|

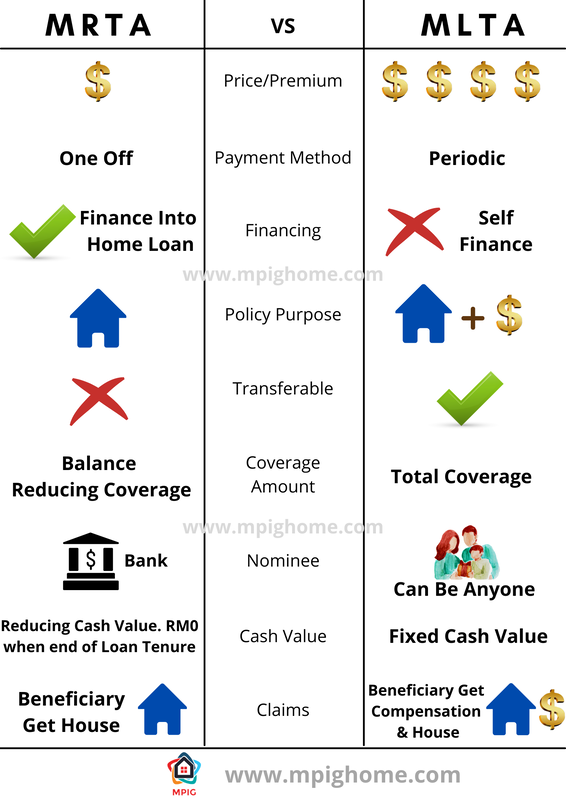

A mortgage insurance policy frees the borrower’s dependents from any debt as it is designed to pay off the remaining debt on repayment mortgages in the event of death or TPD. Which mortgage life insurance do I need? In Malaysia, there are two types of mortgage life insurance available – Mortgage Reducing Term Assurance (MRTA) or Mortgage Decreasing Term Assurance (MDTA) and Mortgage Level Term Assurance (MLTA). However, MRTA and MLTA are often misunderstood. Which do you need as a homeowner? MRTA is a life insurance plan with decreasing sum assured over time, and it used just to cover your home loan owed to bank. This plan is usually offered by the bank you are getting the mortgage from, as it is used as protection for the bank in case of misfortunes that stop you from servicing the loan. On the other hand, MLTA is a slight variation from MRTA and offers an alternative for a borrower who is looking for a life insurance which offers protection plus savings and in some policies returns on the premium. This is a personal plan that you purchase separately through an insurance broker or agency, where you and your dependents are financially protected when you are no longer around, or have lost the ability to generate income. Why Buy Mortgage Reducing Term Assurance ( MRTA)? The bank encouraged everyone to buy Mortgage Reducing Term Assurance ( MRTA ). Typically people buy it because of the attractive Home Loan interest rates offer. If you buy a Mortgage Reducing Term Assurance ( MRTA ), the bank will offer lower Home Loan interest rates in comparison to someone who doesn’t. The fact is most banks have a flexible policy on this. It is not compulsory and only optional. However, when people buy Mortgage Reducing Term Assurance ( MRTA ), they want the coverage and protection for their family. Mortgage Reducing Term Assurance ( MRTA ) Premium Mortgage Reducing Term Assurance ( MRTA ) cost depends on the insured age, coverage amount, home loan interest rate, gender, and years of coverage. Also, paying methods like paying with cash or finance in the loan will increase the Mortgage Reducing Term Assurance ( MRTA ) insurance premium. Usually, when you finance MRTA with the home loan, the premium tends to be pricier. The Misconception Of Mortgage Reducing Term Assurance ( MRTA ) Everyone will think MRTA will cover the latest home loan outstanding balance. But, the truth is. The statement is only partially real. Mortgage Reducing Term Assurance ( MRTA ) Surrender Value Surrender Value is when you no longer need the policy, and you surrender the insurance policy back to the insurance company. Let said, you have pay RM18,841 premium, then you surrender it within the first year. So, you’ll get back RM14,262.00 from the premium you paid. You will not get back the RM18,841, but the insurance company compensates you with RM14,262.00. The difference amount is RM4579. It’s going to be lesser from one year to another because the insurance company is giving you protection all over the years until you surrender the policy. Is it worth having? Most mortgage officers recommend mortgage life insurance (either MRTA or MLTA) when buying a new home. However, before committing to an insurance policy, it helps to do as much research as you can on the product. Mortgage life insurance is aimed at providing security to your loved ones from being burdened by home loan repayments if you pass away or are afflicted by permanent disability. However, if you do not have anyone to leave your property to and money is tight, getting a mortgage life insurance may not be your highest priority. For those with dependents however, it’s worth considering. What do you stand to lose if you do not have a MRTA or MLTA? If you are planning to pay off your mortgage within a few years, then an MRTA or MLTA may not be on the top of your list. However, if you are planning to service it for the next 30 to 35 years, and especially if you are co-buying with someone else, it will be best if you are protected. For example, if you are purchasing a property with your spouse, and each will be paying 50% of the repayment every month, a death or permanent loss of income may be a huge blow on the couple’s finances. Having a mortgage life insurance will provide you the peace of mind that you will not lose your property even if the other person is unable to pay for the mortgage. Suitability The MRTA is most suitable for those who have adequate standalone life and medical insurance, and do not have many financial dependents. This type of insurance will only take care of your home loan, if it is not fully repaid in the event of TPD or death. The sole beneficiary of the policy is the bank, not your family members. However, your family get to inherit the property without having any bank loan attached. MLTA is best for those who need an extra financial protection in the worst case scenario, as it also has a cash value at the end of the policy. This is best for those who have many financial dependents, for example young children and a stay-at-home spouse. However, MLTA is a normal life insurance policy that is not part of your housing loan and customers must ensure they understand the terms and conditions fully otherwise they may find themselves in a tight spot if the insurance company does not approve the claim and the bank loan remains unpaid while the dependents are left without any cash payout either. CLTA CLTA is a relatively new product in the market. CLTA is also known as Credit Term Life Assurance. This product is only offered by limited Bank. CLTA is similar as MLTA as in the coverage will remain same. For other more details, please seek advice from the banker that offer CLTA.

