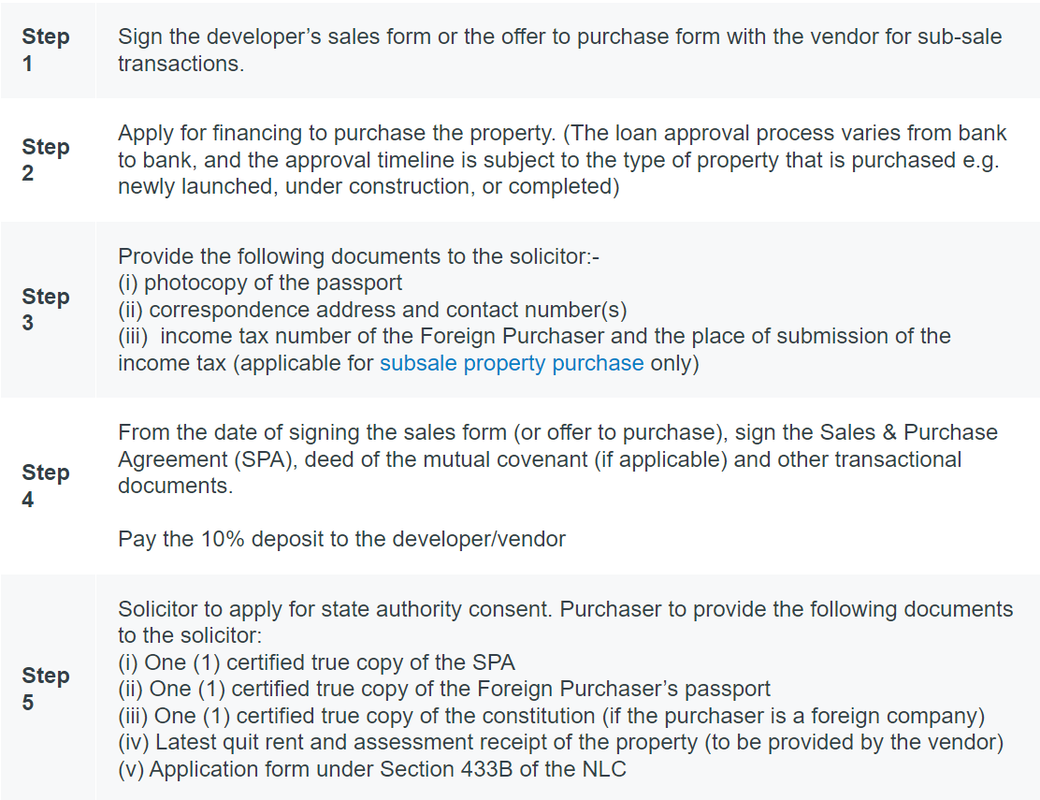

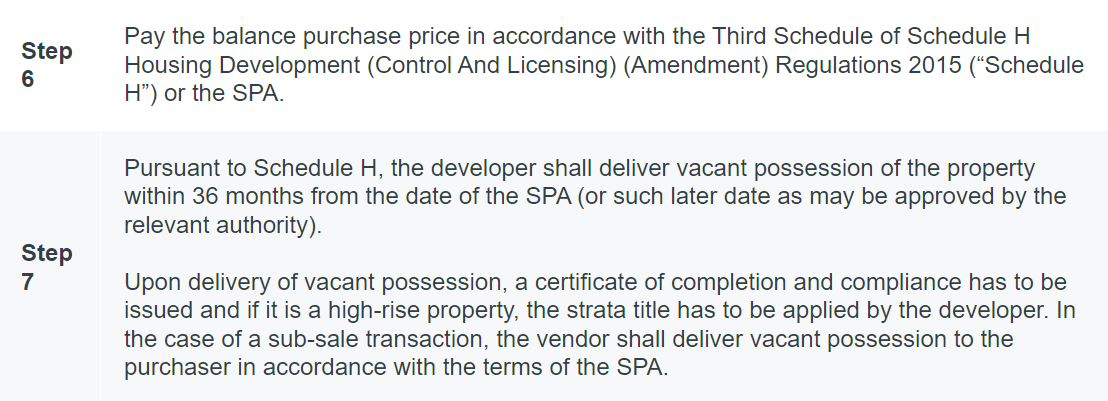

All documents and certificates must be in English or translated into English, certified by the Malaysian Embassy/Consulate. 3. Minimum property price for foreign investment in 2023 Generally speaking, a minimum purchase value of RM1 million is applied to all kinds of property in almost every Malaysian state, except for 3 (refer to the table below). Now, you probably are asking some of these questions, such as what are the property prices in different states? Which cities have the most expensive houses? It is safe to say that the average property price in Perak will not cost as much as in Selangor, but here is a quick reference of all the state’s minimum selling prices along with the prices available under the MM2H programme (residential properties only). 4. How to buy a property in Malaysia as a foreigner? Although the procedure of buying a property varies from agent to agent or from developer to developer, here are the common steps taken when a foreigner decides to buy a property in Malaysia: 5. Can a foreigner obtain a mortgage in Malaysia? According to Bank Negara Malaysia (BNM), under its Frequently Asked Question (FAQ), a non-resident (foreigner) is permitted to borrow in ringgit to finance or refinance activities in the real sector in Malaysia, including the purchase of an immovable property. So yes, foreigners can qualify for home loans in Malaysia. However, access to mortgages in Malaysia very much depends on the individual’s financial standing, the purpose of the purchase and the type of property. Home financing options For starters, obtaining a home loan when buying a house through MM2H is indeed a less complex process, as it is a well-established government programme that provides a visa of 5 years. Therefore, banks will be less concerned that you might suddenly move out of the country with an outstanding loan. If you are not under the MM2H programme, your ability to access a mortgage will vary, depending on whether it is from a local or foreign bank in Malaysia. According to an officer in CIMB bank, unless you are a high net individual (having RM1 million worth of assets), you may need to be a resident in Malaysia for 5 years or more. In addition, you might also require other forms of assets (savings, stocks) in Malaysia that can be used as collateral to obtain a housing loan. Local banks may also have different procedures for houses bought from developers (ranging from newly launched, under construction and completed) and secondary market (subsale). As for foreign banks, an HSBC mortgage specialist shared that the requirements of a foreign applicant (borrower’s loan eligibility and submission of documents) are quite similar to a Malaysian applicant. However, the margin of finance would also vary between 60% – 80% depending on if the borrower is a non-resident or resident foreigner in Malaysia. 6. How much do you need to buy a house in Malaysia? Below are a few significant closing costs that you need to include in your property purchase planning: Stamp Duty Stamp duty is the tax placed on your property documents during the sale or transfer of the property. The tax includes:

Legal Fees (For SPA & Loan Agreement) The legal fees for preparation of the Sale and Purchase Agreement are calculated as a percentage of the property purchase price, varying from 0.25% up to 1% depending on the value of the homes. Real Property Gains Tax (RPGT) This may not be a purchasing cost, but foreign buyers should take note that Real Property Gains Tax (RPGT) will be charged on the profit gleaned from a property disposal (in the future). Should foreigners sell a property within the first five years of owning it, they would be liable to pay RPGT at 30% of the chargeable gain, whereas if they sell off the property in the sixth year onwards, they will only have to pay 10% RPGT. 7. Can a non-Malaysian inherit a property in Malaysia? The short answer is yes. Based on the law, if there is a will, the executor will need to apply for probate (a legal process to carry out the remaining wishes of a dead person’s will) that is required to distribute the property. If a written will is absent, the beneficiaries will need to apply