|

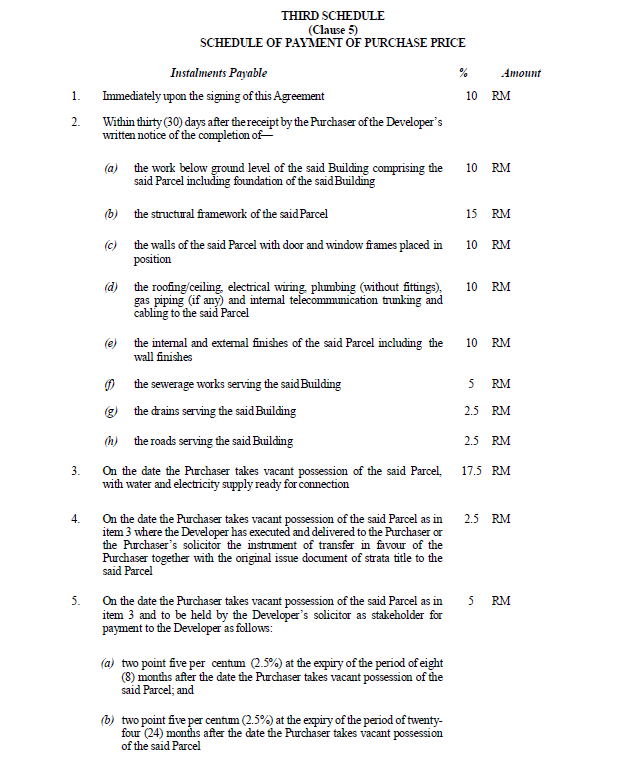

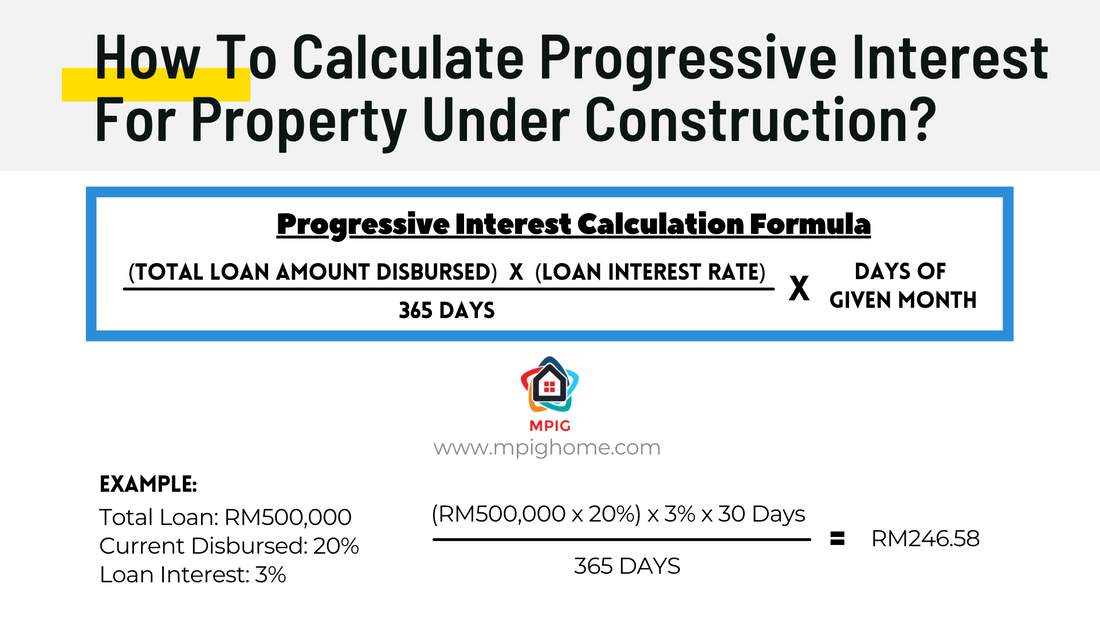

Progressive Interest and Billing Explained Buying a property that’s under construction is one of the best ways to get a great deal. It’s because when you buy a unit in an early phase of the project, you’ll get it at a great price! After the next phase is launched, the price of a home can increase by 10% to 30%. Nonetheless, the loan process is a little more different than when buying a completed house - where your bank will have to release the full loan amount upfront. This is because the payment for a home that’s under construction is progressive, i.e. in stages. Such stages is shown in Schedule (as shown below). Some of the schedule will stated when is the expected claimable date and some dont. Essentially, how it works is- When the developer has completed a certain stage of the building process, your bank will release a bit of money to pay them. These stages and amounts are set by The Ministry of Housing and Local Government (KPKT). For commercial title non HDA, it works differently, normally developer will claim and bank will release the portion of disbursement even when its not complete. Progressive Interest is the interest you’ll need to pay on these stage-by-stage payments which have been released by the bank. Bear in mind that the payments you need to make before 100% of the loan are released are on interest only, but you do have the option of paying more right from the start! This means you get started reducing the original amount loaned, and the interest that is charged on top of it earlier! If you have other financial obligations like the rent for your current home, however, it can help to take it slow as the payments begin in small amounts, so you won’t be overburdened at the start, but it’s still going to come down to managing your finances. At the end of the day, a home is a financial responsibility as much as it is an asset. So let’s give you a pat on the back! As an EXAMPLE for calculation (Shown as below) - Let’s assume your interest rate is 3%, and the bank has released RM100,000 out of the total RM500,000 (20% disbursement) you’ve borrowed for your new home. Some extra tips include:

1 Comment

Leave a Reply. |

AuthorFrom Various Author articles. Jonathan de Ho & reference from others Author articles Archives

November 2023

Categories |

- Home

-

New Property Launch