1 Comment

|

AuthorFrom Various Author articles. Jonathan de Ho & reference from others Author articles Archives

November 2023

Categories |

- Home

-

New Property Launch

- Lakeside Freehold Fully Residential Private Lifestyle Condominium in Cyberjaya

- Spacious 2024 Completion KL Condo Fully Residential KLCC View

- RUMAWIP Bukit Jalil (Bumi Only)

- Lake City @ KL North NEW PHASE FROM RM380k

- Alora Residences – Inspired living within greenery in Subang Jaya

- PJ Spacious and Affordable 5 Star Condo

- Best Investment 2022 PJ Damansara Low Risk Low Entry Price High ROI

- 2022 PJ Rumah Mampu Milik RM270k Damansara

- Bangsar South 2 Rooms from RM390k BELOW Market Price

- 10% ROI PJ Project near Ikea and One Utama Mall

- Mid Valley Seputeh New Launch

- Pavilion Damansara Heights 柏威年 白沙罗岭 马来西亚 吉隆坡 精选楼盘

- 马来西亚RM300千的PJ屋子-首购族,年轻人月入3千能买房

- 2021 Penang Most Awaited Project

- 2021 New Launch - KL Metropolis

- Freehold LRT Linked 3 Room Suites in Glenmarie

- New SPACIOUS Kepong Landed 6 Room 6 Bath

- Bangsar Last Piece Land New Launch

- Avara Seputeh (Mid Valley)

- Project Announcement Registration. Malaysia New Property Launch

-

Existing & Past Project

- 2020 Lowest Risk & Price in Klang Valley with Great ROI

- Kiara East Suite Dex

- 2019 SAFEST PROFITABLE HIGH CASHBACK INVESTMENT

- Best Property Investment Projects in 2018

- KL City Freehold Spacious Affordable 3 room Project

- Jalan Kuching Freehold New Office & Shoplot

- Jalan Ipoh New Freehold Shoplot & Offices

- RM300k KL Sentral New Prelaunch

- The Olive Condo, Sunsuria City

- Prelaunch Landed House Bukit Rahman Putra

- RM260k No Downpayment Puchong South Suites

- PJ North RM400k High Cash Back Project

- Denai Sutera @ Alam Sutera, Bukit Jalil

- First Phase of Banting New Township

- Neu Suites 3rdNVenue @ Embassy Row by Titijaya & CREC

- COURT 28, Jalan Ipoh KL City New Property Launch Service Apartment. Malaysia New Property Launch

- Semanja Kajang New FREEHOLD Kajang Double Storey Houses. Malaysia New Property Launch

- M Suite @ Desa Park North

- BIJI LIVING @ Sek 17 PJ City by Conlay. Malaysia New Property Launch

- Amani Residence Bandar Puteri Puchong New Freehold Service Apartment. Malaysia New Property Launch

- SFERA RESIDENCY @ Puchong South. Malaysia New Property Launch

- KL North Last Release

- PreLaunch Freehold Double Storey

- LAND

- News & Articles

- Other Reference Link & Services

- Referral

- Career

- MPIG

- Get Professional Advice

- PJ八打灵全新地产项目分析手册

Hours

M-S: 9.30am - 9pm

|

Telephone

+60 12 3760864

|

Email

|

RSS Feed

RSS Feed