for a Letter of Administration (LAD). Both processes are to be submitted to the High Court of Malaysia. Similarly, the NLC under Section 433B (1)(e) also states that a foreigner can own and inherit property in Malaysia only after he has obtained approval from the state government. Make sure to read Property inheritance in Malaysia: Related laws and applications for letters of administration 8. Is buying a property in Malaysia a good investment? With everything that is currently happening in Malaysia, both on the economic and political front, you are probably thinking, why even bother right? And with more digital investment options coming into play (cryptocurrency, NFTs, metaverse real estate), buying a property, especially for investment, may seem unnecessary. Nevertheless, investing in a property is still one of the best investment vehicles to deliver capital gains in the long run and the Malaysian residential market remains appealing to buyers from across Asia, particularly China and Japan. A recent property survey, conducted with nearly 350 real estate agents nationwide, further affirms that more than two-thirds of the respondents expect offshore buying of Malaysian property to return to pre-COVID-19 levels within 18 months – that is, by the end of 2023. Malaysia has also been a preferred choice for many expatriates who plans to migrate or settle down with their families. Many areas within Klang Valley have been in constant demand, especially properties in the vicinity of reputable international schools. Make sure to go through top neighbourhoods with international and private schools in Klang Valley. As foreigners are allowed to invest and own properties in Malaysia, the purchased property can be easily leased out or sold in the event the homeowner or investor decides to leave Malaysia. Moreover, demand for properties in the vicinity of such schools has been moving up in tandem. However, if Malaysian property is disposed of with capital gains, it will be subjected to capital gains tax or real property gains tax. What about the Malaysian property market? The property market is also on the right track, progressing at a cautious pace while being perceptive of property buyers’ priorities. The National Property Information Centre (NAPIC)’s Property Market Status Report (First Half of 2022) states that the residential sector had an increase of 26.3% in transaction volume and 32.2% in transaction value compared to the same period in 2021. Four major states, namely Penang, Kuala Lumpur, Johor and Selangor were the main contributors to this transaction volume, while terraced houses dominated the residential new launches. In terms of Malaysian average house price, NAPIC reported that the median house stood at RM320,000, 8.4% higher than its review period in 2021. This upward movement of median prices suggests an observation that there are property buyers who have solid financial footing with an appetite for higher-priced properties. Property investment hotspots In Malaysia, residential properties with close proximity to public transport such as LRT, MRT and monorails are highly sought after. With the heavy traffic, especially after working hours, easy commuting is emphasised as one of the top priorities for renters, residents, and investors. These houses, which are mostly high-rise units, yield potentially higher rental and capital values. The current in-demand properties are mostly in areas linked to interchange stations that are integrated such as the KL Sentral station (connected to 6 rail lines, namely the KTM Batu Caves – Pulau Sebang Line, KTM Tanjung Malim – Pelabuhan Klang Line, LRT Kelana Jaya Line, ERL KLIA Ekspres Line, ERL KLIA Transit Line, and KL Monorail Line). Similarly, the Titiwangsa Station is also expected to be in the spotlight in the near future and will become an integrated interchange station with 5 rail lines – MRT3 Circle Line, MRT Putrajaya Line, LRT Ampang Line, LRT Sri Petaling Line, and KL Monorail Line. Disclaimer: The information is provided for general information only. mpighome.com makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions. For all foreigners & expats: Check out our guide which details the property purchasing process and information on MM2H.