- Lakeside Freehold Fully Residential Private Lifestyle Condominium in Cyberjaya

- Spacious 2024 Completion KL Condo Fully Residential KLCC View

- RUMAWIP Bukit Jalil (Bumi Only)

- Lake City @ KL North NEW PHASE FROM RM380k

- Alora Residences – Inspired living within greenery in Subang Jaya

- PJ Spacious and Affordable 5 Star Condo

- Best Investment 2022 PJ Damansara Low Risk Low Entry Price High ROI

- 2022 PJ Rumah Mampu Milik RM270k Damansara

- Bangsar South 2 Rooms from RM390k BELOW Market Price

- 10% ROI PJ Project near Ikea and One Utama Mall

- Mid Valley Seputeh New Launch

- Pavilion Damansara Heights 柏威年 白沙罗岭 马来西亚 吉隆坡 精选楼盘

- 马来西亚RM300千的PJ屋子-首购族,年轻人月入3千能买房

- 2021 Penang Most Awaited Project

- 2021 New Launch - KL Metropolis

- Freehold LRT Linked 3 Room Suites in Glenmarie

- New SPACIOUS Kepong Landed 6 Room 6 Bath

- Bangsar Last Piece Land New Launch

- Avara Seputeh (Mid Valley)

- Project Announcement Registration. Malaysia New Property Launch

-

Existing & Past Project

- 2020 Lowest Risk & Price in Klang Valley with Great ROI

- Kiara East Suite Dex

- 2019 SAFEST PROFITABLE HIGH CASHBACK INVESTMENT

- Best Property Investment Projects in 2018

- KL City Freehold Spacious Affordable 3 room Project

- Jalan Kuching Freehold New Office & Shoplot

- Jalan Ipoh New Freehold Shoplot & Offices

- RM300k KL Sentral New Prelaunch

- The Olive Condo, Sunsuria City

- Prelaunch Landed House Bukit Rahman Putra

- RM260k No Downpayment Puchong South Suites

- PJ North RM400k High Cash Back Project

- Denai Sutera @ Alam Sutera, Bukit Jalil

- First Phase of Banting New Township

- Neu Suites 3rdNVenue @ Embassy Row by Titijaya & CREC

- COURT 28, Jalan Ipoh KL City New Property Launch Service Apartment. Malaysia New Property Launch

- Semanja Kajang New FREEHOLD Kajang Double Storey Houses. Malaysia New Property Launch

- M Suite @ Desa Park North

- BIJI LIVING @ Sek 17 PJ City by Conlay. Malaysia New Property Launch

- Amani Residence Bandar Puteri Puchong New Freehold Service Apartment. Malaysia New Property Launch

- SFERA RESIDENCY @ Puchong South. Malaysia New Property Launch

- KL North Last Release

- PreLaunch Freehold Double Storey

- LAND

- News & Articles

- Other Reference Link & Services

- Referral

- Career

- MPIG

- Get Professional Advice

- PJ八打灵全新地产项目分析手册

Hours

M-S: 9.30am - 9pm

|

Telephone

+60 12 3760864

|

Email

|

RSS Feed

RSS Feed