Foreign ownership of property is liberal (foreigners can own 100% of the property) in Malaysia as long as minimum requirements are met. In law, foreigners can own any type of properties EXCEPT the following:

2. What is the minimum property purchase price in each state with or without MM2H? Source: https://www.iproperty.com.my/guides/guidelines-for-foreigners-buying-a-house-in-malaysia *Zones in Selangor Zone 1 – Districts of Petaling, Gombak, Hulu Langat, Sepang and Klang Zone 2 – Districts of Kuala Selangor & Kuala Langat Zone 3 – Districts of Hulu Selangor and Sabak Bernam NOTE: In the state of Selangor, foreign purchasers are prohibited from:

3. What are the procedures for foreigners to acquire property? Source: http://www.pwta.com.my/wp-content/uploads/2017/08/Guide-to-Acquisition-of-Real-Estate-In-Malaysia-by-Foreigners-Updated-as-of-2-August-2017.pdf

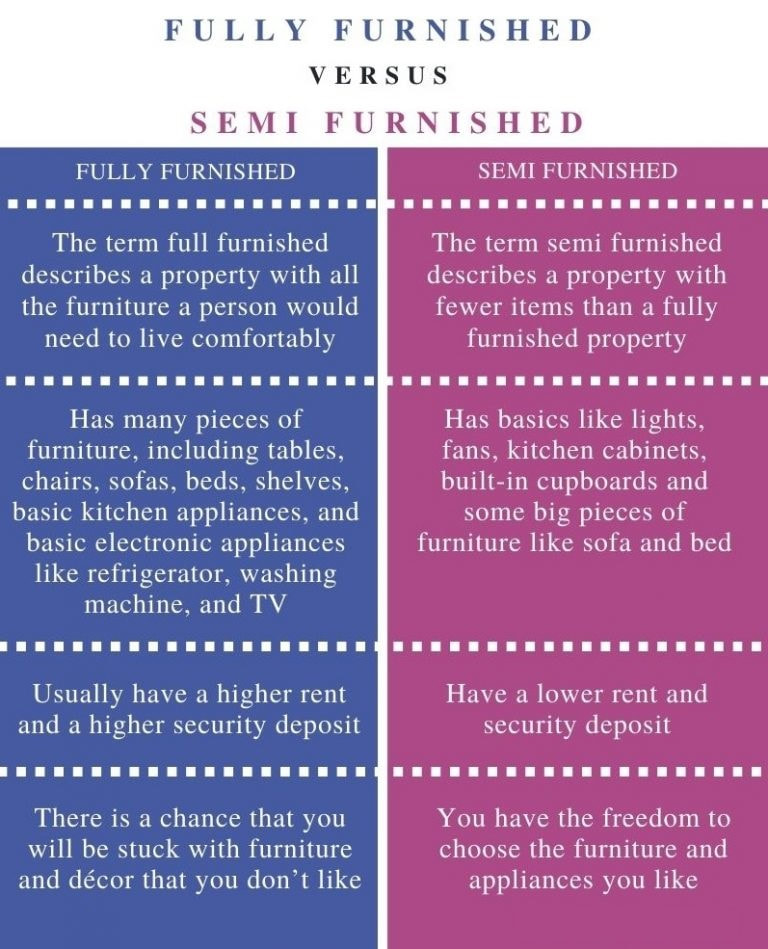

4. What are the costs involved? Stamp duties & Memorandum of Transfer (MOT) Stamp duty rates for properties valued more than RM1 million will be increased from 3% to 4% from January 1, 2019 onwards. Let’s say you are purchasing a home worth RM1.5 million. The final RM0.5 million amount will cost you RM20,000 (4% X RM500,000), bringing the total stamp duty to be paid to RM44,000. Legal Fees Real Property Gains Tax (RPGT) Rental Income Yes it is accountable to Malaysia tax. If you are a foreigner with a permanent residence status, the tax rate will be from 0-25% depending on the tax bracket. If you are a foreigner without a permanent residence status, the tax rate will be 25%. Loan stamping fees 0.5% of total loan amount. Door tax & title deed RM 1,500-RM3,500 for condominium (charged by land office) Maintenance fee This fee is based on price per square feet (psf) set by property developers. It will vary from project to project. A rough estimation of this cost will be from RM 0.30 – RM 1 psf. 5. How do I transfer the funds if I choose to purchase a property in Malaysia using cash? You may do a transfer the funds to the property developer’s Malaysian bank account by stages or to the bank account in other countries (if available). 6. Can I purchase a property with 2 or more individuals? There can be more than 2 individuals who own the property that was purchased. During the signing of the agreement, each individual’s percentage of shareholding must be stated. It will be equal share by default if there is no clause stating how much percentage each individual will own. 7. Will the total square footage of properties sold in Malaysia include the common area? Usually the total square footage of properties sold in Malaysia will consists of useful area & common area will not be included in the calculation. 8. How do I furnish my units & who can manage my units for me? Most property developers will provide semi furnish or fully furnish units. However, should you have your own preference on design taste, our in house design & renovation experts will be with you every step of the way. Additionally, we also provide property management services that will look after your property units when you are away. 9. What are the home loan financing options? MM2H holders can obtain loan as high as 80% margin from banks whereas non-MM2H holders can obtain loan margin close to 50%. Loan tenure can reach until 30 years, provided the applicant is not above 70 years of age when the loan tenure ends. Loan stamp duty is around 0.5% of the loan amount. Legal fees and disbursements will be around 0.8% of loan amount. Click here to fill up the enquiry form for our in house experts to give you the best advice and latest interest rates! *This article was repurposed from iproperty.com.my , first published on iproperty.com.my The main difference between fully furnished and semi furnished is the type of furniture and appliances they contain. A fully furnished property has many pieces of furniture, including tables, chairs, sofas, beds, shelves, basic kitchen appliances, and basic electronic appliances like refrigerator, washing machine, and TV while a semi-furnished property has basics like lights, fans, kitchen cabinets, built-in cupboards and some big pieces of furniture like sofa and bed. Whether you choose to rent a fully furnished property, or a semi-furnished property would depend on a lot of factors. First, you need to fully understand what these terms mean and the pros and cons of each type of property. What Does Fully Furnished Mean The term full furnished describes a property with all the furniture a person would need to live comfortably. Fully furnished houses or apartments will contain furniture like sofas, bed, dining table, chairs, cupboards, and shelves. They will also have items like basic kitchen appliances, cutlery, curtains, mats, lamps, electronics like TV and washing machine, etc. Water heaters and air-conditioning are two other facilities commonly available in many fully furnished properties. Since fully furnished properties have many pieces of furniture and appliances, the rent and security deposit of these properties will also be higher. Pros and Cons of Fully Furnished Pros

What Does Semi Furnished Mean Semi-furnished is a term used to describe a range of properties, from almost bare houses or apartments to an almost fully furnished apartment. In general, a semi-furnished rental property, or a property for sale have fewer items than a fully furnished property. Normally in Malaysia semi-furnished properties will only have the basics such as lights, fans, kitchen cabinets, air conditioner and water heater. Since these have fewer items, they will have lower rent; the security deposit will also be lower. Pros and Cons of Semi Furnished Pros

Difference Between Fully Furnished and Semi Furnished

Definition The term full furnished describes a property with all the furniture a person would need to live comfortably while the term semi furnished describes a property with fewer items than a fully furnished property. Furniture and Appliances A fully furnished property has many pieces of furniture, including tables, chairs, sofas, beds, shelves, basic kitchen appliances, and basic electronic appliances like refrigerator, washing machine, and TV while a semi-furnished property has basics like lights, fans, air conditioner, water heater and kitchen cabinets. Price Fully furnished properties usually have higher rent and a higher security deposit, while semi-furnished properties have a lower rent and security deposit. Freedom to Choose With a fully furnished property, there is a chance that you will be stuck with furniture and décor that you don’t like. However, when you choose a semi-furnished property, you have the freedom to choose the furniture and appliances you like. Conclusion The term full furnished describes a property with all the furniture a person would need to live comfortably while the term semi-furnished describe a property with fewer items than a fully furnished property. A fully furnished property has many pieces of furniture, including tables, chairs, sofas, beds, shelves, basic kitchen appliances, and basic electronic appliances like refrigerator, washing machine, and TV while a semi-furnished property has basics like lights, fans, air conditioner, water heater and kitchen cabinets. Thus, this is the main difference between fully furnished and semi furnished. Should I Opt In to Moratorium ~ 4th July 2021(During MCO 3.0 Extension in Malaysia) This is a FB Live video which I think will be very resourceful and helpful to everyone to have better understanding on what effect Moratorium will bring on overall. This include the extra interest incurred and also extra term incurred after the 6 month moratorium. Jonathan de Ho, the founder of Mpighome.com is honor to invite the experience mortgage loan specialist Jessica Jong from FB: Mortgage Management to provide us more in-depth knowledge about Moratorium and what is next. You will be surprise to see what is the effect after 6 month moratorium and what if u extend further. Sorry the video may be blur as file is too big to put in High Resolution Definition, but the key is the sharing. Here we provide free reports on mortgage loan analysis, home loan eligibility and affordability check and also Property Project Proposal Consultation. You can get it through register at http://www.mpighome.com/getprofessionaladvice.html MPIG (also called Malaysia Property Investment Group) is formed in 2015 by Jonathan de Ho with the websites of www.mpighome.com. It is to provide the latest updates on Property Industry, knowledge related to Real Estate, latest new project launching etc. You can register for latest updates at https://bit.ly/mpighome. If you looking to embark this exciting Real Estate industry with us, feel free to contact [email protected] or click this to whatsapp https://bit.ly/PropertySpecialist 现在马来西亚年轻人月入马币3千能买房吗?马来西亚300千的屋子还能买到吗?

许多国人投诉房屋价格难以负担,但一味埋怨并不能解决问题。说到底,想要拥有自己的房屋,还需靠自己。 不过买家也要记得,购买房屋应注意不要超过自己的可负担范围。马来西亚房屋投资集团(www.mpighome.com) 执行董事兼任房屋资深经纪Jonathan de Ho 建议,应先了解自己的财务状况,才做出重大的财务决定,例如买房子。如果是能负担起的话,建议先买房。 现在的年轻人,马来西亚首购族可从购买较便宜的房产开始,2020和2021是个挑战的一年,随着疫情的侵略,全球经济前景愈发暗淡。可是随着MCO3.0的到来,毕竟疫情已出现了超过一年,大马很多商家也已改变策略以应付经济需求的变化。事实上,经济已逐渐的恢复。 当收入增加后再逐步升级。根据大马统计局的数据,大马人的平均月薪为RM3,087。因此我们以月入RM3,000为例,若想购买入门RM30万的房产,应该怎么做才能达成目标? 规划财务和准备首付款项 要筹措房屋的头期款需要决心、纪律和耐心。假设一间RM30万房屋的头期款为RM3万。对一名月入RM3,000的人来说,每月储蓄RM500至RM833(占薪水的15%至30%)是可行的,但需坚持至少三至五年。还有事实上现在很多新项目都有给很多的优惠,RM300千房屋是可行的。 与此同时,这段期间应避免背负其他贷款,例如车贷,或为了奢侈消费而贷款。Jonathan建议购买便宜的二手车、使用公共交通或居住在靠近公司的地方。 申请房贷 储蓄目标达成并支付头期款后,余款则向银行贷款。我们仍假设月入为RM3,000,不过通常五年后,一名有进取心和肯努力的人的收入应会有所提高。 Jonathan表示,应尝试争取更长的还贷期限,以降低现金流吃紧的风险。这样你的供期会降低,你的负担也不会太大,需要时还有些现金流可以应急一些紧急事件。 为偿还贷款做规划 2021年,买屋子需要多少钱?若能成功争取到RM29.6万贷款和35年的还款期(马来西亚条例,最长还款期是35年或最高年龄达70岁),以3%利息计算,每月还款则为RM1,139。若月入RM3,000,每月RM1,139的还款还算健康(净收入对比是38%),因为它少于净收入的一半,健康的比率应在40%或以下。给此案,在这几年增加收入是非常重要的,是还可以购买房地产的,因为通货膨胀也会使屋价提升,现在不买,将来买的可能会更小间或价格更高。到时可能更加的难买了。 另外,若购买的是二手房,贷款人在银行释出贷款后就要立刻还贷。新项目方面,因为按进度付款的关系,给予贷款人一些缓冲时间来增加收入。新项目建筑中时期,贷款者只需付款利息而已。 需要注意的三大条例 Jonathan表示,从个人理财的角度来说,购屋者需要注意三个条例: 1. 需要注意与妥善管理资金流 — 不规划开支,可能导致入不敷出,进而拖慢买房进度或贷款违约。 2. 需要拟定财务计划 — 财务计划考虑的是财务状况和目标,是长期的理财策略,能够帮助一个人做出更好的财务决定。 3. 不要对财务和人生过于乐观 — 相信船到桥头自然直是自欺欺人的。我们应该清楚认识到买房所伴随的挑战,并尽早做好应对的准备。 马来西亚300千的屋子还能买到吗? 在马来西亚300千的屋子还能买得到吗?不是不能,是还能的。二手屋或新项目都有。二手屋,你可需要将就屋子的现况,你需要准备付款10%头期和律师费用以及印花税等等的费用。至于新项目,300千的屋子不多,尤其是在市中心。PJ屋子新项目今年市场价格是在于每一方尺RM800-1000。如果一RM800一方尺来计算,RM300千项目最多可以购买到375方尺的楼盘。马来西亚首购族以及年轻人买房子在2021年,要买300千屋子,地段要在市中心会比较难。 RM300千屋子二房一厕的楼盘 小编这里刚好有朋友介绍一个RM300千一下的楼盘是。这楼盘的价格是RM270千在PJ八打灵再也,一方尺才RM490,低于PJ市价最少40%。。这楼盘是2房1厕的设计,总面积是550方尺,也附送一个停车位。

这不是Rumawip 或 Rumah Selangorku的项目,而是一个实实在在的公寓。 此楼盘的买家需要是:

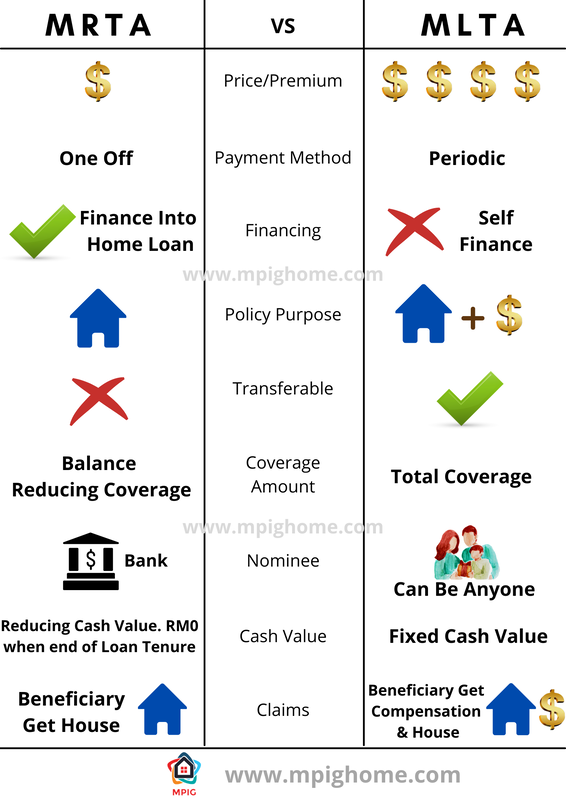

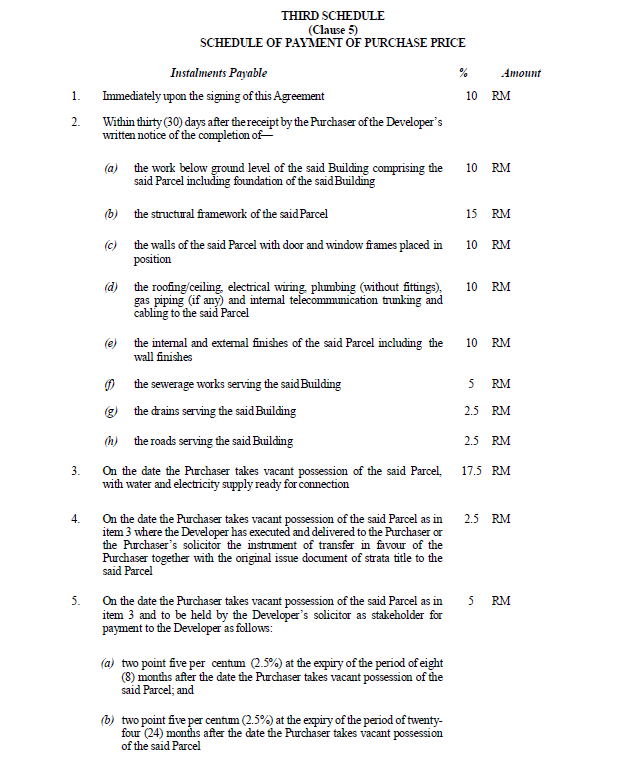

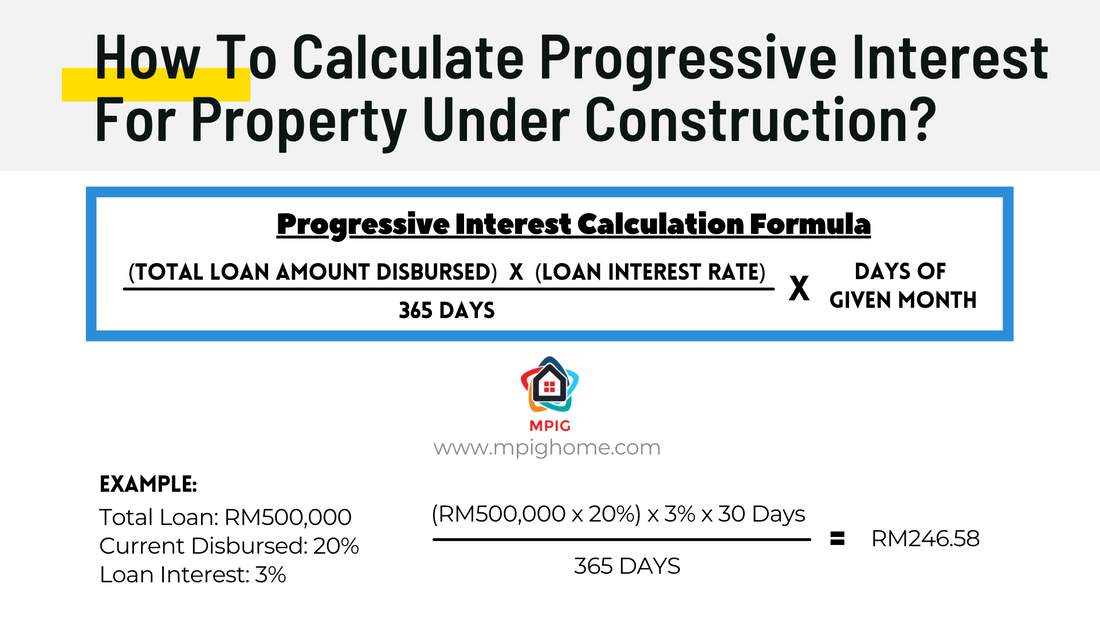

事实上就很多首购族与年轻人都可以购买的笋盘。 你可以按此捷径"RM270千PJ屋子楼盘“来登记与了解此楼盘. A mortgage insurance policy frees the borrower’s dependents from any debt as it is designed to pay off the remaining debt on repayment mortgages in the event of death or TPD. Which mortgage life insurance do I need? In Malaysia, there are two types of mortgage life insurance available – Mortgage Reducing Term Assurance (MRTA) or Mortgage Decreasing Term Assurance (MDTA) and Mortgage Level Term Assurance (MLTA). However, MRTA and MLTA are often misunderstood. Which do you need as a homeowner? MRTA is a life insurance plan with decreasing sum assured over time, and it used just to cover your home loan owed to bank. This plan is usually offered by the bank you are getting the mortgage from, as it is used as protection for the bank in case of misfortunes that stop you from servicing the loan. On the other hand, MLTA is a slight variation from MRTA and offers an alternative for a borrower who is looking for a life insurance which offers protection plus savings and in some policies returns on the premium. This is a personal plan that you purchase separately through an insurance broker or agency, where you and your dependents are financially protected when you are no longer around, or have lost the ability to generate income. Why Buy Mortgage Reducing Term Assurance ( MRTA)? The bank encouraged everyone to buy Mortgage Reducing Term Assurance ( MRTA ). Typically people buy it because of the attractive Home Loan interest rates offer. If you buy a Mortgage Reducing Term Assurance ( MRTA ), the bank will offer lower Home Loan interest rates in comparison to someone who doesn’t. The fact is most banks have a flexible policy on this. It is not compulsory and only optional. However, when people buy Mortgage Reducing Term Assurance ( MRTA ), they want the coverage and protection for their family. Mortgage Reducing Term Assurance ( MRTA ) Premium Mortgage Reducing Term Assurance ( MRTA ) cost depends on the insured age, coverage amount, home loan interest rate, gender, and years of coverage. Also, paying methods like paying with cash or finance in the loan will increase the Mortgage Reducing Term Assurance ( MRTA ) insurance premium. Usually, when you finance MRTA with the home loan, the premium tends to be pricier. The Misconception Of Mortgage Reducing Term Assurance ( MRTA ) Everyone will think MRTA will cover the latest home loan outstanding balance. But, the truth is. The statement is only partially real. Mortgage Reducing Term Assurance ( MRTA ) Surrender Value Surrender Value is when you no longer need the policy, and you surrender the insurance policy back to the insurance company. Let said, you have pay RM18,841 premium, then you surrender it within the first year. So, you’ll get back RM14,262.00 from the premium you paid. You will not get back the RM18,841, but the insurance company compensates you with RM14,262.00. The difference amount is RM4579. It’s going to be lesser from one year to another because the insurance company is giving you protection all over the years until you surrender the policy. Is it worth having? Most mortgage officers recommend mortgage life insurance (either MRTA or MLTA) when buying a new home. However, before committing to an insurance policy, it helps to do as much research as you can on the product. Mortgage life insurance is aimed at providing security to your loved ones from being burdened by home loan repayments if you pass away or are afflicted by permanent disability. However, if you do not have anyone to leave your property to and money is tight, getting a mortgage life insurance may not be your highest priority. For those with dependents however, it’s worth considering. What do you stand to lose if you do not have a MRTA or MLTA? If you are planning to pay off your mortgage within a few years, then an MRTA or MLTA may not be on the top of your list. However, if you are planning to service it for the next 30 to 35 years, and especially if you are co-buying with someone else, it will be best if you are protected. For example, if you are purchasing a property with your spouse, and each will be paying 50% of the repayment every month, a death or permanent loss of income may be a huge blow on the couple’s finances. Having a mortgage life insurance will provide you the peace of mind that you will not lose your property even if the other person is unable to pay for the mortgage. Suitability The MRTA is most suitable for those who have adequate standalone life and medical insurance, and do not have many financial dependents. This type of insurance will only take care of your home loan, if it is not fully repaid in the event of TPD or death. The sole beneficiary of the policy is the bank, not your family members. However, your family get to inherit the property without having any bank loan attached. MLTA is best for those who need an extra financial protection in the worst case scenario, as it also has a cash value at the end of the policy. This is best for those who have many financial dependents, for example young children and a stay-at-home spouse. However, MLTA is a normal life insurance policy that is not part of your housing loan and customers must ensure they understand the terms and conditions fully otherwise they may find themselves in a tight spot if the insurance company does not approve the claim and the bank loan remains unpaid while the dependents are left without any cash payout either. CLTA CLTA is a relatively new product in the market. CLTA is also known as Credit Term Life Assurance. This product is only offered by limited Bank. CLTA is similar as MLTA as in the coverage will remain same. For other more details, please seek advice from the banker that offer CLTA. Progressive Interest and Billing Explained Buying a property that’s under construction is one of the best ways to get a great deal. It’s because when you buy a unit in an early phase of the project, you’ll get it at a great price! After the next phase is launched, the price of a home can increase by 10% to 30%. Nonetheless, the loan process is a little more different than when buying a completed house - where your bank will have to release the full loan amount upfront. This is because the payment for a home that’s under construction is progressive, i.e. in stages. Such stages is shown in Schedule (as shown below). Some of the schedule will stated when is the expected claimable date and some dont. Essentially, how it works is- When the developer has completed a certain stage of the building process, your bank will release a bit of money to pay them. These stages and amounts are set by The Ministry of Housing and Local Government (KPKT). For commercial title non HDA, it works differently, normally developer will claim and bank will release the portion of disbursement even when its not complete. Progressive Interest is the interest you’ll need to pay on these stage-by-stage payments which have been released by the bank. Bear in mind that the payments you need to make before 100% of the loan are released are on interest only, but you do have the option of paying more right from the start! This means you get started reducing the original amount loaned, and the interest that is charged on top of it earlier! If you have other financial obligations like the rent for your current home, however, it can help to take it slow as the payments begin in small amounts, so you won’t be overburdened at the start, but it’s still going to come down to managing your finances. At the end of the day, a home is a financial responsibility as much as it is an asset. So let’s give you a pat on the back! As an EXAMPLE for calculation (Shown as below) - Let’s assume your interest rate is 3%, and the bank has released RM100,000 out of the total RM500,000 (20% disbursement) you’ve borrowed for your new home. Some extra tips include:

|

AuthorFrom Various Author articles. Jonathan de Ho & reference from others Author articles Archives

November 2023

Categories |

- Home

-

New Property Launch

- Lakeside Freehold Fully Residential Private Lifestyle Condominium in Cyberjaya

- Spacious 2024 Completion KL Condo Fully Residential KLCC View

- RUMAWIP Bukit Jalil (Bumi Only)

- Lake City @ KL North NEW PHASE FROM RM380k

- Alora Residences – Inspired living within greenery in Subang Jaya

- PJ Spacious and Affordable 5 Star Condo

- Best Investment 2022 PJ Damansara Low Risk Low Entry Price High ROI

- 2022 PJ Rumah Mampu Milik RM270k Damansara

- Bangsar South 2 Rooms from RM390k BELOW Market Price

- 10% ROI PJ Project near Ikea and One Utama Mall

- Mid Valley Seputeh New Launch

- Pavilion Damansara Heights 柏威年 白沙罗岭 马来西亚 吉隆坡 精选楼盘

- 马来西亚RM300千的PJ屋子-首购族,年轻人月入3千能买房

- 2021 Penang Most Awaited Project

- 2021 New Launch - KL Metropolis

- Freehold LRT Linked 3 Room Suites in Glenmarie

- New SPACIOUS Kepong Landed 6 Room 6 Bath

- Bangsar Last Piece Land New Launch

- Avara Seputeh (Mid Valley)

- Project Announcement Registration. Malaysia New Property Launch

-

Existing & Past Project

- 2020 Lowest Risk & Price in Klang Valley with Great ROI

- Kiara East Suite Dex

- 2019 SAFEST PROFITABLE HIGH CASHBACK INVESTMENT

- Best Property Investment Projects in 2018

- KL City Freehold Spacious Affordable 3 room Project

- Jalan Kuching Freehold New Office & Shoplot

- Jalan Ipoh New Freehold Shoplot & Offices

- RM300k KL Sentral New Prelaunch

- The Olive Condo, Sunsuria City

- Prelaunch Landed House Bukit Rahman Putra

- RM260k No Downpayment Puchong South Suites

- PJ North RM400k High Cash Back Project

- Denai Sutera @ Alam Sutera, Bukit Jalil

- First Phase of Banting New Township

- Neu Suites 3rdNVenue @ Embassy Row by Titijaya & CREC

- COURT 28, Jalan Ipoh KL City New Property Launch Service Apartment. Malaysia New Property Launch

- Semanja Kajang New FREEHOLD Kajang Double Storey Houses. Malaysia New Property Launch

- M Suite @ Desa Park North

- BIJI LIVING @ Sek 17 PJ City by Conlay. Malaysia New Property Launch

- Amani Residence Bandar Puteri Puchong New Freehold Service Apartment. Malaysia New Property Launch

- SFERA RESIDENCY @ Puchong South. Malaysia New Property Launch

- KL North Last Release

- PreLaunch Freehold Double Storey

- LAND

- News & Articles

- Other Reference Link & Services

- Referral

- Career

- MPIG

- Get Professional Advice

- PJ八打灵全新地产项目分析手册

Hours

M-S: 9.30am - 9pm

|

Telephone

+60 12 3760864

|

Email

|

RSS Feed

RSS Feed